| |||||||||

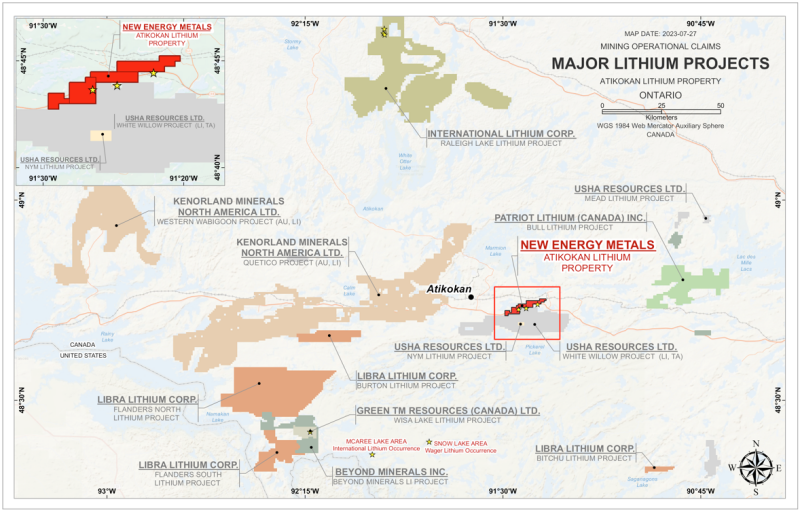

Vancouver, British Columbia - TheNewswire - August 14, 2023 - New Energy Metals Corp. (TSXV:ENRG) (OTC:NRGYF) (“New Energy” or the “Company “) is pleased to announce that it has entered into an option agreement (the "Agreement") dated July 28, 2023, to acquire a 100% interest in the highly prospective Atikokan Lithium Property (the "Property"). The Property consists of 4 mining claims comprising 3,788 hectares and is located approximately 12 km east of Atikokan, Ontario (Figure 1).

Figure 1. Regional location of the Atikokan lithium property.

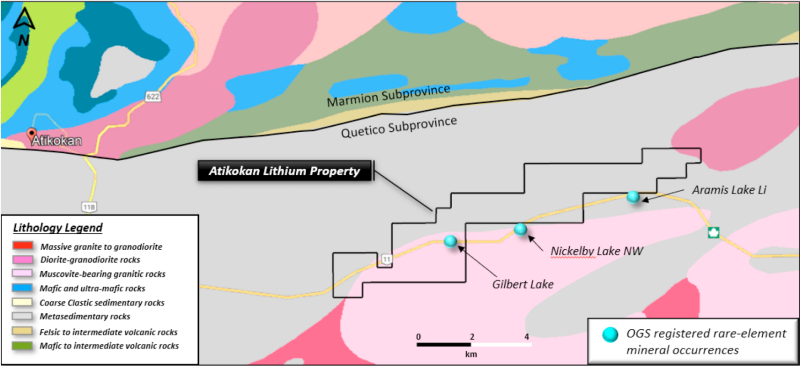

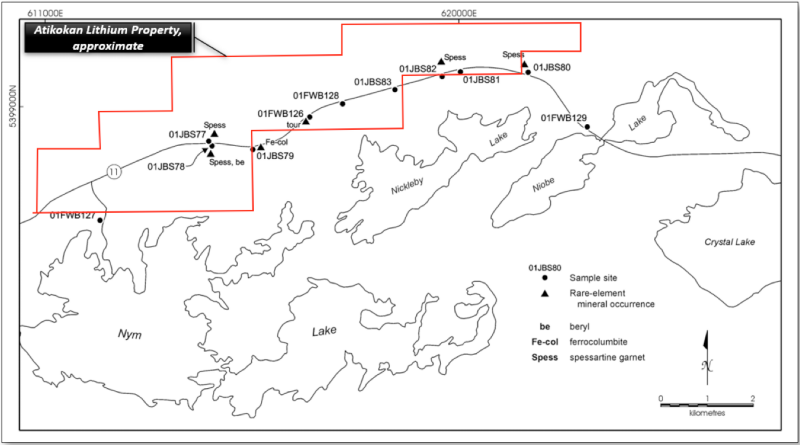

The claims straddle the contact between a peraluminous S-type muscovite-bearing granite and metasediments within the Quetico subprovince (Figure 2). The Quetico-Marmion subprovincial boundary lies just 4 km north of the Property. Numerous lithium deposits of northwestern Ontario occur proximal to a subprovincial boundary (Breaks et al., 2003). Historically, the Atikokan area has documented strongly anomalous lake sediment results in Li, Rb, Cs, Ga and Sn (Jackson, 2001). Muscovite-bearing pegmatite dykes and small pegmatitc granite masses are widely exposed along Highway 11 between Nym Lake Road junction and west to Niobe Lake (McIlwaine and Larsen 1981a, 1981b). In 2003, Breaks et al., took 16 bulk rock samples along Highway 11 largely within the Property boundary (Figure 3). Bulk rock chemistry showed a significant number of anomalous lithium values. Lithium ranged from 11 to 164 ppm with a mean content of 72 ppm, however, 25% and 60% of the data, respectively, exceeded 100 ppm and 50 ppm. Taylor (1964) states that lithium values exceeding 100 ppm indicate extreme fractionation.

The Gilbert Lake rare-element mineral occurrence, sample 01-JBS-78-07 within the Property boundary was the most evolved pegmatitic rock encountered by the survey. This beryl-type pegmatite contains maximum levels in this area for most rare-elements: Be (18 ppm), Cs (80 ppm), Li (99 ppm), Rb (524 ppm), Sn (177 ppm), Ta (20 ppm), Nb (42 ppm) and Ga (81 ppm) (Breaks et al., 2003).

Figure 2. Regional geology of the Atikokan lithium property.

Figure 3. Bulk sample locations by Breaks et al., 2003.

For the rare alkali metals, cesium was significantly enriched 7 to 25 times above its mean crustal abundance for 80% of the data population and varied from 3.9 to 80 ppm. Many values exceeded 15 ppm, a level considered by Černý and Meintzer (1988) to indicate significant fractionation in granitic systems. Rubidium had a range of 5 to 534 ppm and mean content of 270 ppm.

In essence, Breaks et al., 2003 summed up their reconnaissance prospecting and mapping with:

“The anomalous Li, Rb, Cs, Sn and Ga documented in the bedrock by this survey corroborate the earlier lake sediment geochemistry work of Jackson (2001). Exploration for rare-element mineralization in the area should therefore focus on the numerous lake sediment anomalies for these metals in the general area as there is a close correlation with bedrock chemical data at least in the Nym-Niobe lakes area. The discovery of columbite-tantalite group minerals and beryl by this survey gives strong indications that, with careful prospecting, further rare-element minerals may be discovered. The presence of elevated Ta contents in bulk muscovite at localities 01-FWB-126 and 01-JBS-81 suggests that they should be investigated further for possible tantalum mineralization”.

Under the terms of the Agreement, New Energy has the right to acquire a 100% interest in the Property by making aggregate cash payments of $66,000 over a period of two years. The optionors will retain a 3% net smelter returns royalty.

The technical information contained in this news release has been reviewed and approved by Mike Kilbourne, P. Geo., a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

The acquisition is an arm's length transaction and qualifies as an “Exempt Transaction” pursuant to the policies of the TSX Venture Exchange.

The Company also wishes to announce that it has amended the terms of the Troitsa option agreement (the “Troitsa Agreement”) pursuant to which the Company will issue 900,000 shares (the “Shares”) of the Company to the optionor in lieu of the cash payment of $45,000 due in July 2023. The Company or its assignees will have the right of first refusal to purchase the Shares. All other terms of the Troitsa Agreement remain the same.

ON BEHALF OF THE BOARD OF DIRECTORS,

New Energy Metals Corp.

Rishi Kwatra

CEO & Director

#610 – 700 West Pender Street

Vancouver, BC V6C 1G8 Canada

Tel: 604-669-9788

References

1. Breaks, F.W., Selway, J.B. and Tindle, A.G. 2003. Fertile peraluminous granites and related rare-element mineralization in pegmatites, Superior Province, northwest and northeast Ontario: Operation Treasure Hunt; Ontario Geological Survey, Open File Report 6099, 179p.

About New Energy Metals Corp.

New Energy is a Canadian-based resource company listed on the TSX Venture Exchange under the symbol ENRG. The Company has an option to purchase a 100-per-cent interest in the Roslyn lithium property, covering 5,100 hectares located 20 kilometers southeast of the Georgia Lake pegmatite field and 35 kilometers southeast of where Rock Tech Lithium just published a preliminary economic assessment supporting the indicated mineral resource of 10.6 Mt (million tons) grading 0.88 per cent lithium oxide and an inferred mineral resource of 4.2 Mt grading 1.0 per cent Li2O. The Company also has an option to purchase a 100-per-cent interest in the Troitsa copper property covering approximately 7,000 hectares located in the Omineca mining division of British Columbia.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement on Forward Looking Information

Certain statements made, and information contained herein may constitute “forward looking information” and “forward looking statements” within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management’s expectations. Forward-looking statements and information may be identified by such terms as “anticipates”, “believes”, “targets”, “estimates”, “plans”, “expects”, “may”, “will”, “speculates”, “could” or “would”.

All of the forward-looking statements made in this document are qualified by these cautionary statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, forecast or intended and readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. Accordingly, there can be no assurance that forward-looking information will prove to be accurate and forward-looking information is not a guarantee of future performance. Readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this document. The Company disclaims any intention or obligation to update or revise forward–looking information or to explain any material difference between such and subsequent actual events, except as required by applicable law.

Copyright (c) 2023 TheNewswire - All rights reserved.