With a market cap of $33.9 billion, Paychex, Inc. (PAYX) is a leading provider of human capital management (HCM) solutions, offering payroll, HR, employee benefits, and insurance services to small and medium-sized businesses across the United States, Europe, and India. It delivers end-to-end workforce solutions ranging from recruiting and payroll processing to retirement planning, compliance, and risk management.

Shares of the Rochester, New York-based company have lagged behind the broader market over the past 52 weeks. PAYX stock has decreased 36.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.8%. Moreover, shares of the company are down 15.9% on a YTD basis, compared to SPX’s marginal decline.

Focusing more closely, shares of the payroll processor and human-resources services provider have underperformed the State Street Industrial Select Sector SPDR ETF’s (XLI) 26.3% return over the past 52 weeks.

Paychex reported Q2 2026 results on Dec. 19. The company posted adjusted EPS of $1.26 and revenue climbed 18% year-over-year to $1.56 billion, both topping forecasts. Investor sentiment was further boosted by 21% growth in adjusted operating income to $649 million and strong momentum from the Paycor acquisition, which contributed approximately 17% to Management Solutions revenue growth. Additionally, Paychex raised its full-year fiscal 2026 outlook, projecting 10% - 11% growth in adjusted EPS.

For the fiscal year ending in May 2026, analysts expect PAYX’s adjusted EPS to grow 9.2% year-over-year to $5.44. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

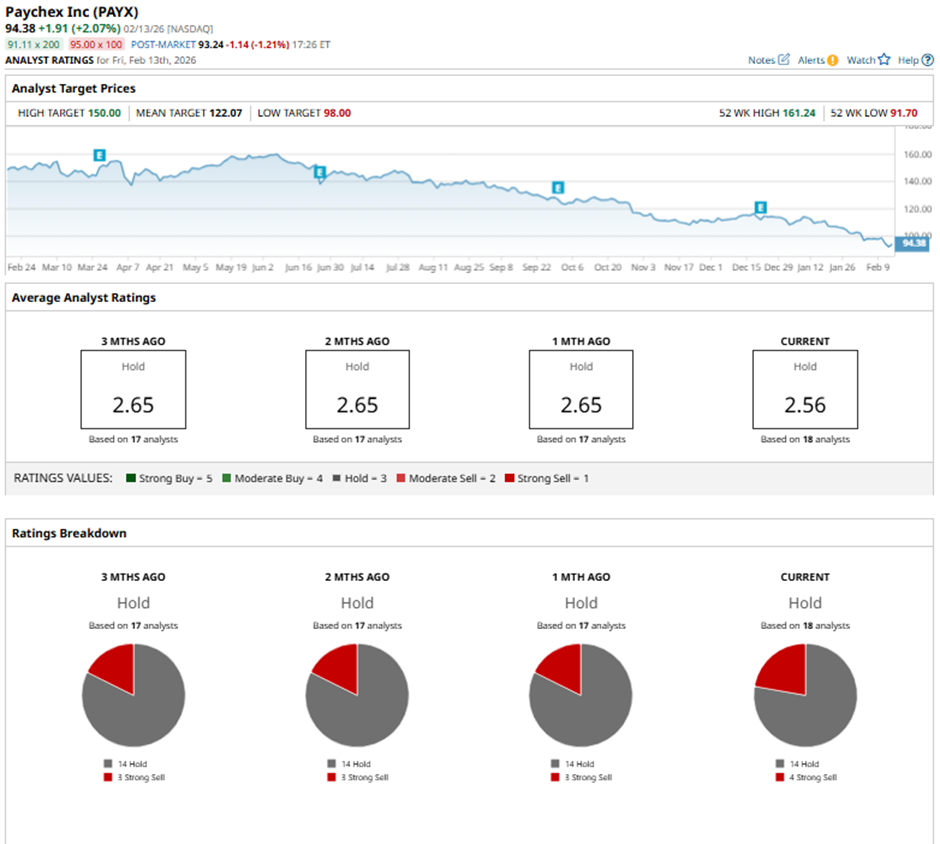

Among the 18 analysts covering the stock, the consensus rating is a “Hold.” That’s based on 14 “Hold” ratings and four “Strong Sells.”

On Jan. 29, Kevin McVeigh of UBS maintained a “Hold” rating on Paychex, setting a price target of $110.

The mean price target of $122.07 represents a 29.3% premium to PAYX’s current price levels. The Street-high price target of $150 suggests a 58.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart