Array’s stock price has taken a beating over the past six months, shedding 34% of its value and falling to $47.30 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Array, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Array Will Underperform?

Even though the stock has become cheaper, we're swiping left on Array for now. Here are three reasons we avoid AD and a stock we'd rather own.

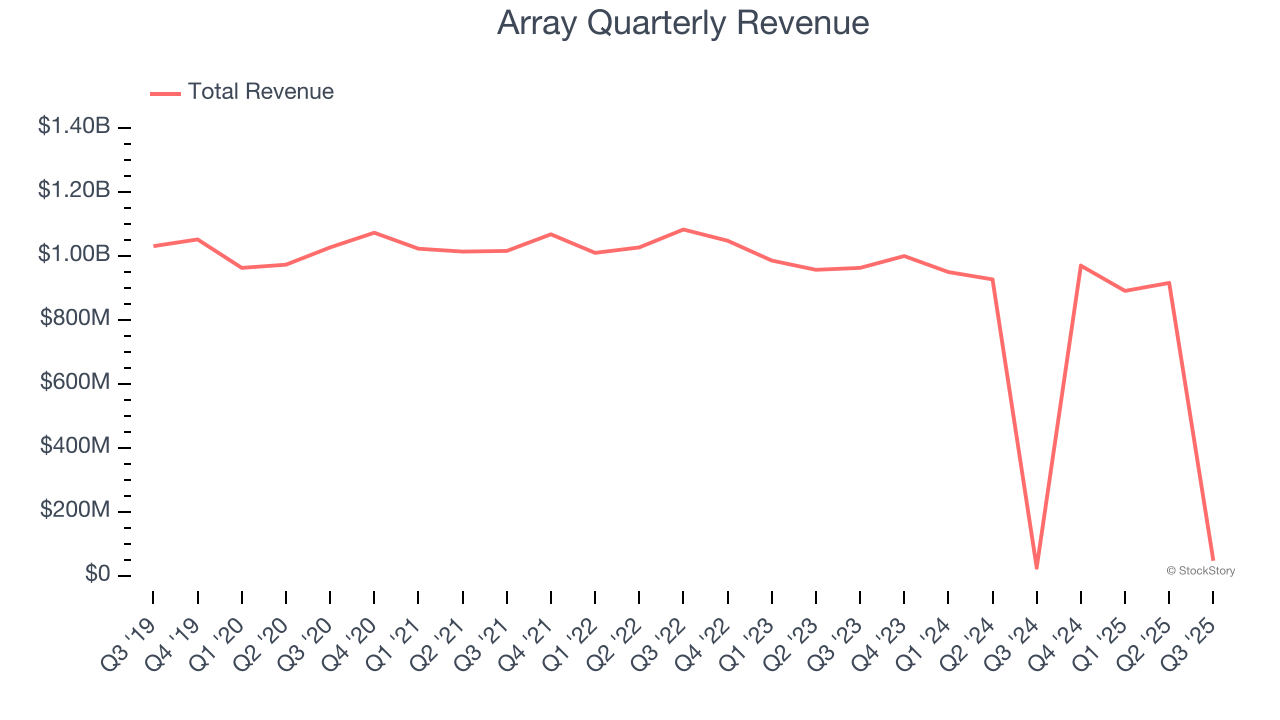

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Array struggled to consistently generate demand over the last five years as its sales dropped at a 6.8% annual rate. This was below our standards and is a sign of poor business quality.

2. EPS Trending Down

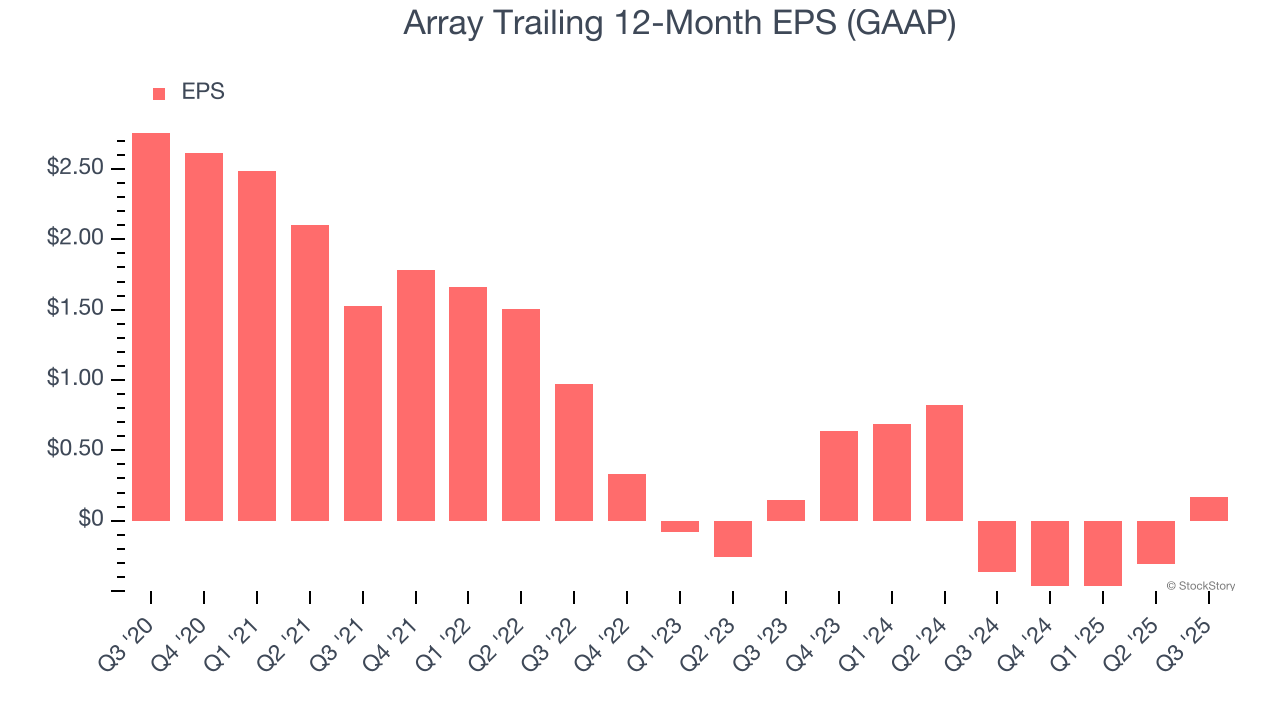

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Array, its EPS declined by 42.7% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

3. Previous Growth Initiatives Haven’t Paid Off Yet

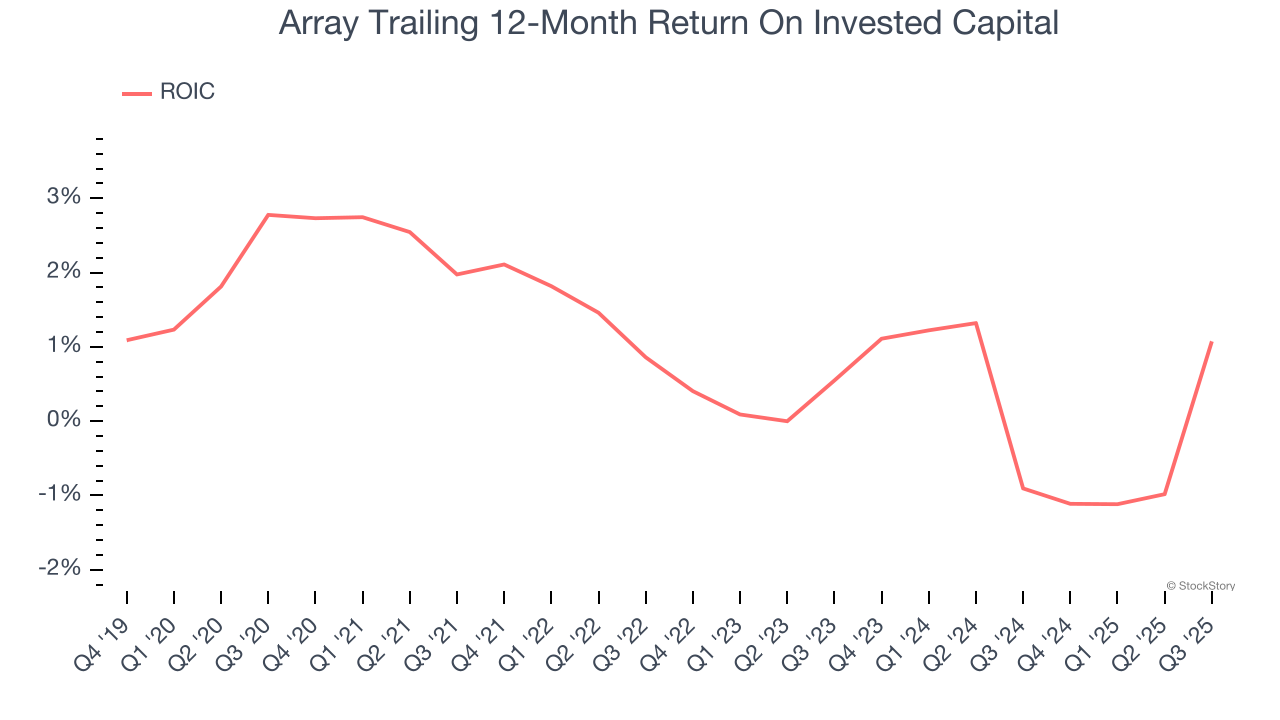

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Array historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.7%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Array, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 22.7× forward EV-to-EBITDA (or $47.30 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than Array

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.