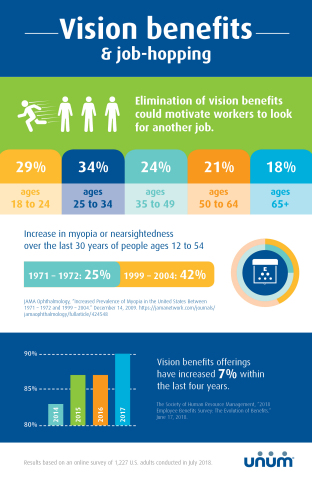

Employee benefits provider Unum (NYSE: UNM) finds the elimination of vision benefits could motivate more than a third (34 percent) of U.S. workers ages 25 to 34 to look for a new job. These results and other key findings were part of an online poll among 1,227 working U.S. adults conducted by Unum in July.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181031005013/en/

Unum finds Millennials likely to job hop for vision insurance (Graphic: Business Wire)

While the likelihood of job-hopping was higher among this primarily Millennial age group, other age ranges also reported they would consider leaving their current employer if vision benefits were eliminated:

- 29 percent of those 18 to 24

- 24 percent of those 35 to 49

- 21 percent of those 50 to 64

- 18 percent of those 65 and older

Vision insurance covers the cost of comprehensive eye exams and can significantly decrease the cost of eyeglasses and contact lenses – items usually not covered by private medical plans. These plans have typically appealed to older workers with aging eyes. However, younger workers today are facing more vision problems compared to young adults 40 years ago, according to a study in JAMA Ophthalmology magazine.

“Vision plans help fill a gap in coverage to maintain eye health, appealing to a multigenerational workforce,” said Amy Marko, senior vice president of dental and vision products at Unum. “These benefits can help an employer decrease the cost of health care, increase productivity and minimize the current workforce trend of job-hopping.”

As competition for talent increases, some employers are increasing their benefits offerings to recruit and retain employees. According to the Society for Human Resource Management’s (SHRM) annual employee benefits report, the number of employers offering vision benefits has increased 7 percentage points within the last four years.

However, many employers still do not include vision benefits in their employee packages. In the Unum survey, only 50 percent of workers indicated their current employers offer vision insurance.

As millions of American workers enroll in employee benefits this fall, Marko encourages employers to reconsider the importance of vison care.

“Employers need to offer benefits that employees need and want – like vision coverage,” she said.

Learn more information about group vision insurance and Unum’s vision plans.

About Unum

Unum Group (www.unum.com) is a leading provider of financial protection benefits in the United States and the United Kingdom. Its primary businesses are Unum US, Colonial Life and Unum UK. Unum’s portfolio includes disability, life, dental, vision, accident and critical illness coverage, which help protect millions of working people and their families. Unum also provides stop-loss coverage to help self-insured employers protect against unanticipated medical costs. The company reported revenues of $11.3 billion in 2017 and provided nearly $7 billion in benefits.

For more information, connect with us on Facebook, Twitter and LinkedIn.

View source version on businesswire.com: https://www.businesswire.com/news/home/20181031005013/en/

Contacts:

Andrea’ Randall 225-400-9245

ARandall@unum.com