“ I’m not going to interfere with their critically important work. ” That's what President Biden said yesterday when meeting with Jerome Powell and Janet Yellen, the current and former heads of the Federal Reserve. This is a strong indication of support for the upcoming Fed Rate Hikes with 2 0.5% hikes expected over the next two meetings. In theory, that is already baked in by the market and Biden's support is just another way of showing Wall Street the Administration is serious about tackling Inflation, despite any potential market consequences. The Fed is trying to cool demand to moderate price pressures. But Mr. Powell has conceded that the central bank’s ability to do that without forcing the economy into a recession depends on developments outside the central bank’s control, including global energy markets that have been badly disrupted by Russia’s war in Ukraine and supply chains snarled by the Covid-19 pandemic. Consumer confidence has slumped amid rising prices of food and gas. Gasoline prices have risen in recent months even as the Biden administration has tapped oil supplies from the U.S. Strategic Petroleum Reserve, releasing one million barrels of oil a day. IN PROGRESS

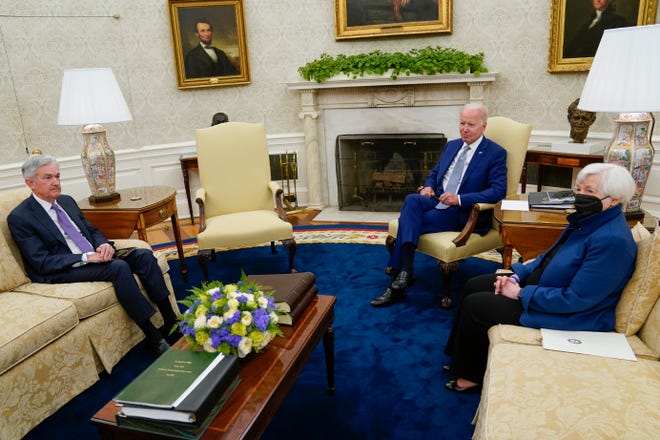

“I’m not going to interfere with their critically important work.”

“I’m not going to interfere with their critically important work.”

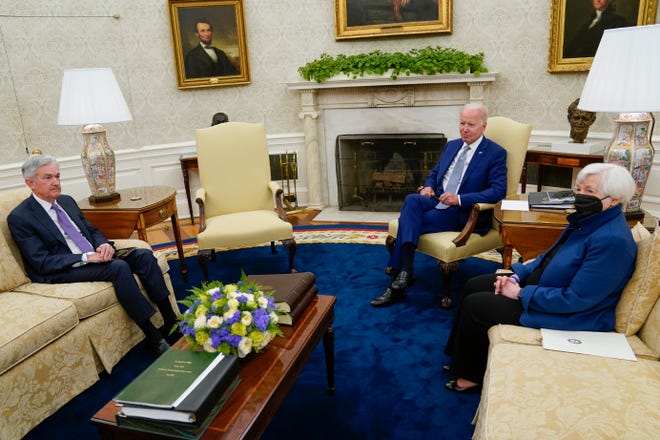

That's what President Biden said yesterday when meeting with Jerome Powell and Janet Yellen, the current and former heads of the Federal Reserve. This is a strong indication of support for the upcoming Fed Rate Hikes with 2 0.5% hikes expected over the next two meetings.

In theory, that is already baked in by the market and Biden's support is just another way of showing Wall Street the Administration is serious about tackling Inflation, despite any potential market consequences. The Fed is trying to cool demand to moderate price pressures. But Mr. Powell has conceded that the central bank’s ability to do that without forcing the economy into a recession depends on developments outside the central bank’s control, including global energy markets that have been badly disrupted by Russia’s war in Ukraine and supply chains snarled by the Covid-19 pandemic.

Consumer confidence has slumped amid rising prices of food and gas. Gasoline prices have risen in recent months even as the Biden administration has tapped oil supplies from the U.S. Strategic Petroleum Reserve, releasing one million barrels of oil a day.

IN PROGRESS

“I’m not going to interfere with their critically important work.”

“I’m not going to interfere with their critically important work.”