Over the last six months, Coherent’s shares have sunk to $87.98, producing a disappointing 6.1% loss - a stark contrast to the S&P 500’s 5.3% gain. This might have investors contemplating their next move.

Following the drawdown, is now the time to buy COHR? Find out in our full research report, it’s free.

Why Does Coherent Spark Debate?

Created through the 2022 rebranding of II-VI Incorporated, a company with roots dating back to 1971, Coherent (NYSE: COHR) develops and manufactures advanced materials, lasers, and optical components for applications ranging from telecommunications to industrial manufacturing.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

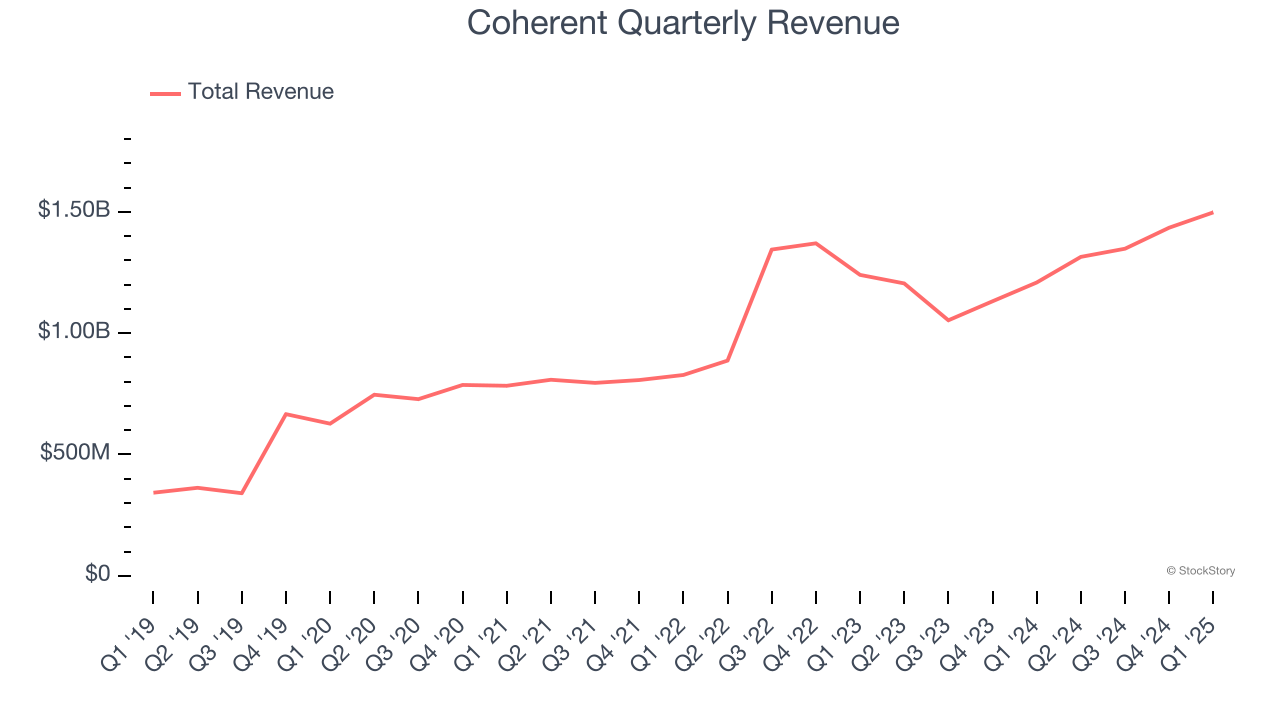

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Coherent’s sales grew at an incredible 22.9% compounded annual growth rate over the last five years. Its growth beat the average business services company and shows its offerings resonate with customers.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Coherent’s revenue to rise by 10.9%, an improvement versus its 22.9% annualized growth for the past five years. This projection is admirable and indicates its newer products and services will spur better top-line performance.

One Reason to be Careful:

Free Cash Flow Margin Dropping

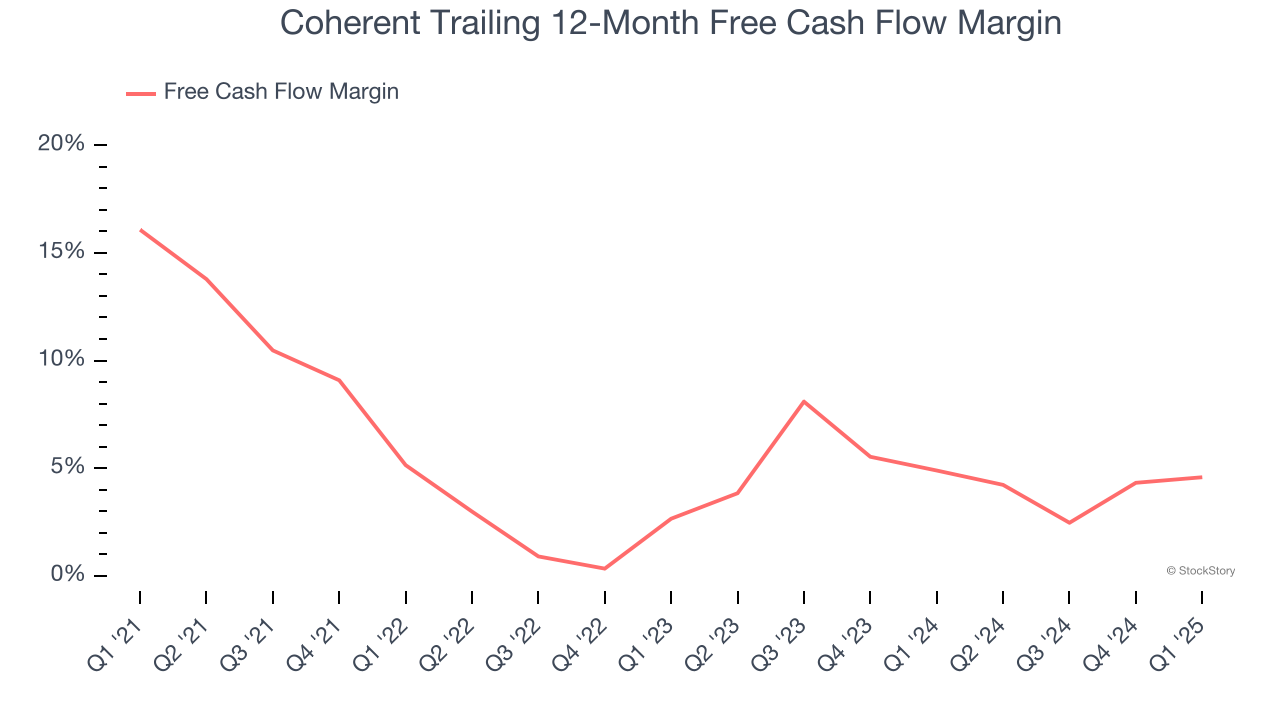

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Coherent’s margin dropped by 11.5 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Coherent’s free cash flow margin for the trailing 12 months was 4.6%.

Final Judgment

Coherent’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 21.4× forward P/E (or $87.98 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.