What a fantastic six months it’s been for Viasat. Shares of the company have skyrocketed 79.9%, setting a new 52-week high of $49.27. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Viasat, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Viasat Not Exciting?

We’re glad investors have benefited from the price increase, but we're swiping left on Viasat for now. Here are three reasons why VSAT doesn't excite us and a stock we'd rather own.

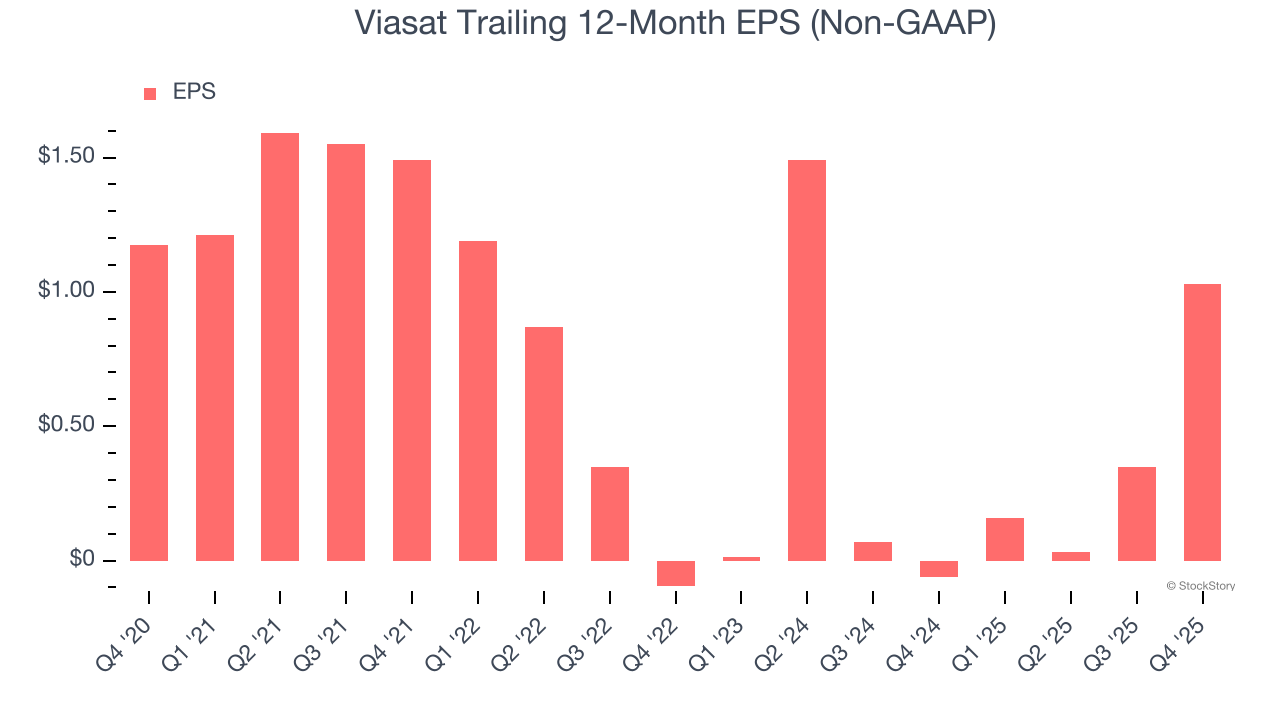

1. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Viasat, its EPS declined by 2.6% annually over the last five years while its revenue grew by 15.4%. This tells us the company became less profitable on a per-share basis as it expanded.

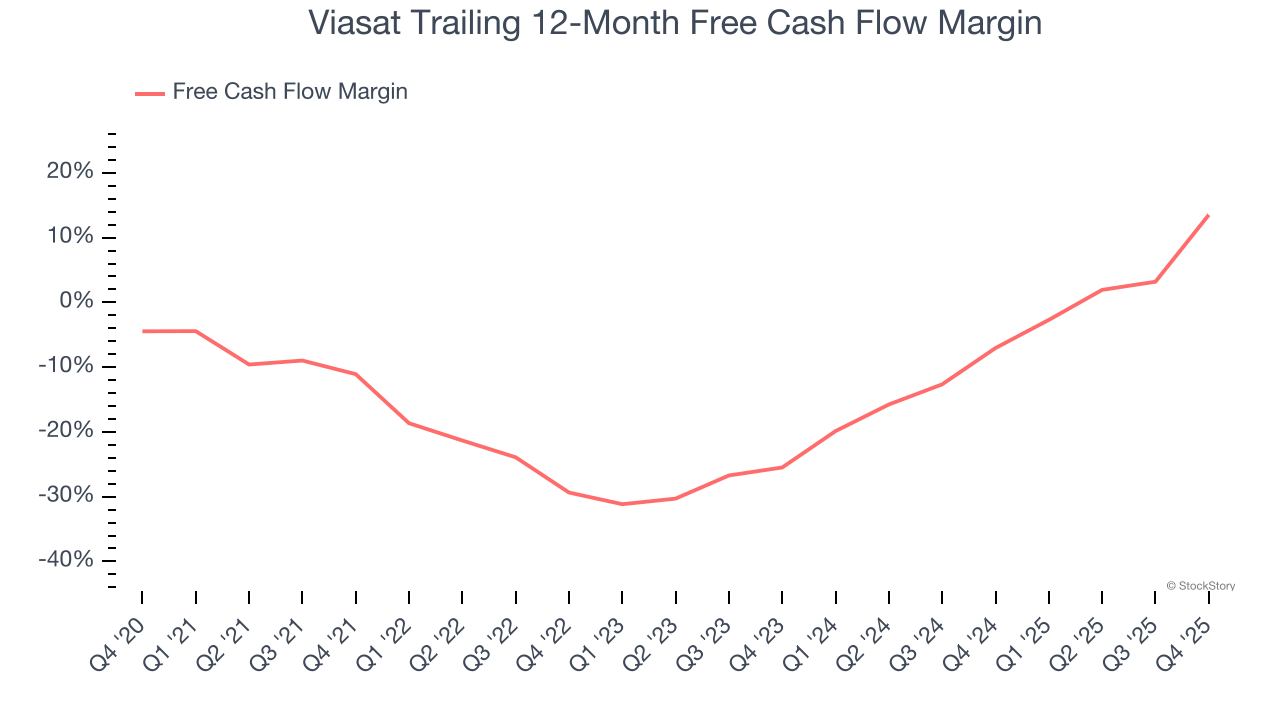

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Viasat posted positive free cash flow this quarter, the broader story hasn’t been so clean. Viasat’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 9.3%, meaning it lit $9.34 of cash on fire for every $100 in revenue.

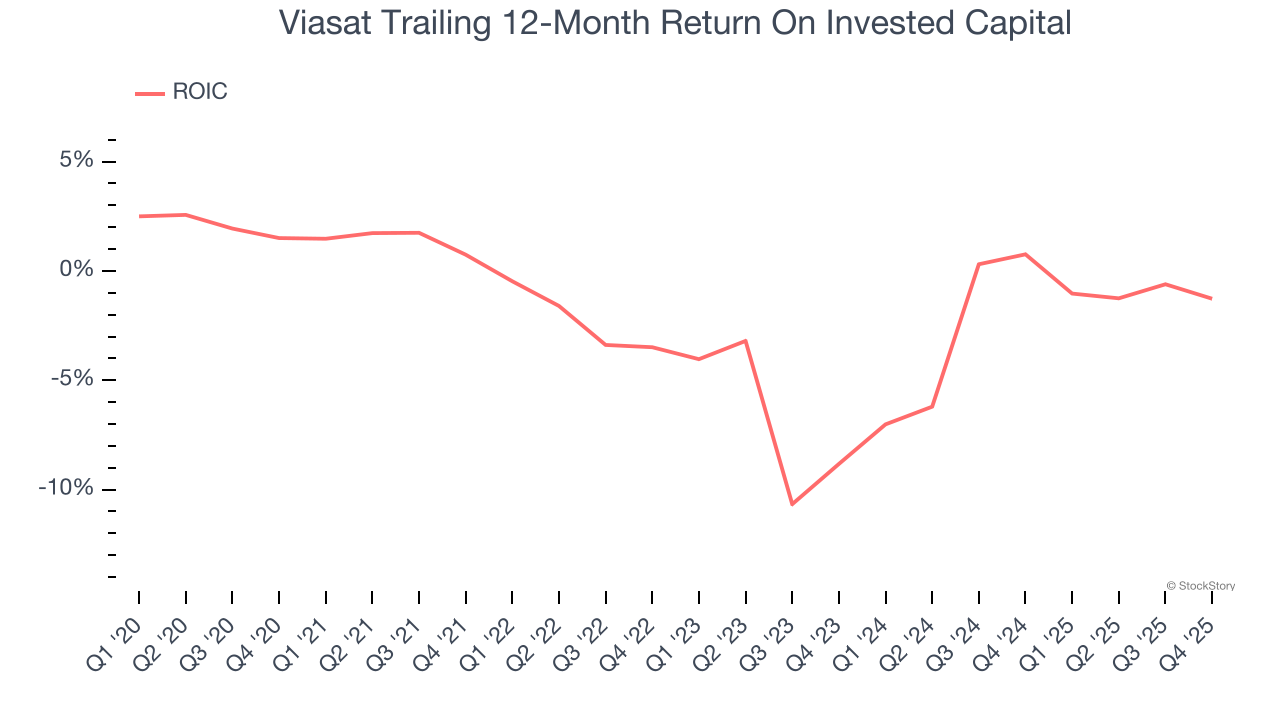

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Viasat’s five-year average ROIC was negative 2.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

Final Judgment

Viasat isn’t a terrible business, but it doesn’t pass our bar. After the recent rally, the stock trades at 75.2× forward P/E (or $49.27 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Like More Than Viasat

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.