Amidst growth concerns, Qualcomm (QCOM) stock has crumbled by 23% in the last month. While the sharp correction seems like a buying opportunity, sustained earnings growth headwinds can be a deterrent to a renewed rally.

Recently, Bank of America Securities downgraded QCOM stock to “Neutral” from “Buy” with a price target of $155. The key reason for the downgrade is memory supply constraints that are negatively impacting the handset market. BofA analysts also noted that an increase in memory prices has impacted the “inventory plans of smartphone OEMs, primarily in China.” Further, these constraints are likely to persist until CY28.

While Qualcomm has other catalysts in the auto and IoT segments, it’s unlikely that earnings growth will accelerate in the foreseeable future. This can potentially imply subdued valuations.

About Qualcomm Stock

Headquartered in San Diego, Qualcomm is a provider of technologies for the wireless industry globally. Qualcomm derives its revenue primarily from the sale of integrated circuit products and the licensing of intellectual property.

The company operates through three segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI). For Q1 FY26, the company reported 5% revenue growth on a year-on-year (YoY) basis to $12.3 billion.

With mobile devices being the key growth driver, Qualcomm has been impacted by growth deceleration in the handset market. This has translated into QCOM stock declining by almost 6% in the last six months.

Soft Guidance to Impact QCOM Stock

For Q1 2026, Qualcomm reported QCT handset revenue of $7.8 billion. However, with higher pricing of memory coupled with lower availability, Qualcomm expects QCT handset revenue to be $6 billion for Q2 2026. As memory crunch impacts handset revenue, QCOM stock valuation is adjusting on the downside. The key point to note is that the headwinds are likely to persist beyond the next quarter.

While Qualcomm expects growth in the QCT IoT and QCT Automotive segments, the handset segment remains the key growth and cash flow driver. This point is underscored by the fact that the automotive segment is likely to grow at 35% on a YoY basis in Q2. However, QCOM stock has crumbled on the back of challenges in the handset business.

On the positive side, Qualcomm announced an expansion into advanced robotics. Further, the company introduced a full suite of robotics technologies and solutions. This includes the Qualcomm Dragonwing IQ10 Series. It will, however, be a few years before this segment has an impact on growth and value creation.

Another important point to note is that Qualcomm ended Q1 with cash and marketable securities of $11.8 billion. With a strong balance sheet and healthy operating cash flows, Qualcomm is positioned for inorganic growth and investment in innovation. In Q1, the company completed the acquisition of Alphawave Semi, which adds high-speed wired connectivity technologies to the company’s portfolio. Ventana Micro Systems was also acquired to further the development of the RISC-V standard.

What Analysts Say About QCOM Stock

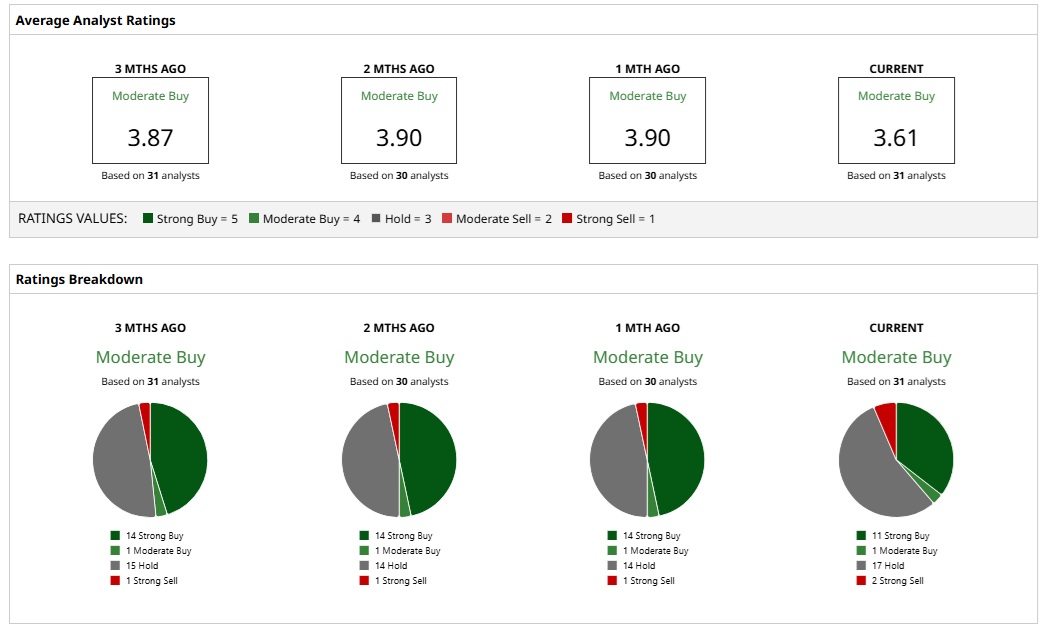

Given the ratings of 31 analysts, QCOM stock is a consensus “Moderate Buy.” While 11 analysts assign a “Strong Buy” rating to QCOM, one analyst opines that the stock is a “Moderate Buy.” A majority of 17 analysts believe that the stock is a “Hold.” Finally, on the bearish side, two analysts have a “Strong Sell” rating.

Based on these ratings, analysts have a mean price target of $167.43 currently, which would imply an upside potential of 22%. Further, the most bullish price target of $205 suggests that QCOM stock could rise as much as 49% from here.

From a valuation perspective, a forward price-earnings ratio of 14 seems attractive. However, analyst estimates indicate that earnings degrowth for FY26 is expected at 4.57%. Further, for FY27, earnings growth is likely to be muted at 4.89%. It’s therefore not surprising that QCOM stock has corrected, even considering a relatively low P/E multiple.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Post-Earnings Dip in Amazon Stock?

- As Kyndryl Stock Plunges Into Deeply Oversold Territory, Should You Buy the Dip?

- Nvidia Reportedly Faces Gaming GPU Delays: Does That Weaken the Bull Case for NVDA Stock Here?

- Why Even Mega-Bull Dan Ives Lowered His Price Target on Amazon Stock After the CapEx Shock