TORONTO, ON / ACCESSWIRE / August 9, 2024 / Aclara Resources Inc. ("Aclara" or the "Company") (TSX:ARA) is pleased to announce an updated mineral resource estimate ("MRE") of the Carina Module, Aclara's ion adsorption clay project located in Goiás, Brazil, (the "Carina Module"), which reflects an inferred mineral resource of 298 Mt, an increase from the previously reported inferred mineral resource statement of 168Mt on December 12, 2023 (the "2023 Resource Statement").

Highlights

The inferred mineral resource for the Carina Module is estimated at 298 Mt, which represents a 77% increase compared to the previously reported inferred mineral resource of 168Mt.

The estimate of contained amounts of magnetic elements1 increased approximately 69% compared to the amount reported in the 2023 Resource Statement, reflecting an increase in contained heavy rare earths (dysprosium and terbium (DyTb)), from 8,240t to 13,470t, and an increase in contained light rare earths (neodymium and praseodymium (NdPr)), from 49,832t to 84,565t. Rare earth magnetic elements (i.e. DyTb and NdPr) are critical to the production of permanent magnets that are used in electric vehicles and wind turbines.

Metallurgical recoveries of rare earths from the Carina Module remain compatible with the technology patented and successfully demonstrated on a pilot scale by Aclara at its pilot plant located in Chile, which is designed to minimize both cost and environmental footprint.

The near-surface location of the deposit results in a low strip ratio (0.2) providing a positive backdrop for low-cost mining operations.

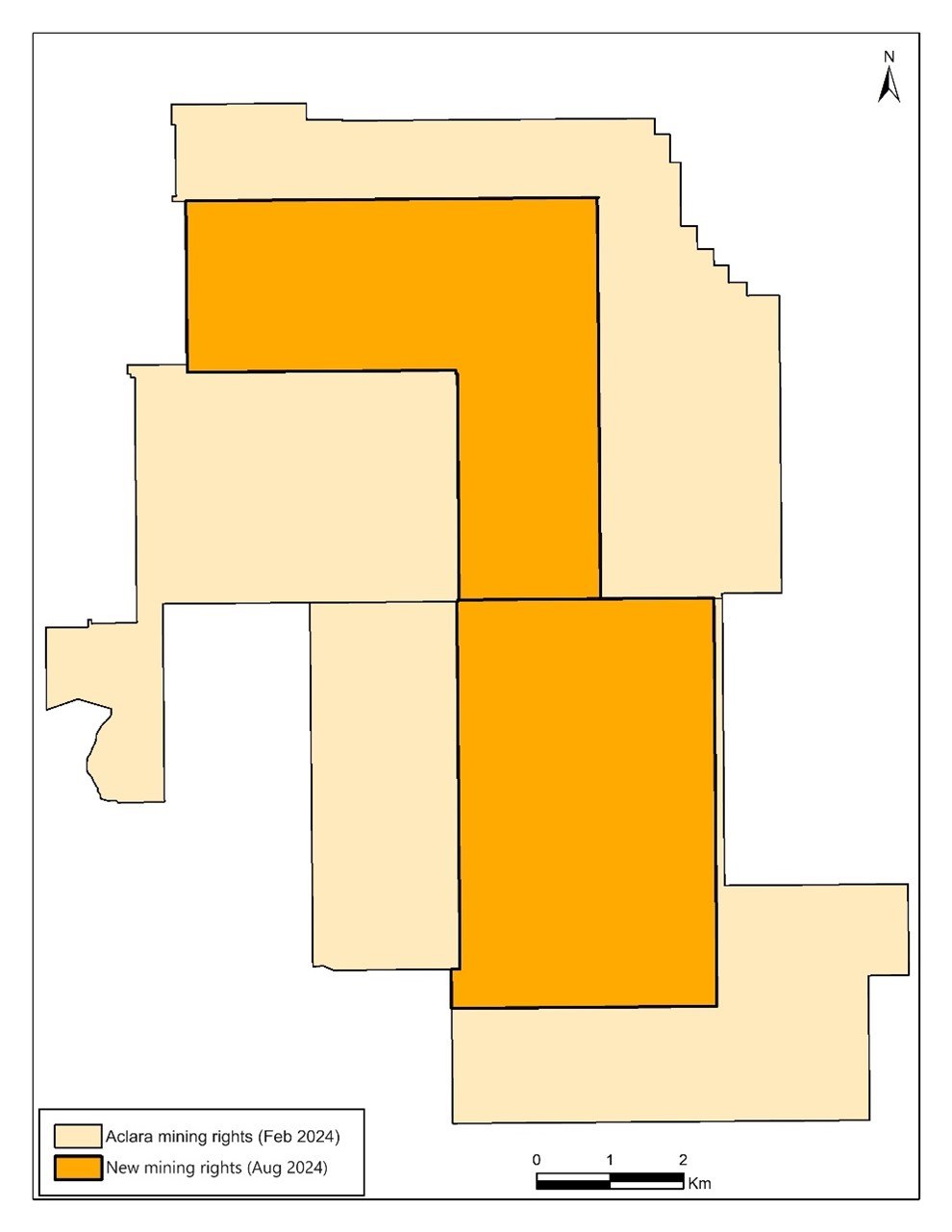

Secured two additional mining rights adjacent to its existing mineral rights in the Carina Module through a public bidding process conducted by the Brazilian National Mining Agency ("Agencia Nacional de Mineração" or "ANM"). The two new mining rights will enable Aclara to explore new areas in the future and further optimize the design of the Carina Module.

Next Steps

Anticipated completion of an updated preliminary economic assessment of the Carina Module in September 2024.

Continuation of the Carina Module pre-feasibility study as previously reported in the Company's press release dated May 6, 2024.

Completion of a 15,200-meter Phase 2 reverse circulation ("RC") drill campaign aimed at converting inferred mineral resources to a measured and indicated mineral resources category, which is expected to be completed by Q4 2024.

Execution of a metallurgical test campaign during H2 2024 and H1 2025. Sample collections will be obtained through sonic drilling and sent to SGS Lakefield for mineralogical and recovery characterization, to serve as additional inputs for the Carina Module prefeasibility study and to form the basis for a new piloting operation.

Installation and operation of a new semi-industrial scale pilot plant in the State of Goias, Brazil during Q2 2025. The piloting operation will be aimed at (i) confirming the processing parameters and final process flowsheet design for the feasibility study, (ii) generating a high purity HREE carbonate for separation trials in support of future off-take agreements, and (iii) demonstrating to relevant stakeholders the environmental sustainability of the process design.

1 Magnetic Elements: Neodymium (Nd), Praseodymium (Pr), Dysprosium (Dy) and Terbium (Tb).\

Aclara COO, Barry Murphy, commented:

"The mineral resource update represents a crucial milestone towards the production of a heavy REE carbonate from the Carina deposit. With a comprehensive understanding of the entire deposit now in hand, we are well positioned to advance confidently and accelerate progress on multiple fronts. These include converting inferred mineral resources to measured and indicated mineral resources, optimizing metallurgical processes, advancing pre-feasibility and feasibility studies, and continuing with environmental and social licensing requirements. Our patented metallurgical recovery process, known as "Circular Mineral Harvesting", is recognised for its cost competitiveness and enhanced environmental attributes, and further sets a promising stage for the forthcoming preliminary economic assessment update. We are very pleased to be significantly expanding our capacity as a key supplier of magnetic rare earths, particularly dysprosium, which is an essential component in addressing climate change."

Mineral Resource Statement

The following table provides a summary of the drilling database in support of the MRE.

Table 1. Summary of drilling database used to update mineral resource estimate.

Drilling Type |

Hole Count |

Total Length (m) |

Sample Count |

Auger |

283 |

2,101 |

1,791 |

RC |

80 |

2,003 |

1,998 |

Total |

363 |

4,104 |

3,789 |

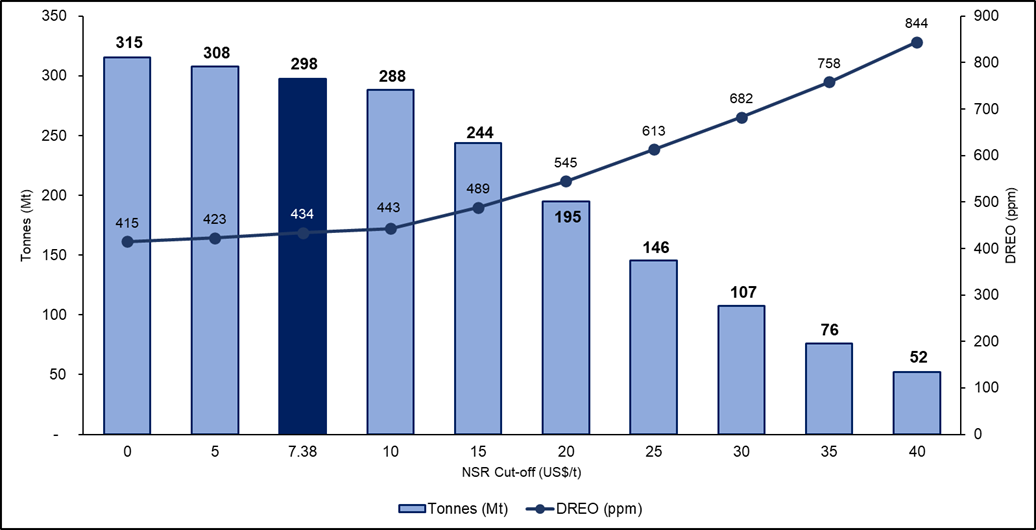

At a 7.4 US$/t NSR Cut-off2 the mineral resource estimate reflects 298Mt in inferred mineral resources, which further represents 1,452 ppm TREO containing an average Dy and Tb grade of 38.9 ppm and 6.4 ppm, respectively. The resulting average NSR value of the mineral resource is 28.42 US$/t. The MRE has been reported in accordance with the requirements of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The following table provides a detailed summary of the MRE, including TREO, NdPr, Dy and Tb content by geological domains including types of hydrothermal alteration and regolith horizons.

2 NSR Cut-off: The NSR Cut-off used is based on the marginal costs of the Carina Module. Using a marginal cut-off to discriminate between waste and plant feed (ore) ensures that the net revenue value of the rare earth concentrate produced is equal to the cost of producing it. Since this strategy is applied only to material contained by the "optimal" pit, which contains material that must be mined out, it will maximize cash flow over the life of the operation.

Table 2. Carina Module Inferred Mineral Resource Estimate (as of May 3, 2024)

Geological Domain |

Mass |

Oxide Total Grade (ppm) |

Oxide Content (t) |

||||||

Mt |

TREO |

NdPr |

Dy |

Tb |

TREO |

NdPr |

Dy |

Tb |

|

Upper Pedolith |

12.4 |

814 |

106 |

11 |

2 |

10,119 |

1,317 |

136 |

21 |

Lower Pedolith |

46.6 |

1,255 |

196 |

23 |

4 |

58,465 |

9,140 |

1,084 |

173 |

Upper Saprolite |

221.4 |

1,527 |

312 |

43 |

7 |

338,071 |

69,179 |

9,586 |

1,581 |

Lower Saprolite |

13.3 |

1,358 |

254 |

43 |

7 |

18,104 |

3,393 |

568 |

88 |

Saprock |

3.8 |

1,907 |

404 |

52 |

9 |

7,244 |

1,535 |

198 |

34 |

Total |

297.6 |

1,452 |

284 |

39 |

6 |

432,003 |

84,565 |

11,573 |

1,897 |

Notes:

TREO means total rare earth oxides (La2O3, CeO2, Pr6O11, Nd2O3, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3, and Y2O3).

NdPr means neodymium and praseodymium (Nd2O3 and Pr6O11).

Dy means dysprosium (Dy2O3).

Tb means terbium (Tb4O7).

Mineral resources were estimated above an NSR Cut-off of 7.4 US$/t, using average long term metal prices and metallurgical recoveries outlined below under "Cut-Off Determination & Selection".

Mineral resources are not mineral reserves and do not have demonstrated economic viability. Totals may reflect inaccuracies due to rounding.

Cut-Off Determination & Selection

The MRE is pit-constrained using GEOVIA Whittle 2022 software, with an overall slope angle of 25° and a mining cost of US$2.13/t. The MRE is reported at an NSR Cut-off of US$7.4/t, based on processing costs, plus royalties and general and administrative cost estimates. The NSR calculation uses recoveries that are based on preliminary metallurgical test work performed by the AGS Laboratory in La Serena, Chile and SGS Geosol Laboratory in Vespasiano Minas Gerais, Brazil.3

Selling prices for rare earth oxides: The price estimates used for pit optimization (reported in US$/kg) are as follows: La2O3 = 0.68, CeO2 = 0.69, Pr6O11 = 144.18, Nd2O3 = 150.75, Sm2O3 = 2.39, Eu2O3 = 27.45, Gd2O3 = 71.55, Tb4O7 = 1,789.25, Dy2O3 = 477.25, Ho2O3 = 137.25, Er2O3 = 59.10, Tm2O3= 0.0, Yb2O3 = 19.85, Lu2O3 =834.75, Y2O3 = 2.86.

Metallurgical recoveries: Metallurgical recovery results were obtained from analyses performed by AGS Laboratory in La Serena, Chile, and SGS Geosol Laboratory in Vespasiano Minas Gerais, Brazil from a total of 3,789 drilling samples. The analytical assays were tested under conditions that carry out desorption at a pH of 4.0, plus a synthetic lixiviant solution designed to emulate the predicted concentrations of recycled salts generated in the closed-circuit process.

Plant efficiency: Variable by element, ranging from 86 to 98% with an average of 94%.

Carbonate transportation and selling cost: US$0.032/kg of carbonates.

Carbonate purity: 92.7%

3 NSR values were estimated based on metallurgical tests using the process parameters developed for the Penco Module in Chile (see the Company's press release dated November 9, 2022). No QA/QC program was applied to this initial metallurgical test campaign and, as such, the results should be considered speculative in nature, and have not been reported in the mineral resources.

Chart 1: Carina Module NSR Cut-off vs. Tonnage & DREO Grade curve

All technical and economic parameters remain subject to further review in connection with the preparation of the preliminary economic assessment of the Carina Module, which is scheduled to be reported in early September 2024.

Geological Results from the Drilling Campaigns

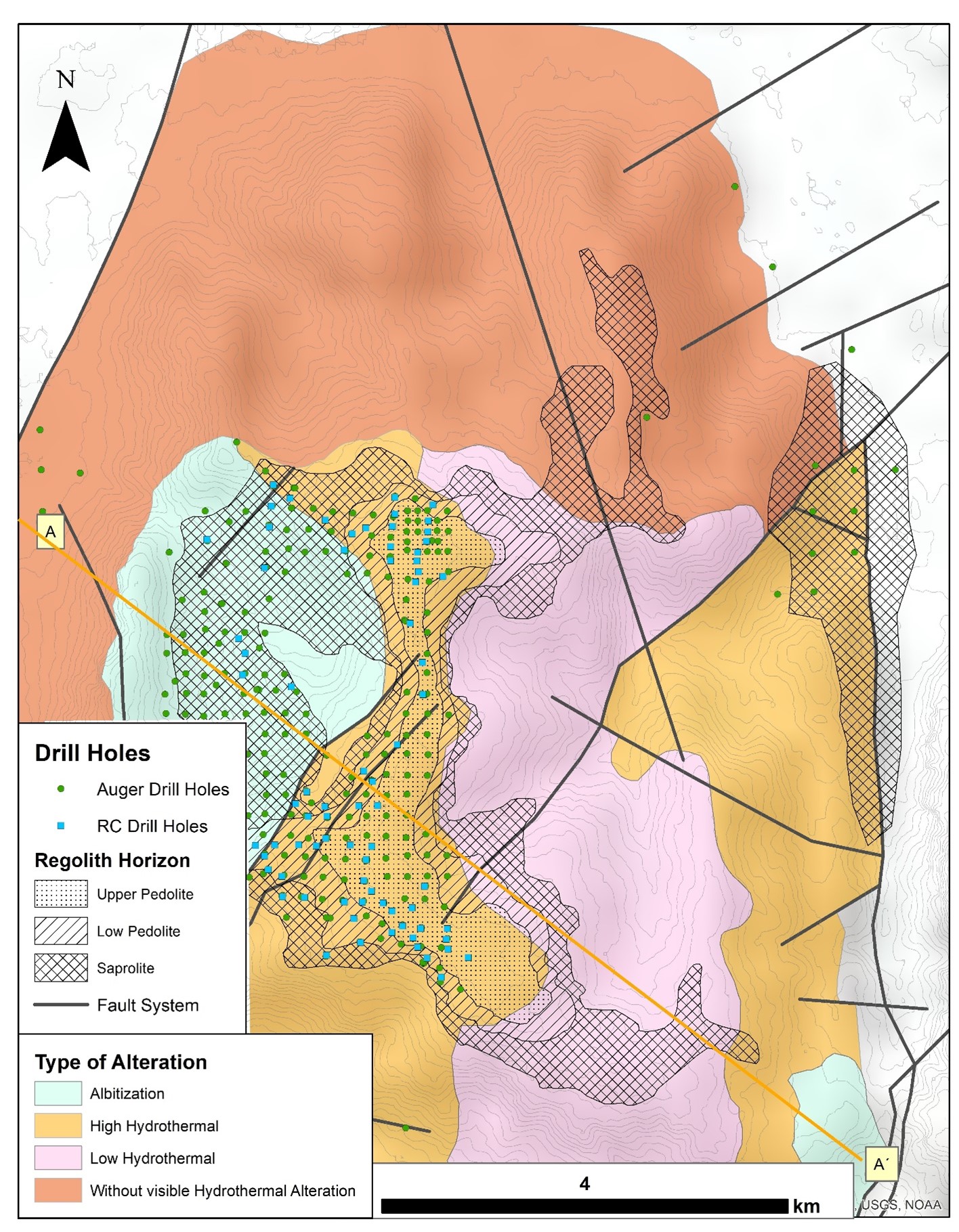

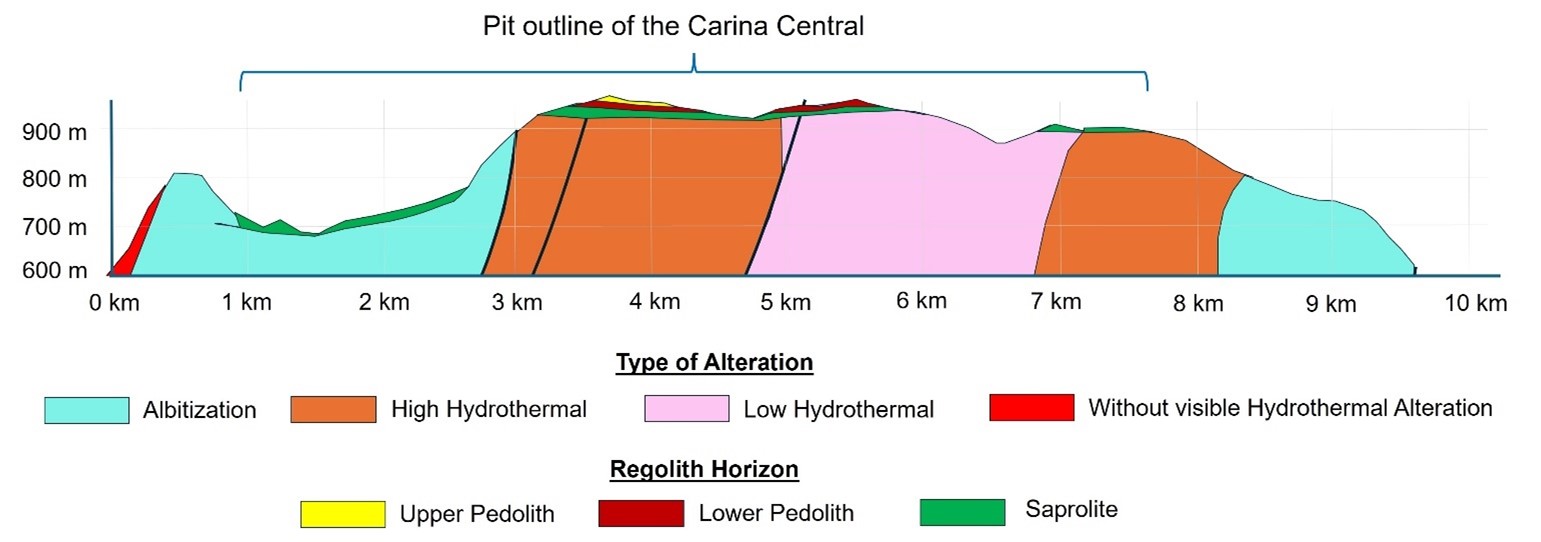

The Carina Module maiden resource estimate, previously disclosed in the Company's press release dated December 12, 2023, was developed using preliminary results obtained from the initial drilling campaign of 283 auger drill holes (2,101m) completed in 2023. Results from a subsequent drilling campaign, which was completed between late 2023 and early 2024, included 80 RC drill holes (2,003 m), supplemented those results from the initial auger drill campaign and resulted in a total of 363 drill holes (4,104 m), and formed the basis for the MRE. The supplemental RC drill campaign provided sufficient information to allow for a detailed understanding of the extension and continuity of the regolith over the Massif (see Figures 1 and 2). Furthermore, the RC drill campaign was used to determine the bottom limits of the regolith (pedolith and saprolite horizons) where the bedrock was found to vary between 2 m and 40 m below the natural surface level, with an average depth of 15.8 m. This data made it possible to verify the lateral continuity of the lower pedolith and saprolite horizons (see Figure 2), as well as develop an understanding of how the host rock lithologies underwent hydrothermal alteration. These inputs complemented observations from field mapping and core logging to yield the following geological domains (see Figure 1)

Saprolite: Albitized and greisenized Li-mica leucogranite and albitized medium-grained equigranular pink biotite granite leucogranite.

Saprock, saprolite, lower and upper pedolith: Partially albitized coarse-grained inequigranular pink biotite granite, inequigranular pink biotite granite, and coarse-grained porphyritic pink biotite granite.

NE-SW fault zone system core: Black greisen veins with abundant cassiterite and crackle breccia.

The average drilling grid spacing across the Carina Central (see Figure 1) area was 200 m × 200 m with a grid of 100 m x 100 m in the northeastern part of the area. In addition, auger drilling was conducted in the eastern, western and southern parts of the Carina Module where the average drilling grid spacing was 400 m x 400 m

The information gathered from the new drilling campaigns supports the reported increase of 77% in the inferred resource category. The MRE has limited geological evidence and sampling to imply, but not verify, geological and grade continuity. The foregoing results remains to be further validated with the current 15,200 m RC infill drilling campaign for measured and indicated mineral resource estimates.

Figure 1: Map of the Carina Module area showing the distribution of the types of alteration, superimposed by lateral extent of the upper and lower pedolith and saprolite subhorizons, including the locations of the Carina Central and Carina Eastern areas, as defined by the RC and auger drill holes. Cross-section A-A' is illustrated in Figure 2 below.

Figure 2. Cross-section A-A' showing the principal geological domains from Figure 1 and the fault zone system overlain by the regolith horizons. It is evident that the saprolite is thicker than the upper and lower pedolith and has lateral continuity over the Carina Central area.

Sampling, Assay & QA/QC Protocols

363 drill holes were sampled at intervals of 0.5 m to 2 m, which resulted in a total of 3,789 samples for the analysis of total rare earth element and desorbable rare earth element composition and 342 QA/QC samples for QA/QC analysis. 3,211 samples were sent to ALS laboratory in Lima, Peru and 578 samples were sent to SGS Geosol laboratory in Vespasiano, Brazil to be analysed for total rare earth element composition, and 3,211 samples were sent to the AGS laboratory in La Serena, Chile and 578 samples were sent to SGS Geosol laboratory in Vespasiano, Brazil to be analysed for desorabable rare earth element composition.

In respect of the total rare earth element composition analysis, GE21 Consultoria Mineral ("GE21") utilizes sampling and analytical protocols that follow industry standards in accordance with NI 43-101. The QA/QC program has been implemented in the ALS and SGS Geosol laboratories, respectively. The quality of the assay data for Dy, Nd, Pr and Tb was statistically evaluated by GE21 based on the QA/QC samples delivered by the Company, which included an analysis of certified reference materials, field duplicates and sample split duplicates, fine and coarse blanks via the execution of twin holes. GE21 is a Brazilian based engineering consultancy with considerable experience in resource modelling and estimation. GE21 considers the assay results to be of sufficient precision and accuracy to support the MRE.

Estimation Methodology & Reporting of Mineral Resources

High-grade capping supported by statistical analysis was completed on 1 m composites and applied to the MRE.

The MRE was completed using the LEAPFROG GEO EGDE software to generate a block model consisting of parent blocks measuring 50 m x 50 m x 4 m with sub-blocks of 12.5 m x 12.5 m x 2 m dimensions.

Variography exercises were conducted with the LEAPFROG GEO EDGE software on three groups of elements, which were defined based on the characteristics of the elements and the correlations between them, and included the following groupings: (i) Ce; (ii) the light REEs La, Pr, Nd, Sm, and Eu; and (iii) the heavy REEs together with Gd, Tb, Dy, Ho, Er, Tm, Yb, Lu, and Y.

Experimental variograms were constructed in the vertical and horizontal directions. No continuity differences were observed in different directions in the horizontal plane; therefore, the use of horizontal/omnidirectional experimental variograms was chosen. The variograms were constructed within the high hydrothermal lower pedolith, high hydrothermal upper saprolite and albitization upper saprolite geological domains.

The grade estimation considered orientation, type, and continuity of the mineralization and the drilling grid spacing within each domain. The ordinary kriging method was used to estimate total REEs in each geological domain within the dynamic anisotropy tool of the LEAPFROG GEO EDGE software. Kriging in the presence of high-grade approach was applied in the sample search to restrict the influence of outliers, which are composites with grades higher than a defined value.

Block estimation was validated visually, by global bias analysis and by trend analysis.

In-situ bulk density was assumed to have a value of 1.8 t/m3 for the regolith profile, based on similar projects in the region.

The inferred mineral resources classification reported in the MRE was based on the level of confidence in the data, geological continuity and geostatistical parameters appropriate for the deposit type.

Qualified Person

All mineral reserve and mineral resource estimates and other scientific and technical information in this press release were prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and NI 43-101, has been reviewed and approved by Fábio Xavier (MAIG #5179), a Geologist associated with GE21. GE21 is a specialized, independent mineral consulting company. Sample preparation, analytical techniques, laboratories used and quality assurance-quality control protocols used during the drilling programs are consistent with industry standards and independent certified assay labs are used.

The MRE has been prepared by Fábio Xavier. Mr. Xavier is a member of the Australian Institute of Geoscientists (AIG) and is a qualified person for purposes of NI 43-101. Mr. Xavier has reviewed and approved the scientific and technical information related to the MRE contained in this press release.

Mr. Xavier visited the Carina Module from July 17 to July 18, 2024, during the execution of the Phase 2 RC drill campaign. The visit was supported by Carina's Exploration Manager, Luiz Jorge Frutuoso Junior. Mr. Frutuoso is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), a Fellow of the Australian Institute of Geoscientists (AIG) and is a qualified person for purposes of NI 43-101. Relevant geological information and database analysis relating to the Carina Module were provided by Juan Pablo Navarro, who is Aclara's Corporate Exploration Manager, a member of the Australian Institute of Geoscientists (AIG, #9021) and a qualified person for purposes of NI 43-101.

A technical report for the Carina Module, to be prepared in accordance with NI 43-101, will be filed under the Company's profile on SEDAR+ at www.sedarplus.com within 45 days of this press release.

Acquisition of Mineral Rights Adjacent to the Carina Module

The Company has secured two additional mining rights adjacent to its existing mineral rights in the Carina Module through a public bidding process conducted by the Agencia Nacional de Mineração. The new mining rights are expected to enable the Company to explore new areas and optimize the design of its operating facilities.

Figure 3: Map with the existing mining rights comprising the Carina Module and the newly acquired mining rights.

About Aclara

Aclara Resources Inc. (TSX:ARA) is a development-stage company that focuses on heavy rare earth mineral resources hosted in Ion-Adsorption Clay deposits. The Company's rare earth mineral resource development projects include the Penco Module in the Bio-Bio Region of Chile and the Carina Module in the State of Goiás, Brazil.

Aclara's rare earth extraction process offers several environmentally attractive features. Circular mineral harvesting does not involve blasting, crushing, or milling, and therefore does not generate tailings and eliminates the need for a tailing's storage facility. The extraction process developed by Aclara minimizes water consumption through high levels of water recirculation made possible by the inclusion of a water treatment facility within its patented process design. The ionic clay feedstock is amenable to leaching with a common fertilizer main reagent, ammonium sulfate. In addition to the development of the Penco Module and the Carina Module, the Company will continue to identify and evaluate opportunities to increase future production of heavy rare earths through greenfield exploration programs and the development of additional projects within the Company's current concessions in Brazil, Chile, and Peru.

Forward-Looking Statements

This press release contains "forward-looking information" within the meaning of applicable securities legislation, which reflects the Company's current expectations regarding future events, including statements with regard to: mineral continuity, grade, metallurgical recoveries, methodology, production timing and upside at the Carina Module, the Company's exploration plan, drilling campaigns and activities in Brazil and the expectations of the Company's management as to the timing, cost, scope and results of such exploration works and drilling activities and the Phase 2 RC drill campaign in Brazil, the results and interpretations of the MRE relating to the and the timing and issuance of an updated preliminary economic assessment relating to the Carina Module.. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company's control. Such risks and uncertainties include, but are not limited to risks related to operating in a foreign jurisdiction, including political and economic problems in Brazil; risks related to changes to mining laws and regulations and the termination or non-renewal of mining rights by governmental authorities; risks related to failure to comply with the law or obtain necessary permits and licenses or renew them; compliance with environmental regulations can be costly; actual production, capital and operating costs may be different than those anticipated; the Company may be not able to successfully complete the development, construction and start-up of mines and new development projects; risks related to mining operations; and dependence on the Carina Module. Aclara cautions that the foregoing list of factors is not exhaustive. For a detailed discussion of the foregoing factors, among others, please refer to the risk factors discussed under "Risk Factors" in the Company's annual information form dated as of March 22, 2024, filed on the Company's SEDAR+ profile. Actual results and timing could differ materially from those projected herein. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained in this press release is provided as of the date of this press release and the Company does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required under applicable securities laws.

For further information, please contact:

Ramon Barua Costa

Chief Executive Officer

investorrelations@aclara-re.com

Table 3: Carina Module - Mineral Resource Estimate (Effective May 3, 2024) - By the Total Rare Earth Oxides at 7.4 US$/t NSR Cut-off*

Geological Domain |

Mass |

La2O3 |

CeO2 |

Pr6O11 |

Nd2O3 |

Sm2O3 |

Eu2O3 |

Gd2O3 |

Tb4O7 |

Dy2O3 |

Ho2O3 |

Er2O3 |

Tm2O3 |

Yb2O3 |

Lu2O3 |

Y2O3 |

TREO |

Mt |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

Ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

|

Upper Pedolith |

12.4 |

104 |

472 |

24 |

82 |

15 |

1 |

10 |

2 |

11 |

2 |

8 |

1 |

10 |

1 |

72 |

814 |

Lower Pedolith |

46.6 |

181 |

609 |

44 |

152 |

28 |

1 |

21 |

4 |

23 |

5 |

15 |

2 |

18 |

3 |

148 |

1,255 |

Upper Saprolite |

221.4 |

297 |

420 |

70 |

243 |

49 |

2 |

42 |

7 |

43 |

9 |

27 |

4 |

28 |

4 |

283 |

1,527 |

Lower Saprolite |

13.3 |

257 |

355 |

58 |

197 |

41 |

2 |

40 |

7 |

43 |

9 |

27 |

4 |

26 |

4 |

290 |

1,358 |

Saprock |

3.8 |

412 |

491 |

92 |

312 |

63 |

3 |

54 |

9 |

52 |

10 |

29 |

4 |

29 |

4 |

343 |

1,907 |

Total |

297.6 |

270 |

450 |

63 |

221 |

44 |

2 |

37 |

6 |

39 |

8 |

24 |

4 |

25 |

4 |

254 |

1,452 |

Table 4: Carina Module - Mineral Resource Estimate (Effective May 3, 2024)- By Metallurgical Recoveries at 7.4 US$/t NSR Cut-off*

Geological Domain |

Mass |

La |

Ce |

Pr |

Nd |

Sm |

Eu |

Gd |

Tb |

Dy |

Ho |

Er |

Tm |

Yb |

Lu |

Y |

REO-Ce |

Mt |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

% |

|

Upper Pedolith |

12.4 |

64 |

9 |

74 |

77 |

69 |

72 |

50 |

44 |

35 |

28 |

25 |

21 |

19 |

19 |

31 |

57 |

Lower Pedolith |

46.6 |

68 |

7 |

70 |

70 |

64 |

66 |

48 |

46 |

40 |

33 |

30 |

27 |

25 |

25 |

36 |

57 |

Upper Saprolite |

221.4 |

39 |

2 |

39 |

41 |

41 |

44 |

40 |

44 |

42 |

38 |

36 |

33 |

32 |

34 |

45 |

41 |

Lower Saprolite |

13.3 |

14 |

2 |

14 |

16 |

21 |

27 |

32 |

37 |

35 |

34 |

34 |

34 |

32 |

36 |

45 |

27 |

Saprock |

3.8 |

9 |

1 |

8 |

9 |

12 |

16 |

20 |

25 |

27 |

27 |

26 |

24 |

24 |

27 |

33 |

17 |

Total |

297.6 |

41 |

3 |

41 |

43 |

42 |

46 |

40 |

43 |

41 |

37 |

35 |

32 |

31 |

33 |

44 |

42 |

Table 5: Carina Module - Mineral Resource Estimate (Effective May 3, 2024) - By the Desorbable Rare Earth Oxides at 7.4 NSR Cut-off US$/t*

Geological Domain |

Mass |

La2O3 |

CeO2 |

Pr6O11 |

Nd2O3 |

Sm2O3 |

Eu2O3 |

Gd2O3 |

Tb4O7 |

Dy2O3 |

Ho2O3 |

Er2O3 |

Tm2O3 |

Yb2O3 |

Lu2O3 |

Y2O3 |

DREO |

Mt |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

|

Upper Pedolith |

12.4 |

67 |

41 |

18 |

63 |

10 |

1 |

5 |

1 |

4 |

1 |

2 |

0 |

2 |

0 |

22 |

235 |

Lower Pedolith |

46.6 |

123 |

40 |

31 |

106 |

18 |

1 |

10 |

2 |

9 |

2 |

5 |

1 |

4 |

1 |

53 |

406 |

Upper Saprolite |

221.4 |

116 |

10 |

27 |

100 |

20 |

1 |

17 |

3 |

18 |

3 |

10 |

1 |

9 |

1 |

128 |

464 |

Lower Saprolite |

13.3 |

35 |

5 |

8 |

32 |

9 |

1 |

13 |

2 |

15 |

3 |

9 |

1 |

9 |

1 |

129 |

273 |

Saprock |

3.8 |

38 |

6 |

7 |

28 |

8 |

0 |

11 |

2 |

14 |

3 |

8 |

1 |

7 |

1 |

113 |

247 |

Total |

297.6 |

111 |

15 |

26 |

95 |

19 |

1 |

15 |

3 |

16 |

3 |

8 |

1 |

8 |

1 |

112 |

434 |

Notes:

REO = rare earth oxides (La2O3, CeO2, Pr6O11, Nd2O3, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3,) + Y2O3.

Totals may not balance due to rounding of figures.

Mineral Resources are not Mineral Reserves, as they do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant factors.

Mineral resources were classified as Inferred.

Mineral resources are reported with effective date May 3, 2024. The responsible QP is Mr. Fábio Xavier (MAIG #5179).

Mineral resources are classified in accordance with the CIM (2014) Standards and Definitions of Mineral Resources.

Blocks estimated by ordinary kriging at support of 50 m × 50 m × 4 m with sub-blocks 12.5 m × 12.5 m × 2 m.

Mineral Resources were estimated using TREO grades.

NSR were calculated based on desorbed grades calculated by average metallurgical recoveries to support the RPEEE definition. NSR values are not part of mineral resource declaration.

The results are presented in-situ and undiluted, are constrained within optimized open pit shells, and are considered to have reasonable prospects of economic viability, using the following parameters:

a. Mining recovery: 98.5%.

b. Pit slope angle: 25°.

c. Selling cost :0.032US$/kg of concentrate.

d. Costs: Mining: 2,13US$/t mined; Process: 7.23 US$/t processed; Royalties: 2% of revenue; Discount: 7.00US$/kg REO.

e. Metallurgical Recoveries calculated from the estimate of head and desorbed grades:

UP: 29.1%; LP: 29.9%; US: 31.2%; LS: 26.7%; SapRock: 18.5%.

a. NSR cut-off value = US$7.4/t.

SOURCE: Aclara Resources Inc.

View the original press release on accesswire.com