Stock prices were sideswiped Tuesday by the news that existing vaccines may be of limited utility against Omicron and Powell's hawkish turn. At a Senate hearing, Powell called for the retirement of the "transitory" term as a way to describe inflation, "It’s probably a good time to retire that word and explain more clearly what we mean." As well, Powell stated that it was time for the FOMC to consider accelerating the pace of QE taper at its December meeting. The S&P 500 tanked and undercut its lows set on Friday.

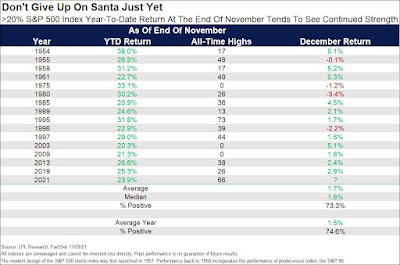

Can the market still manage a year-end Santa Claus rally? Ryan Detrick of LPL Financial argues that history is still on the bulls' side.When the S&P 500 is up >20% for the year going into December, the final month of the year is actually stronger than normal.

What about you? Do you believe in Santa?

The full post can be found here.