Robotics stocks are back in focus after reports that President Donald Trump’s administration is preparing a major push to make automation and advanced machines a key part of its domestic manufacturing plan.

In late November, Trump signed an executive order launching the Genesis Mission, an initiative aimed at speeding up scientific discovery, and talk in the market has already turned to when a similar policy playbook might appear for robotics and service automation.

That shift was clear midweek, when Serve Robotics (SERV) jumped after reports that the Trump administration is treating robotics as a strategically important industry and may move toward an executive order that directly supports robotic manufacturing and automation.

As SERV remains a relatively small stock connected to last-mile autonomous delivery, the potential for both friendlier policies and increased capital in the robotics industry brings up a crucial question for investors: Could Serve Robotics be an attractive way to tap into the new Trump-era robotics trend? Let’s examine this further.

Serve Robotics’ Financial Trajectory

Serve Robotics is a focused play on autonomous sidewalk delivery, running fleets of last‑mile robots for partners like Uber Eats (UBER) and DoorDash (DASH) and getting paid on both the deliveries and the technology that powers them.

The stock price is starting to reflect that setup. Over the past 52 weeks, SERV is up about 51%.

In the third quarter of 2025, revenue came in at about $687,000, up roughly 209% from the same quarter in 2024, driven by delivery volume that climbed 66% quarter over quarter and around 300% year over year. That growth is still coming off a small base, with annual sales near $2 million. Serve Robotics is also still unprofitable, with a recent loss per share of $0.54.

The funding picture, however, is solid. SERV ended the quarter with around $210 million in liquidity and then raised another $100 million through a registered direct offering, which leaves the company in a strong position to handle near‑term losses while it scales.

The Fundamental Growth Story Powering SERV

Serve’s growth story starts with where its robots actually run. The company has moved past small tests and is now operating in major U.S. cities, with its latest expansion bringing autonomous deliveries to the Chicago area through Uber Eats. Chicago is Serve’s first step into the Midwest and adds 14 neighborhoods, giving hundreds of thousands of households access to contact‑free deliveries from over 100 restaurants. That sits on top of earlier launches in Los Angeles, Miami, Dallas-Fort Worth, and Atlanta.

Serve has also pushed hard on the technology side with its acquisition of Vayu Robotics. Vayu focuses on urban robot navigation using large AI foundation models, and combining that with Serve’s autonomy stack and large real‑world sidewalk dataset is meant to produce smarter, safer navigation that can adapt to more places.

Demand is being built in parallel with that. A new multi‑year partnership with DoorDash connects Serve to one of the largest local commerce platforms in the world. In Los Angeles, DoorDash customers can already have orders delivered by Serve robots, and the agreement is designed to expand robot deliveries across the U.S. over time. That creates a larger pool of potential orders, fits into DoorDash’s plan to use drivers, drones, and robots together, and leans on Serve’s record of more than 100,000 completed deliveries from over 2,500 restaurants.

What Wall Street Sees Next for SERV

For 2025, Serve is guiding to more than $2.5 million in revenue and analysts expect the company to lose $1.52 per share for the full year.

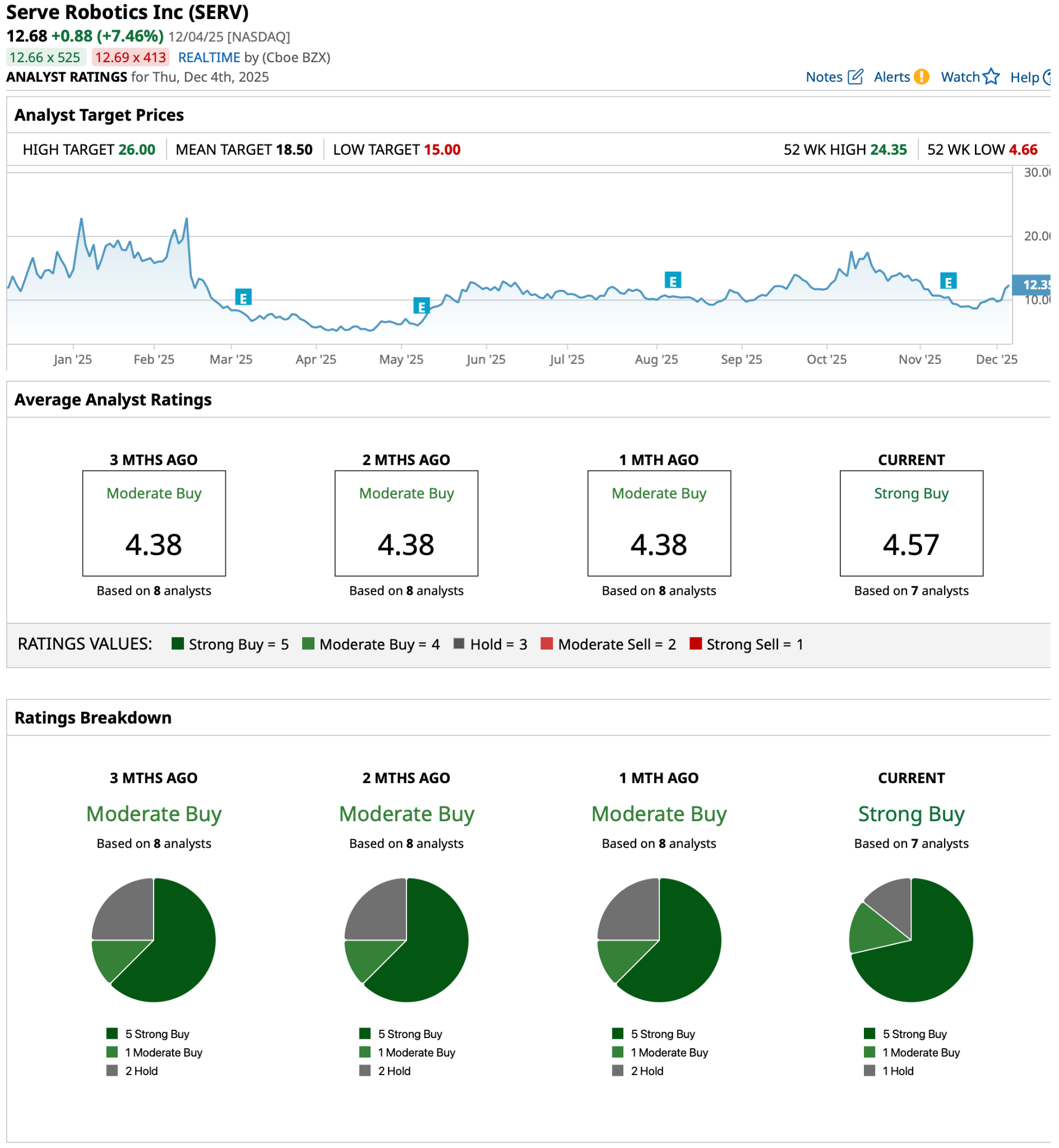

Seven analysts cover the stock and give it a consensus “Strong Buy” rating with an average target of $18.50, implying about 56.8% upside if the story plays out as they expect.

Conclusion

Serve Robotics looks like a classic way to lean into Trump’s robotics push without chasing the already‑crowded mega‑caps. You’ve got a tiny but fast‑growing revenue base, real‑world deployments with Uber Eats and DoorDash, a clear “physical AI” angle via Vayu, and a “Strong Buy” conensus rating. That doesn’t remove the execution or dilution risk, but it does tilt the odds.

If Trump’s administration follows through pro-robotics policies, SERV’s shares are more likely to grind higher over time than drift sideways from here.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Archer Aviation Just Signed on a New Aerospace Partner. Should You Buy ACHR Stock Here?

- Stifel Says This 1 ‘Picks and Shovels’ AI Stock Is a Buy for Massive Growth in 2026

- As Trump Looks to Boost Robotics, This 1 Lesser-Known Stock Is a Strong Buy

- With Fears Swirling, IBM Says There Is No AI Bubble. Does That Make IBM Stock a Buy Here?