With a market cap of $53.6 billion, Valero Energy Corporation (VLO) is one of the world’s largest independent petroleum refiners and a major producer of renewable fuels. Headquartered in San Antonio, Texas, the company operates an extensive network of refineries across the United States, Canada, and the U.K., with significant capacity to process crude oil into transportation fuels, petrochemicals, and other refined products.

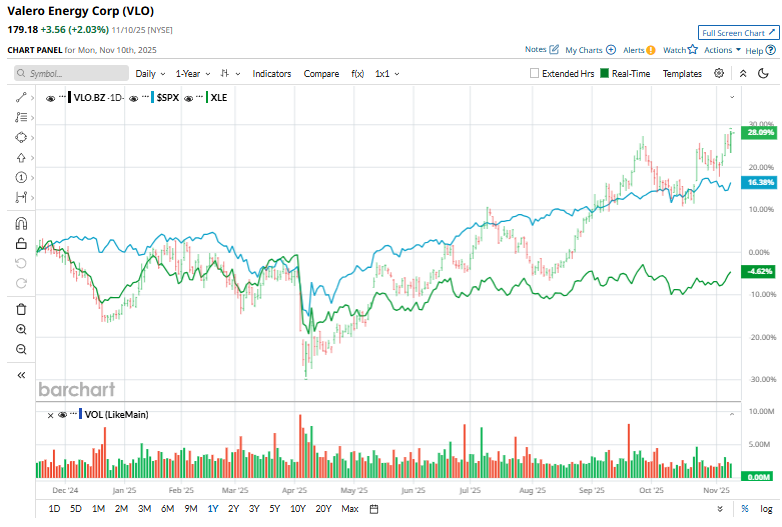

Shares of the energy giant have outshone the broader market over the past 52 weeks. VLO stock has surged 31.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14%. Moreover, shares of the company are up 46.2% on a YTD basis, compared to SPX's 16.2% gain.

Looking closer, shares of Valero Energy have outpaced the Energy Select Sector SPDR Fund's (XLE) 3.6% dip over the past 52 weeks and 5.5% rally in 2025.

Valero Energy posted its FY2025 Q3 earnings on Oct. 23. Its adjusted EPS of $3.66 and revenue of $32.17 billion topped expectations. Refining margins also rebounded, driven by strong diesel and gasoline margins amid low inventories. The company’s average throughput volume increased to 3.1 million barrels per day from 2.9 million barrels per day a year earlier. Driven by the solid performance, its shares popped 7% post announcement.

For the fiscal year ending in December 2025, analysts expect VLO's EPS to rise 8.5% year over year to $9.20. The company's earnings surprise history is stellar. It has surpassed the consensus estimates in each of the last four quarters.

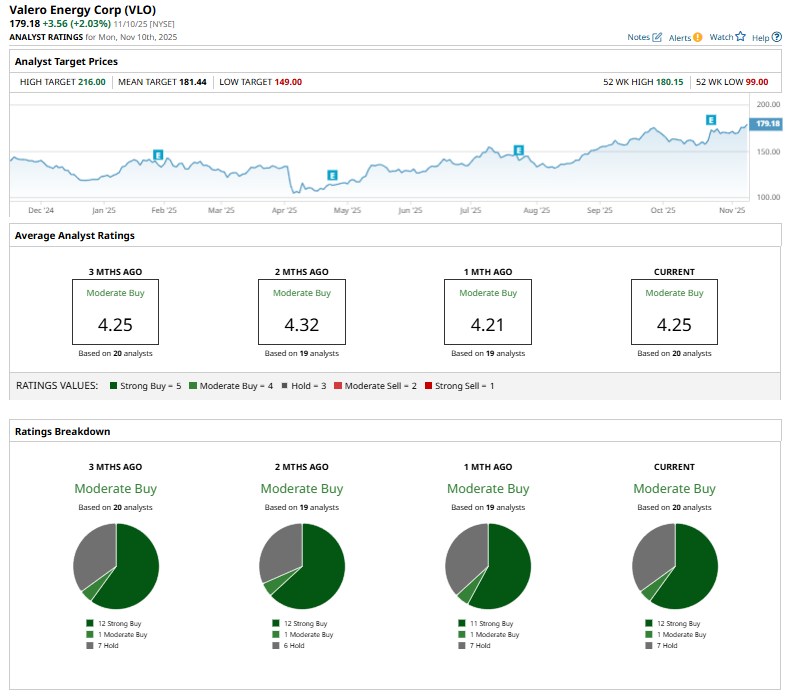

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

This configuration is bullish than a month ago, with 11 “Strong Buy” ratings on the stock.

On Oct. 8, Barclays plc (BCS) analyst Theresa Chen reaffirmed her “Buy” rating on Valero Energy and set a price target of $169.

Its mean price target of $181.44 implies a premium of 1.3% from the current market prices. The Street-high price target of $216 implies a potential upside of 20.5%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart