Enterprise AI is increasingly becoming a critical battleground in the AI war. After Alphabet (GOOG) (GOOGL) expanded its partnership with the vibe coding platform, Replit, tech giant IBM (IBM) announced a mammoth $11 billion all-cash deal to acquire data streaming platform Confluent (CFLT). The deal, done to serve its enterprise clients better with enhanced AI offerings, is expected to close by mid-2026.

Commenting on the deal, CEO Arvind Krishna said, “With the acquisition of Confluent, IBM will provide the smart data platform for enterprise IT, purpose-built for AI.”

The market reacted positively to the news as shares of both IBM and Confluent are up, with the CFLT stock seeing a pop of almost 30% following the news of the deal. Meanwhile, IBM expects the acquisition to be value accretive to adjusted EBITDA and free cash flow within the first and second years, respectively.

How Will Confluent Add Value to IBM?

Parting with $11 billion in cash is not a trivial matter. Thus, IBM must have seen value in Confluent to bet such a hefty amount, making this its second-largest acquisition since its $34 billion buyout of Red Hat in 2019. Notably, Confluent is a leader in event/data streaming, built around Apache Kafka, with an annualized revenue run rate of a little over $1 billion as of 2025. By integrating Confluent’s real-time data streaming capabilities, IBM can position itself as a comprehensive enterprise AI provider, giving it control over the full data lifecycle from collection and movement to storage, governance, and ultimately AI deployment, enhancing its “one-stop shop” value proposition for organizations pursuing large-scale AI adoption.

Moreover, Confluent’s revenue is expected to reach about $1.35 billion by 2026. Analysts estimate that it could add roughly 2% to IBM’s revenue growth once consolidated. IBM’s software segment is projected to be around $29.7 billion in 2025. Adding a streaming platform with upwards of a billion dollars in revenue and double-digit growth gives IBM a faster-growing sub-engine inside software and supports the narrative that “IBM is a software/AI company,” not a legacy hardware/services story.

Finally, Confluent is tightly linked to Apache Kafka, which has become the de facto standard for real-time event streaming in many enterprises. Owning Confluent gives IBM influence over one of the key data backbones for modern apps, increasing IBM’s relevance to developers and data engineers, a group where IBM historically has trailed the hyperscalers.

However, risks remain with hyperscalers like AWS, Azure, and Google Cloud, all offering their own streaming/data-integration services that are tightly integrated with their clouds. For this deal to be a success, Confluent must stay cloud-agnostic and innovative enough that enterprises prefer it over native services, even when hyperscalers bundle their own tools aggressively.

Growth Driven By Innovation

For a legacy company founded in 1911, IBM could have been expected to be less nimble than the tech titans of Silicon Valley. And they were in the wilderness for a period of time in between, but not anymore, as innovation has been at the core of its growth story along with acquisitions that have brought synergies with it.

IBM consistently ranks among the top patent recipients in the United States, turning its intellectual property into a meaningful revenue stream through licensing agreements and royalties. While one-time transactions, such as the $900 million sale of roughly 1,000 patents to Google, grab headlines, the ongoing portfolio generates several hundred million dollars annually in recurring fees.

More recently, the company has shifted emphasis from raw patent volume toward high-impact domains: hybrid cloud, artificial intelligence, enterprise automation, advanced semiconductors, and especially quantum computing. Quantum represents a particularly promising frontier, playing directly to IBM’s long-standing enterprise heritage. The push toward commercially viable, fault-tolerant systems gained momentum with the unveiling of the Nighthawk processor and accompanying software stack, alongside progress in the DARPA Quantum Benchmarking program.

However, at the core of IBM’s recurring cash flow remains the IBM Z mainframe franchise, which continues to dominate roughly 90% of the global market. Contrary to repeated forecasts of obsolescence, these systems retain an unmatched edge in high-volume batch processing, security, and uptime, attributes that cloud-native alternatives have yet to replicate at scale. Customer appetite for the newest z17 generation has been strong, with hardware bookings jumping 59% in the latest reported quarter. Each hardware refresh typically pulls through higher-margin software licenses, operating-system upgrades, database enhancements, and developer tools.

Finally, IBM is simultaneously modernizing the platform by embedding generative AI capabilities, advanced automation, and tighter security controls. The Red Hat acquisition has proved instrumental here, enabling seamless hybrid-cloud integration that bridges mainframe workloads with distributed environments. Looking ahead, the forthcoming z18 cycle is expected to sustain this momentum, while the successful commercialization of quantum technology could open an entirely new chapter of high-value enterprise adoption.

Strong Financials

IBM has maintained a healthy set of financials along with its innovation core. That is why, valued at a market cap of $289 billion, the IBM stock is up 41% on a year-to-date (YTD) basis and 147% on a five-year basis. Further, the stock offers a dividend yield of 2.17%, which is higher than the sector median of 1.06%, as it is also a member of the “Dividend Aristocrat” club, having raised dividends consecutively for more than 26 years.

Moreover, the company's quarterly earnings have pipped expectations consecutively for more than two years, or eight quarters. Q3 2025's story was no different as well, with both revenue and earnings surpassing estimates. The company reported revenues of $16.3 billion, which denotes an annual rise of 9%. Earnings per share of $2.65 marked a year-over-year (YoY) growth of 15.2%, outpacing the consensus estimate of $2.45 comfortably.

Cash flows also remained robust as IBM reported net cash from operating activities of $3.1 billion in Q3 2025, up from $2.9 billion in the year-ago period. Overall, the company closed the quarter with a cash balance of $11.6 billion, higher than its short-term debt levels of $7.9 billion.

Analyst Opinion on IBM Stock

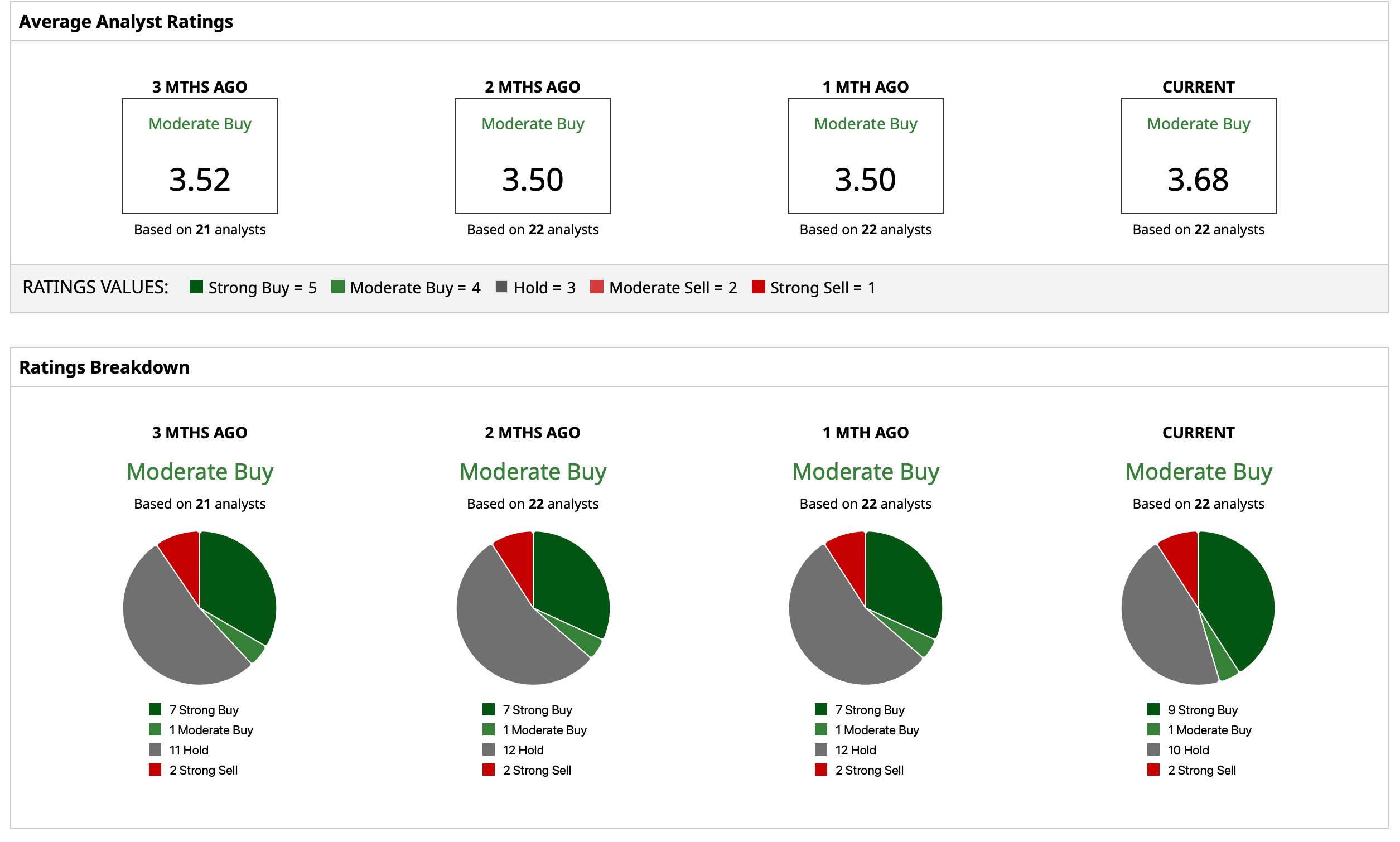

Considering all this, analysts have attributed a consensus rating of “Moderate Buy” for the stock with a mean target price that has already been surpassed. The high target price of $360 indicates an upside potential of about 16% from current levels. Out of 22 analysts covering the stock, nine have a “Strong Buy,” one has a “Moderate Buy” rating, 10 have a “Hold” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Greenlights AI Chip Sales to China, Should You Buy Nvidia Stock?

- Unusual Call Options Volume in GameStop Corp. Stock - Should Investors Buy GME Stock?

- Do We Have Permission to Buy Bitcoin Yet? Our Top Chart Strategist Maps Out the Path to $141,685

- Could Meta Stock Skyrocket in 2026 If Mark Zuckerberg Declares Another ‘Year of Efficiency’?