With a market cap of $88.5 billion, Corning Incorporated (GLW) is a global materials science company that operates across optical communications, display technologies, environmental technologies, specialty materials, and life sciences. It serves industries ranging from telecommunications and consumer electronics to automotive emissions control and laboratory sciences worldwide.

Shares of the Corning, New York-based company have significantly surpassed the broader market over the past 52 weeks. GLW stock has surged 111.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.5%. Moreover, shares of Corning have soared 26% on a YTD basis, compared to SPX's 1.9% rise.

Looking closer, shares of the gorilla glass maker has also outpaced the State Street Technology Select Sector SPDR ETF's (XLK) return of 25.9% over the past 52 weeks.

Corning reported strong Q4 2025 results on Jan. 28, with adjusted EPS of $0.72 and core sales of $4.41 billion, both surpassing forecasts. Investor sentiment was further boosted as Corning upgraded its Springboard growth plan, raising projected incremental annualized revenue to $11 billion by the end of 2028 and $6.5 billion by the end of 2026, alongside significant margin expansion, including a 390-basis-point increase in core operating margin to 20.2%. However, the stock fell nearly 5% on that day.

For the fiscal year ending in December 2026, analysts expect GLW's adjusted EPS to grow 21.8% year-over-year to $3.07. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

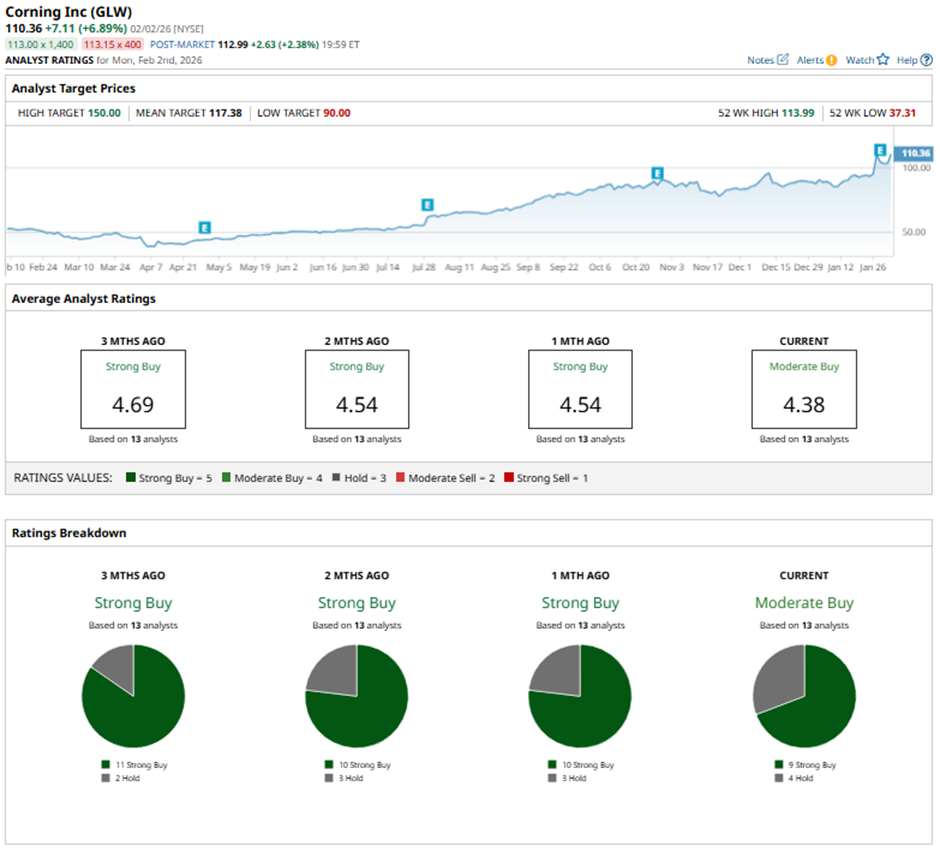

Among the 13 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buys” and four “Holds.”

This configuration is less bullish than three months ago, with 11 “Strong Buy” ratings on the stock.

On Jan. 29, Susquehanna raised Corning’s price target to $125 and maintained a “Positive” rating.

The mean price target of $117.38 represents a 6.4% premium to GLW’s current price levels. The Street-high price target of $150 implies a potential upside of 35.9% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Think This Dividend Stock Is Headed for Big Payout Growth Ahead

- What Company Is Ryan Cohen Eyeing for a GameStop Megadeal? And Should You Buy GME Stock Here?

- 2 High-Risk, High-Reward Quantum Computing Stocks to Buy Now

- Here’s What Options Traders Expect from Advanced Micro Devices Stock After Earnings