E*TRADE Financial Corporation (NASDAQ: ETFC) today announced it is now offering new thematic investing features on etrade.com. Customers can select exchange-traded funds (ETFs) that invest in companies and industries that align with their values and interests, including:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180924005938/en/

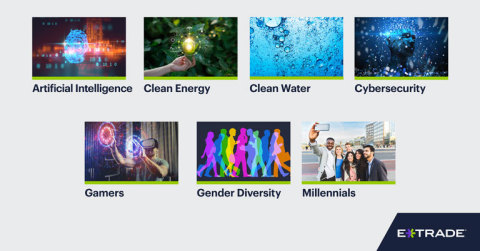

Customers can now choose ETFs from seven investing themes ranging from Artificial Intelligence to Millennials (Graphic: Business Wire)

- Artificial Intelligence: Discover investing opportunities in this growing field of technology

- Clean Energy: Consider investing in companies that are addressing the growing call for clean and renewable energy

- Clean Water: Find companies that are in industries related to potable water, water conservation, and purification

- Cybersecurity: Explore companies that help safeguard data and computer systems

- Gamers: Seek opportunities in one of the biggest sectors of the entertainment industry—video gaming

- Gender Diversity: Learn about investing in companies that are leaders in the advancement of women

- Millennials: Uncover companies that are affected by the rising economic importance of the Millennial generation

“Now more than ever, investors want to help address social and environmental challenges through their investment portfolio,” said Rich Messina, SVP of Investment Product Management at E*TRADE Financial. “We are thrilled to give our customers more ways to screen for ETFs through this lens. Investors are savvy, and identifying underlying market and social trends has become core to building a strategy they can be invested in both personally and financially.”

Learn more about Thematic Investing on etrade.com.

E*TRADE aims to enhance the financial independence of traders and investors through a powerful digital offering and professional guidance. To learn more about E*TRADE’s trading and investing platforms and tools, visit etrade.com.

For useful trading and investing insights from E*TRADE, follow the company on Twitter, @ETRADE.

About E*TRADE Financial and Important Notices

The Thematic Investing screener is an educational tool and should not be relied upon as the primary basis for investment, financial, tax-planning, or retirement decisions. This tool provides a sample of exchange-traded funds (“ETFs”) that may be of interest to investors and is provided to customers as a resource to learn more about different categories of ETFs and the use of screeners. This educational information neither is, nor should be construed as, investment advice, financial guidance, or an offer or a solicitation or recommendation to buy, sell, or hold any security, or to engage in any specific investment strategy by E*TRADE. Additional ETFs available through E*TRADE Securities LLC (“ETS”) may be found by using the ETF screener at https://www.etrade.wallst.com/Research/Screener/ETF/.

An ETF's prospectus contains its investment objectives, risks, charges, expenses and other important information and should be read and considered carefully before investing. For a current prospectus, visit the Exchange-Traded Funds Center at www.etrade.com/etf.

ETFs are subject to risks similar to those of other diversified portfolios. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indexes, they may not be able to exactly replicate the performance of the indexes because of expenses and other factors. Also, there are brokerage commissions associated with trading ETFs that may negate their low management fees. ETFs are required to distribute portfolio gains to shareholders at year end. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. ETF trading will also generate tax consequences.

E*TRADE Financial and its subsidiaries provide financial services including brokerage and banking products and services to retail customers. Securities products and services, including ETFs, are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures and options on futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. Bank products and services are offered by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE Savings Bank, both of which are federal savings banks (Members FDIC). More information is available at www.etrade.com.

The information provided herein is for general informational purposes only and should not be considered investment advice. Past performance does not guarantee future results.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE Financial Corporation. ETFC-G

© 2018 E*TRADE Financial Corporation. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20180924005938/en/

Contacts:

646-521-4418

mediainq@etrade.com

or

E*TRADE

Investor Relations

646-521-4406

IR@etrade.com