Headquartered in Cambridge, Massachusetts, Biogen Inc. (BIIB) researches, develops, and commercializes therapies for severe neurological, immunological, and rare disorders. Commanding a market cap of approximately $28.8 billion, its portfolio spans treatments for multiple sclerosis, spinal muscular atrophy, Alzheimer’s disease, amyotrophic lateral sclerosis (ALS), and other debilitating conditions.

Over the past 52 weeks, Biogen’s shares have appreciated 41.9%, substantially outperforming the S&P 500 Index ($SPX), which delivered an 11.8% gain over the same period. Year-to-date (YTD), BIIB stock is up another 11.7%, while the broader index has recorded a marginal decline.

Sector comparisons further validate the outperformance. The iShares Biotechnology ETF (IBB) has risen 25.9% over the last 52 weeks and a further 2.2% YTD. Although these returns reflect healthy sector momentum, they trail Biogen’s gains by a meaningful margin.

Operational results have supported the narrative. On Feb. 6, the stock advanced 8.5% following the release of stronger-than-expected Q4 fiscal 2025 financial results. Revenue declined 7.1% year over year to $2.28 billion, but surpassed the $2.2 billion analyst estimate. Adjusted EPS reached $1.99, exceeding Street’s expectations of $1.63.

Management attributed the quarter’s performance to sustained momentum within its newer product portfolio, particularly Lekembi, Skyclaris, Xerxuve, and Calcadi, which collectively generated more than $1 billion in annual revenue.

Looking ahead, they project fiscal year 2026 total revenue to decline by a mid-single-digit percentage compared with 2025. However, it projects non-GAAP diluted EPS in the range of $15.25 to $16.25, indicating that disciplined cost management and operational efficiency should help sustain profitability.

For fiscal year 2026, ending in December, analysts project diluted EPS to grow 3.3% year over year to $15.79. Additionally, Biogen has beaten EPS estimates in three of the past four quarters, with only one miss.

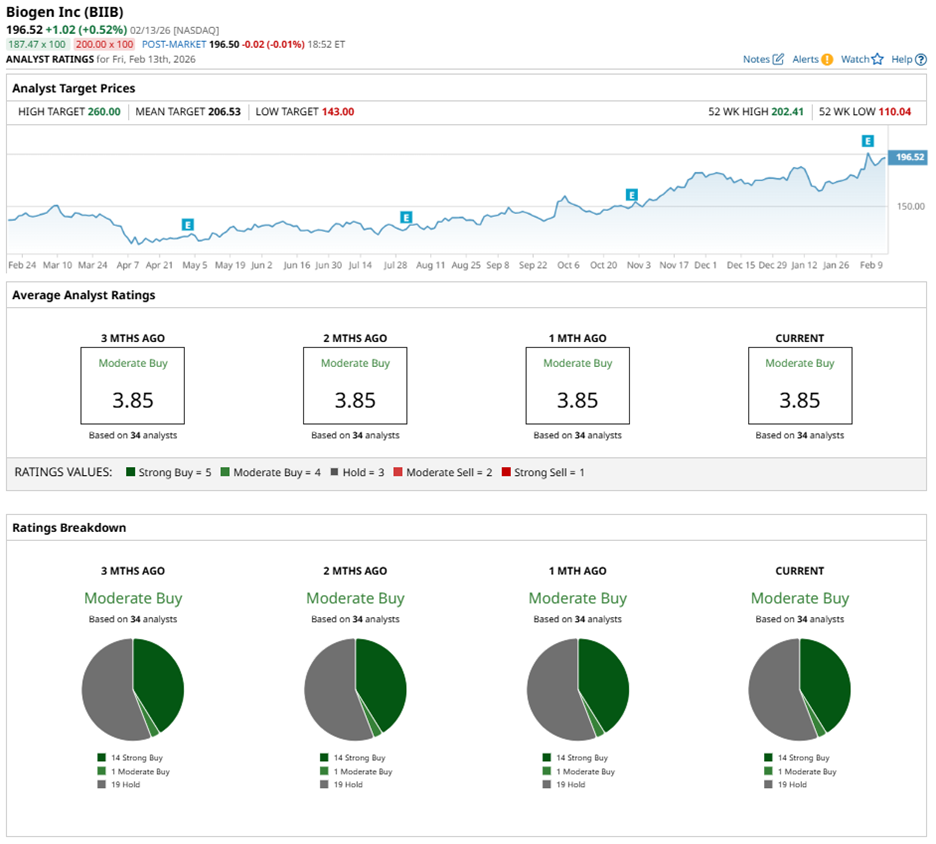

Wall Street currently assigns BIIB an overall rating of “Moderate Buy.” Among 34 analysts covering the stock, 14 recommend “Strong Buy,” one suggests “Moderate Buy,” and 19 advise “Hold.”

Analyst sentiment has remained broadly stable over the past three months, when 14 analysts also assigned “Strong Buy” ratings to Biogen.

Following the earnings release, HC Wainwright & Co., led by Andrew S. Fein, reiterated its “Buy” rating on Feb. 9 and raised its price target from $194 to $228, reflecting a more constructive outlook after the quarterly performance.

Even after the run-up, pricing metrics still suggest room for appreciation. The mean price target of $206.53 implies potential upside of 5.1%, while the Street-high target of $260 represents a gain of 32.3% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart