Since July 2020, the S&P 500 has delivered a total return of 97.3%. But one standout stock has more than doubled the market - over the past five years, Live Nation has surged 222% to $145.27 per share. Its momentum hasn’t stopped as it’s also gained 13% in the last six months thanks to its solid quarterly results, beating the S&P by 6.2%.

Is now the time to buy Live Nation, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Live Nation Not Exciting?

Despite the momentum, we're swiping left on Live Nation for now. Here are three reasons why there are better opportunities than LYV and a stock we'd rather own.

1. Weak Growth in Events Points to Soft Demand

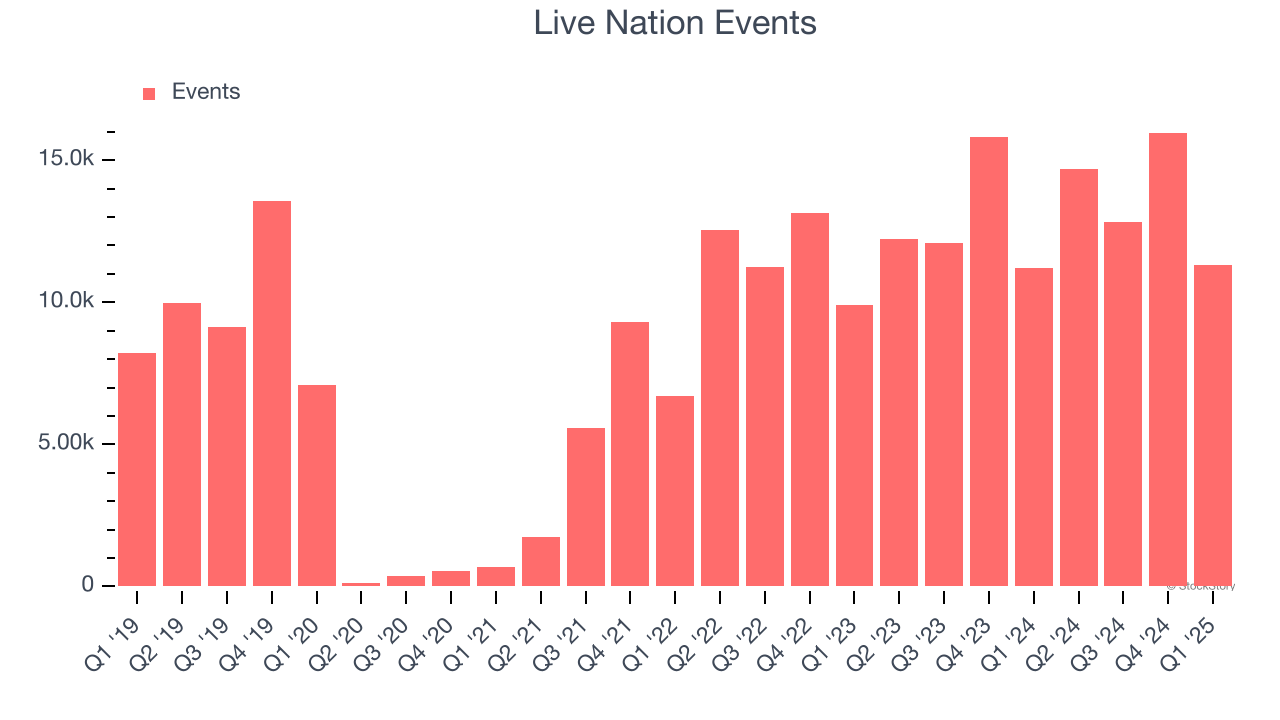

Revenue growth can be broken down into changes in price and volume (for companies like Live Nation, our preferred volume metric is events). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Live Nation’s events came in at 11,295 in the latest quarter, and over the last two years, averaged 8.3% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Weak Operating Margin Could Cause Trouble

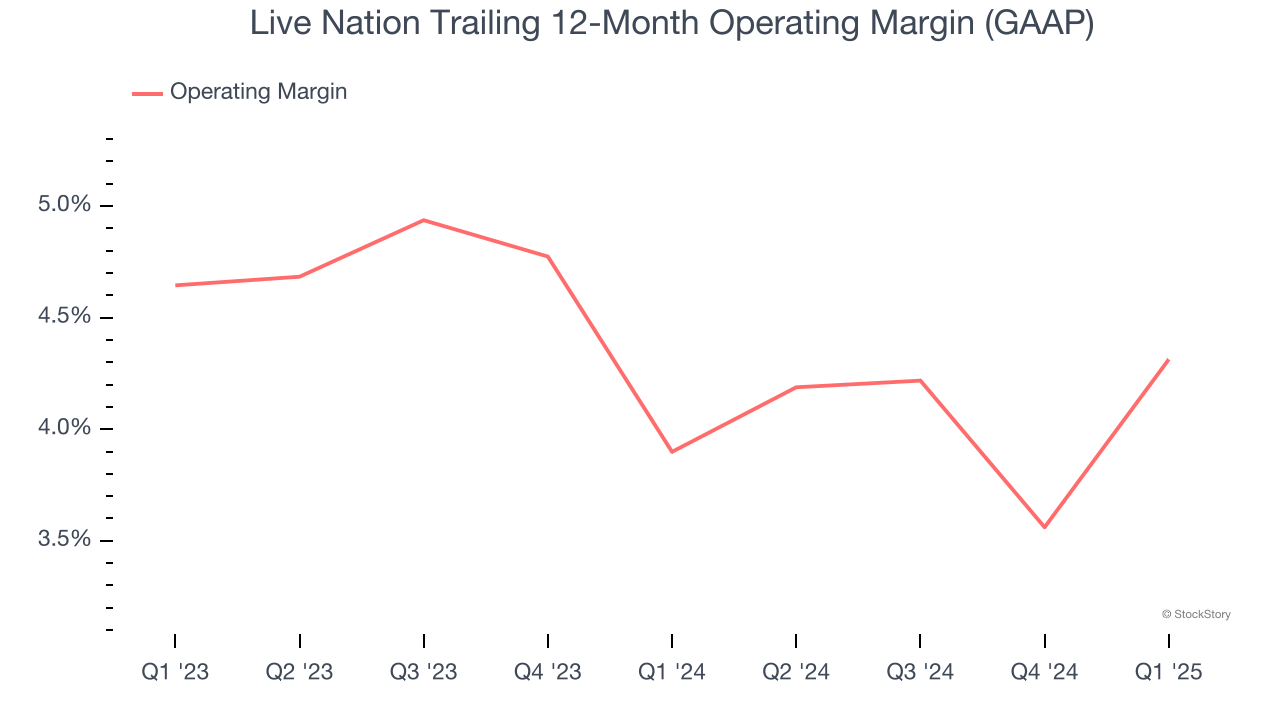

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Live Nation’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 4.1% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

3. Cash Flow Margin Set to Decline

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict Live Nation’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 6.8% for the last 12 months will decrease to 3.6%.

Final Judgment

Live Nation’s business quality ultimately falls short of our standards. With its shares topping the market in recent months, the stock trades at 61.6× forward P/E (or $145.27 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Live Nation

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.