Church & Dwight currently trades at $98.04 per share and has shown little upside over the past six months, posting a small loss of 3.3%. The stock also fell short of the S&P 500’s 6.9% gain during that period.

Is now the time to buy Church & Dwight, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Church & Dwight Not Exciting?

We're cautious about Church & Dwight. Here are three reasons why there are better opportunities than CHD and a stock we'd rather own.

1. Slow Organic Growth Suggests Waning Demand In Core Business

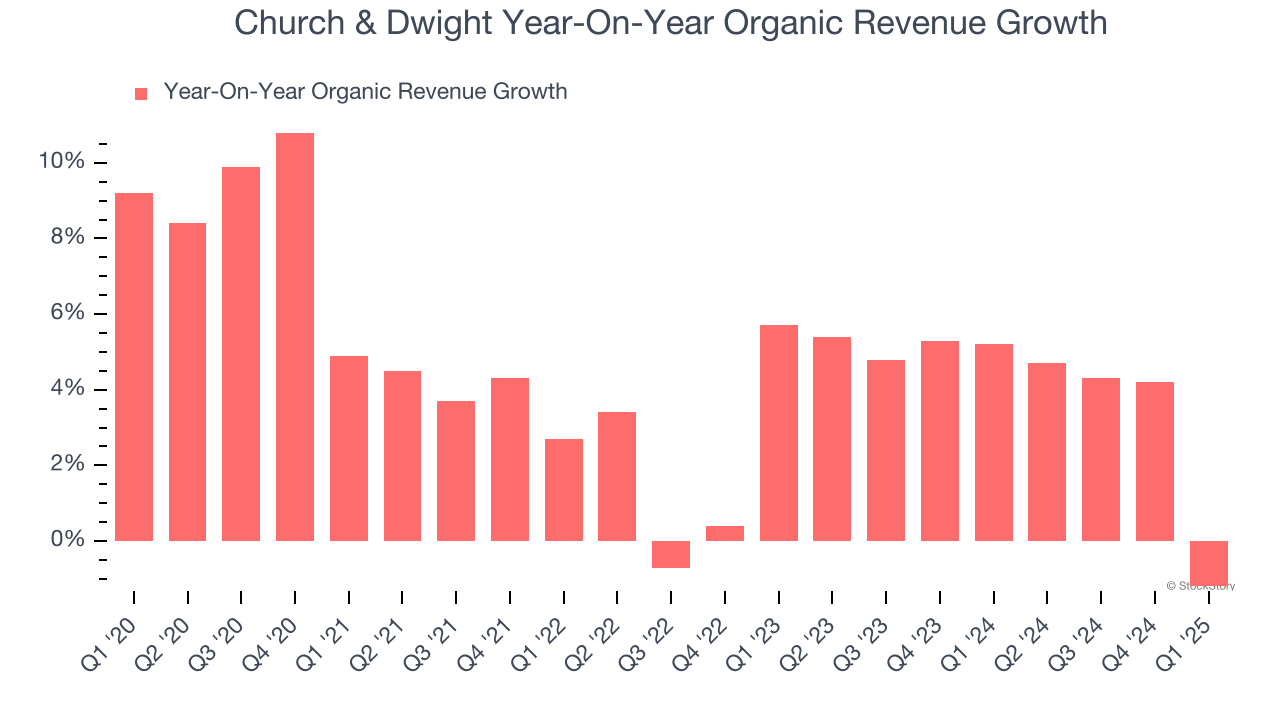

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Church & Dwight’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 4.1% year on year.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Church & Dwight’s revenue to rise by 1%, a deceleration versus This projection is underwhelming and implies its products will see some demand headwinds.

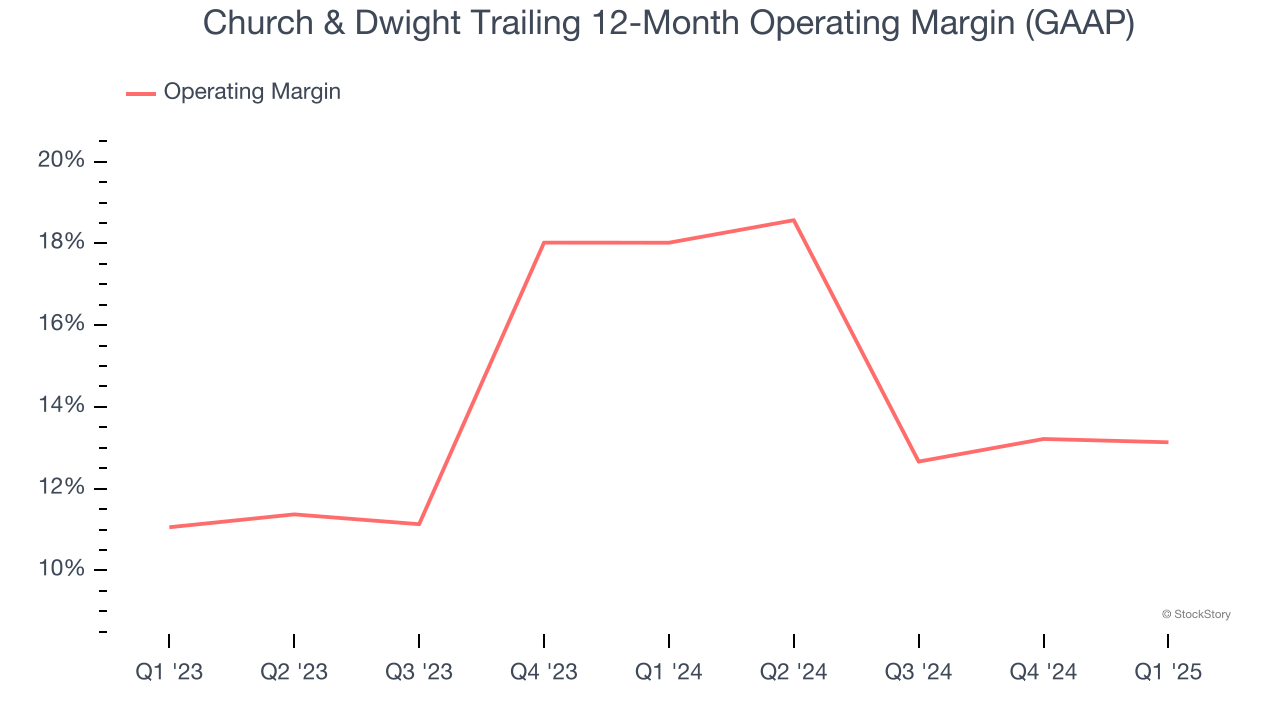

3. Shrinking Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, Church & Dwight’s operating margin decreased by 4.9 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 13.1%.

Final Judgment

Church & Dwight isn’t a terrible business, but it doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 26× forward P/E (or $98.04 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d recommend looking at the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.