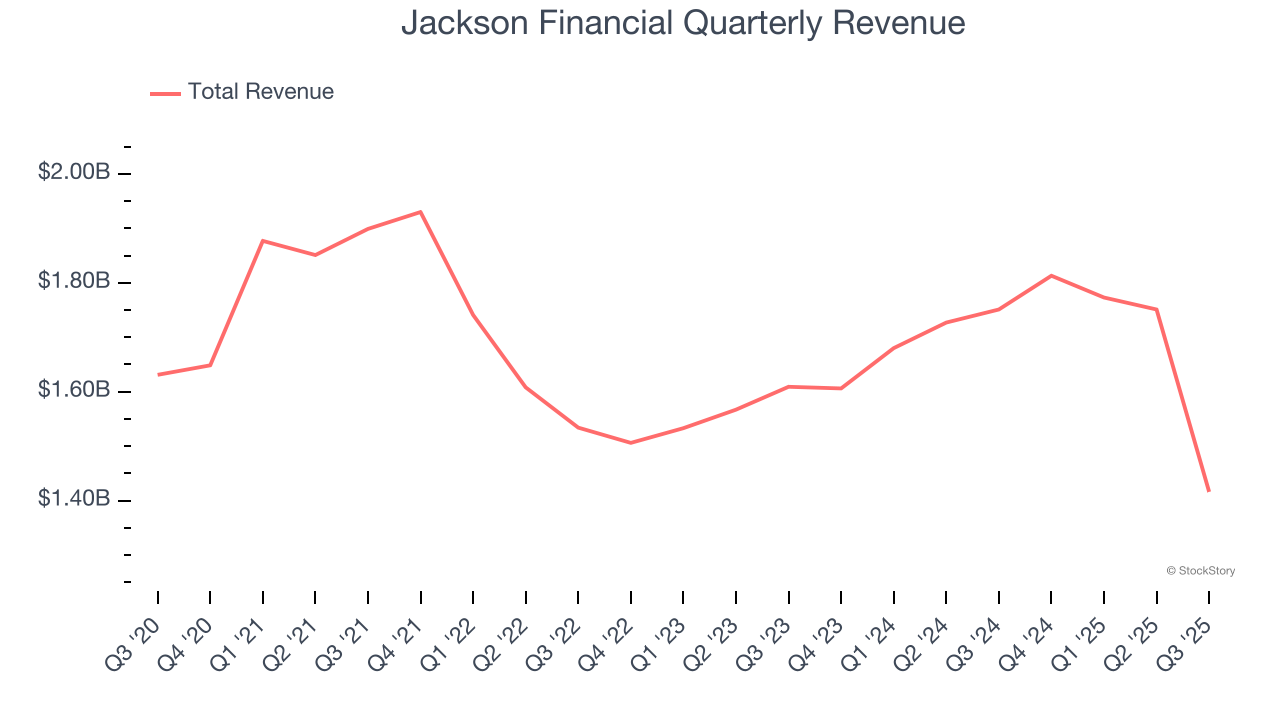

Retirement solutions provider Jackson Financial (NYSE: JXN) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 19.1% year on year to $1.42 billion. Its non-GAAP profit of $6.16 per share was 13% above analysts’ consensus estimates.

Is now the time to buy Jackson Financial? Find out by accessing our full research report, it’s free for active Edge members.

Jackson Financial (JXN) Q3 CY2025 Highlights:

Laura Prieskorn, President and Chief Executive Officer of Jackson, stated, “Our third quarter performance highlights the ongoing strength and momentum of our business as we advance toward our strategic goals. Retail annuity sales grew year over year, driven by our broad and innovative product portfolio, including record RILA sales and the successful launch of our Jackson Income Assurance℠ and Jackson Income Assurance℠ Advisory fixed index annuities. Our robust in-force book continued to deliver healthy free cash flow, generating $216 million in the quarter and nearly $1 billion over the past year. In addition, we returned $210 million to common shareholders, increased our estimated RBC ratio, and further enhanced our already substantial excess cash position at the holding company. Looking ahead, we believe we are well positioned to extend on this momentum through the remainder of 2025 and into 2026, continuing our commitment to helping Americans achieve financial security.”

Company Overview

Spun off from British insurer Prudential plc in 2021 after more than 60 years as its U.S. subsidiary, Jackson Financial (NYSE: JXN) offers annuity products and retirement solutions that help Americans grow and protect their retirement savings and income.

Revenue Growth

Insurance companies generate revenue three ways. The first is the core insurance business itself, represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected but not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from policy administration, annuities, and other value-added services. Unfortunately, Jackson Financial struggled to consistently increase demand as its $6.75 billion of revenue for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of lacking business quality.

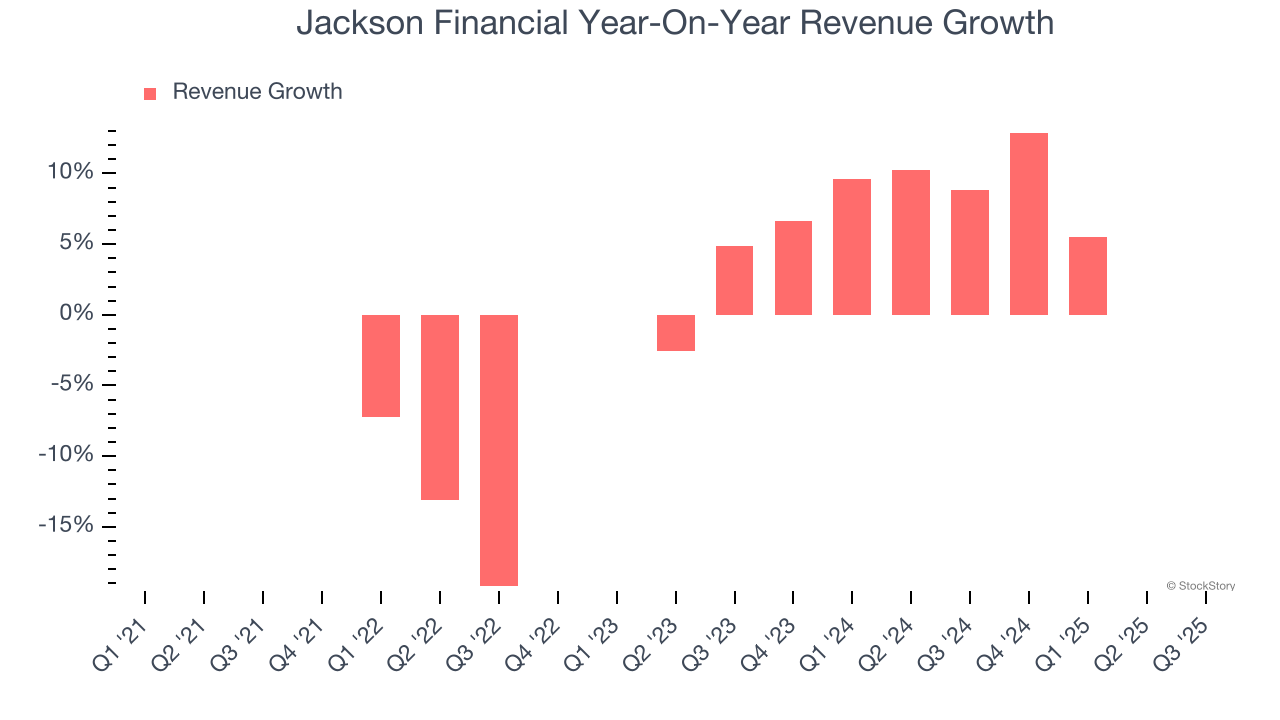

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Jackson Financial’s annualized revenue growth of 4.2% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Jackson Financial missed Wall Street’s estimates and reported a rather uninspiring 19.1% year-on-year revenue decline, generating $1.42 billion of revenue.

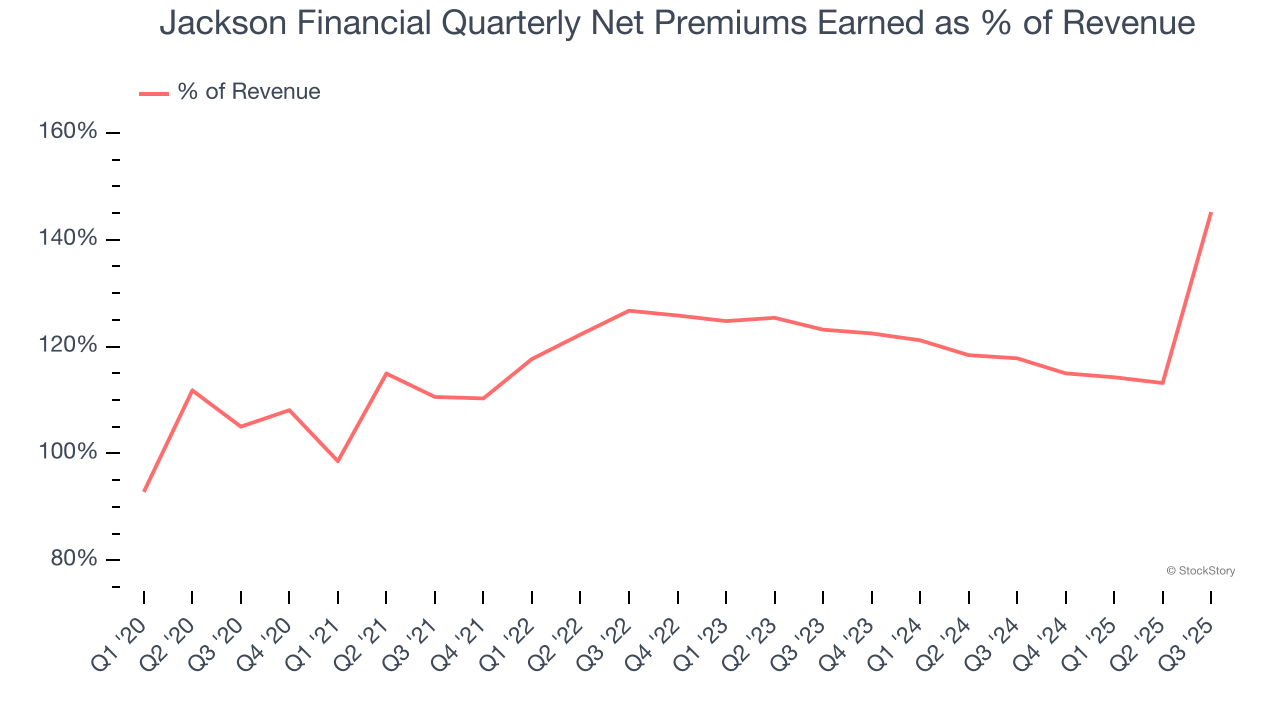

Since the company recorded losses on certain securities, it generated more net premiums earned than revenue (a 1.2x multiple of its revenue to be exact) during the last five years, meaning Jackson Financial lives and dies by its underwriting activities because non-insurance operations barely move the needle.

Our experience and research show the market cares primarily about an insurer’s net premiums earned growth as investment and fee income are considered more susceptible to market volatility and economic cycles.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Net Premiums Earned

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

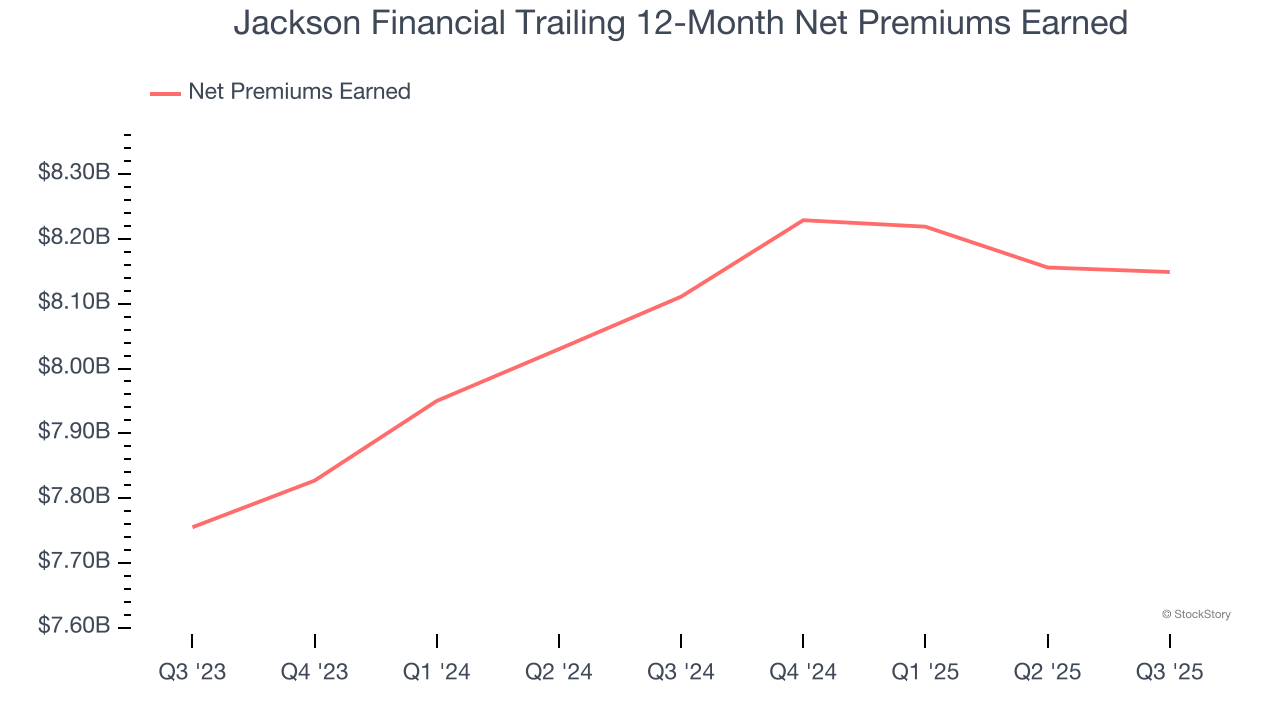

Jackson Financial’s net premiums earned has grown at a 4% annualized rate over the last five years, worse than the broader insurance industry but faster than its total revenue.

When analyzing Jackson Financial’s net premiums earned over the last two years, we can see that growth decelerated to 2.5% annually. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. While these supplementary streams affect the bottom line, their contribution can fluctuate. Some firms have been more successful and consistent in investing their float over the long term, but sharp movements in the fixed income and equity markets can play a substantial role in short-term performance.

Jackson Financial produced $2.06 billion of net premiums earned in Q3, flat year on year.

Key Takeaways from Jackson Financial’s Q3 Results

It was good to see Jackson Financial beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $100.80 immediately following the results.

So do we think Jackson Financial is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.