Valued at a market cap of $30.1 billion, DTE Energy Company (DTE) is a diversified regulated utility holding company headquartered in Detroit, Michigan. It primarily provides electricity and natural gas to customers in Michigan through its two regulated subsidiaries, DTE Electric and DTE Gas, while also operating a portfolio of non-utility energy businesses.

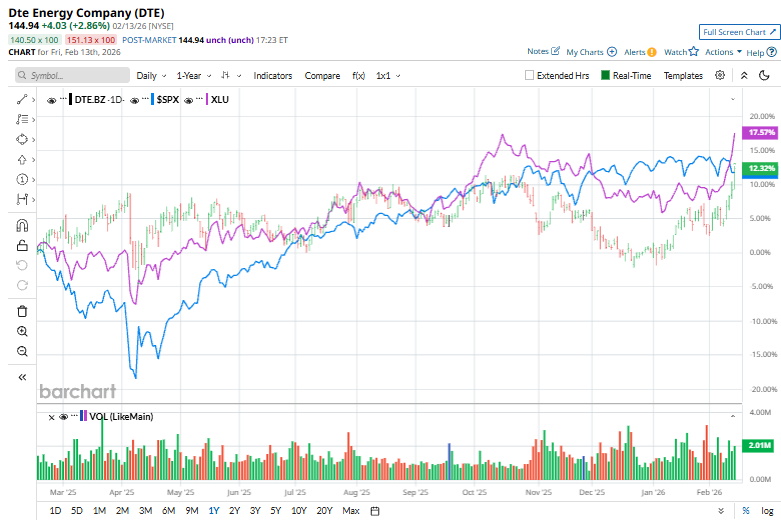

Shares of this utility company have outpaced the broader market over the past 52 weeks. DTE has surged 13.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.8%. Moreover, on a YTD basis, the stock is up 12.4% compared to the SPX’s marginal drop.

Zooming in further, DTE has trailed the State Street Utilities Select Sector SPDR Fund’s (XLU) 17.1% uptick over the past 52 weeks but has surpassed the ETF’s 8.9% return in 2026.

On Feb. 5, DTE Energy announced a quarterly common-stock dividend of $1.165 per share, payable April 15, 2026, to shareholders of record as of March 16. The declaration reaffirmed the utility’s stable cash-flow profile and ongoing commitment to shareholder returns, and the stock edged marginally higher following the announcement.

For FY2025 that ended in December, analysts expect DTE’s EPS to grow 5.7% year over year to $7.22. The company’s earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters, while missing in the previous quarter.

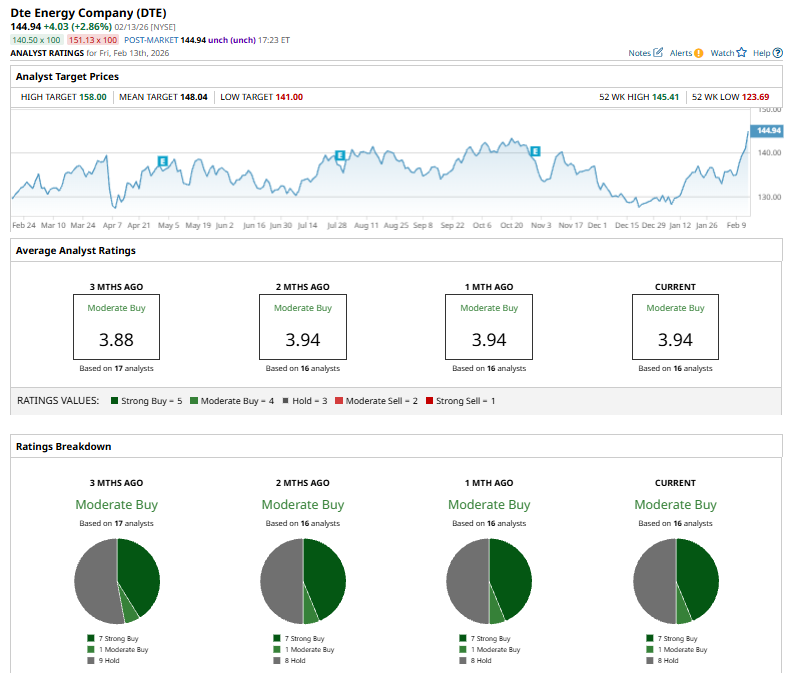

Among the 16 analysts covering the stock, the consensus rating is a “Moderate Buy,” which is based on seven “Strong Buy,” one “Moderate Buy,” and eight “Hold” ratings.

On Feb. 2, Morgan Stanley analyst David Arcaro reiterated an “Overweight” rating on DTE Energy and slightly raised the price target to $143 from $142, signaling continued confidence in the company’s outlook.

DTE’s mean price target of $148.04 implies a premium of 9.7% from the current market prices, and the Street-high of $158 indicates that the stock could soar by 14.8%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart