The US president, unhappy with last week's US election results, vented against the US beef industry last Friday.

US cattle futures have indeed been manipulated into a selloff, though beef at the eat counter has largely ignored the move.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.The US president could get his demand for lower meat prices if economic policies lead to an economic slowdown, as feared by the US Federal Open Market Committee.

Back in the day when I worked in the newsroom, part of my job was to visit with Chicago floor reporter Gary Wilhelmi. Gary had been around markets for decades and had wonderful stories from both the Board of Trade and Mercantile Exchange. Those of you who have been with me for a while are familiar with the Wilhelmi Element (The only price that matters is the close) and the Market Meteorological Musing (Weather patterns tend to change with the seasons), but there was so much more to our daily visits.

Among these other things, and I don’t recall what day of the week it was in particular, Gary would have a weekly listing of meat cash prices. We then spent the next 5 to 10 minutes going over the various prices as he added analytical commentary. I’ve been reminded of these conversations and wondering what Gary would have to say – he was never at a loss for words or opinions – about the ongoing hullabaloo regarding US beef prices. As I’ve said before, it would be good for the industry if cattle legends John Harrrington and Walt Hackney were still with us.

This past week I took a trip to the local meat market and was not surprised by what I found.

- Beef

- Hamburger was about $8 per pound

- Roasts were running roughly $10 per pound

- Brisket was $17 per pound

- And steaks ran from $20 to $40 per pound

- Pork

- Shoulder was $1 per pound

- Ham $3 per pound

- Chops $5 per pound

- And Bacon was running $7 per pound

- Chicken

- Whole bird was $2 per pound

- Just the breast was $5 per pound

- And since the US is in Turkey season

- The whole bird was $1.50 per pound

- While the breast alone was $2.00

- For those on a pescetarian (fish) diet

- Frozen whole catfish was $12 per pound

- And Atlantic salmon was priced at $19 per pound

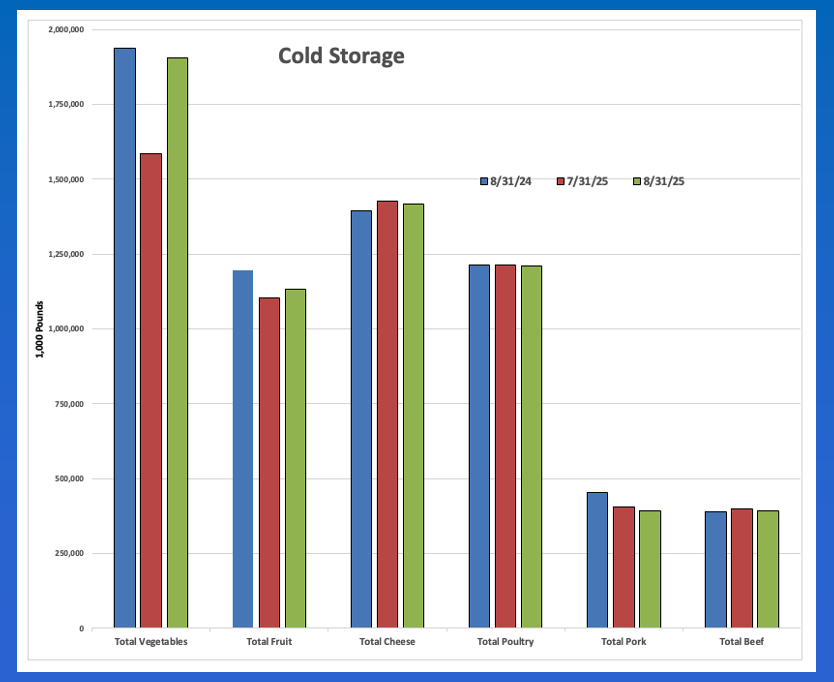

At the end of August, what seems like a lifetime ago now, US frozen beef stocks were reportedly up 2% from the previous August, though simple numbers still showed beef to be the smallest of the proteins.

- Total beef = 393.8 million pounds

- Total pork = 393.9 million pounds

- Total Red Meat = 809.7 million pounds

- Total chicken = 790.9 million pounds

- Total turkey = 418.4 million pounds

- Total Poultry = 1.212 billion pounds

If we can believe these numbers, and you know my thoughts on all things USDA, then the stage is set for a downturn in the US economy to force demand from beef to pork and poultry. Some of this is an annual change given the end of grilling season and the start of the holiday season, but it could be more pronounced this time around the calendar if policies dictate a weakening economy. How will we know when it happens? As an attendee at this past summer’s Barchart Grain Merchandising and Technology Conference in Manhattan, Kansas told me, we’ll know when the payoff from a bet is chicken rather than a steak.

That may be sooner than we think.

Before the lights were turned out last Friday, my friend in the cattle industry passed along the latest social media post from the US president. It was a doozy given the US president was still in a foul mood following this past Tuesday’s election (US). In his mind, the poor performance at the ballot box was all about beef prices, so he once again took to social media saying, “While cattle prices have dropped substantially, the price of boxed beef has gone up – Therefore, you know something is “fishy”. We will get to the bottom of it very quickly. If there is criminality, those people responsible will pay.”

Let’s take this point by point.

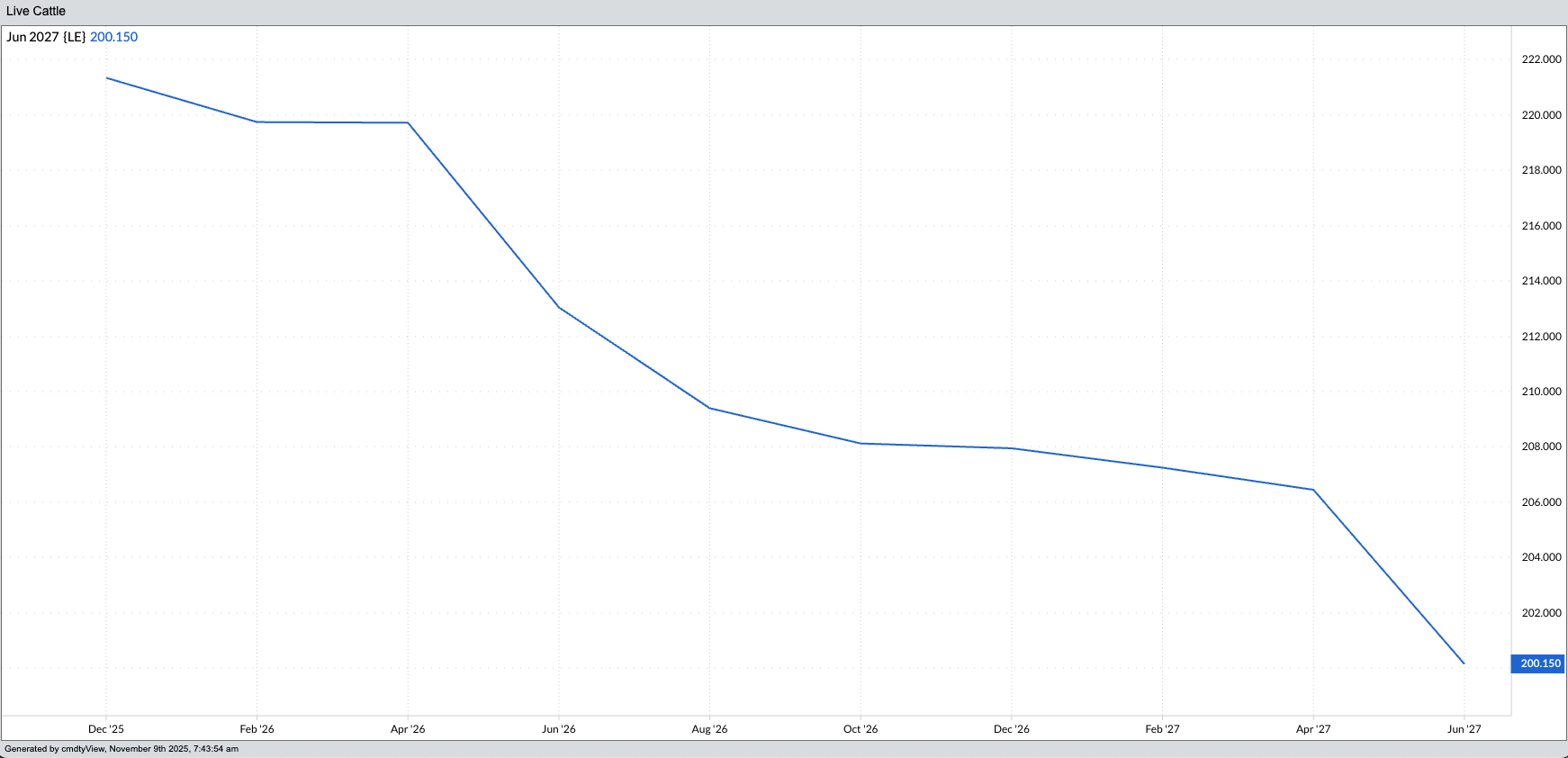

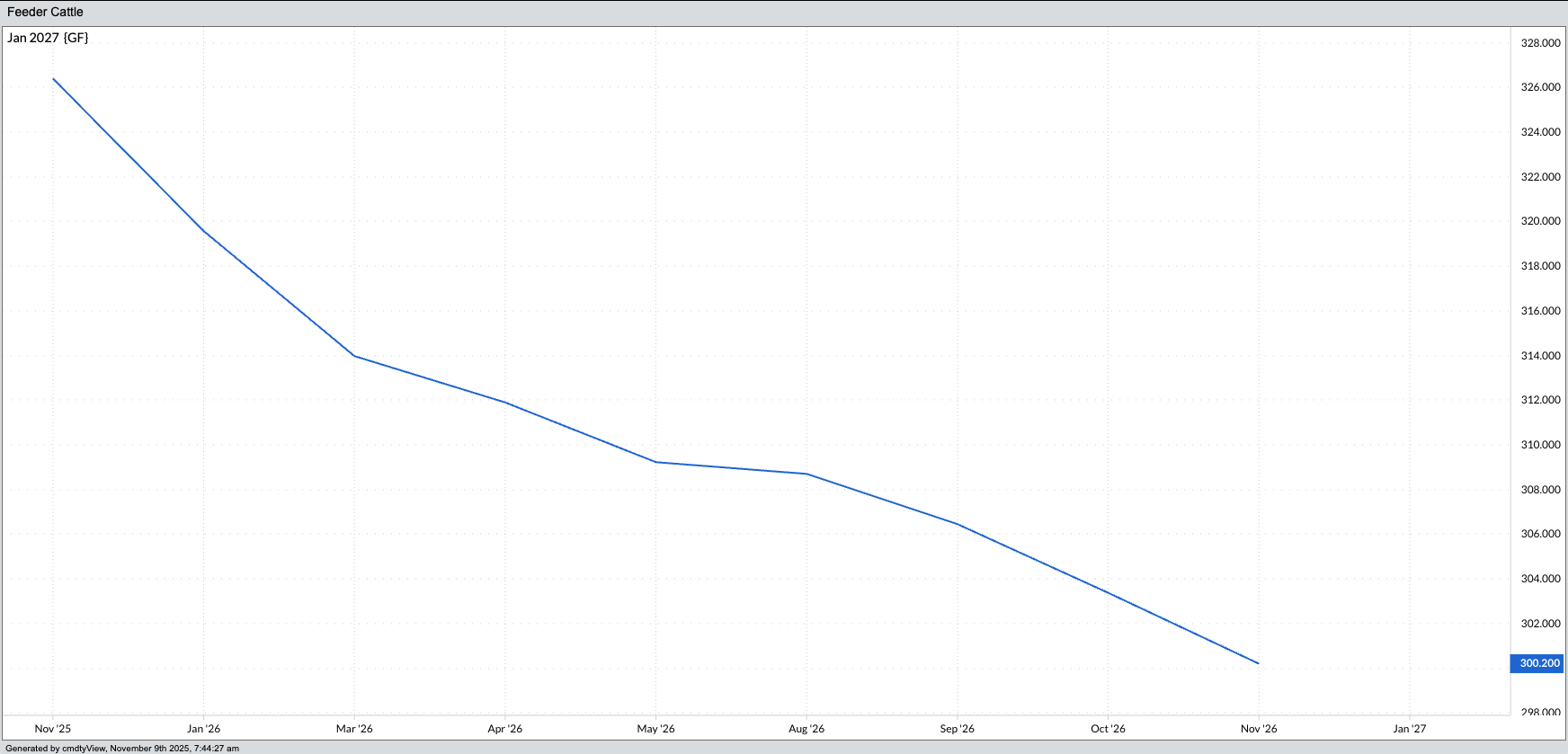

On paper (futures, ETFs, etc.), cattle prices have fallen. But those who understand much of anything know futures aren’t necessarily reality. Futures prices can be manipulated by triggering algorithms with statements, posts, and “policies”. Regarding the latter, cattle from Mexico remain locked up at the border as the US sends boatloads of money to Argentina for supplies that don’t exist. Meanwhile, the December live cattle futures contract (LEZ25) has fallen from $248 to last week’s low of $218, a decrease of 12%. Not to be outdone, the January feeder cattle futures contract (GFF26) has lost nearly $70 (18%).

The price of boxed beef has stabilized. After the US president initially vowed to lower beef prices, US Ag Secretary Rollins made sure USDA reported lower boxed beef prices almost every day. But the price at the meat counter wasn’t actually going down. In fact, prices have continued to climb. Why? Because demand continues to outpace supplies and as Newsom’s Market Rule #6 tells us, “Fundamentals win in the end”.

How do I know US cattle fundamentals haven’t changed? Though off recent record highs, both the Live Cattle (LEY00) and Feeder Cattle (GFY00) national cash indexes remain in the upper percentages of historic prices. If we apply the economic Law of Supply and Demand – market price is the equilibrium between quantities demanded and quantities available – then we know supplies are still not keeping up with demand. The fact cash markets have stayed strong while futures prices have been made to go lower means national average basis is skyrocketing, a key sign a market’s immediate-term fundamentals are growing more bullish.

But what about longer-term? Keep in mind cattle are not a storable commodity, so I don’t usually pull out forward curves. But now we see a strong backwardation (inverse) in both live and feeder cattle telling us commercial traders are expecting real fundamentals are expected to stay bullish for the foreseeable future. For the record, these spreads are generally running much stronger than normal for this time of year. When you get basis and futures spreads in this situation while futures are collapsing it means the Rubber Band Disposition is being stretched and nearing its breaking point.

The US president doesn’t seem to understand the Law of Supply and Demand. If he were to put his rants aside for a moment he might realize the strong boxed beef markets indicate US consumer demand remains firm, indicating the domestic economy has not collapsed. At least not yet. As US Fed Chairman Powell continues to talk about, there is growing concern over this administration’s “policies” and the ripple effects on inflation and domestic labor market. Therefore, if the US president continues down his chosen economic path (tariffs against everyone, demanding lower interest rates, firing everyone he can, etc.) then boxed beef prices will come down because demand will go away.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart