Nvidia (NVDA) stock took a hit on Monday, dropping over 3% as reports surfaced that its planned $100 billion investment in OpenAI had stalled. The semiconductor giant's shares continued to slide through the week, falling 9% in the past five days and 15% from all-time highs as investors digested what appeared to be cracks in one of AI's most important partnerships.

The drama started when The Wall Street Journal reported that Nvidia CEO Jensen Huang had privately told business associates the investment wasn't binding. Sources reported that Huang criticized OpenAI's business strategy and expressed concern about competition from Google (GOOG) (GOOGL) and Anthropic.

Huang quickly pushed back on the narrative over the weekend, telling Bloomberg the reports were "nonsense" and reaffirming Nvidia's commitment to OpenAI. "We are going to make a huge investment in OpenAI. I believe in OpenAI, the work that they do is incredible," Huang said, calling it "probably the largest investment we've ever made."

Altman Fires Back at "Insanity"

OpenAI CEO Sam Altman took to X, formerly Twitter, to defend the partnership, writing, "We love working with NVIDIA and they make the best AI chips in the world. We hope to be a gigantic customer for a very long time. I don't get where all this insanity is coming from."

The public show of support came after The Wall Street Journal reported OpenAI wasn't satisfied with some of Nvidia's latest chips for AI inference—the process where trained models analyze new data and generate outputs. OpenAI has been shopping for alternatives since last year, seeking chips that can deliver faster responses for products like Codex, its coding assistant.

That search led OpenAI to strike deals with AMD (AMD), Broadcom (AVGO), and startup Cerebras, totaling over $10 billion in commitments. The moves signal OpenAI's strategy to diversify beyond Nvidia's dominant grip on AI chips, which currently powers over 90% of the GPU market.

Despite the apparent friction, Nvidia and OpenAI remain deeply intertwined. Altman has repeatedly said OpenAI needs massive quantities of Nvidia chips to hit its revenue targets. The company is on track for $20 billion in annual sales but won't turn profitable until 2030, according to analysts. More computing power means faster growth.

Meanwhile, Nvidia relies on customers like OpenAI to create services that wow users and justify its premium-priced systems. When ChatGPT launched in late 2022, Nvidia was generating $6 billion in quarterly revenue. That number exploded almost tenfold to $57 billion by October 2025.

"This is part negotiation and part Nvidia making sure that other competitors are not fueled by Nvidia's investments into OpenAI," Wedbush analyst Dan Ives wrote Monday. "At the end of the day Nvidia will make a huge investment in OpenAI likely near the $100 billion zip code."

The September announcement outlined a letter of intent for Nvidia to invest up to $100 billion in OpenAI to build AI infrastructure requiring 10 gigawatts of power. But an SEC filing in November revealed no definitive agreement had been signed.

Huang told CNBC's Jim Cramer on Tuesday that Nvidia will participate in OpenAI's next fundraising round, which could raise as much as $100 billion and become "the largest private round ever raised in history."

"There's no drama involved. Everything's on track," Huang said.

Still, the lack of a signed contract five months after the announcement has investors questioning whether the deal will materialize as originally outlined.

The tension appears to be rooted in OpenAI's evolving hardware needs. Reuters reported that OpenAI wants chips with large amounts of SRAM embedded directly on silicon, which would offer speed advantages for chatbots serving millions of users. Nvidia's GPUs rely on external memory, which adds processing time.

Nvidia moved to address competition by licensing technology from Groq, a startup developing SRAM-heavy chips, in a $20 billion deal that effectively ended OpenAI's talks with the company.

Wall Street Weighs In

Sarah Kunst, managing director at Cleo Capital, told CNBC that uncertainty over the exact investment amount raised concerns.

"One of the things I did notice about Jensen Huang is that there wasn't a strong ‘It will be $100 billion,’" Kunst said. "That kind of back and forth isn't normal between an investor and a startup to play out in the media."

Wedbush's Ives believes the public sparring is partly strategic, with Nvidia leveraging its strong negotiating position while managing concerns about "circular financing" in AI, where major companies invest in each other in ways that cloud their actual profitability.

For investors watching Nvidia stock, the message from both CEOs is clear: the partnership remains intact, even if the exact terms of future investments are still being worked out.

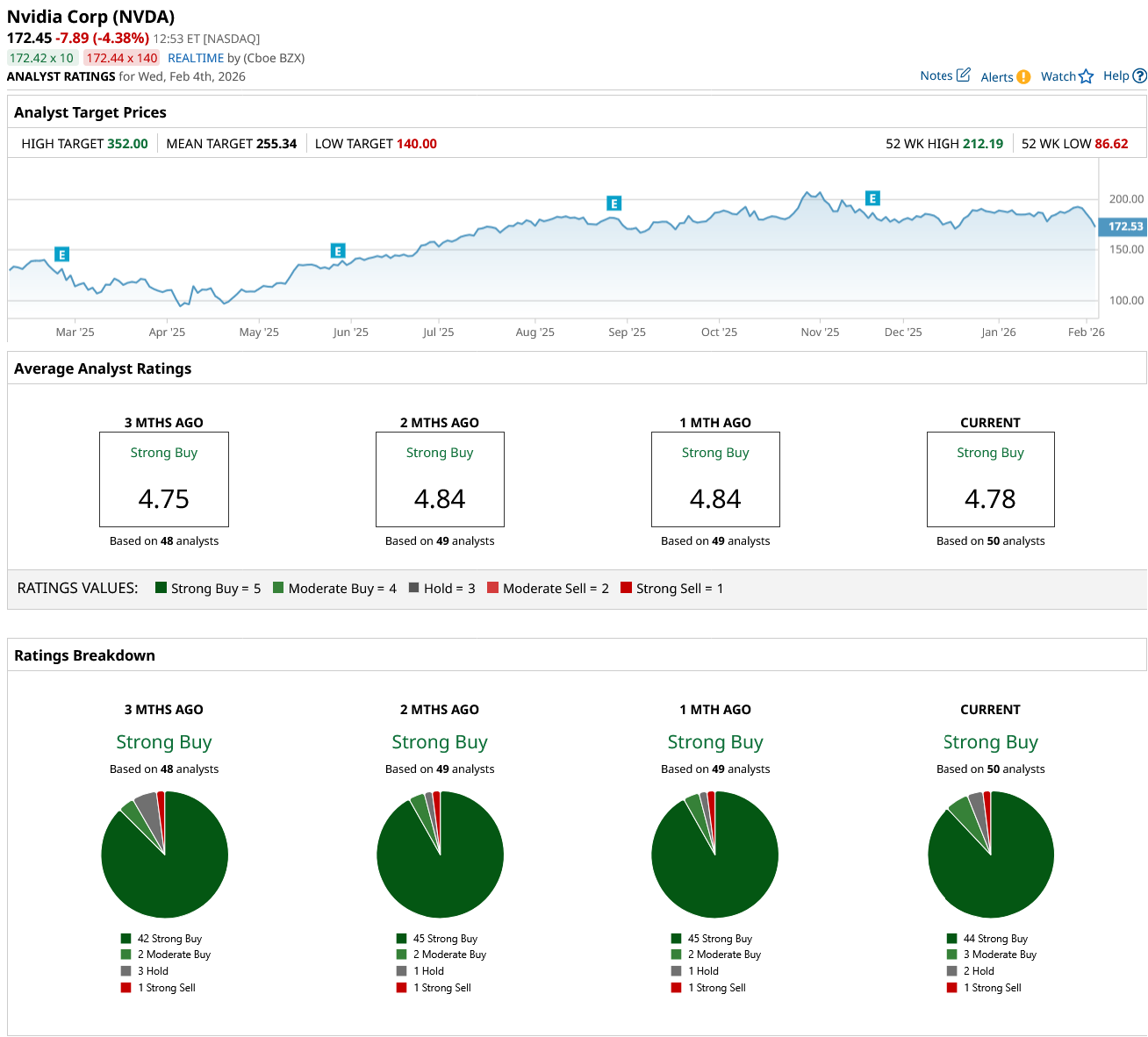

Out of the 50 analysts covering NVDA stock, 44 recommend “Strong Buy,” three recommend “Moderate Buy,” two recommend “Hold,” and one recommends “Strong Sell.” The average NVDA stock price is $255, above the current price of $180.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Blue-Chip Dividend Stock Is Now Part of the Trillion-Dollar Club. Is It Still a Buy Here?

- Waymo Raises Another Red Flag for Tesla. Should You Sell TSLA Stock in February 2026?

- 3 Key Risks Facing SMCI Stock As Super Micro Computer Revenue Surges

- Tesla Is Investing $2 Billion in xAI. Is That Bad News or Good News for TSLA Stock?