All Three Operating Segments Generate Positive Operating Income

CHELMSFORD, MA / ACCESSWIRE / November 10, 2022 / Harte Hanks, Inc. (NASDAQ: HHS), a leading global customer experience company focused on bringing companies closer to customers for nearly 100 years, today announced financial results for the third quarter, the period ended September 30, 2022.

Harte Hanks CEO, Brian Linscott, commented: "Harte Hanks continues to deliver improved operating metrics, including solid year-over-year growth as new agreements offset the erosion of pandemic-related projects and legacy direct mail projects. Each of our operating segments is operating efficiently, delivering positive contribution margin, and driving consistent profitability. A higher mix of logistics revenue compressed our gross and operating margins, but we were able to generate $2.5 million from the sale of unused IP addresses, a legacy digital asset that we monetized to further bolster our cash position."

Demand for our Fulfillment and Logistics services continues to grow, giving us increasing confidence that we will grow our top-line this year and drive significant improvements in operating income and cash generation for the full-year," added Linscott. "Simultaneously, our sales pipeline for Marketing Services and Customer Care continues to strengthen, and we believe we are well-positioned for growth in 2023. With our restructuring fully complete, we are focused on profitable growth and continuing to provide tangible value to our clients."

Third Quarter Financial Highlights

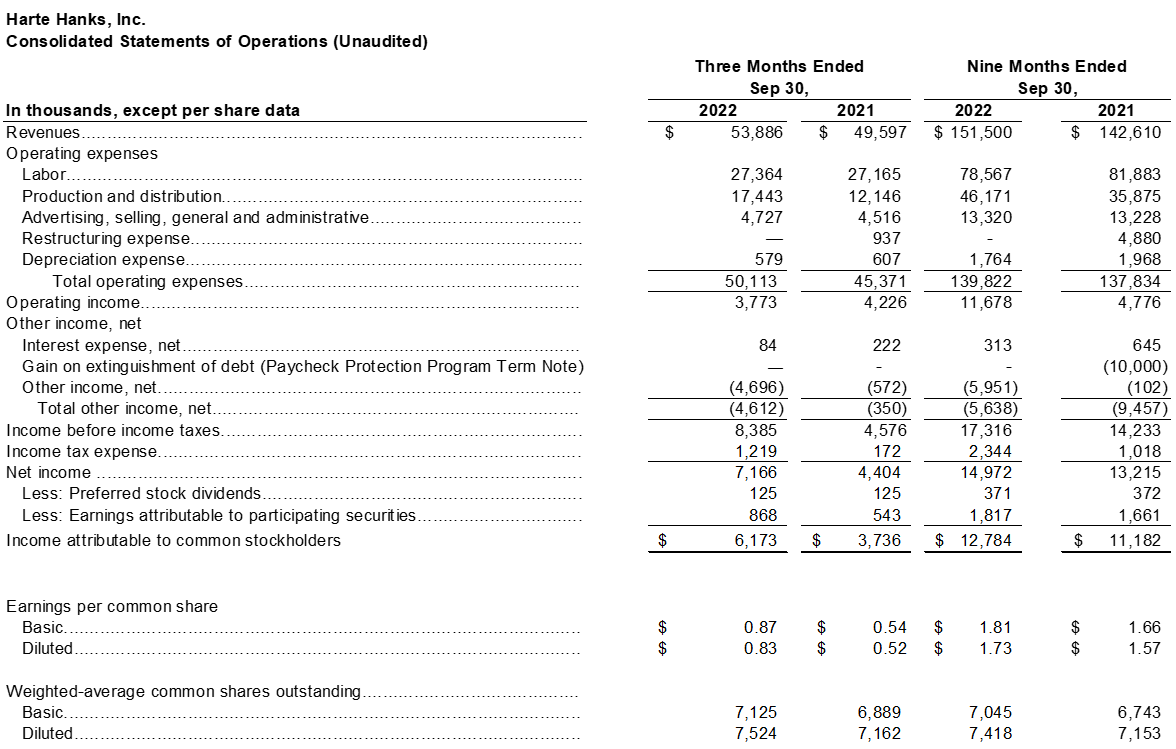

- Revenues increased by 8.7% to $53.9 million, compared to $49.6 million in the same period in the prior year.

- Fulfillment & Logistics Services grew 55.6%, offsetting declines in Marketing Services (11.6%) and Customer Care (12.1%) revenue related to sunsetting projects.

- Operating income of $3.8 million, compared to operating income of $4.2 million in the same period in the prior year, resulted in a decrease of 10.7% due to revenue mix and increased stock compensation expense.

- Net income of $7.2 million, inclusive of $2.5 million in other income related to the sale of unused IP addresses, was an increase compared to net income of $4.4 million in the same period in the prior year.

- Diluted EPS delivered was $0.83 for the third quarter of 2022 vs. $0.52 for the same period in the prior year.

- EBITDA was $4.4 million compared to $ 4.8 million in the same period in the prior year, the decrease was mainly driven by increased stock compensation costs in the current quarter.[1]

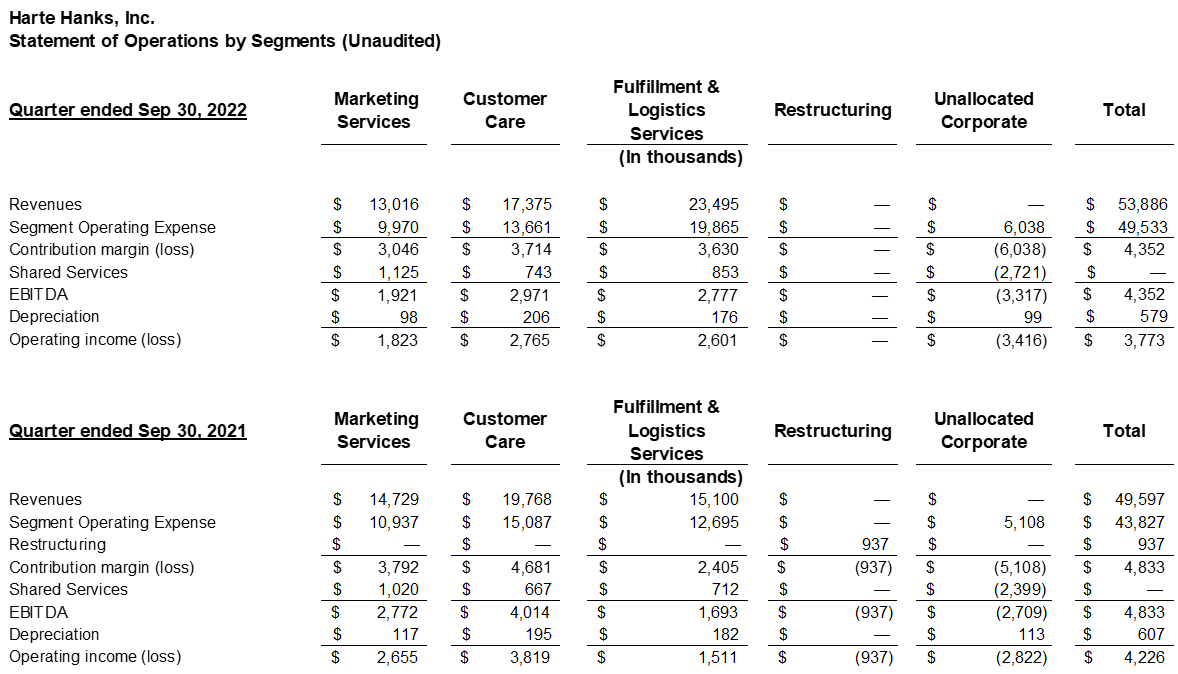

Segment Highlights

-

Customer Care, $17.4 million in revenue, 32% of total - Revenue decreased by 12.1%, or $2.4 million, from the prior year quarter, and year-over-year EBITDA decreased by 26.0% to $3.0 million from $4.0 million. Decreased revenue was driven by sunsetting of pandemic-related projects. New business wins for the quarter included:

- An existing Fulfillment & Logistics customer in the beverage and spirits industry engaged Harte Hanks to provide call center and digital support agents with specialized foreign languages skills serving regions outside of the U.S.

- Harte Hanks was awarded an outbound lead generation project. Our Marketing Services and Customer Care teams will partner with a hospitality client to increase its international offering and accelerate growth.

-

Fulfillment & Logistics Services, $23.5 million in revenue, 44% of total - Revenue increased by 55.6%, or $8.4 million, compared to the prior year quarter; and year-over-year EBITDA improved 64.0% to $2.8 million from $1.7 million. New business wins for the quarter included:

- Harte Hanks Logistics recently won a "Less-than-Truckload" (LTL) contract from a national logistics provider. The win has led to further opportunities with full Truckload (TL) lanes given our ability to secure competitive pricing and unparalleled service.

- Harte Hanks Fulfillment is partnering with a new client to execute an employee recognition program for a large retailer. The program includes digitally printing and fulfilling personalized awards/certificates along with promotional products depending on the level of achievement.

-

Marketing Services, $13.0 million in revenue, 24% of total - Revenue decreased by 11.6% compared to the prior year quarter and year-over-year EBITDA decreased 30.7% to $1.9 million from $2.8 million. Decreased revenue was mainly driven by a reduction of Direct Mail work for clients. New business wins for the quarter included:

- As mentioned above in Customer Care, Harte Hanks was selected by a market leader in the hospitality industry to implement an international omnichannel campaign to increase its offering in the market and accelerate growth. The campaign will cover direct mail, telemarketing, email, and social channels.

- The Marketing Services team has expanded their program footprint beyond Annual Enrollment Periods to include Affordable Care Act strategy work for a major health plan client. The expanded partnership further solidifies our position in this important category within healthcare.

[1] EBITDA is a non-GAAP financial measure. See "Supplemental Non-GAAP Financial Measures" below. EBITDA is also the Company's measure of segment profitability.

Consolidated Third Quarter 2022 Results

Third quarter revenues were $53.9 million, up 8.7% from $49.6 million in the third quarter of 2021. The Company's Fulfillment & Logistics Services segment grew, more than offsetting declines in Marketing Services and Customer Care.

Third quarter operating income was $3.8 million, compared to operating income of $4.2 million in the third quarter of 2021. The reduction resulted from a higher mix of lower-margin fulfillment and logistics revenue, partially offset by higher revenues.

Net income for the quarter was $7.2 million, inclusive of $2.5 million related to the sale of unused IP addresses and $2.8 million of currency gain on intercompany receivables due to the strengthening dollar, compared to net income of $4.4 million in the third quarter last year. Income attributable to common stockholders for the third quarter was $6.2 million, or $0.87 per basic share and $0.83 per fully diluted share, compared to net income attributable to common shareholders of $3.7 million, or $0.54 per basic share and $0.52 per fully diluted share during the prior year third quarter.

Consolidated Year-To-Date 2022 Results

Revenues for the first nine months of 2022 were $151.5 million, up 6.2% from $142.6 million last year. Year-to-date operating income was $11.7 million, compared to operating income of $4.8 million last year. Net income for the first nine months of 2022 was $15.0 million, compared to net income of $13.2 million (inclusive of a $10.0 million gain related to the forgiveness of the Company's PPP loan), last year. Income attributable to common stockholders for the first nine months was $12.8 million, or $1.81 per basic share and $1.73 per fully diluted share, compared to net income attributable to common shareholders of $11.2 million, or $1.66 per basic share and $1.57 per fully diluted share.

Balance Sheet and Liquidity

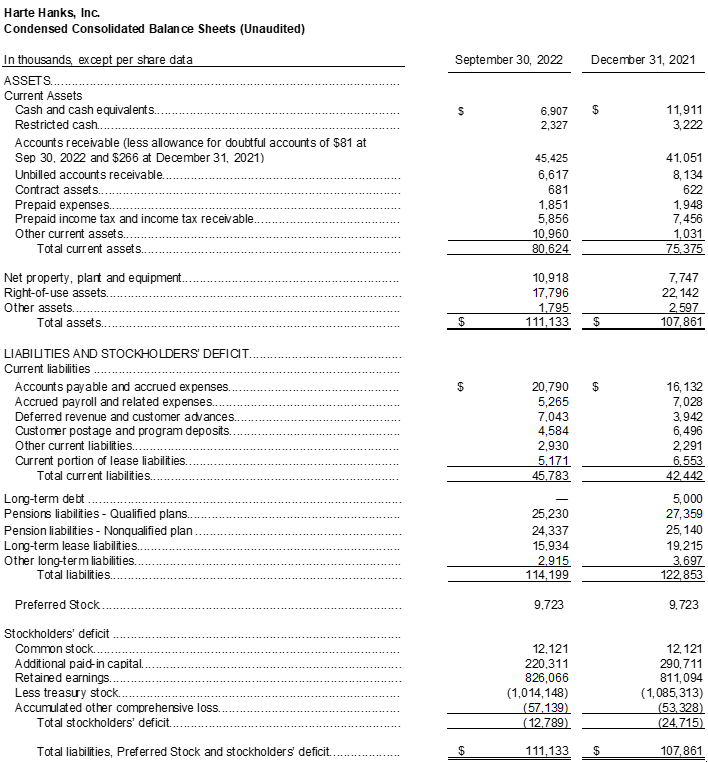

Harte Hanks ended the quarter with $9.2 million in cash, cash equivalents and restricted cash, compared to $15.1 million at December 31, 2021. On September 30, 2022, the Company had no debt, and $49.6 million in outstanding long-term pension liability. On December 31, 2021, the Company had no short-term debt, $5 million in long-term debt and $52.5 million in outstanding long-term pension liability.

During 2022, Harte Hanks has decreased outstanding debt by $5 million and paid $9.9 million of cash to an escrow account in accordance with the agreement to redeem the preferred shares. The $9.9 million is classified as other current assets on the balance sheet until the redemption of the preferred shares is completed.

The company anticipates receiving a Federal income tax refund related to a net operating loss (NOL) carryback claim of $7.6 million which will further enhance liquidity.

Conference Call Information

The Company will host a conference call and live webcast to discuss these results today at 4:30 p.m. EST. Interested parties may access the webcast at https://investors.hartehanks.com/events or may access the conference call by dialing in the United States 877-545-0523 or internationally 973-528-0016 and access code is 739004.

A replay of the call can also be accessed via phone through November 24, 2022 by dialing (877) 481-4010 from the U.S., or (919) 882-2331 from outside the U.S. The conference call replay passcode is 46932.

About Harte Hanks:

Harte Hanks (NASDAQ: HHS) is a leading global customer experience company whose mission is to partner with clients to provide them with CX strategy, data-driven analytics and actionable insights combined with seamless program execution to better understand, attract and engage their customers.

Using its unparalleled resources and award-winning talent in the areas of Customer Care, Fulfillment and Logistics, and Marketing Services, Harte Hanks has a proven track record of driving results for some of the world's premier brands, including Bank of America, GlaxoSmithKline, Unilever, Pfizer, HBOMax, Volvo, Ford, FedEx, Midea, Sony and IBM among others. Headquartered in Chelmsford, Massachusetts, Harte Hanks has over 2,500 employees in offices across the Americas, Europe, and Asia Pacific.

For more information, visit hartehanks.com

As used herein, "Harte Hanks" or "the Company" refers to Harte Hanks, Inc. and/or its applicable operating subsidiaries, as the context may require. Harte Hanks' logo and name are trademarks of Harte Hanks.

Cautionary Note Regarding Forward-Looking Statements:

Our press release and related earnings conference call contain "forward-looking statements" within the meaning of U.S. federal securities laws. All such statements are qualified by this cautionary note, provided pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements other than historical facts are forward-looking and may be identified by words such as "may," "will," "expects," "believes," "anticipates," "plans," "estimates," "seeks," "could," "intends," or words of similar meaning. These forward-looking statements are based on current information, expectations and estimates and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to vary materially from what is expressed in or indicated by the forward-looking statements. In that event, our business, financial condition, results of operations or liquidity could be materially adversely affected and investors in our securities could lose part or all of their investments. These risks, uncertainties, assumptions and other factors include: (a) local, national and international economic and business conditions, including (i) the outbreak of diseases, such as the COVID-19 coronavirus, which has curtailed travel to and from certain countries and geographic regions, created supply chain disruption and shortages, disrupted business operations and reduced consumer spending, (ii) market conditions that may adversely impact marketing expenditures, (iii) the impact of the Russia/Ukraine conflict on the global economy and our business, including impacts from related sanctions and export controls and (iv) the impact of economic environments and competitive pressures on the financial condition, marketing expenditures and activities of our clients and prospects; (b) the demand for our products and services by clients and prospective clients, including (i) the willingness of existing clients to maintain or increase their spending on products and services that are or remain profitable for us, and (ii) our ability to predict changes in client needs and preferences; (c) economic and other business factors that impact the industry verticals we serve, including competition and consolidation of current and prospective clients, vendors and partners in these verticals; (d) our ability to manage and timely adjust our facilities, capacity, workforce and cost structure to effectively serve our clients; (e) our ability to improve our processes and to provide new products and services in a timely and cost-effective manner though development, license, partnership or acquisition; (f) our ability to protect our facilities against security breaches and other interruptions and to protect sensitive personal information of our clients and their customers; (g) our ability to respond to increasing concern, regulation and legal action over consumer privacy issues, including changing requirements for collection, processing and use of information; (h) the impact of privacy and other regulations, including restrictions on unsolicited marketing communications and other consumer protection laws; (i) fluctuations in fuel prices, paper prices, postal rates and postal delivery schedules; (j) the number of shares, if any, that we may repurchase in connection with our repurchase program; (k) unanticipated developments regarding litigation or other contingent liabilities; (l) our ability to complete anticipated divestitures and reorganizations, including cost-saving initiatives; (m) our ability to realize the expected tax refunds; and (n) other factors discussed from time to time in our filings with the Securities and Exchange Commission, including under "Item 1A. Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2021 which was filed on March 21, 2022. The forward-looking statements in this press release and our related earnings conference call are made only as of the date hereof, and we undertake no obligation to update publicly any forward-looking statement, even if new information becomes available or other events occur in the future.

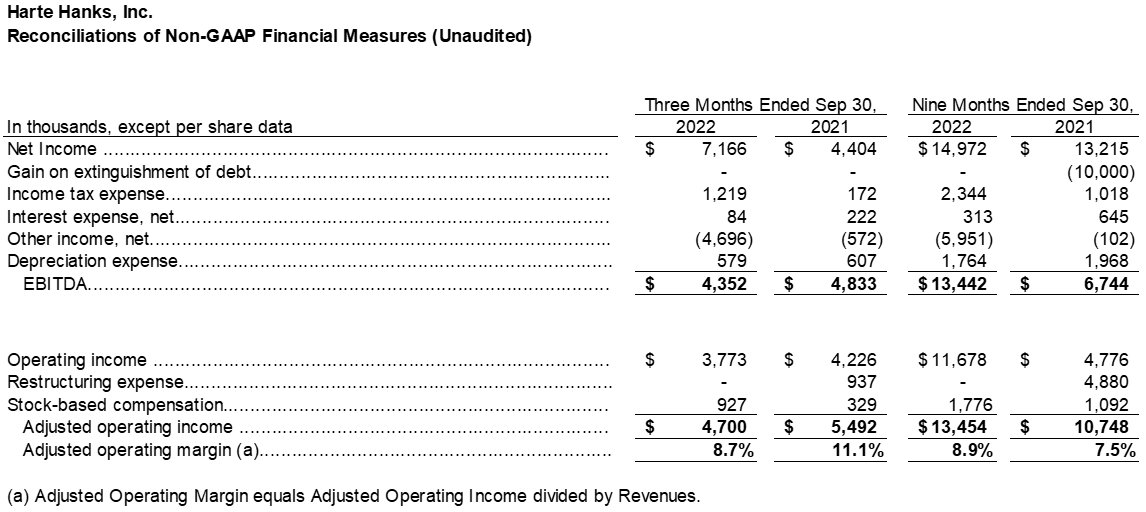

Supplemental Non-GAAP Financial Measures:

The Company reports its financial results in accordance with generally accepted accounting principles ("GAAP"). However, the Company may use certain non-GAAP measures of financial performance in order to provide investors with a better understanding of operating results and underlying trends to assess the Company's performance and liquidity in this press release and our related earnings conference call. We have presented herein a reconciliation of these measures to the most directly comparable GAAP financial measure.

The Company presents the non-GAAP financial measure "Adjusted Operating Income (Loss)" as a measure useful to both management and investors in their analysis of the Company's financial results because it facilitates a period-to-period comparison of Operating Revenue and Operating Income (Loss) by excluding restructuring expense, impairment expense and stock-based compensation. The most directly comparable measure for this non-GAAP financial measure is Operating Income (Loss).

The Company presents the non-GAAP financial measure "EBITDA" as a supplemental measure of operating performance in order to provide an improved understanding of underlying performance trends. The Company defines "Adjusted EBITDA" as earnings before interest expense net, income tax expense (benefit) and depreciation expense. The most directly comparable measure for EBITDA is Net Income (Loss). We believe EBITDA is an important performance metric because it facilitates the analysis of our results, exclusive of certain non-cash items, including items which do not directly correlate to our business operations; however, we urge investors to review the reconciliation of non-GAAP EBITDA to the comparable GAAP Net Income (Loss), which is included in this press release, and not to rely on any single financial measure to evaluate the Company's financial performance.

The use of non-GAAP measures do not serve as a substitute and should not be construed as a substitute for GAAP performance but should provide supplemental information concerning our performance that our investors and we find useful. The Company evaluates its operating performance based on several measures, including this non-GAAP financial measures. The Company believes that the presentation of this non-GAAP financial measures in this press release and earnings conference call presentations are useful supplemental financial measures of operating performance for investors because they facilitate investors' ability to evaluate the operational strength of the Company's business. However, there are limitations to the use of this non-GAAP measures, including that they may not be calculated the same by other companies in our industry limiting their use as a tool to compare results. Any supplemental non-GAAP financial measures referred to herein are not calculated in accordance with GAAP and they should not be considered in isolation or as substitutes for the most comparable GAAP financial measures.

EBITDA is the Company's measure of segment profitability.

Investor Relations Contact:

Rob Fink

FNK IR

HHS@fnkir.com

646-809-4048

For media inquiries, contact Jennifer London at Jen.London@HarteHanks.com.

SOURCE: Harte Hanks, Inc.

View source version on accesswire.com:

https://www.accesswire.com/724894/Harte-Hanks-Grows-Revenue-87-and-Delivers-083-EPS-in-the-Third-Quarter-of-2022