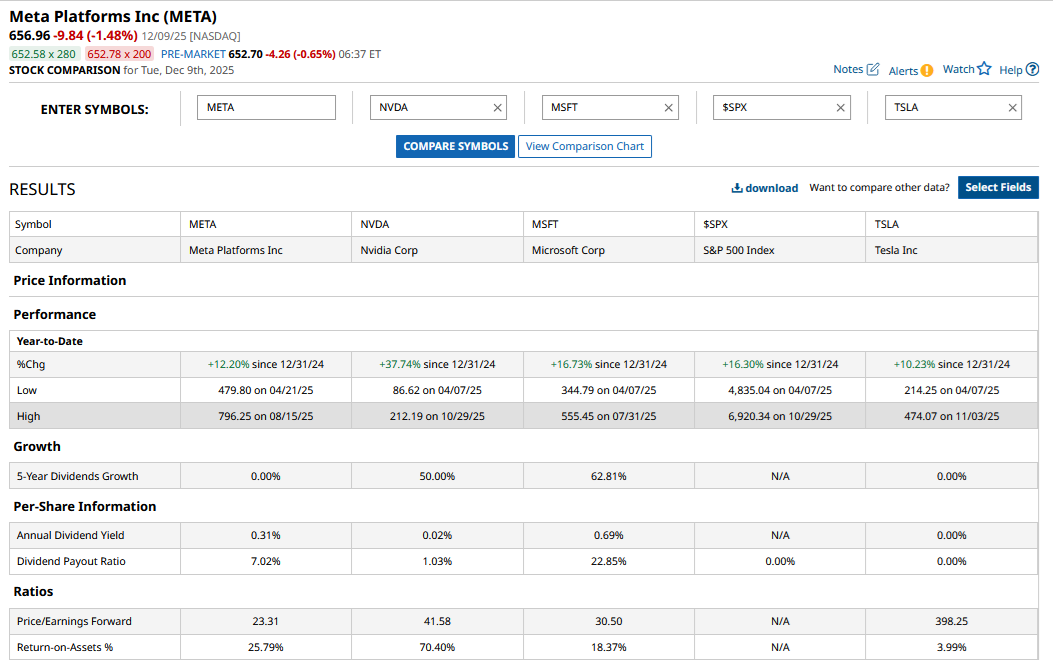

Magnificent Seven stocks, which led the stock market rally from the front between 2023 and 2024, have looked relatively shaky this year, and Apple (AAPL), Tesla (TSLA), Amazon (AMZN), and Meta Platforms (META) are underperforming their average S&P 500 Index ($SPX) peer, while Microsoft’s (MSFT) performance is barely in line. Even Nvidia’s (NVDA) year-to-date gains of around 36% look quite grounded, given what the stock has delivered to investors in the last two years.

Notably, U.S. tech stocks crashed in 2022 amid the broader market selloff. What followed was an aggressive belt-tightening exercise where, among others, Big Tech companies slashed thousands of jobs. Meta Platforms’ cuts were the most aggressive, as CEO Mark Zuckerberg termed 2023 as the “year of efficiency.”

Meta Stock Soared in 2023 on “Year of Efficiency”

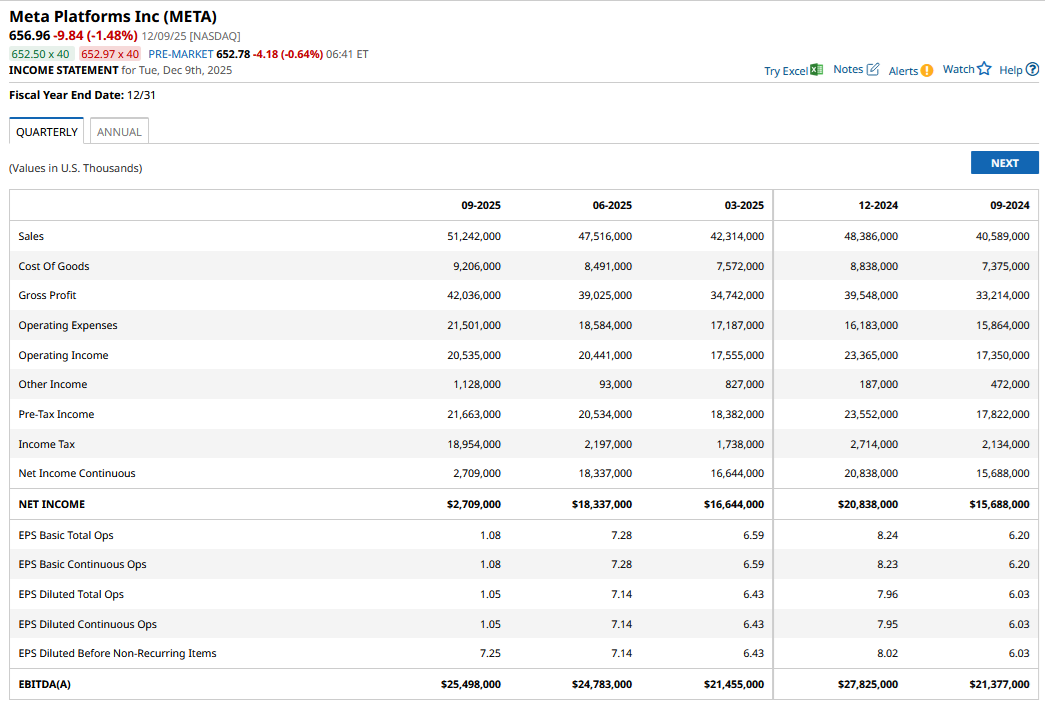

Markets gave the cost cuts a thumbs-up, and Meta shares nearly tripled in 2023, making it the second-best Magnificent Seven constituent, trailing only Nvidia, which went parabolic that year. Meanwhile, tech companies find themselves in a similar situation now as markets question their burgeoning artificial intelligence (AI) spending. Meta is a case in point here, as the stock plunged following the Q3 2025 earnings release despite beating on both the top line and the bottom line and providing upbeat guidance. Notably, capex raises have been a recurring theme for tech giants this year, and Meta’s 2025 capex is expected to be around 36% of its revenues. 2026 looks no different, and tech companies look set to continue their spending spree in the AI arms race. Moreover, Zuckerberg has hired AI talent at eye-popping compensation, which would lead to an increase in spending. The metaverse losses have only complicated the picture for Meta, putting further pressure on the company's cash flows.

Meta Has Sunk Billions into Reality Labs

Meanwhile, Meta plans to cut its metaverse spending by as much as 30% next year. The business is part of Reality Labs, which is also building hardware products like the Quest headsets, but has been losing a ton of money. In Q3 2025, Reality Labs posted an operating loss of $4.4 billion, which, for context, was nearly 10x the revenues it generated in the quarter. It has pretty much been the same story for the last many quarters, and that segment’s operating losses have been in the ballpark of $5 billion. Since 2021, the Reality Labs segment has accumulated losses of over $70 billion, which is no small change even for a behemoth like Meta Platforms.

To be sure, Meta CEO Mark Zuckerberg has defended these losses in the past, terming the metaverse as crucial for the company’s long-term success. The company withstood pressure from shareholders and continued to invest in that business, which has had little to show in terms of revenues, let alone profitability. Now, the company is reallocating resources towards AI, which has been a near-term driver.

Meta Might Cut Metaverse Budget Even Further for AI

Meta is witnessing the positive impact of AI in the form of higher engagement and better-targeted ads, which are fueling its topline growth. AI initiatives have helped power Meta’s growth, and the Q3 2025 revenue growth was the highest since Q1 2024. Meta’s core digital ad business is doing remarkably well, with AI only turbocharging growth.

However, the AI-driven revenue growth has come at a cost in terms of higher capex, which has started to flow to the income statement in the form of depreciation. Higher depreciation would continue to put a lid on the earnings of Big Tech companies, Meta included, and sooner rather than later, they would face pressure from shareholders. So far, investors have been patient because the AI mania has helped keep the stock prices buoyant. However, with the AI rally facing scrutiny amid bubble fears and several tech names, including Meta, underperforming in 2025, investor patience might be running thin.

AI is a near-term opportunity for Meta, and the company has already built a lead with smart glasses. However, the metaverse has so far been a vanity project with unproven potential. I believe it is perhaps time for Zuckerberg to take a call on capital allocation, as the burgeoning investment towards AI and the metaverse might not continue in parallel until eternity.

Zuckerberg’s “year of efficiency” initiatives help propel META stock in 2023 and 2024, and it is perhaps time that the world’s sixth richest person goes after the soaring capex and metaverse losses the way he went after expenses. A namesake of “year of capital allocation rationalization” can do wonders for Meta, whose core digital ad business is otherwise doing remarkably well, only to see its profits being dipped into by metaverse losses.

On the date of publication, Mohit Oberoi had a position in: META , TSLA , AMZN , MSFT , AAPL , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why This Analyst Says the Warner Bros. Deal Is Bad News for Netflix Stock

- As Trump Greenlights AI Chip Sales to China, Should You Buy Nvidia Stock?

- Unusual Call Options Volume in GameStop Corp. Stock - Should Investors Buy GME Stock?

- Do We Have Permission to Buy Bitcoin Yet? Our Top Chart Strategist Maps Out the Path to $141,685