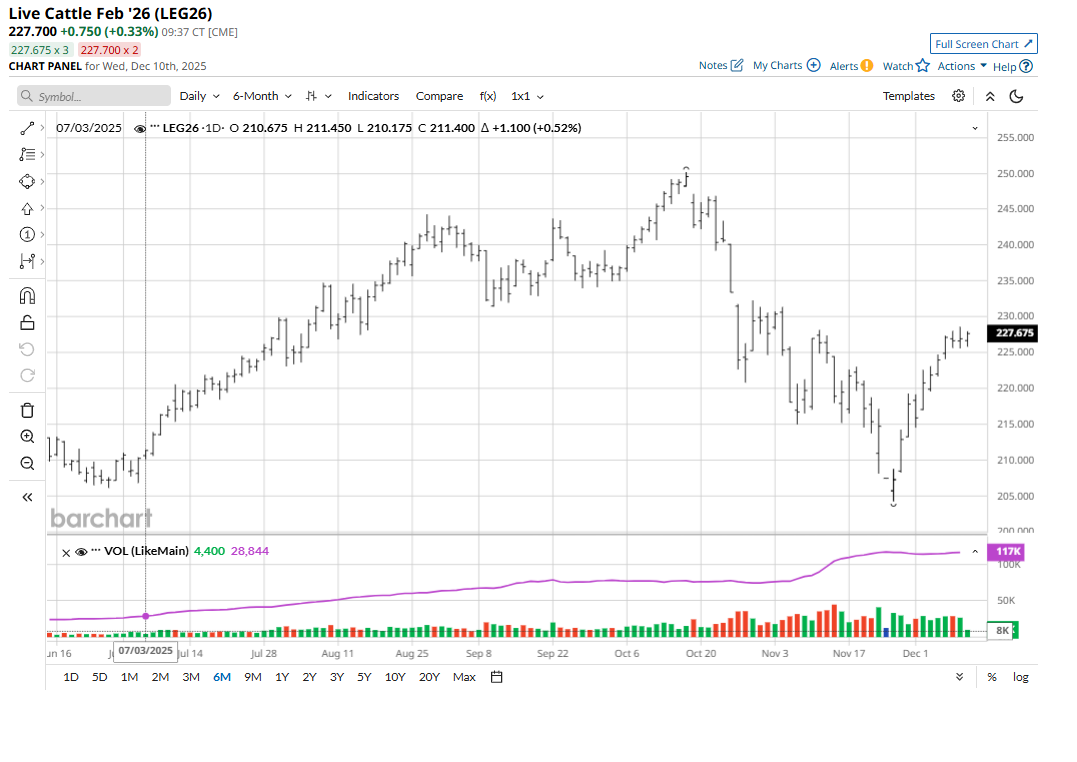

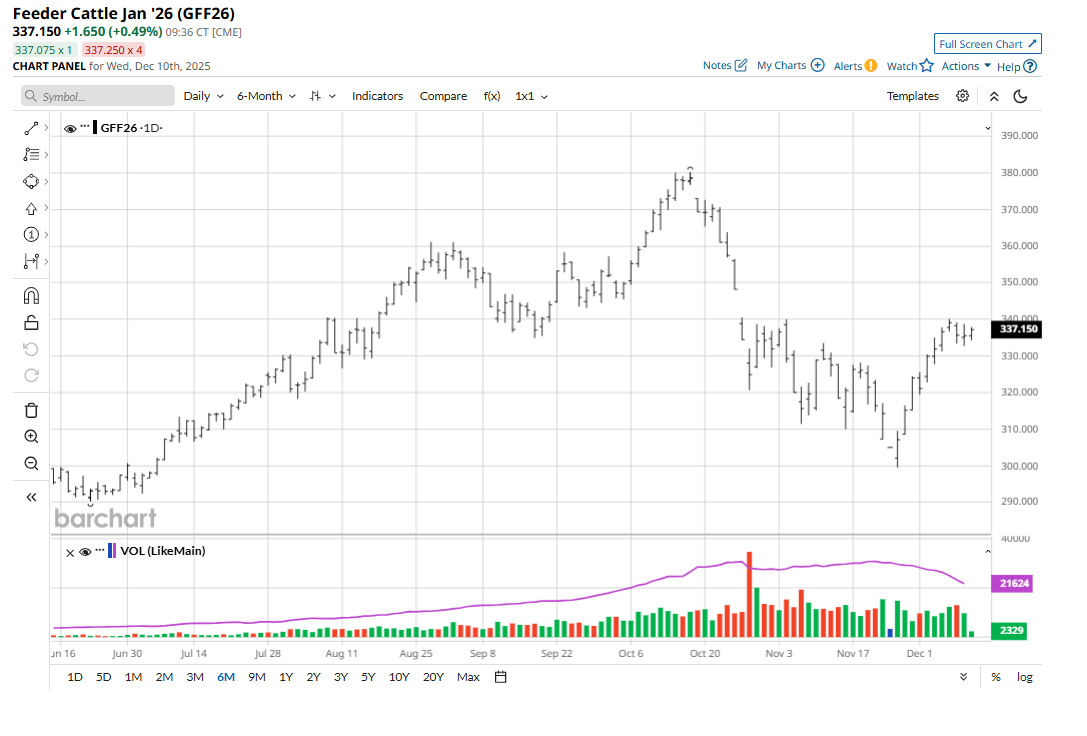

February live cattle (LEG26) futures hit a four-week high on Tuesday, while January feeder cattle (GFF26) futures saw a modest corrective price pullback after scoring a six-week high last Friday. Recent solid price gains firmly suggest near-term market bottoms are in place for the cattle futures markets — and that their fledgling price uptrends can be sustained. The much-improved near-term technical postures for cattle futures markets will likely continue to invite the chart-based speculators to the buy sides.

Cash Cattle and Boxed Beef Fundamentals Improving

USDA at midday Monday reported the average cash cattle trade for last week at $221.21 per hundredweight, which is up $9.68 from the prior week’s average of $211.53. Boxed beef values have also been improving recently. Both are encouraging live and feeder cattle futures bulls to the buy sides again, after both markets hit record highs in October. Recent wintry weather in the U.S. Plains states and more to come has likely and will likely continue to stress livestock and their weight-gain potential, which is also price-friendly for futures.

Consumer Demand for Beef Remains Solid

U.S. consumer demand for beef at the meat counter remains robust, with better demand coming from retailers featuring beef cuts for holiday meals. Cattle carcass weights continue to increase and reached an all-time high of 960 pounds last week — up 3 lbs. from the previous week and 41 lbs. higher than one year ago. Quality continues to ramp up as dairy/beef crosses, which produce very high-quality grade, are reducing the importance of the Select-grade category. Don’t be surprised to see grocers offer more prime cuts available this holiday season. These factors should keep a floor under cash cattle prices, support wholesale boxed beef values and beef packer margins in the coming weeks, as well as boost future prices.

A compelling perspective on the U.S. cattle markets came from Farm Bureau economist Bernt Nelson in a recent report. Nelson said recent declines in cattle prices came “at a time when cattle farmers are typically making decisions about whether to hold back heifers for breeding or place them on feed. Retaining heifers for breeding could lead to herd expansion in 2028, but with input costs at near-record levels and prices still 25% higher than a year ago, there is a lot of incentive for farmers to market cattle rather than hold them back for breeding. Fundamentally, this means cattle supplies will likely remain tight through 2026, which will delay expansion even further.”

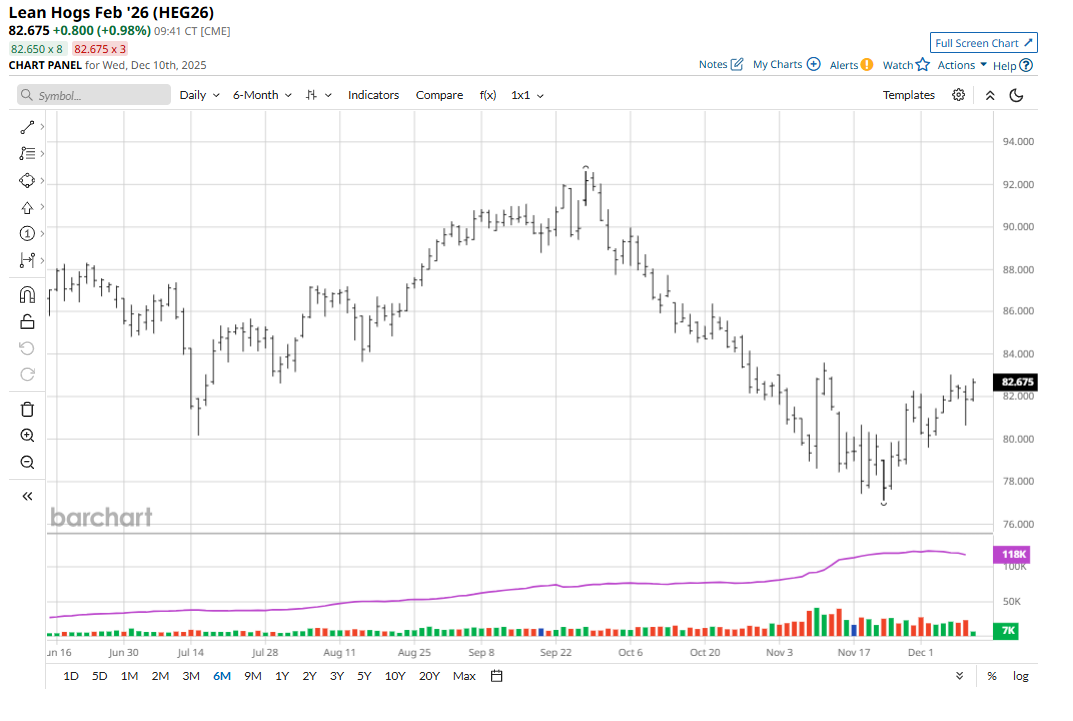

Lean Hog Futures Bulls Also Enjoying a Near-Term Price Uptrend

February lean hogs (HEG26) on Monday posted slight gains but closed at a four-week high close. Hog futures prices paused following recent good gains. Traders are thinking the cash hog market has put in a seasonal bottom. Also, lean hog futures prices are starting to trend up on the daily bar chart, suggesting the path of least resistance for prices in the near term will be sideways to higher. The Philippines has temporarily banned imports of pig and pork products from Spain and Taiwan following outbreaks of African swine fever in both locations, according to Manila’s agriculture ministry. Lean hog futures traders will continue to closely monitor this situation and its implications for better U.S. pork exports.

Cash Hog and Fresh Pork Fundamentals Also Looking Better

The latest CME lean hog index is down 2 cents to $81.81. Tuesday’s projected cash index price is up 3 cents at $81.84. Monday’s national direct 5-day rolling average cash hog price quote is $70.42. A price-stabilization in the cash hog market is also bullish for futures, suggesting the cash market has put in a seasonal price bottom. Pork carcass cutout value has also posted upside price action recently.

Holiday demand for hams is likely one factor that has helped to stop the slide in cash hog and hog futures prices. Still historically high beef prices at the meat counter are also likely pushing consumers to buy the less-expensive pork cuts. The USDA quarterly hogs and pigs report and monthly cold storage report should be coming out this month, which hog futures trades will closely examine.

Recent U.S. trade deals have hog producers hopeful for better global demand for U.S. pork in the coming months — especially as No. 2 world exporter Spain deals with African Swine Fever. China is a major pork importer, and U.S-China relations are presently on the upswing. That’s positive for the hog and pork futures markets.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.