Trust the Trump administration and the current AI megatrend to compel the largest developer of renewable energy in the United States to base its future capex plans around nuclear, fossil fuels, and data centers. That is precisely what is happening with NextEra Energy (NEE). The Florida-based renewable energy major is looking to develop 15 gigawatts of new power generation capabilities for data centers by 2035. And CEO John Ketchum deems it to be just a “conservative” target, commenting, “Quite frankly, based on what we’re seeing today, we’ll be disappointed if we don’t do more,” as he outlined ambitions to build 30 gigawatts of capacity by 2035.

Google and Meta Partnerships

To that end, NextEra has recently penned some significant partnerships with two of the biggest hyperscalers in the world: Alphabet (GOOG) (GOOGL) and Meta Platforms (META).

While in the partnership with Alphabet, NextEra and the former's unit, Google Cloud, have agreed to collaborate to build multiple new gigawatt-scale data center campuses across the U.S., and NextEra has secured about 2.5 gigawatts of clean-energy contracts with Meta via 11 power purchase agreements (PPAs) and two energy-storage agreements (ESAs). These are spread across multiple solar and storage projects to supply Meta’s data centers.

The partnership with Google Cloud involves plans to launch an AI-powered product (for energy-grid asset management and field-operations optimization) on Google Cloud Marketplace by mid-2026, while the projects under the contracts with Meta are scheduled to come online between 2026 and 2028.

Notably, for shareholders, these partnerships emerge as bright spots, with cloud-driven, sustained revenue growth expected to provide predictable cash flows while reducing exposure to commodity price swings as the combined tailwinds of electrification and AI provide strong demand visibility for a long time. However, building such huge power capacities requires the company to undertake massive capex, for which equity dilution may be an option to raise funds. On the other hand, execution risks may compress margins, while any unexpected regulatory development may halt the project for years.

About NextEra Energy

Tracing its roots back to about a century ago, NextEra Energy has existed in its current state since 2010. A diversified energy company, its businesses include a regulated utility, which involves generation, transmission, distribution, and sale of electricity—mainly serving Florida; energy infrastructure and development, which builds and manages generation, storage, transmission, and distribution; and finally serving wholesale power supply & energy services to businesses, utilities, and wholesale customers across North America (U.S. and some parts of Canada).

Valued at a market cap of $173.1 billion, the NEE stock is up 12.4% on a year-to-date (YTD) basis. Further, the stock offers a dividend yield of 2.73% while also being a member of the coveted “Dividend Aristocrats” club, having raised dividends consecutively over the past 30 years.

Thus, amid all these developments, is the NEE stock worthy of an investment, or should investors avoid it? Let's find out.

Not Just A Dividend Powerhouse

Apart from its consistent dividend payouts, NextEra has seen steady growth in its revenue and earnings. Over the past five years, the company has clocked revenue and earnings CAGRs of 7.65% and 8.48%, respectively.

Although the results for the most recent quarter were a mixed set, with earnings beating but revenues missing estimates, the overall financial picture of the company remains solid. In Q3 2025, NextEra's revenues came in at about $8 billion, up 5.7% from the previous year. Earnings increased by 9.7% in the same period to $1.13 per share, outpacing the consensus estimate of $1.02 per share. Notably, the company's quarterly earnings have been beating expectations consecutively over the past two years.

Coming to the cash situation, NextEra closed the quarter with a cash balance of $2.4 billion, which was below its short-term debt levels of $4.7 billion. However, the company generated net cash from operating activities of almost $10 billion for the nine months ended Sept. 30, implying sound cash generation capabilities from its operations.

For 2025, NextEra is expecting earnings to be in the range of $3.45 to $3.70 per share, the midpoint of which would denote a yearly earnings growth rate of 4.2% on an annual basis. For 2026 and 2027, the company expects EPS ranges of $3.63 to $4.00 and $3.85 to $4.32, respectively.

Serious Growth Drivers in Place

With about 76 gigawatts of operating capacity spanning nuclear, natural gas, wind, solar, and battery storage, NextEra Energy stands as the leading clean-energy infrastructure owner in North America and one of the largest electric utilities overall. The company currently maintains its most robust development pipeline ever, carrying a signed backlog of roughly 30 gigawatts, with an additional 3 gigawatts of new renewables and storage projects secured during the third quarter alone.

Meanwhile, a notable profitability catalyst lies in the planned restart of the Duane Arnold nuclear facility. The 615-megawatt plant, originally headed for retirement after operations ceased in 2020 amid unfavorable economics, is now on track to return online by 2029 and will increase NextEra’s nuclear fleet capacity by just over 10% relative to 2024 levels.

Overall, as the dominant renewable energy provider in the United States, NextEra is uniquely positioned to capture a sizable share of the surging electricity demand from data centers. Domestic data center consumption stood at 183 terawatt-hours in the most recent readings and is forecast to climb to 426 terawatt-hours by 2030. NextEra’s sheer scale, established supply chain relationships, and procurement leverage enable it to secure turbines, panels, and storage systems on more favorable terms than smaller competitors, translating into meaningful cost advantages and faster project execution.

These factors collectively reinforce NextEra’s ability to convert rising power needs, particularly from hyperscale computing, into long-term, high-return growth opportunities.

Analyst Opinion on NEE Stock

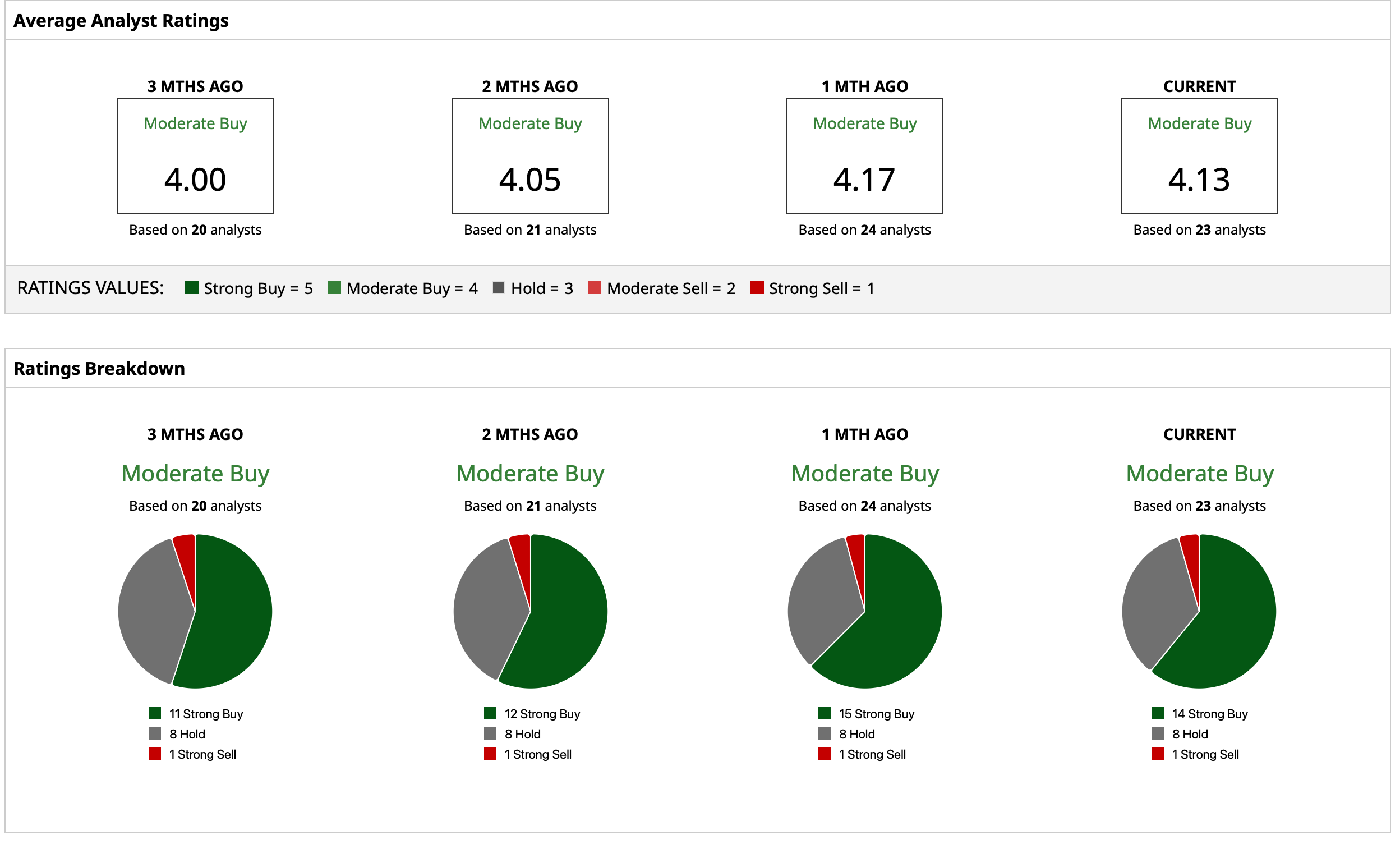

Thus, analysts remain cautiously optimistic about the NEE stock, attributing to it a consensus rating of “Moderate Buy,” with a mean target price of $89.62. This denotes an upside potential of about 12% from current levels. Out of 23 analysts covering the stock, 14 have a “Strong Buy” rating, eight have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart