E*TRADE Financial Corporation (NASDAQ: ETFC) today announced results from the most recent wave of StreetWise, E*TRADE's quarterly tracking study of experienced investors. The results show that despite the popularity of passive investing through exchange-traded funds (ETFs), active investing through individual stocks continues to be the preferred approach:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181001005962/en/

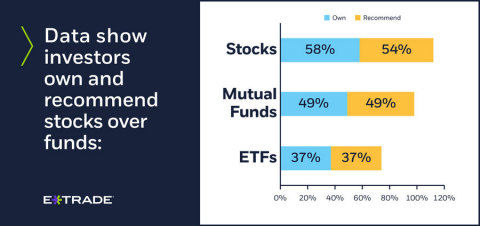

While it would appear ETFs are increasing in popularity, stocks and mutual funds remain the top choice among surveyed investors (Graphic: Business Wire)

- Stocks are the majority of investors’ first choice for their portfolios. Even though stock investing is down 14 percentage points since 2015, it remains more favored than investing with mutual funds and ETFs. This quarter, 58% of surveyed investors said they put their money in individual stocks, as opposed to 49% who said they invest in mutual funds and 37% who invest in ETFs.

- They’re also most likely to recommend stocks to others. More than half (54%) of investors would recommend investing in individual stocks to a friend or family member, followed by equity mutual funds (49%), money market funds (39%), and ETFs (37%).

- Investors prefer stocks as a vehicle for sector exposure. Almost two thirds (65%) of investors said they typically purchase shares of one or a handful of companies to gain exposure to specific sectors rather than buying a sector-specific ETF (18%) or mutual fund (17%). In particular, young investors over-index in stocks, with 80% describing them as their preferred method for sector exposure.

- That said, the preference gap is narrowing. Among surveyed investors, the preference gap between stocks and ETFs has narrowed by 16 percentage points since 2015. Stock preference declined from 72% to 58% over that period, while ETF preference has remained relatively consistent at 37%.

“While ETFs are hugely popular, it’s important to remember that compared with stocks and mutual funds, they are still a new kid on the block and investing habits can be hard to break,” said Rich Messina, SVP, Investment Products and E*TRADE Financial. “It’s good to see preference for stocks and mutual funds gradually come closer in line with ETFs, because it suggests investors may be embracing diversification and taking to heart that each security type can play a role in one’s portfolio.”

Mr. Messina offered additional observations for investors who might be considering active or passive strategies:

- There is no one-size-fits-all solution. Just as investors’ financial goals vary, the way they choose to pursue those goals can and should differ. If one’s goal is to maximize tax efficiency or low expense ratios, certain ETFs may be a sound choice. If one is more comfortable with having professional portfolio managers oversee assets, mutual funds could be a better fit.

- Not all ETFs are the same. Not all ETFs are constructed around market-cap-weighted indexes. In fact, many multi-factor ETFs are quasi-actively managed, which can also mean higher expense ratios and less transparent methodologies.

- You can mix and match. Depending on one’s financial goals, a healthy mix of active and passive strategies can make a lot of sense—particularly for added diversification.

- Style matters. Deciding whether to pursue an active or passive approach can also depend on the style. For example, active managers may gain more of an information advantage in emerging markets or in certain segments of the fixed income market than in large-cap equities, which are more heavily researched and widely traded.

E*TRADE aims to enhance the financial independence of traders and investors through a powerful digital offering and professional guidance. To learn more about E*TRADE’s trading and investing platforms and tools, visit etrade.com.

For useful trading and investing insights from E*TRADE, follow the company on Twitter, @ETRADE.

| Which of the following products and services do you currently hold/own across all of your household investments? | Q3’18 Total | ||

| Stocks | 58% | ||

| Mutual funds | 49% | ||

| ETFs | 37% |

If you could give advice to a friend or family member who is thinking of investing right now, would it be to get into... | Q3’18 Top 4 | ||

| Individual stocks | 54% | ||

| Equity mutual funds | 49% | ||

| Money market funds or other cash-like instruments | 39% | ||

| ETFs | 37% |

| What is your preferred method for achieving exposure to a specific sector for your portfolio? | ||||||||||||

| Total | Age | |||||||||||

| <34 | 35–44 | 55+ | ||||||||||

| Buy shares of the best performing company in the sector | 21% | 29% | 17% | 19% | ||||||||

| Buy shares of a handful of different companies in the sector | 44% | 51% | 50% | 34% | ||||||||

| Buy a sector-specific ETF | 18% | 13% | 22% | 18% | ||||||||

| Buy a sector-specific mutual fund | 17% | 7% | 11% | 29% | ||||||||

| Which of the following products and services do you currently hold/own across all of your household investments? | ||||||||||||

| Q3’18 | Q3’17 | Q3’16 | Q3’15 | |||||||||

| Stocks | 58% | 63% | 72% | 72% | ||||||||

| Mutual Funds | 49% | 54% | 61% | 57% | ||||||||

| ETFs | 37% | 42% | 42% | 35% | ||||||||

About the Survey

This wave of the survey was conducted from July 1 to July 11 of 2018 among an online US sample of 940 self-directed active investors with an online brokerage account. The survey has a margin of error of ±3.20 percent at the 95 percent confidence level. It was fielded and administered by Research Now. The panel is broken into thirds of active (trade more than once a week), swing (trade less than once a week but more than once a month), and passive (trade less than once a month). The panel is 60% male and 40% female, with an even distribution across online brokerages, geographic regions, and age bands.

About E*TRADE Financial and Important Notices

E*TRADE Financial and its subsidiaries provide financial services, including brokerage and banking products, and services to retail customers. Securities products and services, including stocks, mutual funds and ETFs, are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. Bank products and services are offered by E*TRADE Bank, a Federal savings bank, Member FDIC, or its subsidiaries. More information is available at www.etrade.com.

The information provided herein is for general informational purposes only and should not be considered investment advice. Past performance does not guarantee future results.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE Financial Corporation. ETFC-G

E*TRADE Financial Corporation and Research Now are separate companies that are not affiliated. E*TRADE Financial Corporation engages Research Now to program, field, and tabulate the study.

About Research Now

Research Now Group, Inc. is a global leader in digital research data for better insights and business decisions. The company provides world-class research data solutions that enable better decisions and better results for its 3,000 market research, consulting, media, and corporate clients through access to over 11 million deeply profiled business professionals and consumers in more than 40 countries. Research Now operates globally with locations in the Americas, Europe, the Middle East, and Asia-Pacific, and is recognized as the quality, scale, and customer satisfaction leader in the market research industry. For more information, please go to www.researchnow.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20181001005962/en/

Contacts:

646-521-4418

mediainq@etrade.com

or

E*TRADE

Investor Relations

646-521-4406

IR@etrade.com