With a market cap of $43.1 billion, Axon Enterprise, Inc. (AXON) is a global public safety technology company that develops integrated hardware and cloud-based software solutions for law enforcement and other first responders. Its two segments: Software and Sensors, and TASER, provide products ranging from body and in-car cameras to conduct energy devices, digital evidence management, and VR training.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Axon Enterprise fits this criterion perfectly. The company serves law enforcement, first responders, justice organizations, and commercial customers.

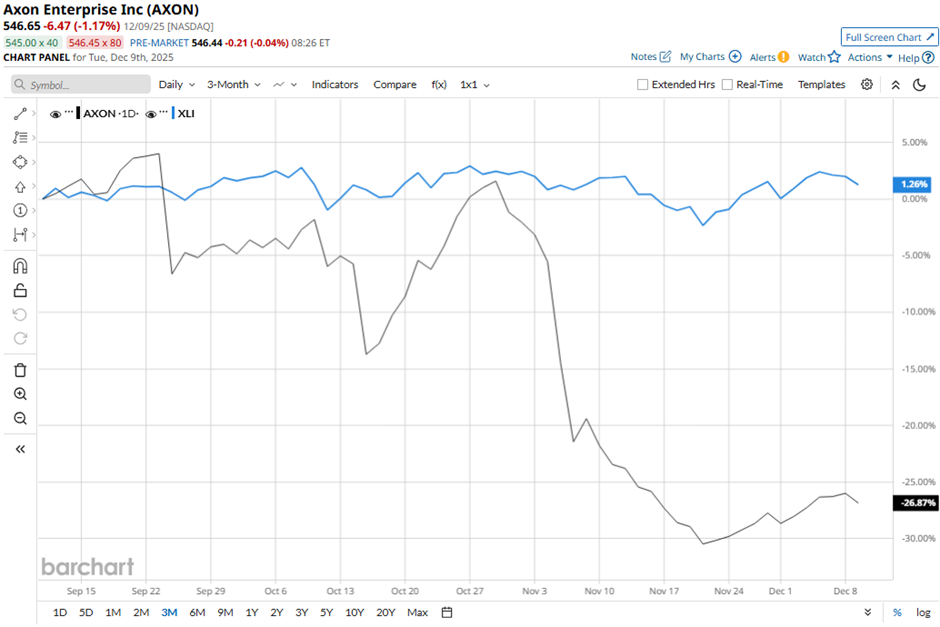

AXON stock has dropped 38.3% from its 52-week high of $885.91. Shares of the company have fallen 25.3% over the past three months, underperforming the Industrial Select Sector SPDR Fund’s (XLI) 2% rise over the same time frame.

In the longer term, AXON stock is down over 8% on a YTD basis, lagging behind XLI’s 16.3% increase. Moreover, shares of the maker of stun guns and body cameras have declined 14.9% over the past 52 weeks, compared to XLI’s nearly 10% return over the same time frame.

The stock has been trading mostly below its 50-day average since early July. Also, it has fallen below its 200-day moving average since November.

Despite reporting better-than-expected Q3 2025 revenue of $710.64 million on Nov. 4, shares of AXON tumbled 9.4% the next day as the company posted adjusted EPS of $1.17, below the forecasts. Investors were also concerned by margin pressures, with total gross margin slipping to 60.1% and elevated stock-based compensation totaling $146 million across COGS, SG&A and R&D.

Moreover, AXON stock has underperformed compared to its rival, AerCap Holdings N.V. (AER). Shares of AerCap have surged 46.6% over the past 52 weeks and nearly 46% on a YTD basis.

Despite AXON’s weak performance, analysts remain strongly optimistic about its prospects. The stock has a consensus rating of “Strong Buy” from the 20 analysts covering the stock, and the mean price target of $815.29 is a premium of 49.1% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- VICI Properties Hits a New 52-Week Low: Is It Time for Income Investors to Place a Bet?

- Salesforce Could Rebrand to Focus on Its AI Offerings. Should You Buy the Dip in CRM Stock Here?

- Creating a 39% “Dividend” on MRVL Stock Using Options

- Stock Index Futures Muted Amid Caution Ahead of Fed Rate Decision