Health care services provider Encompass Health (NYSE: EHC) met Wall Streets revenue expectations in Q4 CY2025, with sales up 9.9% year on year to $1.54 billion. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $6.42 billion at the midpoint. Its non-GAAP profit of $1.46 per share was 12.1% above analysts’ consensus estimates.

Is now the time to buy Encompass Health? Find out by accessing our full research report, it’s free.

Encompass Health (EHC) Q4 CY2025 Highlights:

- Revenue: $1.54 billion vs analyst estimates of $1.54 billion (9.9% year-on-year growth, in line)

- Adjusted EPS: $1.46 vs analyst estimates of $1.30 (12.1% beat)

- Adjusted EBITDA: $335.6 million vs analyst estimates of $313.7 million (21.7% margin, 7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $5.96 at the midpoint, beating analyst estimates by 2.3%

- EBITDA guidance for the upcoming financial year 2026 is $1.36 billion at the midpoint, in line with analyst expectations

- Operating Margin: 18.3%, up from 17% in the same quarter last year

- Free Cash Flow Margin: 15.2%, up from 13.6% in the same quarter last year

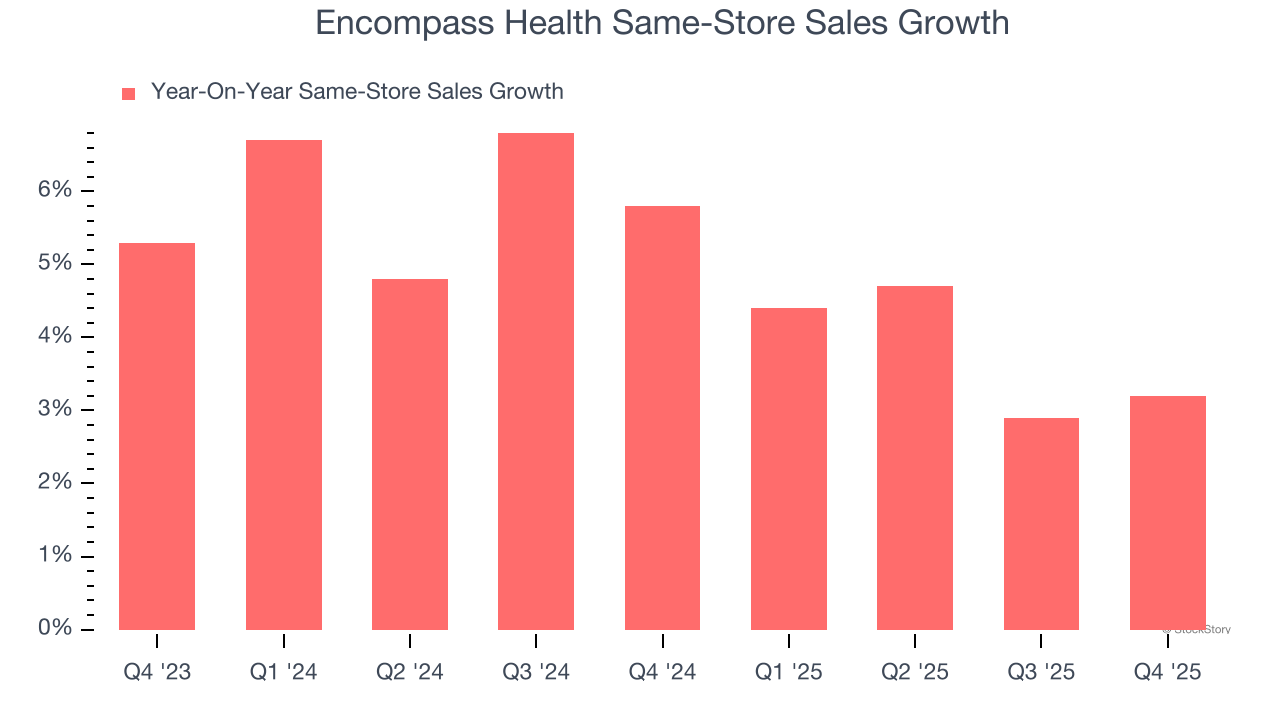

- Same-Store Sales rose 3.2% year on year (5.8% in the same quarter last year)

- Market Capitalization: $9.62 billion

"Our Q4 performance was very strong, capping a stellar 2025," said President and Chief Executive Officer Mark Tarr.

Company Overview

With a network of 161 specialized facilities across 37 states and Puerto Rico, Encompass Health (NYSE: EHC) operates inpatient rehabilitation hospitals that help patients recover from strokes, hip fractures, and other debilitating conditions.

Revenue Growth

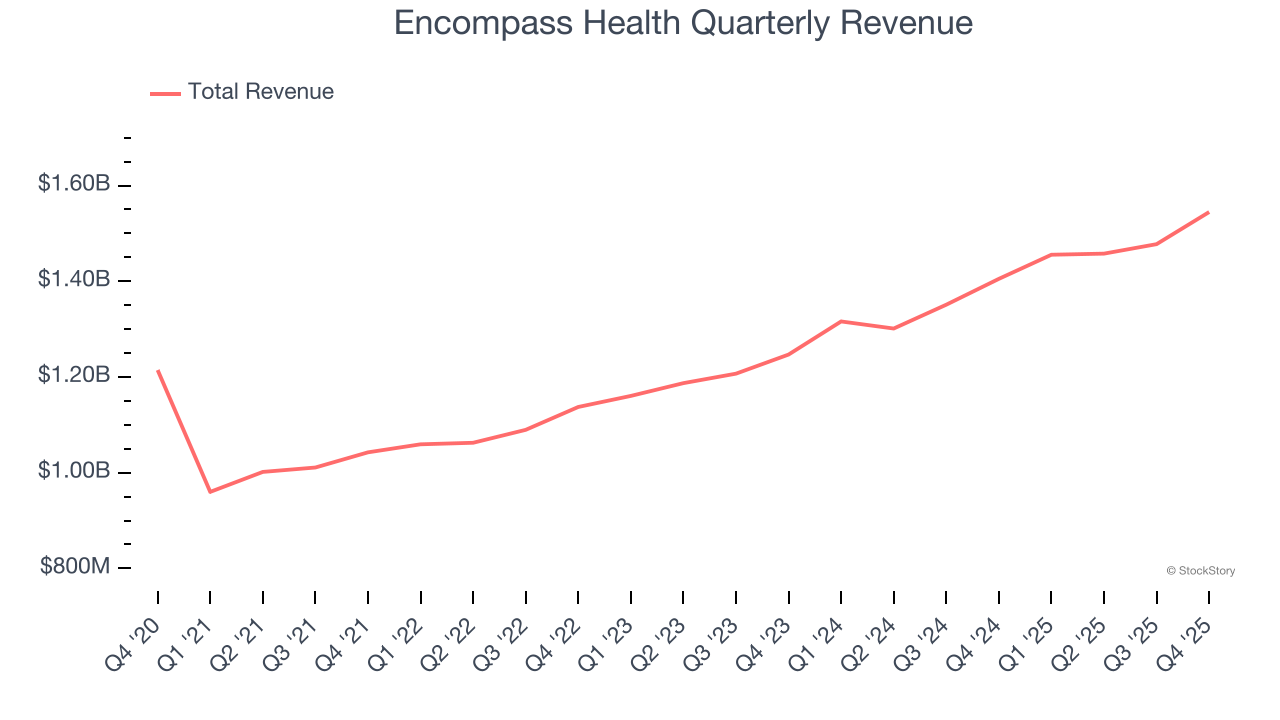

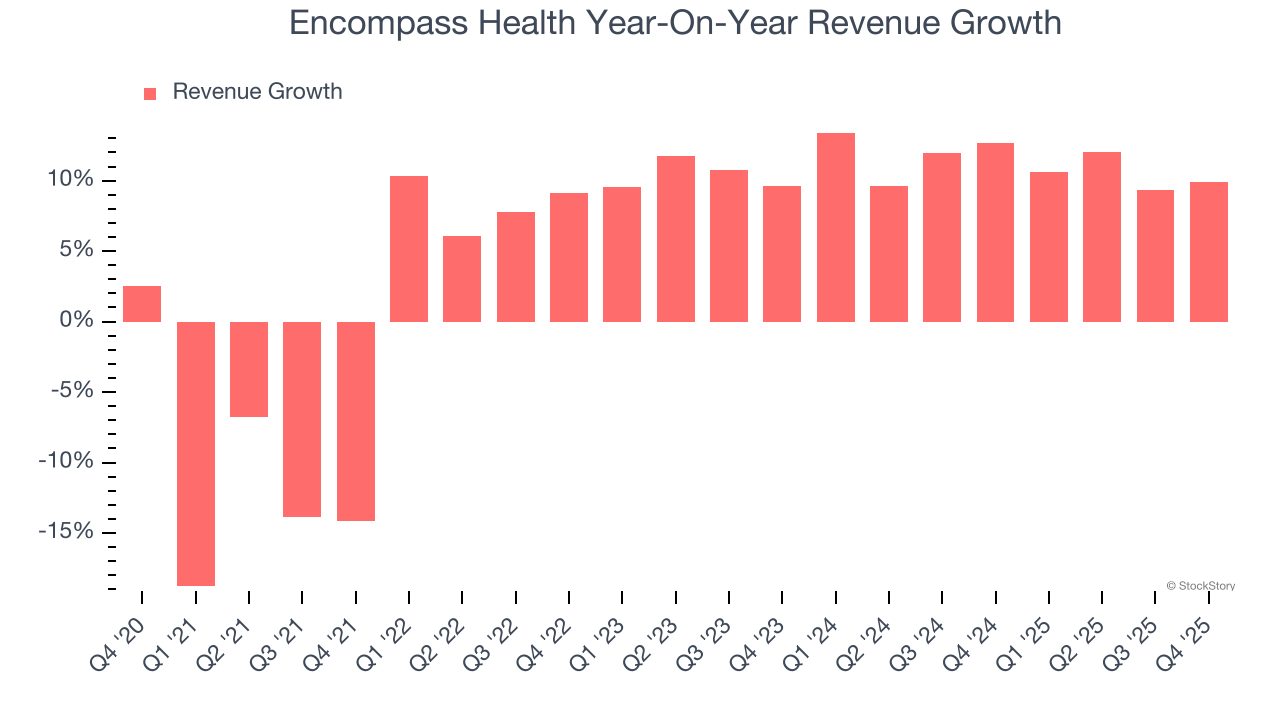

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Encompass Health grew its sales at a mediocre 5% compounded annual growth rate. This was below our standard for the healthcare sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Encompass Health’s annualized revenue growth of 11.2% over the last two years is above its five-year trend, suggesting some bright spots.

We can better understand the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Encompass Health’s same-store sales averaged 4.9% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Encompass Health grew its revenue by 9.9% year on year, and its $1.54 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, a slight deceleration versus the last two years. Despite the slowdown, this projection is commendable and suggests the market sees success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Adjusted Operating Margin

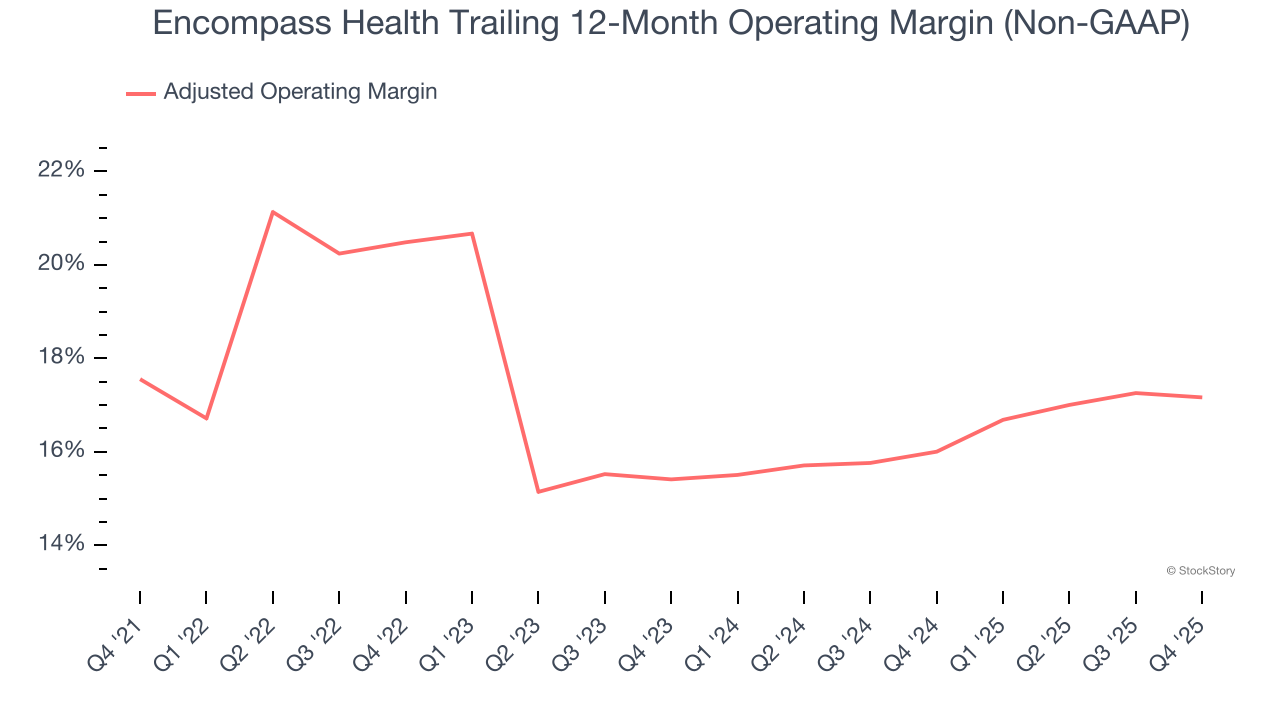

Encompass Health’s adjusted operating margin has risen over the last 12 months and averaged 17.2% over the last five years. Its solid profitability for a healthcare business shows it’s an efficient company that manages its expenses effectively.

Analyzing the trend in its profitability, Encompass Health’s adjusted operating margin of 17.2% for the trailing 12 months may be around the same as five years ago, but it has increased by 1.8 percentage points over the last two years.

This quarter, Encompass Health generated an adjusted operating margin profit margin of 16.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

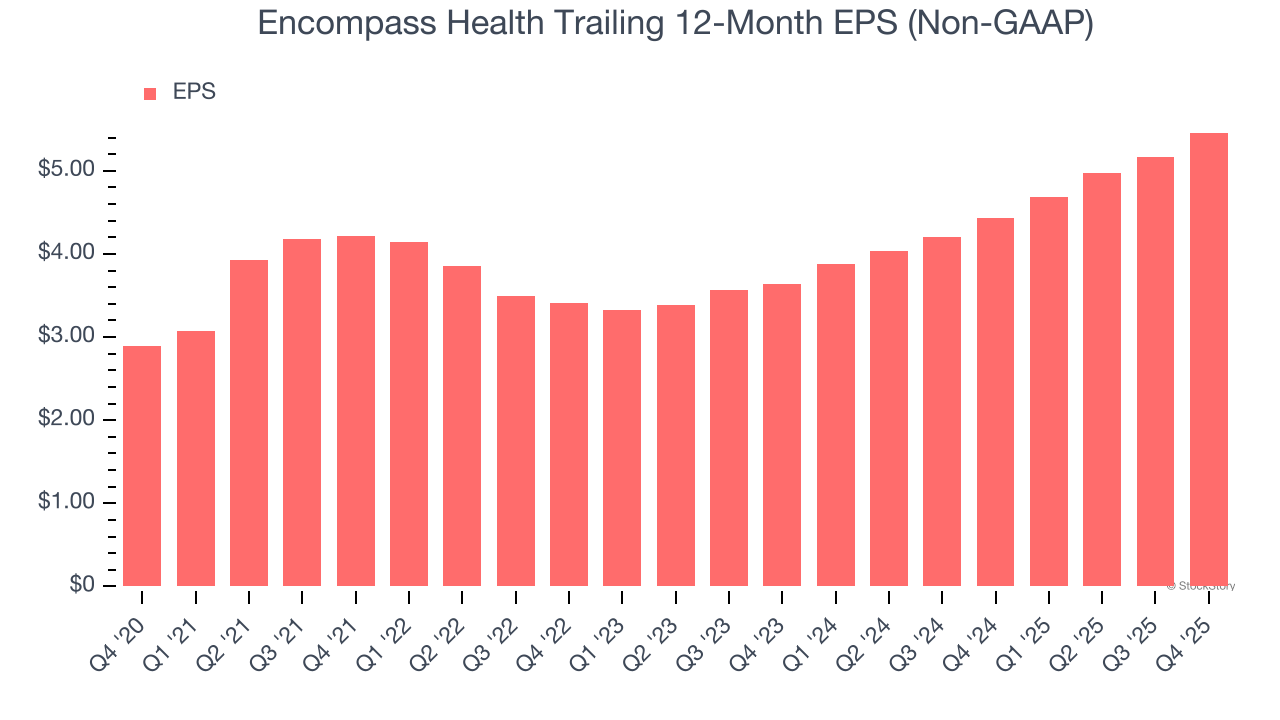

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Encompass Health’s EPS grew at a spectacular 13.6% compounded annual growth rate over the last five years, higher than its 5% annualized revenue growth. However, we take this with a grain of salt because its adjusted operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, Encompass Health reported adjusted EPS of $1.46, up from $1.17 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Encompass Health’s full-year EPS of $5.46 to grow 6.1%.

Key Takeaways from Encompass Health’s Q4 Results

It was good to see Encompass Health beat analysts’ EPS expectations this quarter despite in line revenue. We were also happy its full-year EPS guidance outperformed Wall Street’s estimates, and this outlook is driving the stock up. Overall, this print had some key positives. The stock traded up 17.5% to $116.96 immediately following the results.

Is Encompass Health an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).