In Tuesday trading, 88 NYSE stocks hit new 52-week highs, along with 27 new lows. Over on Nasdaq, 153 hit new 52-week highs, while 99 hit new lows.

Among the 27 new 52-week lows on the NYSE was VICI Properties (VICI), a Las Vegas-based REIT (real estate investment trust) that owns 93 gaming and experiential properties in the U.S. and Canada.

It was the 11th new 52-week low for VICI over the past 12 months. In addition to reaching a new 52-week low, the share price is just 13% away from its January 2021 five-year low of $24.51.

The Barchart Technical Opinion is a Strong Sell in the near term. Despite the technicals shouting sell, there are some good reasons for income investors to consider placing a bet.

Here are three off the top of my head.

It Owns Prime Real Estate

Before I get into the positives of the REIT’s real estate holdings, I would be remiss not to mention that the Federal Reserve is likely to announce a final 25-basis-point cut in the key federal funds rate at 2 p.m. EST on Wednesday, long after my commentary’s gone to press.

The final cut of the year will make investors happy, but there’s no guarantee mortgage rates will fall as a result. That will undoubtedly be of interest to VICI’s management. But I digress.

As I said in the introduction, the REIT owns 93 properties in the U.S. and Canada -- 54 gaming and 39 non-gaming -- with 127 million square feet, 60,300 hotel rooms, and over 500 bars, restaurants, and sportsbooks. It also owns four championship golf courses -- two in Las Vegas, one in Indiana, and one in Mississippi -- managed by The Cabot Collection, the people behind Cabot Cliffs and Cabot Links in my home province of Nova Scotia.

As for the cash generated by the triple-net leases at its properties, it was $3.28 billion on an annualized basis through Oct. 1, 2025. Approximately 42% of its rents are subject to CPI-linked (consumer price index) rent increases in 2025, with 90% subject to CPI-linked increases over the long haul. It’s a stable income, for sure.

However, there’s an elephant in the room. That would be two elephants, actually: First, the state of Las Vegas tourism isn’t great, and second, proposition betting is slowly eating into traditional gambling and sports betting.

The degenerate economy, as venture capitalist Howard Lindzon likes to call what retail investors are interested in these days, is sold on the prediction markets.

“I think the game within the game of predictions and betting, lightweight, small bet, bragging rights type games is a massive market,” Lindzon wrote on Dec. 7.

The thinking is that bettors will stop going to Vegas and other in-person casinos, opting to sit at home in their pyjamas, and place bets on every conceivable event on the planet. This change in betting hurts traditional casino operators such as Caesars Entertainment (CZR), MGM Resorts International (MGM), and Penn Entertainment (PENN), three of its largest tenants, which lease 33 of its 93 properties.

No business is perfect. It is what it is.

The Dividend Yield Is Attractive

As an income investment, VICI is very attractive. With the September 2025 dividend payment, it now pays shareholders a quarterly dividend of $0.45. The $1.80 annual rate yields a high 6.5%.

Income investors look for consistent dividend growth. It doesn’t have to be home-run growth to contribute to a stock’s total return. VICI has increased its dividend for eight consecutive years, generating a CAGR (compound annual growth rate) of 6.6%.

Its capital allocation for dividends is straightforward: it seeks to pay out 75% of its AFFO (adjusted funds from operations) each year. While there are plenty of REIT options other than VICI, it is projected to be the seventh-highest dividend payer in 2026 at $2.0 billion.

Notably, it doesn’t repurchase its shares -- except to account for withholding taxes on stock compensation -- leaving its AFFO for dividends and other capital-allocation levers. Your dividend is relatively safe as a result.

The healthy dividend contributed significantly to the REIT’s five-year annualized total return of 6.95%. You’re getting about 80% of your total return from dividends.

If you’re looking for off-the-charts capital appreciation, VICI is not for you.

The Share Price Appears to Have a Floor

Now that I’ve warned you off VICI stock for above-average capital gains, that doesn’t mean you can’t generate them. It just requires good timing--and that’s not something I advocate very often.

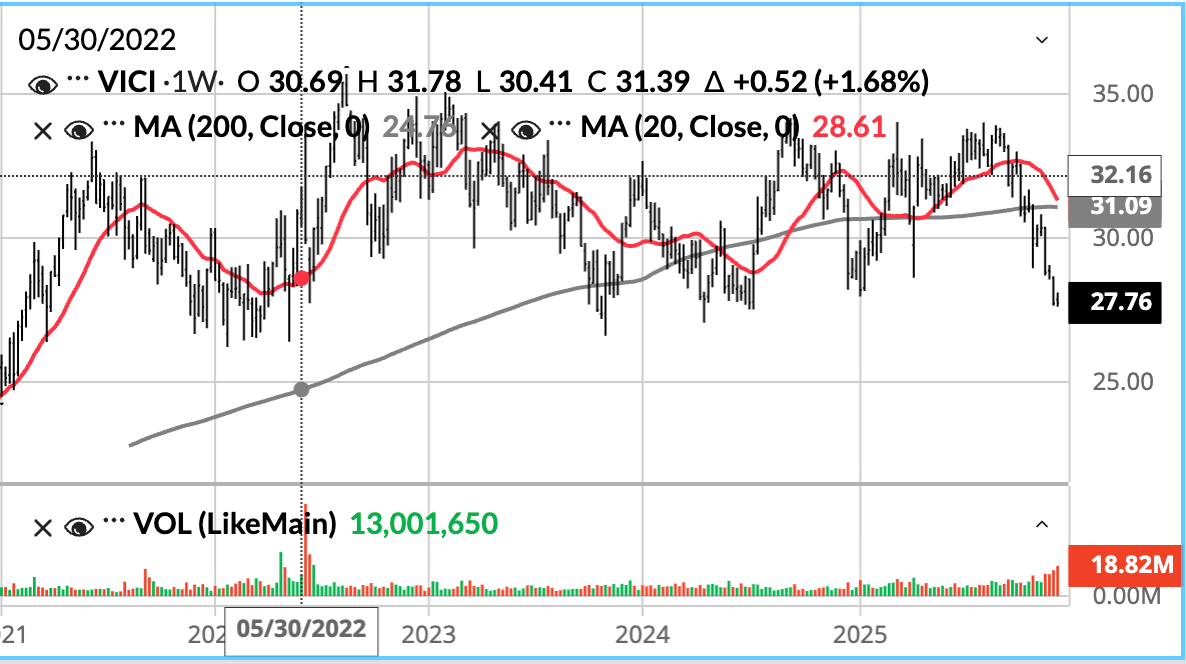

As you can see from the five-year chart below, VICI is trading below its 200-day (black line) and 20-day (red) moving averages. You generally want to buy when the share price is above the 200-day moving average and below the 20-day moving average.

Having said this, I am not a technical analyst; not even close. However, I do like to look at trading patterns to figure out the probability of a stock falling further. I’ve added a third straight line below.

Over the past four years, the share price hasn’t consistently traded below $26. Over five years, it hasn’t traded below $25.

VICI’s five-year history suggests its stock trades between $25 and $35.

The average yield of the six U.S. REITs that payout more dividends than VICI is 4.63%, 183 basis points less than VICI’s.

From where I sit, VICI looks like an income-focused investor’s dream stock.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Palantir: The Future of Defense Contracts or DiamondCluster 2.0? What Michael Burry Has to Say About PLTR Stock.

- VICI Properties Hits a New 52-Week Low: Is It Time for Income Investors to Place a Bet?

- Salesforce Could Rebrand to Focus on Its AI Offerings. Should You Buy the Dip in CRM Stock Here?

- Creating a 39% “Dividend” on MRVL Stock Using Options