Additional information about the highly anticipated Alibaba IPO was released yesterday (Monday) when the Chinese e-commerce giant updated its SEC filing - and some of the numbers tempered investor excitement.

But there's actually a lot for investors to love.

One concern stemmed from lower profit margin. Alibaba reported that its operating margin fell to 45% in the quarter ending March 31, compared to the 51% the company reported the previous year. The company attributed the decline to increased spending on marketing for its sites and for its mobile business.

Likewise, revenue growth in the first quarter was 39%. That was down drastically from the 71% the company reported last year. The company is still growing, but the pace has slowed considerably.

While those numbers caused some analysts and investors to pause, other important details were unveiled that were much more bullish.

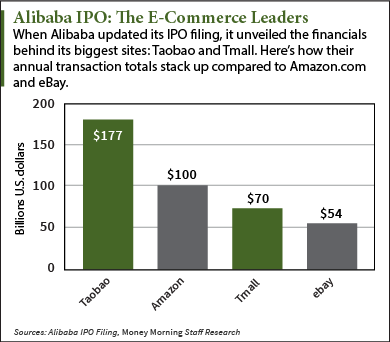

In the document, Alibaba officials answered the biggest remaining mystery since the company initially filed for a U.S. IPO back in May: the financials behind its two biggest websites, Taobao and Tmall.

In the document, Alibaba officials answered the biggest remaining mystery since the company initially filed for a U.S. IPO back in May: the financials behind its two biggest websites, Taobao and Tmall.

In 2013, Alibaba reported that Taobao handled approximately $177 billion worth of transactions, while Tmall handled $70 billion. By comparison, Amazon.com Inc. (Nasdaq: AMZN) handled $100 billion in transactions last year, while eBay Inc. (Nasdaq: EBAY) handled $54 billion.

Alibaba also provided a look at its early 2014 numbers, revealing that transactions totaled $47 billion in the first quarter on Taobao and $22 billion on Tmall.

Investors had also been curious about what the company's executive board would look like following the Alibaba IPO - and they got answers.

The nine-member board will be led by Founder Jack Ma, Goldman Sachs Group Inc.'s (NYSE: GS) executive J. Michael Evans, and Yahoo Inc.'s (Nasdaq: YHOO) Jerry Yang. Yang had previously served on Alibaba's board from 2005-2012.

Expect More Alibaba IPO Details to Come It's common for companies to update their IPO filings and release more detailed information as their IPO date approaches. Once the U.S. Securities and Exchange Commission (SEC) reviews a company's F-1 filing, it will send back the document asking for revisions or clarifications. This is done so that global investors have as much information as possible before investing in the IPO.

It's common for companies to update their IPO filings and release more detailed information as their IPO date approaches. Once the U.S. Securities and Exchange Commission (SEC) reviews a company's F-1 filing, it will send back the document asking for revisions or clarifications. This is done so that global investors have as much information as possible before investing in the IPO.

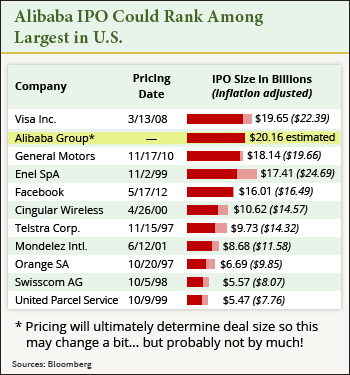

The Alibaba IPO in particular is drawing heavy interest because many analysts predict that it could be the largest U.S. IPO of all time. Some projections place the IPO over the $20 billion mark.

Valuation estimates on the company have topped $160 billion, while some optimistic estimates top $200 billion. For example, Sanford C. Bernstein has valued the Chinese firm at an incredible $230 billion.

Alibaba's revenue growth may have slipped in the most recent quarter, but the company still has a stranglehold on the Chinese e-commerce market. At the time of its initial filing, 80% of Chinese e-commerce took place on one of Alibaba's sites.

And these numbers show how that market is set to explode...

Alibaba IPO Update: Looking into the NumbersChinese e-commerce was a $210 billion industry in 2012, and, according to research firm McKinsey & Co., that number is expected to reach $420 billion by 2020. If Alibaba can maintain its dominance of the market, it will see the lion's share of that revenue growth.

Secondly, Alibaba officials pointed out yesterday that operating margin dropped because the company increased spending on advertising the company's mobile business. By all accounts, that's had an impact.

"[N]early 20% of its business comes from mobile devices, which means it oversees about 76% of China's mobile e-commerce," Wired's Ryan Tate said in May.

Alibaba is investing in its mobile business during a time when mobile e-commerce is growing. By spending the money now and building that mobile base, the company should be rewarded in the long run.

For Money Morning's Chief Investment Strategist Keith Fitz-Gerald, Alibaba is "as big as it gets" when it comes to the IPO market.

"You're talking about a company that is going to come out with the size, scope, and scale to eat Amazon, eBay, and Facebook Inc. (Nasdaq: FB) and still have room for lunch," Fitz-Gerald said on FOX Business' "Varney & Co." "Alibaba controls an extraordinary 2% of Chinese GDP all by itself, and they're just getting started."

And according to Fitz-Gerald, the Alibaba IPO is much different from many of the other tech IPOs we've seen in recent years.

"In contrast to a lot of the other social media IPOs or e-IPOs, this one I'm actually very excited about because there is real revenue backing this thing up, and there's 800 million Chinese citizens coming online by the end of this year," Fitz-Gerald added.

And the best news about this looming IPO is that it has created a major profit opportunity that most investors haven't yet noticed... It's happening now, months before Alibaba hits the market...

In fact, this could be your one and only chance to make the kind of gains normally reserved for the high-net-worth investors and bankers. You can learn more about this Alibaba profit play here.

Do you plan on investing in Alibaba stock after it hits the market? Join the conversation on Twitter @moneymorning using #Alibaba.

Related Articles:

- The Wall Street Journal: Alibaba Gives More Detail About Internet Business in New IPO Filing

The post More Bullish Numbers in the Just-Released Alibaba IPO Update appeared first on Money Morning - Only the News You Can Profit From.