Over the past six months, Hilltop Holdings has been a great trade, beating the S&P 500 by 6.9%. Its stock price has climbed to $31.26, representing a healthy 12.2% increase. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Hilltop Holdings, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Hilltop Holdings Will Underperform?

We’re happy investors have made money, but we're swiping left on Hilltop Holdings for now. Here are three reasons why HTH doesn't excite us and a stock we'd rather own.

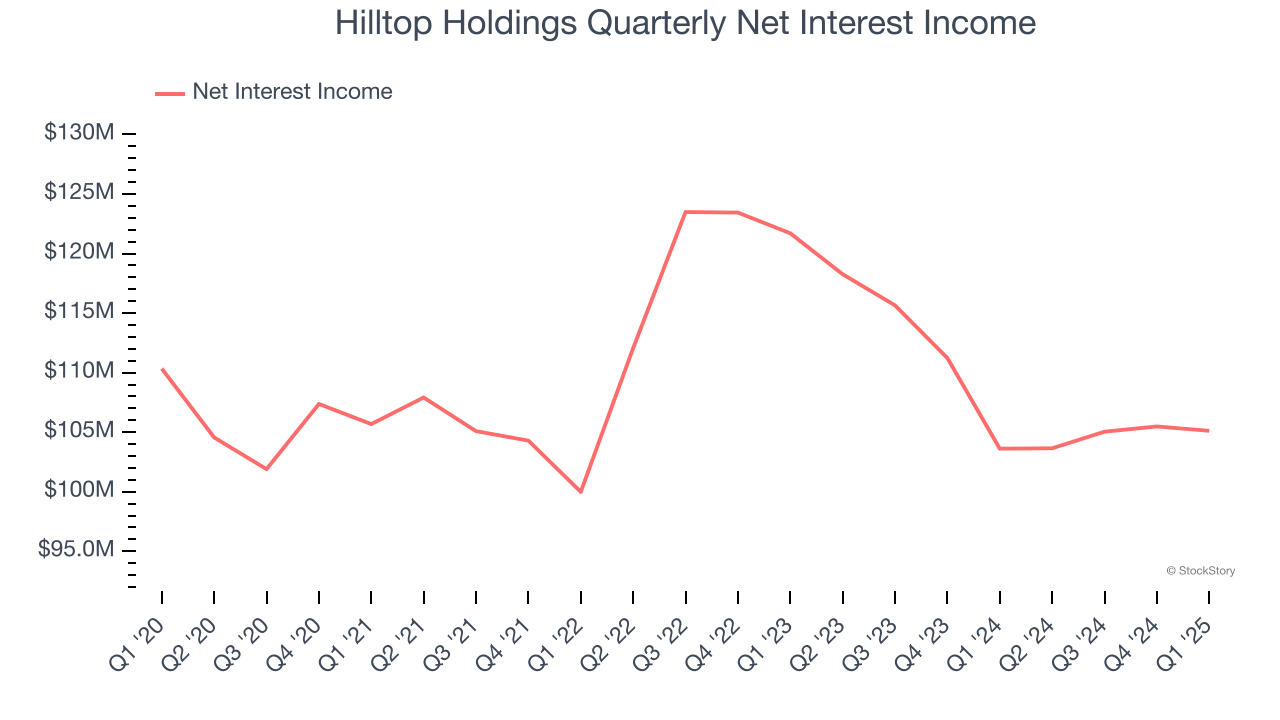

1. Net Interest Income Hits a Plateau

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Hilltop Holdings’s net interest income was flat over the last four years, much worse than the broader bank industry.

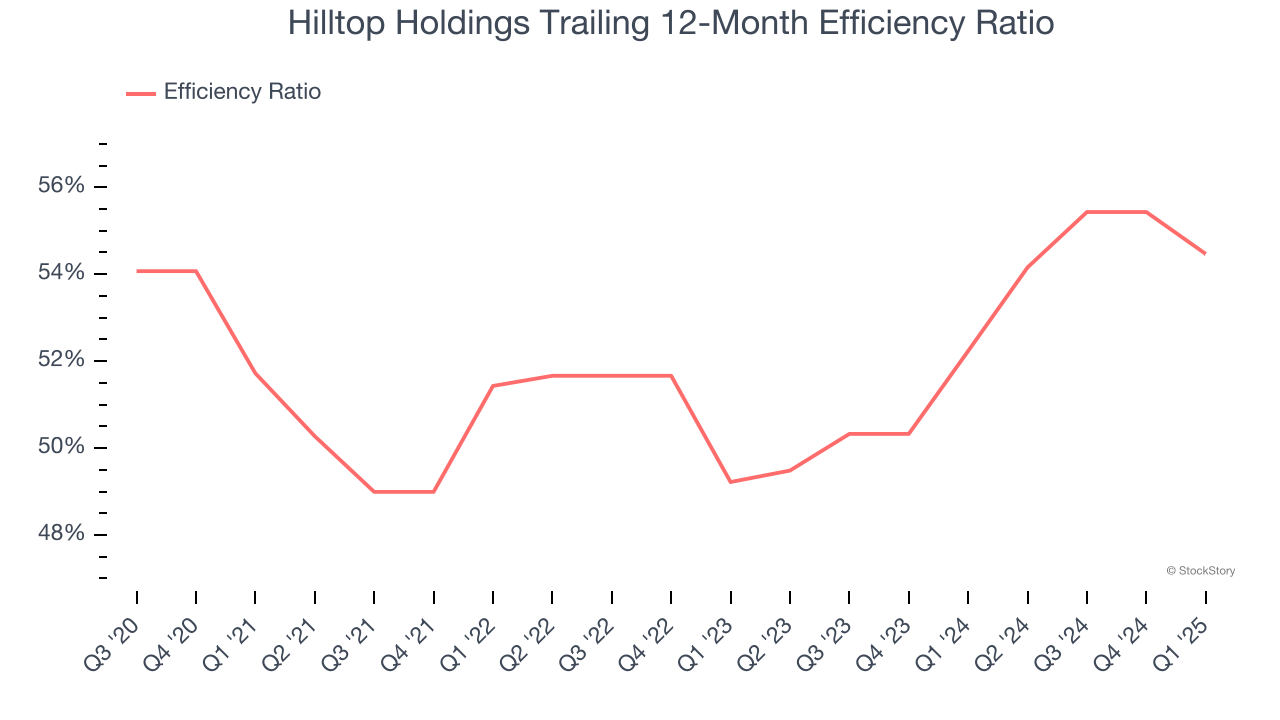

2. Efficiency Ratio Expected to Falter

Topline growth alone doesn't tell the complete story - the profitability of that growth shapes actual earnings impact. Banks track this dynamic through efficiency ratios, which compare non-interest expenses such as personnel, rent, IT, and marketing costs to total revenue streams.

Markets emphasize efficiency ratio trends over static measurements, recognizing that revenue compositions drive different expense bases. Lower efficiency ratios signal superior performance by indicating that banks are controlling costs effectively relative to their income.

For the next 12 months, Wall Street expects Hilltop Holdings to become less profitable as it anticipates an efficiency ratio of 86.5% compared to 54.5% over the past year.

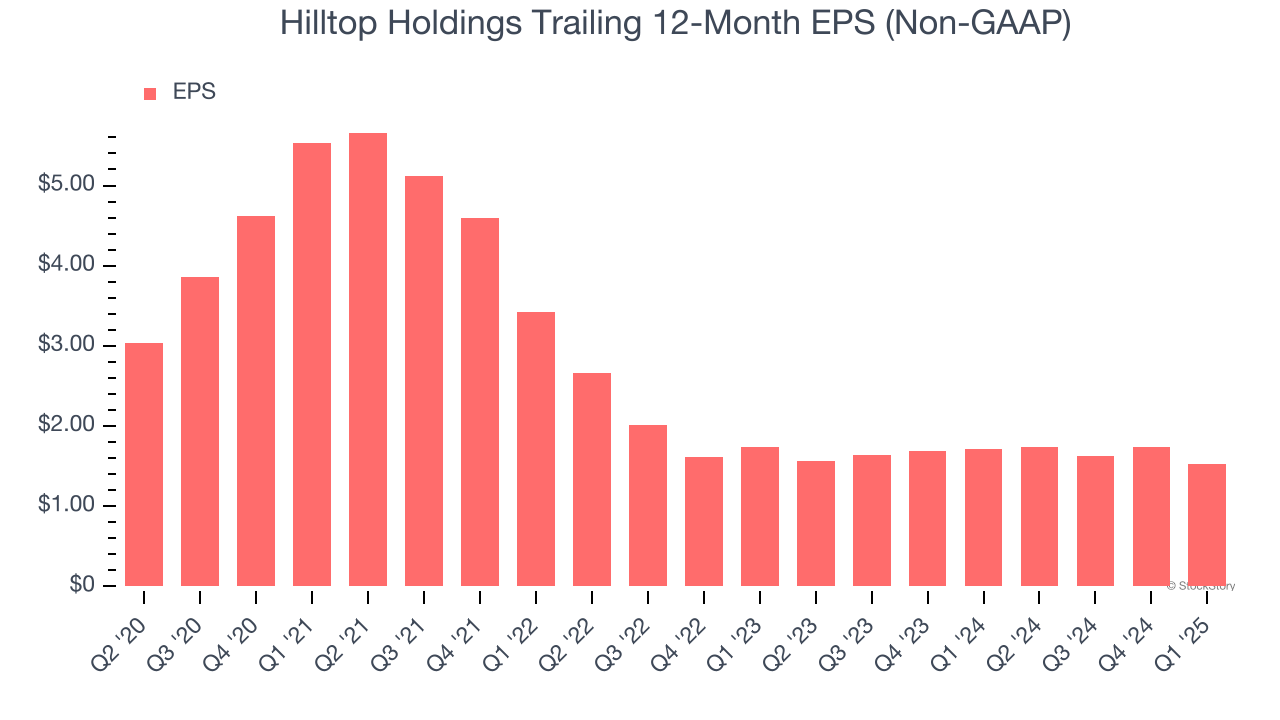

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Hilltop Holdings, its EPS declined by 9% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

We see the value of companies driving economic growth, but in the case of Hilltop Holdings, we’re out. With its shares beating the market recently, the stock trades at 0.9× forward P/B (or $31.26 per share). At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Hilltop Holdings

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.