Wrapping up Q3 earnings, we look at the numbers and key takeaways for the therapeutics stocks, including Halozyme Therapeutics (NASDAQ: HALO) and its peers.

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 11 therapeutics stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 10.5%.

Thankfully, share prices of the companies have been resilient as they are up 9.4% on average since the latest earnings results.

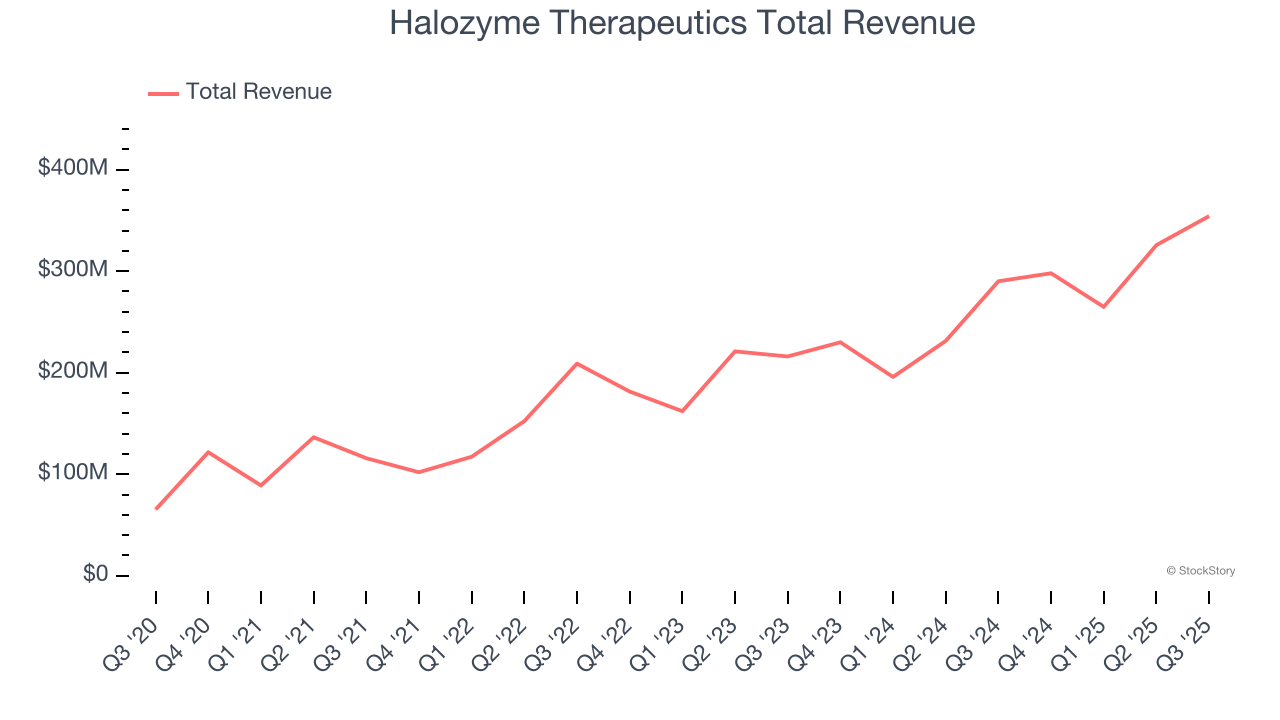

Best Q3: Halozyme Therapeutics (NASDAQ: HALO)

Known for transforming hours-long intravenous infusions into minutes-long subcutaneous injections, Halozyme Therapeutics (NASDAQ: HALO) develops and licenses its proprietary ENHANZE technology that enables subcutaneous delivery of injectable drugs that would otherwise require intravenous administration.

Halozyme Therapeutics reported revenues of $354.3 million, up 22.1% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was an exceptional quarter for the company with full-year EBITDA guidance exceeding analysts’ expectations and a solid beat of analysts’ full-year EPS guidance estimates.

Halozyme Therapeutics pulled off the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 7.3% since reporting and currently trades at $71.

Is now the time to buy Halozyme Therapeutics? Access our full analysis of the earnings results here, it’s free.

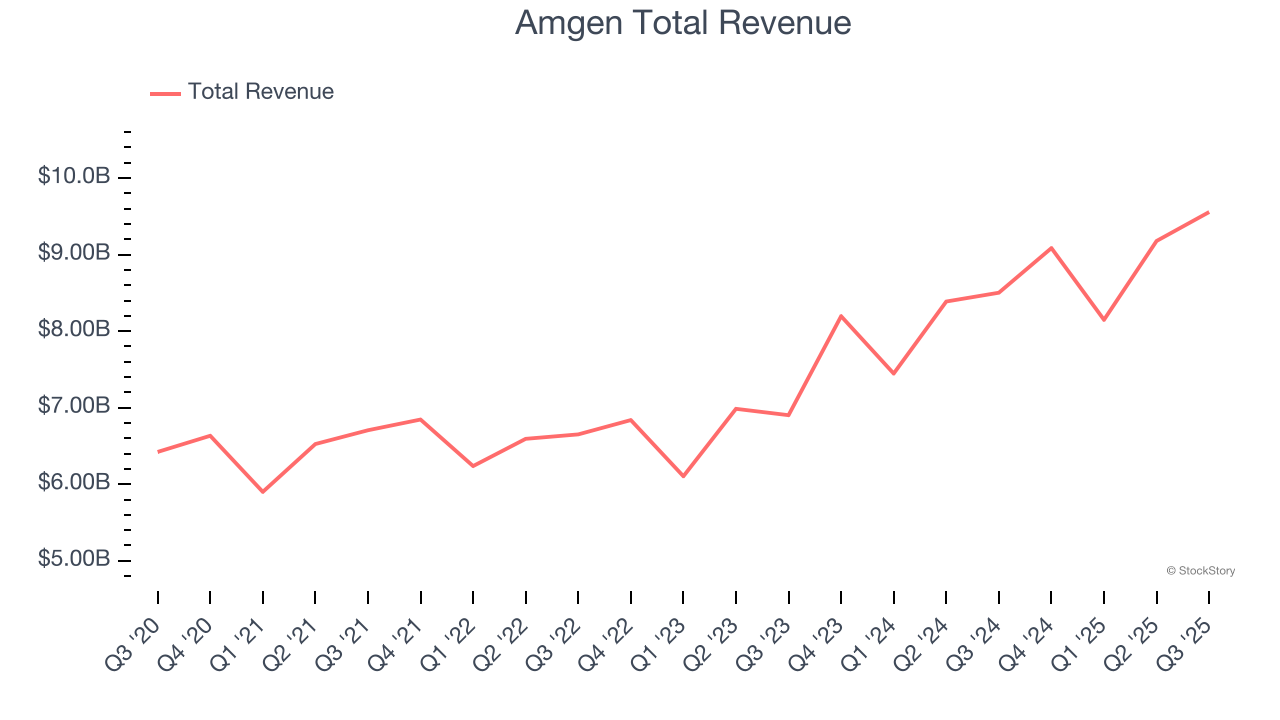

Amgen (NASDAQ: AMGN)

Founded in 1980 during the early days of the biotechnology revolution, Amgen (NASDAQ: AMGN) is a biotechnology company that discovers, develops, and manufactures innovative medicines to treat serious illnesses like cancer, osteoporosis, and autoimmune diseases.

Amgen reported revenues of $9.56 billion, up 12.4% year on year, outperforming analysts’ expectations by 6.6%. The business had a very strong quarter with an impressive beat of analysts’ revenue estimates and full-year revenue guidance beating analysts’ expectations.

The market seems happy with the results as the stock is up 11.7% since reporting. It currently trades at $331.51.

Is now the time to buy Amgen? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: United Therapeutics (NASDAQ: UTHR)

Founded by a mother seeking treatment for her daughter's pulmonary arterial hypertension, United Therapeutics (NASDAQ: UTHR) develops and commercializes medications for chronic lung diseases and other life-threatening conditions, with a focus on pulmonary hypertension treatments.

United Therapeutics reported revenues of $799.5 million, up 6.8% year on year, falling short of analysts’ expectations by 1.6%. It was a softer quarter as it posted a miss of analysts’ revenue estimates and a significant miss of analysts’ EPS estimates.

United Therapeutics delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 11.9% since the results and currently trades at $464.85.

Read our full analysis of United Therapeutics’s results here.

Vertex Pharmaceuticals (NASDAQ: VRTX)

Founded in 1989 with a mission to create medicines that treat the underlying causes of disease rather than just symptoms, Vertex Pharmaceuticals (NASDAQ: VRTX) develops and markets transformative medicines for serious diseases, with a focus on cystic fibrosis, sickle cell disease, and pain management.

Vertex Pharmaceuticals reported revenues of $3.08 billion, up 11% year on year. This print was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but full-year revenue guidance meeting analysts’ expectations.

The stock is up 3.2% since reporting and currently trades at $439.75.

Read our full, actionable report on Vertex Pharmaceuticals here, it’s free.

Novavax (NASDAQ: NVAX)

Pioneering a nanoparticle technology that mimics the molecular structure of disease pathogens, Novavax (NASDAQ: NVAX) develops and commercializes protein-based vaccines for infectious diseases, with a primary focus on its COVID-19 vaccine and combination respiratory vaccine candidates.

Novavax reported revenues of $70.45 million, down 16.6% year on year. This number topped analysts’ expectations by 61%. Aside from that, it was a mixed quarter as it also recorded a solid beat of analysts’ revenue estimates but a significant miss of analysts’ EPS estimates.

Novavax pulled off the biggest analyst estimates beat among its peers. The stock is up 3.8% since reporting and currently trades at $7.98.

Read our full, actionable report on Novavax here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.