ServisFirst Bancshares has been treading water for the past six months, recording a small loss of 2.9% while holding steady at $81.34. The stock also fell short of the S&P 500’s 5.3% gain during that period.

Is now the time to buy ServisFirst Bancshares, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is ServisFirst Bancshares Not Exciting?

We're cautious about ServisFirst Bancshares. Here are three reasons why SFBS doesn't excite us and a stock we'd rather own.

1. Net Interest Income Points to Soft Demand

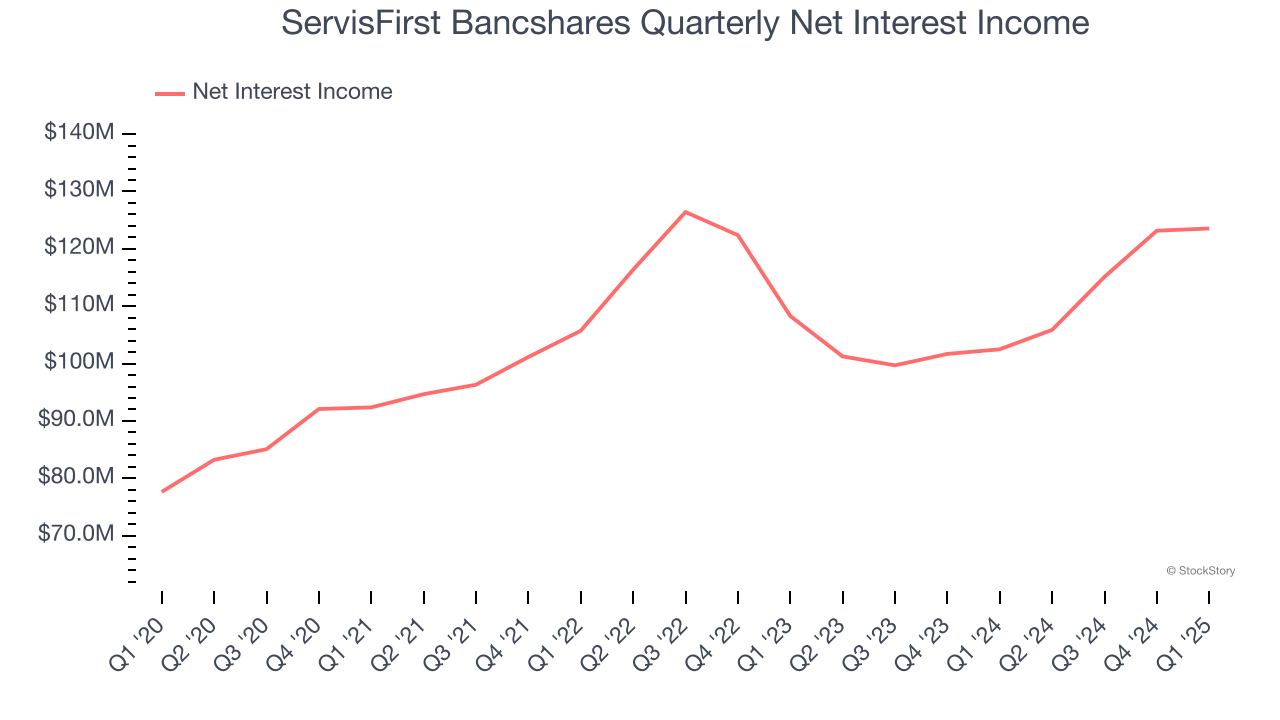

While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

ServisFirst Bancshares’s net interest income has grown at a 7.3% annualized rate over the last four years, slightly worse than the broader bank industry.

2. Net Interest Margin Dropping

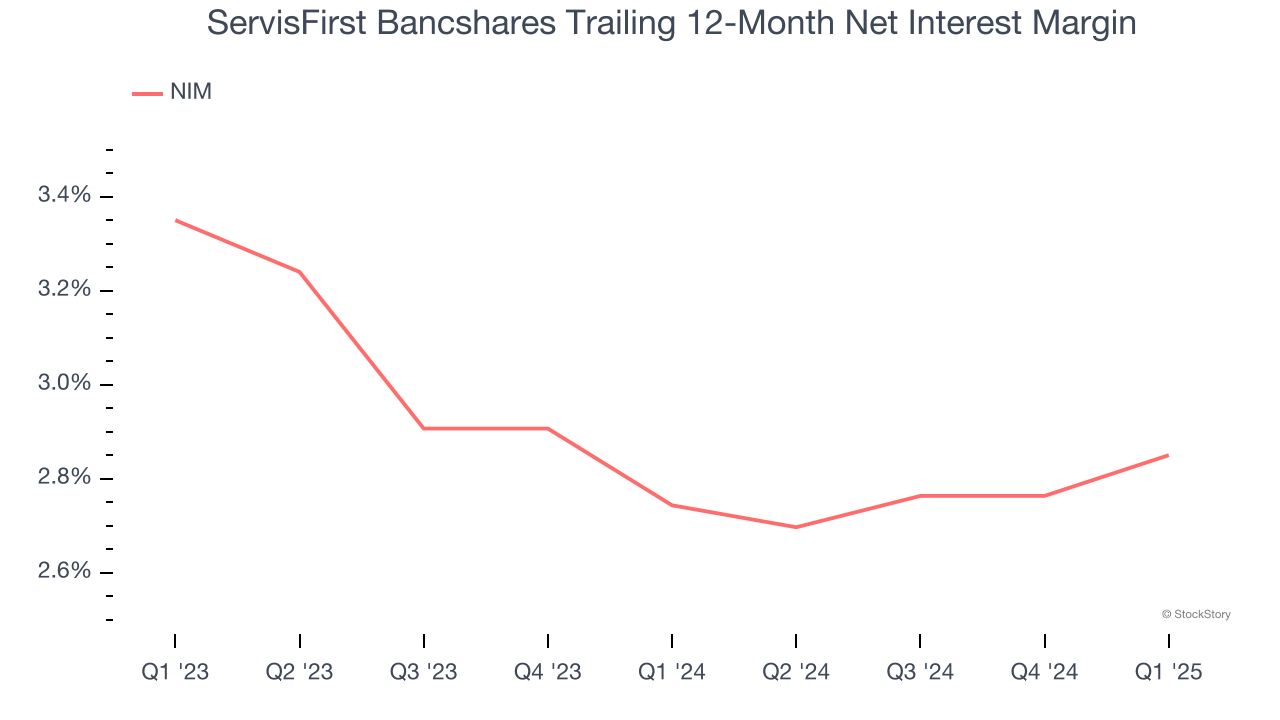

Net interest margin represents how much a bank earns in relation to its outstanding loans. It’s one of the most important metrics to track because it shows how a bank’s loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, ServisFirst Bancshares’s net interest margin averaged 2.8%. Its margin also contracted by 50 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean ServisFirst Bancshares either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

3. High Interest Expenses Increase Risk

Leverage is core to the bank’s business model (loans funded by deposits) and to ensure their stability, regulators require certain levels of capital and liquidity, focusing on a bank’s Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a bank holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all banks must maintain a Tier 1 capital ratio greater than 4.5% On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, banks generally must maintain a 7-10% ratio at minimum.

Over the last two years, ServisFirst Bancshares has averaged a Tier 1 capital ratio of 11%, which is considered unsafe in the event of a black swan or if macro or market conditions suddenly deteriorate. For this reason alone, we will be crossing it off our shopping list.

Final Judgment

ServisFirst Bancshares isn’t a terrible business, but it isn’t one of our picks. With its shares underperforming the market lately, the stock trades at 2.4× forward P/B (or $81.34 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

Stocks We Would Buy Instead of ServisFirst Bancshares

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.