The idea for today’s commentary about Barchart’s Top 100 Top/Bottom Stocks to Buy comes from a Globe and Mail article from yesterday about a Canadian couple using their TFSA (tax-free savings account) -- very similar to a Roth IRA -- to build a $4 million investment portfolio.

The couple maximized their TFSA annual contributions from 2009, when the Canadian government created the TFSA, until their combined portfolio reached $2 million. At that point, it made no sense to keep adding to it, although they could have.

To reach $4 million, the husband invested their funds in two stocks on the brink of bankruptcy: Air Canada (ACDVF) and Bombardier (BDRBF). While both companies have gone through many ups and downs, Bombardier has been the more successful of the two over the past five years, up over 2,000%. Now focused on the luxury jet market, the business is doing very well.

I subscribe to the Globe, so I’ve gifted the article. I recommend you give it a read, if only to understand that buying beaten-down stocks can be a winning play--but you’ve got to know what you’re doing.

Long story short, that’s got me thinking about these two bottom 100 stocks to buy that are all trading above $10.

Cava Group (CAVA)

Cava Group (CAVA) stock is down 67% over the past 52 weeks and 74% from its all-time high of $172.43 on Nov. 13, 2024.

As with all beaten-down stocks, there’s usually a good reason they got there. The markets are reasonably efficient at sussing out posers.

In the case of Cava, it finds itself in a no-win situation where customers are cutting back on spending due to inflation, economic uncertainty, job-loss fears, and a tech correction—the list goes on.

That’s not necessarily specific to Cava only. Same-store sales across the fast-casual universe have been weak, especially among younger customers.

“‘When you look at different age demographics of fast casual, the 25- to 34-year-old consumer seems to be impacted a bit more than others, and fast casual tends to have a higher concentration of those consumers within their guest portfolio,’ CFO Tricia Tolivar said in an interview, adding that the company saw demand fall as it entered the final quarter of the year,” CNBC reported on Nov. 4.

Cava’s same-store sales in Q3 2025 were up 1.9% with flat traffic over last year. As a result, the restaurant chain lowered its same-store sales guidance for 2025 to 3.5% at the midpoint, down from 5% previously.

Since announcing its earnings after the markets closed on Nov. 4, its shares have lost 13% of their value.

So, the question is: How much lower can CAVA go?

It went public in June 2023 at $22. In 2022, its revenues were $564.1 million, and it posted an operating loss of $59.8 million, resulting in an operating margin of -10.6%. In the trailing 12 months ended Oct. 5, its operating margin was 5.5% on $1.13 billion in revenue.

In three years, it’s gone from an operating loss to an operating profit. Cava’s market cap is one-third what it was last November, yet it’s still moving in the right direction.

In the Globe article, Globe contributor Larry MacDonald mentions that the TFSA investor used call options to juice the couple’s returns on Air Canada.

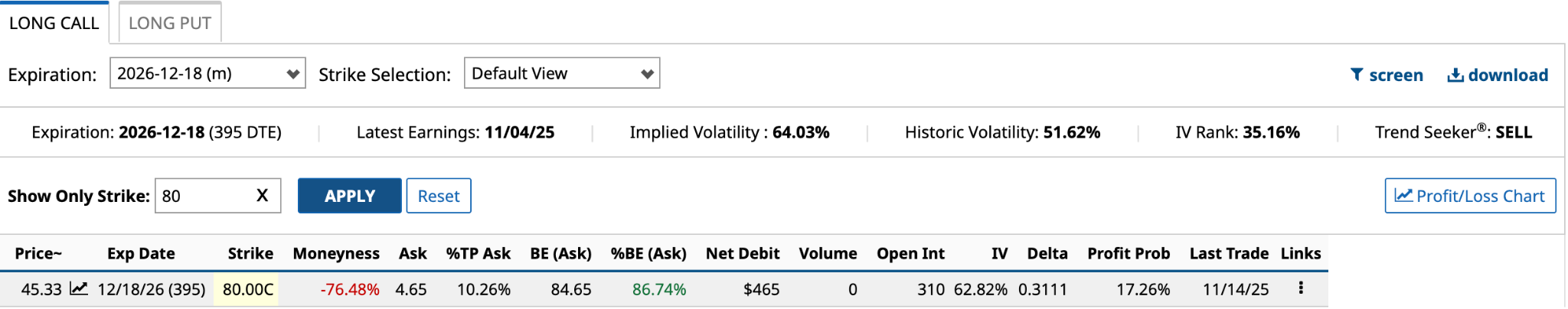

The same could be true for Cava. The $80 call expires just before Christmas in 2026. The $465 net debit is 10.3% of its current share price. While the 17.3% profit probability is low, there’s also a chance that the stock appreciates by 33% and you double your money by selling the call before it expires.

It might not reach $84.65, but it could still see $60.27. The expected move takes the stock to $65.22 on the upside.

Bellring Brands (BRBR)

Bellring Brands (BRBR)

Bellring Brands' (BRBR) stock is down 67% over the past 52 weeks and 69% from its all-time high of $80.67 on Jan. 30, 2025.

Post Holdings (POST) spun off Bellring in October 2019 at $14. Post owned approximately 75% of the stock after the IPO. Post sold off all its stock by November 2022, when its shares were trading around $23, slightly below today's price.

In the past three fiscal years (September year-end), Bellring has grown its revenue by 69% to $2.32 billion. At the same time, it’s grown its operating income by 68% to $357.4 million. Its operating margin is about the same at 15.4%.

That’s not so horrible. I’d lost track of Bellring in the past year. Obviously, something happened to deliver a 69% drop since February. The easiest place to look for clues is the inevitable class-action-suit press releases that appear after significant drops in a stock’s share price.

In Bellring’s case, the growth issues it faced first surfaced in May, when it reported its Q2 2025 results. More issues surfaced in August. Its shares lost nearly 19% on May 6 and 33% on Aug. 5. Bellring reported Q4 2025 results this morning before the markets opened. Its shares are down about 3.5% after 1.5 hours into the trading day.

Bellring’s guidance suggests that competition is growing. It expects sales in fiscal 2026 to increase by 6% at the midpoint to $2.45 billion. Its adjusted EBITDA should be $440 million. In 2027 and beyond, sales are expected to grow by 8% annually, with EBITDA margins of 19%.

When Bellring went public in October 2019, it was valued at $551 million based on 39.4 million shares outstanding. However, if you assume that Post Holdings’ 71.2% stake in the operating LLC was exchangeable for 97.4 million shares, the entire 100% would be worth $1.92 billion. In November 2022, after Post sold the remaining 4.6 million shares it owned, Bellring’s market cap was approximately $3.11 billion based on 135.3 million shares outstanding.

That’s a price-to-sales ratio of 2.27. The P/S multiple today is 1.36, about 40% lower, with operating income 41% lower. If ever there were a bottom 100 stock to buy, BRBR would be it. Here’s a call to consider betting on BRBR.

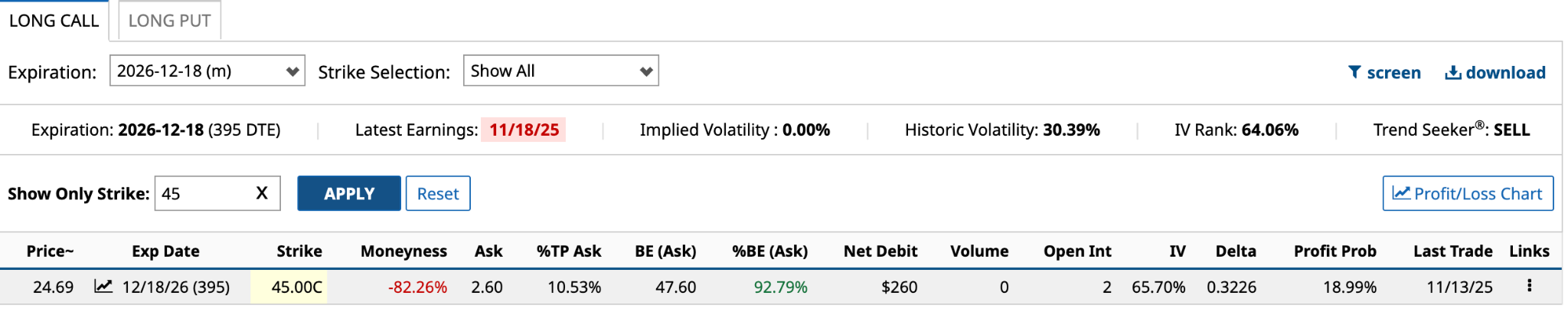

The $45 call expires at the same time as the CAVA call from earlier. The $260 net debit is 10.5% of its current share price. With an 18.99% profit probability, if the stock appreciates by 33%, you can double your money by selling the call before it expires in December 2026.

The $45 call expires at the same time as the CAVA call from earlier. The $260 net debit is 10.5% of its current share price. With an 18.99% profit probability, if the stock appreciates by 33%, you can double your money by selling the call before it expires in December 2026.

The hardest part of this one could be seeing enough volume to buy one or two $45 call options.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Data Science Points to Upside for Citigroup (C) Stock Despite the ‘Insurance’ Bet

- Domino's Pizza Stock is Undervalued Here - Shorting One-Month Put Options Yields 1.67%

- Are These Beaten-Down Bottom 100 Stocks to Buy Ready to Rebound?

- Here Is What Options Traders Expect for NVDA Stock After Nvidia Reports Q3 Results This Week