Over the past six months, Berkshire Hills Bancorp’s stock price fell to $26.19. Shareholders have lost 8.1% of their capital, which is disappointing considering the S&P 500 has climbed by 5.2%. This may have investors wondering how to approach the situation.

Is now the time to buy Berkshire Hills Bancorp, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Berkshire Hills Bancorp Not Exciting?

Despite the more favorable entry price, we're swiping left on Berkshire Hills Bancorp for now. Here are three reasons why you should be careful with BHLB and a stock we'd rather own.

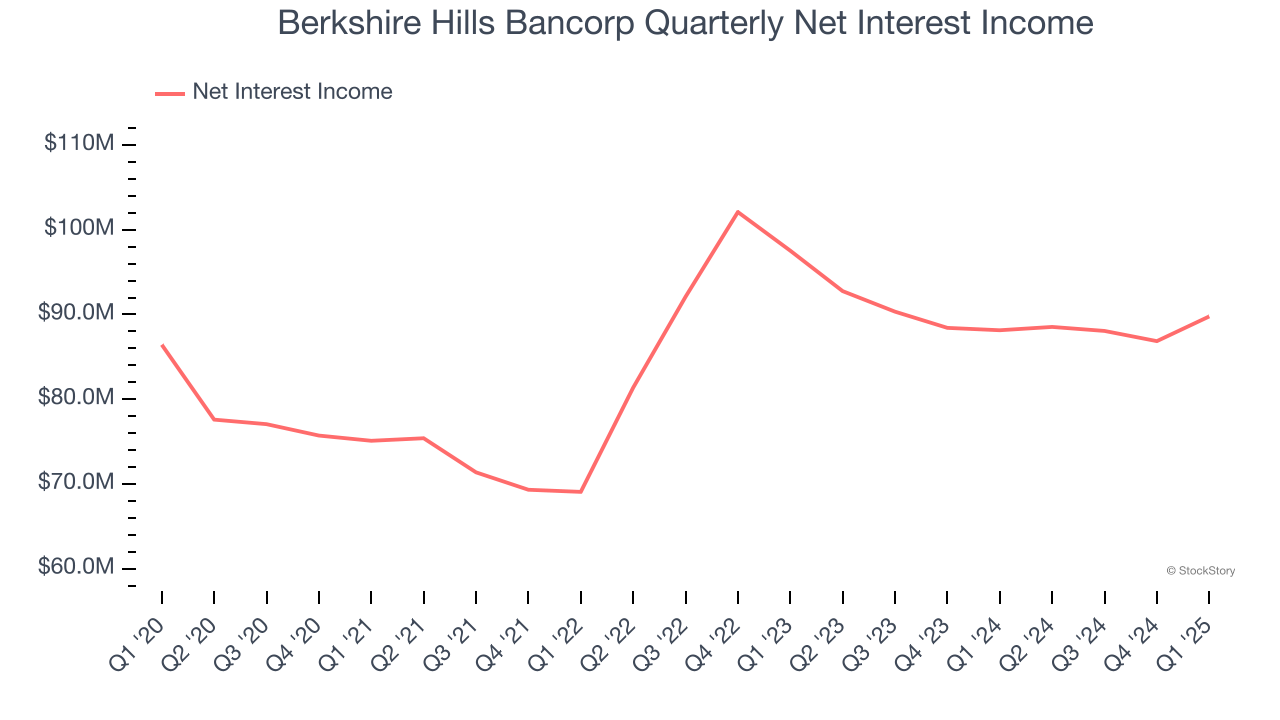

1. Net Interest Income Points to Soft Demand

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

Berkshire Hills Bancorp’s net interest income has grown at a 3.7% annualized rate over the last four years, worse than the broader bank industry. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book was flat throughout that period.

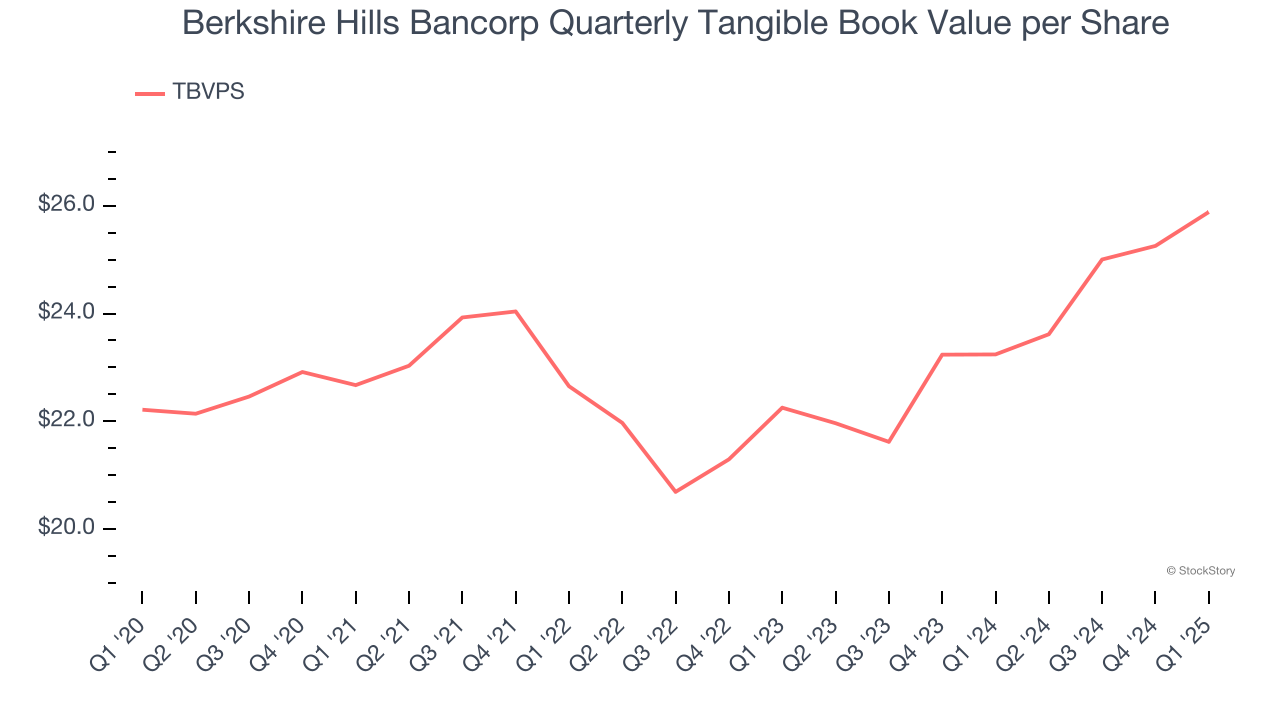

2. TBVPS Projections Show Stormy Skies Ahead

Tangible book value per share (TBVPS) growth is driven by a bank’s ability to earn more than its cost of capital through lending activities while maintaining a strong balance sheet.

Over the next 12 months, Consensus estimates call for Berkshire Hills Bancorp’s TBVPS to shrink by 14.8% to $22.05, a sour projection.

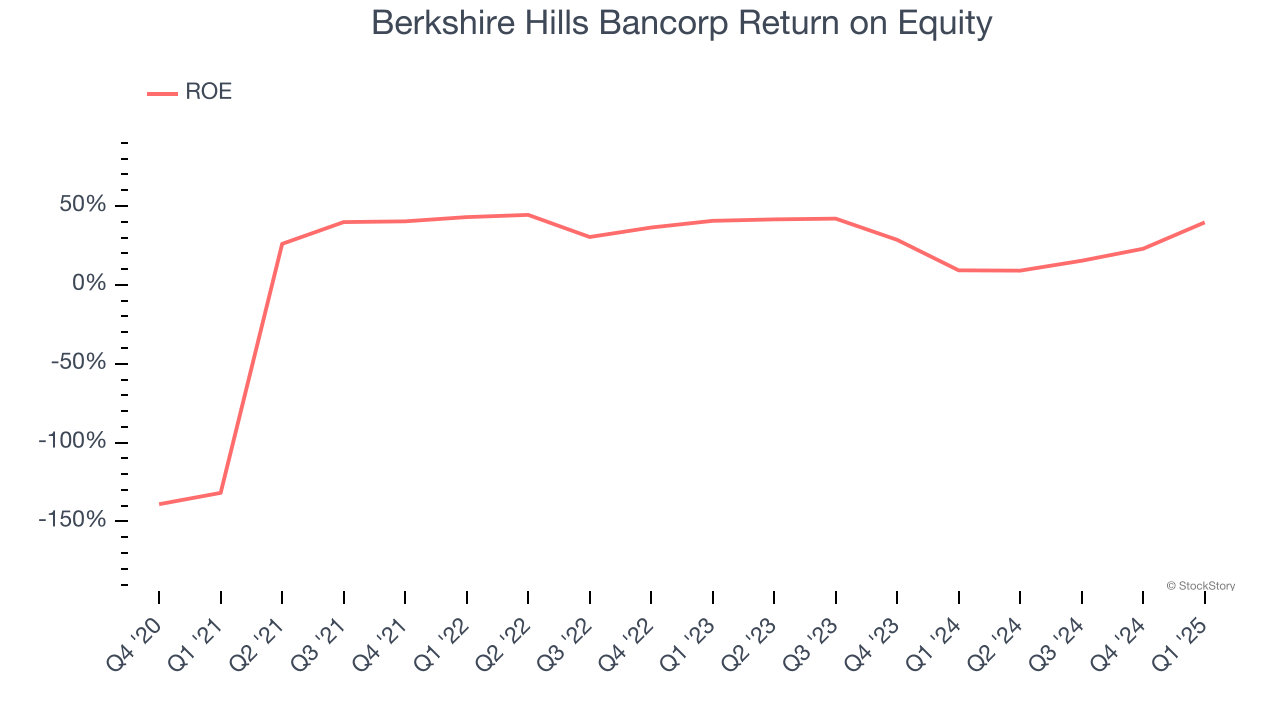

3. Previous Growth Initiatives Haven’t Paid Off Yet

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Berkshire Hills Bancorp has averaged a breakeven ROE, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

Final Judgment

Berkshire Hills Bancorp isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 0.9× forward P/B (or $26.19 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. We’d recommend looking at the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.