Salesforce (CRM) evolving identity now reflects a company that can accurately gauge the state of the market. As the demand for artificial intelligence (AI) is accelerating, the world's #1 AI CRM has already begun reshaping its product family under the Agentforce banner, indicating much more than a cosmetic update as the need for AI picks up speed.

It signifies Salesforce's gradual shift away from its cloud-centric foundations and toward a future characterized by autonomous, intelligent systems. Recently, CEO Marc Benioff hinted that this change might be much more profound. When asked whether the entire corporation might adopt the Agentforce name, he offered a simple, almost playful answer: “It might. That would not shock me.”

Salesforce has moved quickly to reinforce its strategic shift. Sales now carries the Agentforce Sales label, Service runs as Agentforce Service, and the Platform has become Agentforce 365 Platform. Within this evolving landscape, investors may find opportunity in CRM by timing their entry as the company leans fully into its AI pivot.

About Salesforce Stock

Headquartered in San Francisco, California, Salesforce stands as a global force in cloud-based CRM technology, supported by a growing suite of intelligent tools. Its portfolio includes Agentforce AI, Data Cloud, Salesforce Starter for SMBs, Slack, Tableau analytics, and a range of industry-focused AI solutions.

Still, the stock has struggled this year as investors questioned whether rapid advances in AI could overlap with or diminish elements of Salesforce’s existing product mix. With a market cap of nearly $243.2 billion, the company watched its shares slide 25.76% over the past 52 weeks, trailing much behind the broader tech sector.

However, recent momentum has injected fresh energy into the narrative. Over the past month, the stock advanced 8.81%, and in just the last five trading days, it climbed 11.21%, majorly fueled by a stronger-than-expected fiscal 2026 third-quarter earnings report.

At current levels, CRM trades at 22.05 times forward adjusted earnings and 5.87 times sales, both below their respective five-year average multiples, hinting at a potential valuation discount.

In addition, Salesforce pays an annual dividend of $1.66, producing a 0.64% yield. Its most recent quarterly dividend of $0.416 per share is scheduled for payment on Jan. 8, 2026, to shareholders of record as of Dec. 18, 2025.

A Closer Look at Salesforce’s Q3 Earnings

On Dec. 3, CRM shares added 1.7%, and the momentum carried into the next session with a 3.7% jump after Salesforce delivered solid financial results and paired them with upbeat revenue guidance for the fourth quarter.

The company reported revenue of $10.26 billion, up 8.6% year-over-year (YOY). Although the figure landed just shy of the Street’s $10.27 billion mark, the performance underscored the strength of Agentforce, Data 360, and the expanding Agentforce sales and service ecosystem.

Adjusted EPS reached $3.25, beating analyst estimates of $2.86, and up 34.9% from the previous year’s quarter. Non-GAAP net income climbed to almost $3.1 billion, reflecting another 33.2% YOY gain. Salesforce also showcased firm demand through its backlog. Current remaining performance obligation (cRPO) rose 11% to $29.4 billion, while total RPO advanced 12% to $59.5 billion.

The shift toward AI-driven products continued to shine. Annual recurring revenue (ARR) from Agentforce and Data 360 surged 114% YOY to $1.4 billion. Agentforce alone crossed $500 million in ARR during Q3, soaring 330% YOY. Since launch, Salesforce has closed more than 18,500 Agentforce deals, including over 9,500 paid deals, a 50% quarter-over-quarter (QOQ)increase.

Guidance echoed this upbeat tone. For the fiscal fourth quarter, Salesforce expects adjusted EPS between $3.02 and $3.04 on revenue of $11.13 billion to $11.23 billion. For fiscal 2026, the company projects full-year adjusted EPS of $11.75 to $11.77 and revenue between $41.45 billion and $41.55 billion.

Analysts, meanwhile, expect Q4 2026 EPS to decline 3.6% YOY to $2.14. However, they forecast the full fiscal year 2026 bottom line to advance 13.1% to $8.92 from the prior year, while projecting fiscal 2027 EPS to climb 8.9% YOY to $9.71.

What Do Analysts Expect for Salesforce Stock?

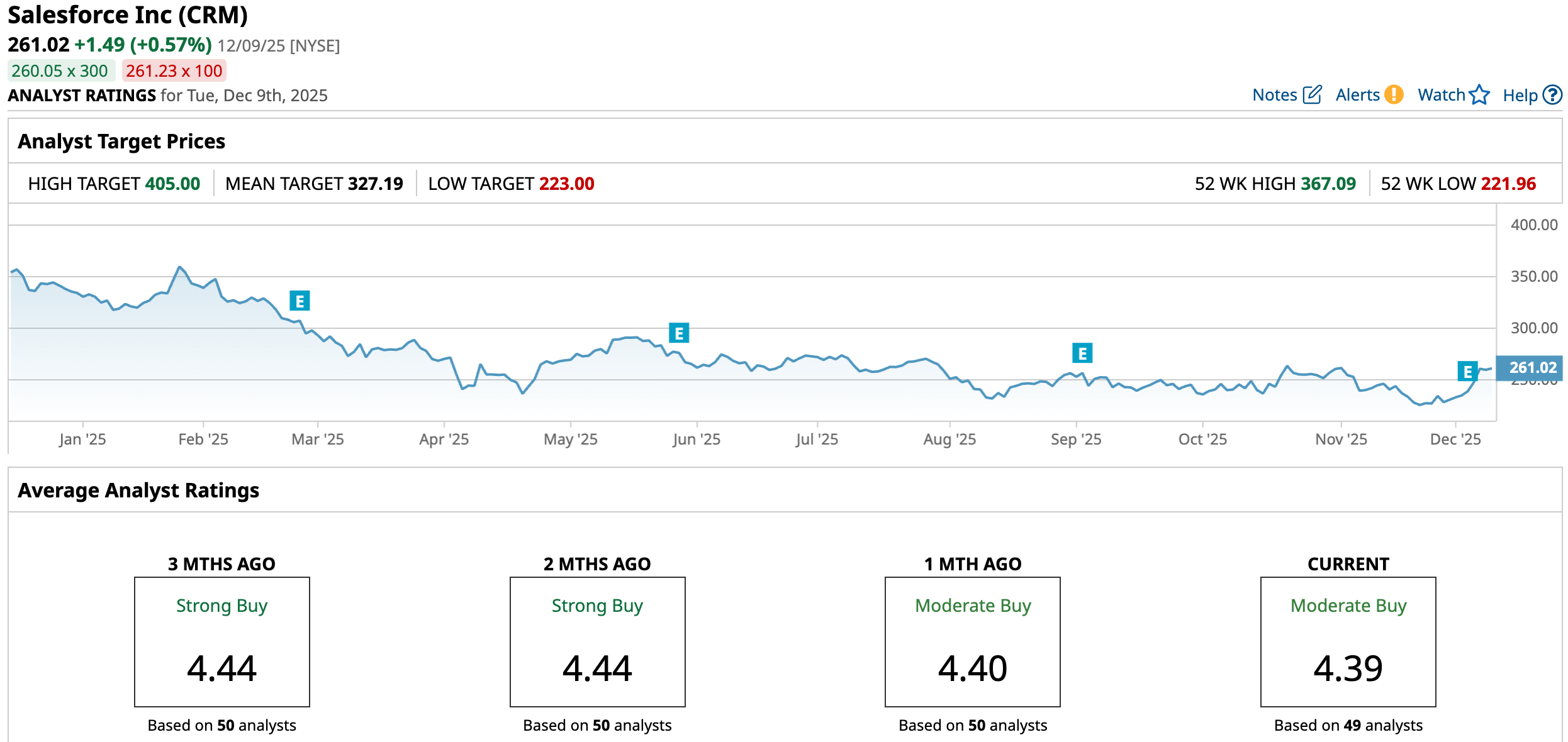

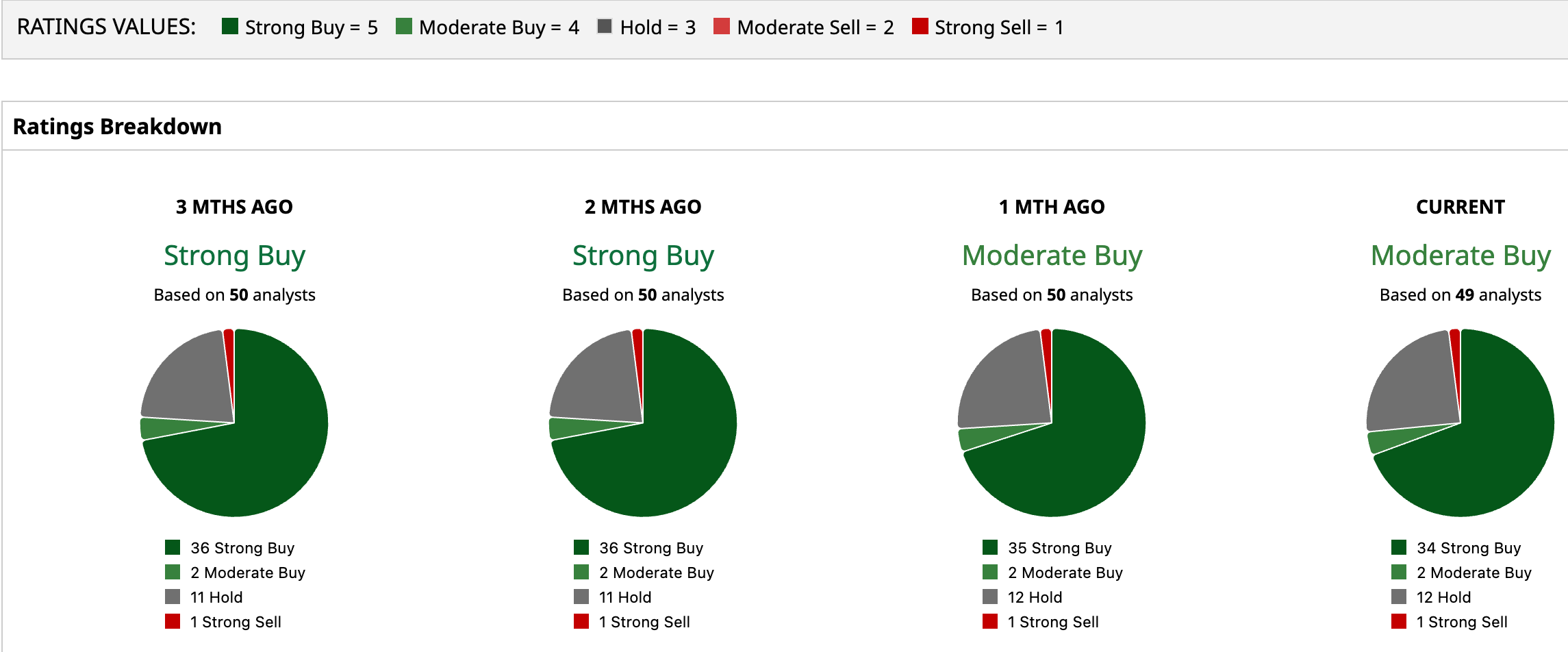

Analysts remain firmly bullish. For instance, Needham’s Scott Berg reaffirmed his “Buy” rating and held his $400 price target, reinforcing confidence in Salesforce’s long-term trajectory.

The broader analyst community has echoed that optimism, assigning CRM a “Moderate Buy” consensus rating. Out of 49 analysts covering the stock, 34 have issued a “Strong Buy,” two offer a “Moderate Buy,” 12 recommend a “Hold,” and one suggests “Strong Sell.”

The average price target of $327.19 suggests potential upside of 25.4%. Meanwhile, the Street-high target of $405 from Citizens' analyst Patrick Walravens, represents potential gain of 55.2% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- VICI Properties Hits a New 52-Week Low: Is It Time for Income Investors to Place a Bet?

- Salesforce Could Rebrand to Focus on Its AI Offerings. Should You Buy the Dip in CRM Stock Here?

- Creating a 39% “Dividend” on MRVL Stock Using Options

- Stock Index Futures Muted Amid Caution Ahead of Fed Rate Decision