When markets are up, we feel like geniuses. But when they turn volatile, investors often ask a different question: “What keeps paying me no matter what?” Having a stable income suddenly feels more valuable and can make the sting of volatility hurt a little less. I’m talking about the kind of income that shows up quarter after quarter, even when headlines turn negative and stock prices swing.

That is where companies on the Dividend Aristocrats list stands out. These are S&P 500 companies that have increased their dividends for at least 25 consecutive years. They have managed not only to pay but also to increase shareholder payouts.

Today, I’m screening my Dividend Aristocrats list, which are not only consistent dividend payers but also still growing earnings and cash flow, supported by solid analyst coverage.

How I came up with the following stocks

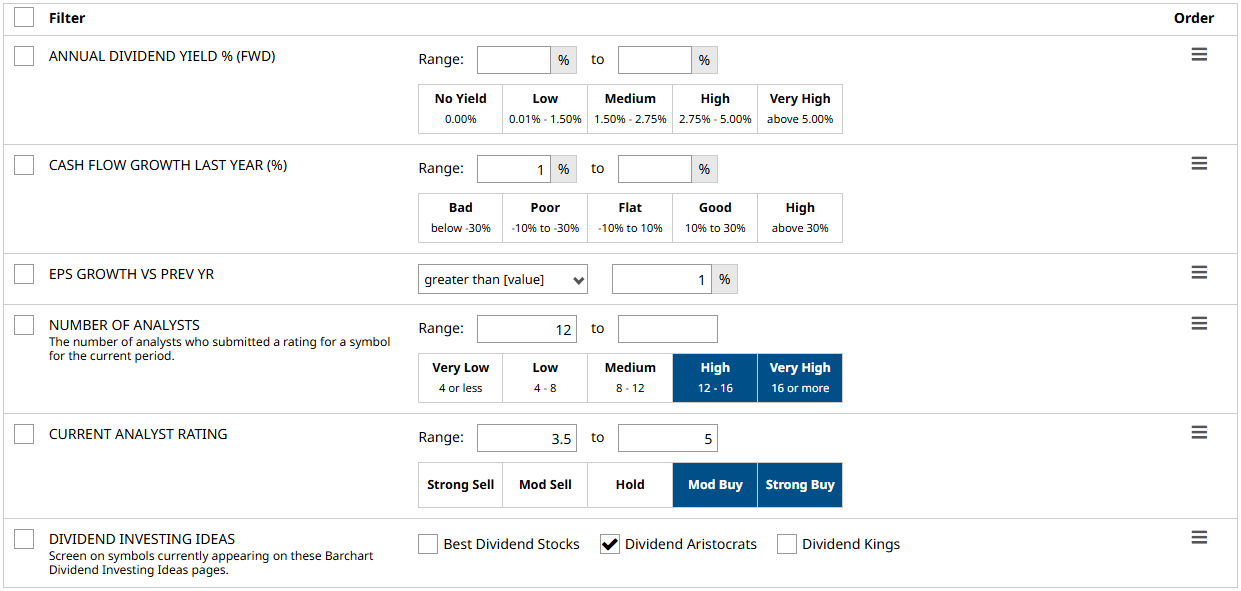

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- Annual Dividend Yield % (FWD): Left blank so I can sort it from highest to lowest.

- Cash Flow Growth Last Year (%): At least 1% increase year-over-year, displaying the company’s ability to reinvest and grow dividend payments.

- EPS Growth Vs Prev Yr: Greater than 1%. Companies whose net profit increased over the past year.

- Number of Analysts: 12 or more. A higher number suggests greater confidence in the rating.

- Analyst Rating: Consensus Moderate to Strong Buy

- Dividend Investing Ideas: Dividend Aristocrats.

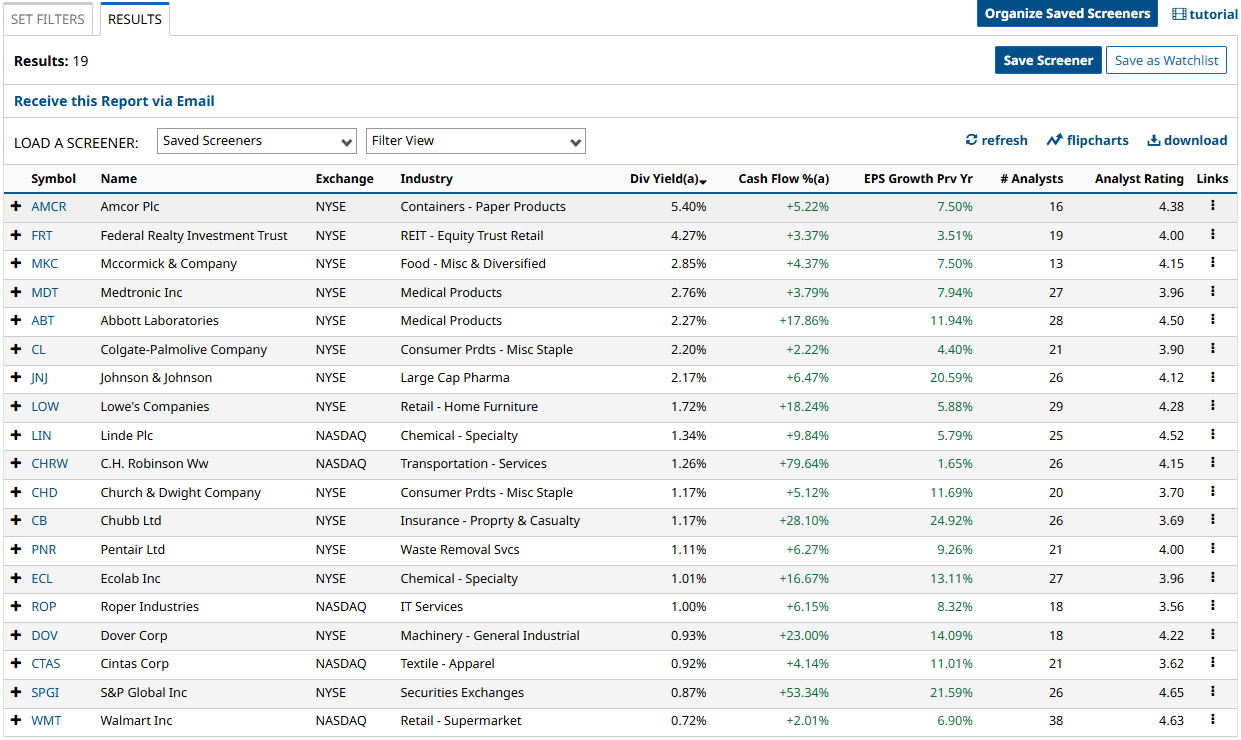

With these filters set, I ran the screen and got 19 results and I'll cover three companies with the highest forward annual dividend yield.

Let’s kick off the list with the first Dividend Aristocrat:

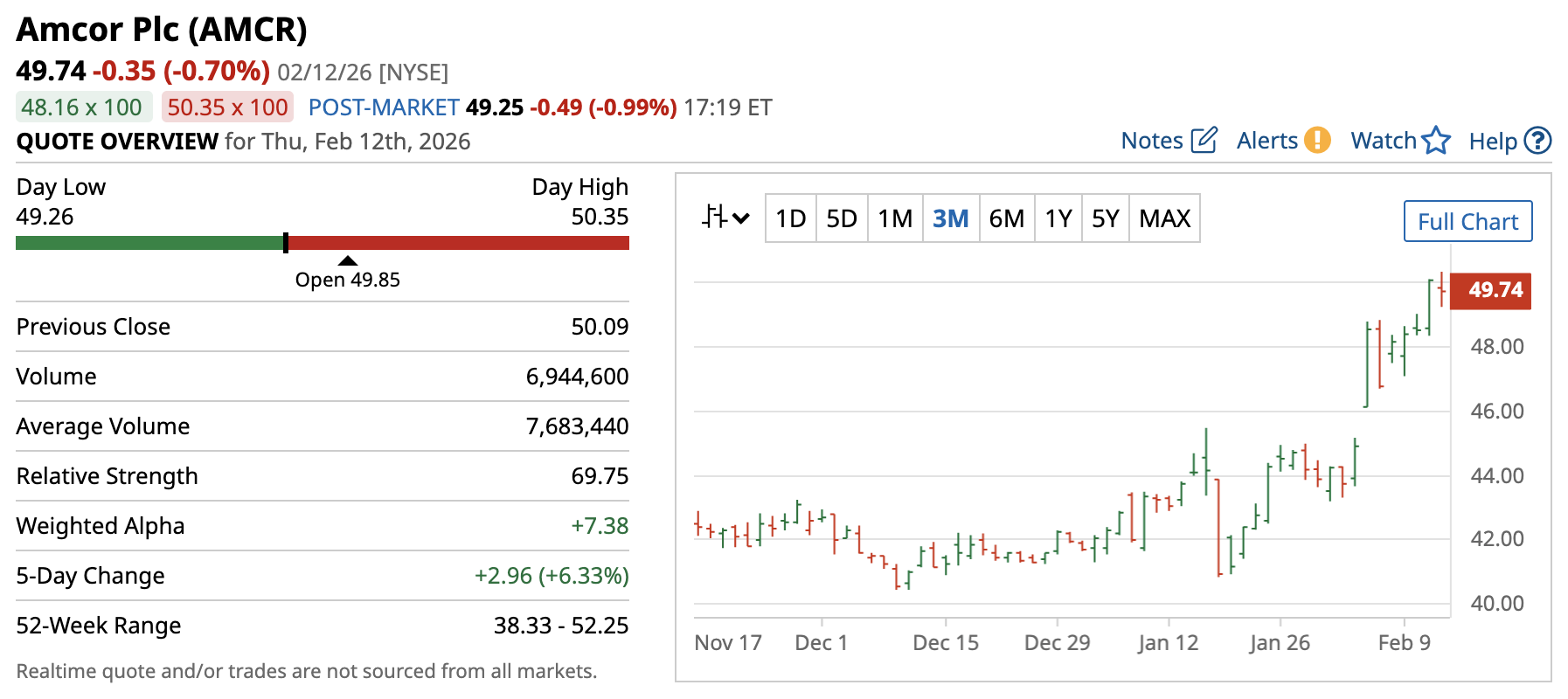

Amcor Plc (AMCR)

Amcor Plc is a global packaging company that makes flexible and rigid packaging for various industries, including food, healthcare, and consumer products. Its wide product portfolio helps protect products, extend shelf life, and improve sustainability across markets worldwide.

In its recent quarterly financials, Amcor reported that sales rose 68% YOY to $5.4 billion and net income was up 9% to $177 million. But that’s not the whole story- its operating cash flow grew 5.22% in 2025, and full-year EPS increased 7.5%, which suggests (slow but) steady growth.

Amcor has paid increasing dividends for 27 consecutive years. Today, it pays a forward annual dividend of $2.60, translating to a yield of just over 5%.

Meanwhile, 16 analysts rate the stock a “Moderate Buy”. It has around 20% upside if it achieves its high target of $60.

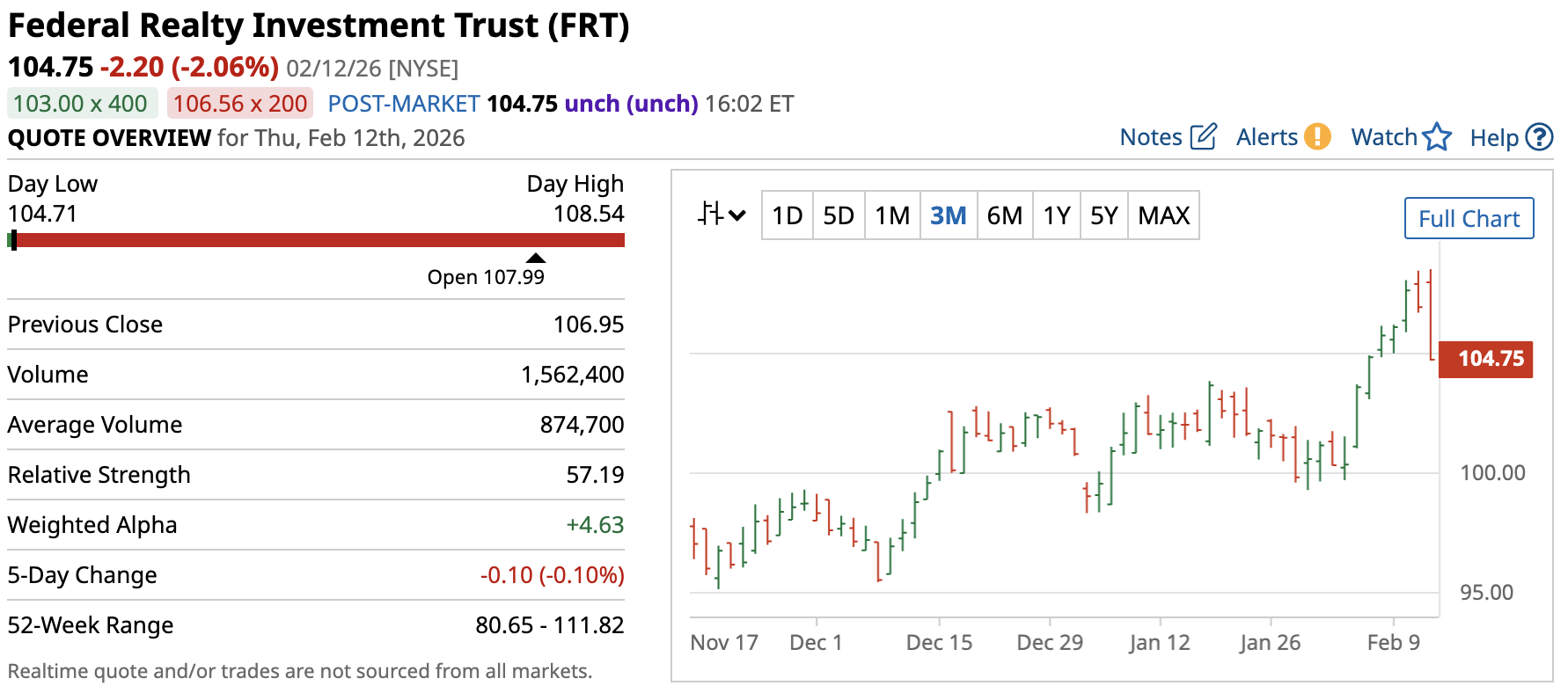

Federal Realty Investment Trust (FRT)

The second Dividend Aristocrat is Federal Realty Investment Trust, a REIT that operates retail and mixed-use properties in high-income U.S. markets, primarily through shopping centers and urban retail locations.

Its most recent quarterly financials reported that sales were up 6% YOY to $322 million. Net income also increased 1% to $61 million. Federal Realty’s operating cash flow rose 3.37% over the past year, while its EPS grew 3.51%, which is pretty solid as REITs are not usually built for rapid earnings expansion.

Federal Realty has increased its dividends for 58 consecutive years, and currently pays a forward annual dividend of $4.52, translating to a yield of approximately 4.3%.

Further, a consensus among 19 analysts rates the stock a “Moderate Buy” and suggests there’s around 15% upside should it reach its target high of $120.

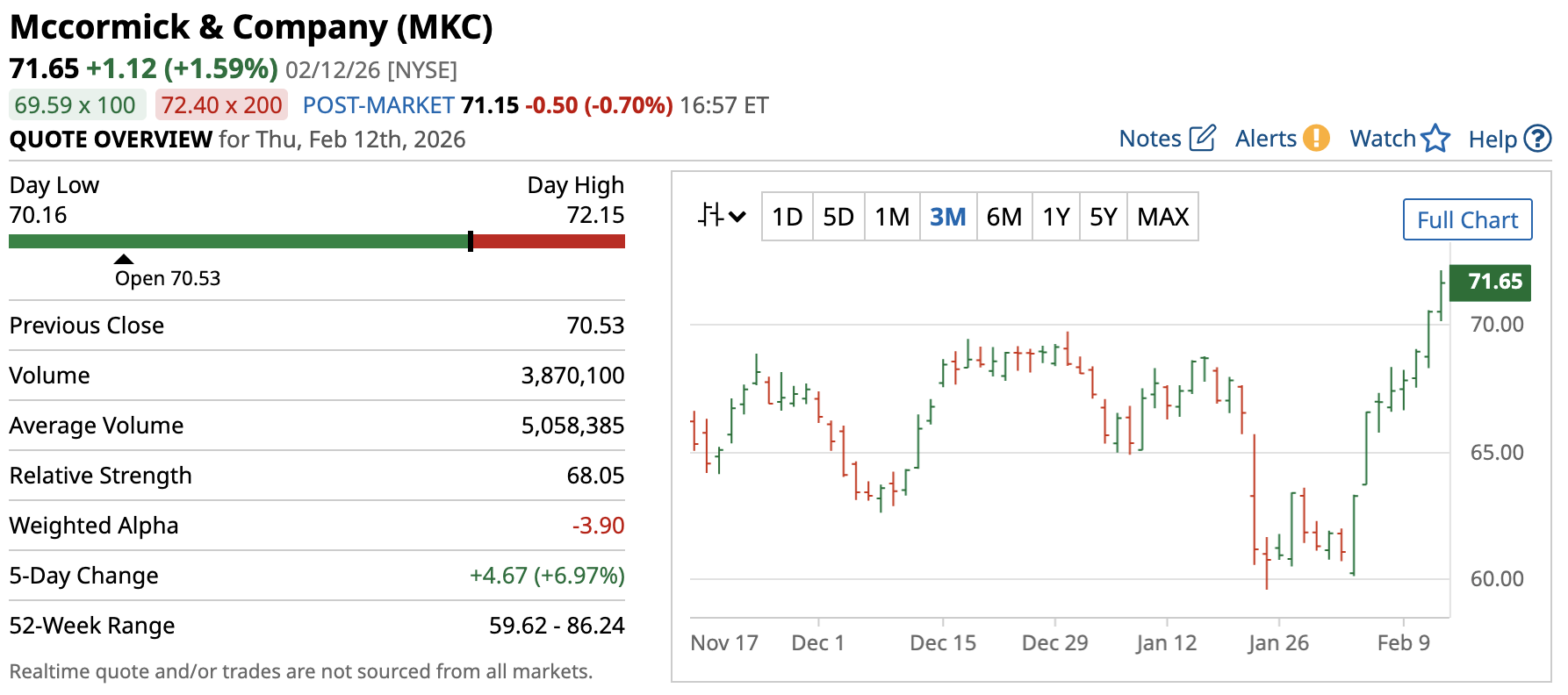

McCormick & Company (MKC)

The final Dividend Aristocrat on my list today is McCormick & Company, a renowned food company known mainly for its wide range of spices used to enhance the taste of home and commercial food meals around the world. Actually, I think there’s a strong chance that at least one of its products is already sitting in my kitchen cabinet.

In its recent quarterly financials, McCormick reported sales increased 3% YOY to $1.9 billion, and operating cash flow rose 4.37%. On the bottom line, net income grew 5.3% to $227 million.

In terms of providing shareholder value, McCormick increased its dividends for 40 consecutive years, paying a forward annual dividend of $1.92, translating to a yield of ~2.7%.

With that, a consensus among 13 analysts rate the stock a “Moderate Buy” with as much as 24% upside potential if the stock hits its high target of $89.

Final Thoughts

There you have it, three of the highest-yielding Dividend Aristocrats worth buying today. They didn’t make the noisiest headlines, but they do continue to provide a stable source of income even through volatility. Though, as they say, nothing lasts forever, and past years’ results may not be as good as this year. But remember, it’s how all funds are sold- so it’s never wrong consider the fundamentals first.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Highest-yielding Dividend Aristocrats That'll Pay You For Generations

- 1 High-Yield Dividend Stock to Buy Hand Over Fist in February 2026

- Investors in Search of Alpha Are Fleeing Tech Stocks for These 3 High-Yield Sectors Instead

- This Outperforming Dividend Stock Increased Its 2026 Payout by 20%: Should You Buy?