Looking back at the first half of 2022, the dollar trend has largely continued the upward trend of the second half of 2021, and the growth rate has accelerated to a new high of nearly 20 years; in terms of U.S. stocks, the U.S. Nasdaq index plunged 33%, the rate of decline hit a new high of nearly 20 years; during the same period, the UK FTSE index fell 3%, the French CAC40 index fell 17%, the German DAX index fell 16%, the Italian MIB index fell 20.5%, the U.S. technology index fell far more than Europe and the United States and other developed countries.

Natural gas, which once rose sharply by 60%, recorded a 3.9% decline in the second quarter; crude oil is also falling; prices of wheat, corn and soybeans have fallen back to their end-March levels; cotton prices have fallen by more than one-third since the beginning of May; and benchmark prices of copper and lumber for construction materials are down 22% and 31%, respectively.

From energy, metals, building materials to agricultural products, commodity prices have fallen back, also reflecting that the interest rate hike policy has had some effect.

The cumulative decline in BTC in the first half of 2022 amounted to 59%, compared to the all-time high of $69,000 in November last year fell 71%, although the decline is still some distance from the last bull market peak to the bottom valley of 84%, the market has passed the most torturous moments.

In addition to this, there is no interest rate hike expected in August, the U.S. stock market has fallen back from its highs by more than 20%, and the current market sentiment has changed a bit, with some big short-sellers in U.S. stocks, having quietly stopped shorting.

Bob Doll, chief investment officer at Crossmark Global Investments, said his firm has begun to scale back short bets: You always want to be short when the market is at a high and stop being short when the market is at a bottom.

BTC has been lacking effective rebound since the fall from $48,000, and $20,000 belongs to the key psychological level, whether from the decline or K-line trend, the recent W bottom formation, there is hope to test $23,000 near, so as to further rebound.

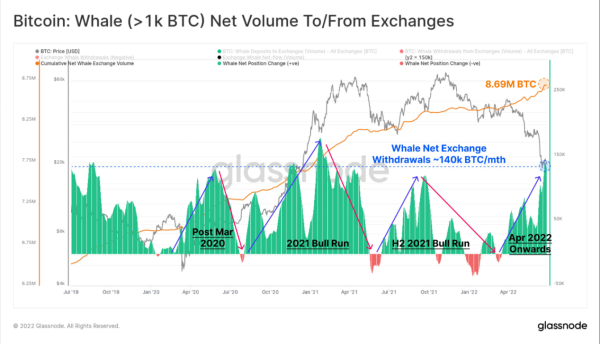

From the data on the chain, as of now BTC net outflow 9836 volume is large. The recent sustained outflow and pressure reduction has stimulated BTC to rebound further, and the short-term panic pressure is smaller than the past main force in the state of absorption, providing momentum for the recent trend rebound. According to Glassnode’s latest data, since mid-June, there has been a large increase in the number of addresses with BTC greater than 1, with nearly 1,000 addresses joining the ranks every day. Giant whales holding more than 1,000 BTC are actively adding to their BTC holdings, with monthly additions of about 140,000 pieces. As of the end of June, the giant whales have accumulated 8.69 million BTC, accounting for 45.6% of the total BTC supply. The giant whales already control more than 45% of BTC, and if you consider the BTC that has been lost and the scattered bitcoin holdings, I’m afraid most of the BTC is already controlled by the giant whales.

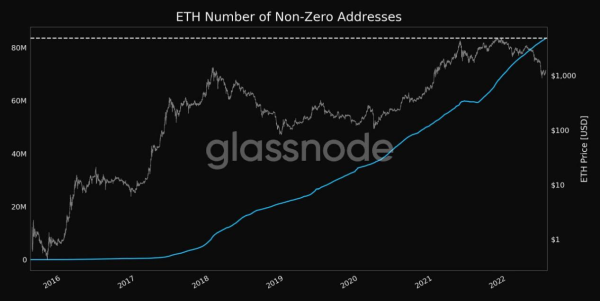

One piece of data about ETH is also worth noting. Glassnode data on July 8 showed that the number of ETH non-zero addresses reached a record high of 83,595,439. At the same time, the number of coins held on ETH greater than 0.01 addresses was 23,432,651, a record high. 0.01ETH is approximately This is very much in line with the psychological state of most beginning investors.

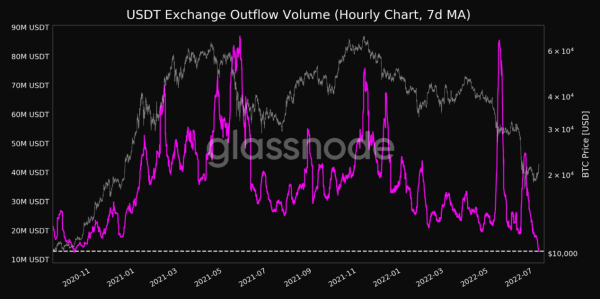

On July 8, Glassnode data showed that USDT exchange outflows (seven-day average) were 12,835,494.682 USDT, reaching a 20-month low, indicating that dealers have certain expectations for the later period, and the probability of the next market rebound is high.

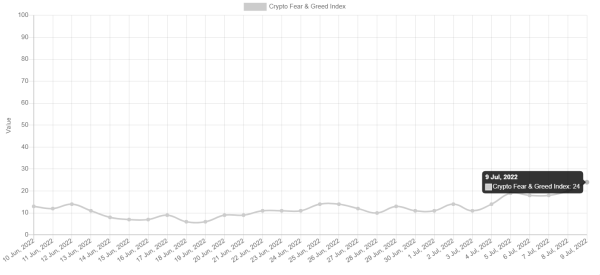

At the time of writing, the BTC balance greater than 1 address is 870,000, continuing to set new highs. People’s emotions have eased somewhat, and after almost two months of fear, the fear index began to be greater than 10 from June 22, and the fear greed index was 24 on July 9, with the market now out of the extreme fear zone.

Commodities are falling in general, interest rate hikes are having a significant effect, and some big shorts in US stocks are gradually stopping shorting. Many chain and market performance indicators also side-by-side indicate that the bearish sentiment index of the market is gradually being eased, and ZT Labs believes that there is a strong possibility of a wave of rebound in the crypto market in July.

The current crypto asset deleveraging cycle will probably not be long, the cost of holding coins by institutions is also rising, and the data on the chain has shown that a large part of the bubble has been consumed now, all of which are favorable factors for the market rally in July.

On July 1, Salvadoran President NavibBukele said on social media that his country had purchased 80 more bitcoins at a unit price of $19.000, for a total of about $ 1.5 million.

ZT Labs warmly reminds you that July crypto asset investment advice needs to focus on CPI, interest rate hikes, and Q2 GDP data.

First, on July 13 the U.S. will release CPI data for June, so around this time if it is a short term behavior, you can take the necessary position reduction, bagging is a prudent trading behavior.

Then, there is the Fed rate hike meeting on July 28 at 2 a.m. From the current market situation, the possibility of a 75 basis point rate hike still exists, and the Fed’s Powell said he is more worried about the risk of not being able to curb high inflation compared to the possibility of a dry hike too high and the economy falling into recession.

Cleveland Fed President Meister is the same idea, she said for the Fed, the wrong assumption that inflation will return to low levels, to be more harmful than raising interest rates too much and found that inflation expectations are still anchored at lower levels. So you can’t expect the Fed to turn “dovish” or soften its stance in the near future.

Finally, the U.S. second quarter GDP, July 28 at 20:30 pm, this time is later than the Fed rate hike resolution time, because the Fed interest rate meeting got CPI data but did not get GDP data, so this time before and after the market will become more sensitive, in order to avoid its large fluctuations, the necessary position management is still very important.

If you have any ideas and questions about the next crypto market in July, please contact us at ZT Market Brand Partnership email: media@ztb.com and we look forward to talking with you.

Media Contact

Company Name: ZT

Contact Person: Wendy

Email: Send Email

Country: Seychelles

Website: ztb.im