Regional banking company Hope Bancorp (NASDAQ: HOPE) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 26.1% year on year to $145.8 million. Its non-GAAP profit of $0.27 per share was 3.8% above analysts’ consensus estimates.

Is now the time to buy Hope Bancorp? Find out by accessing our full research report, it’s free.

Hope Bancorp (HOPE) Q4 CY2025 Highlights:

- Net Interest Income: $127.4 million vs analyst estimates of $129.6 million (24.7% year-on-year growth, 1.7% miss)

- Net Interest Margin: 2.9% vs analyst estimates of 2.9% (3.3 basis point miss)

- Revenue: $145.8 million vs analyst estimates of $143.4 million (26.1% year-on-year growth, 1.7% beat)

- Efficiency Ratio: 68.2% vs analyst estimates of 66.6% (158 basis point miss)

- Adjusted EPS: $0.27 vs analyst estimates of $0.26 (3.8% beat)

- Tangible Book Value per Share: $13.71 vs analyst estimates of $13.65 (flat year on year, in line)

- Market Capitalization: $1.51 billion

“We delivered solid earnings growth in the fourth quarter of 2025, with net income up 12% from the third quarter of 2025, reflecting growth in net interest income, strength in customer fee revenue, and lower provisions for credit losses,” commented Kevin S. Kim, Chairman, President and Chief Executive Officer.

Company Overview

With roots in serving Korean-American communities and now expanded to a multi-ethnic clientele across 12 states, Hope Bancorp (NASDAQ: HOPE) operates Bank of Hope, providing commercial and retail banking services with a focus on serving multi-ethnic communities across the United States.

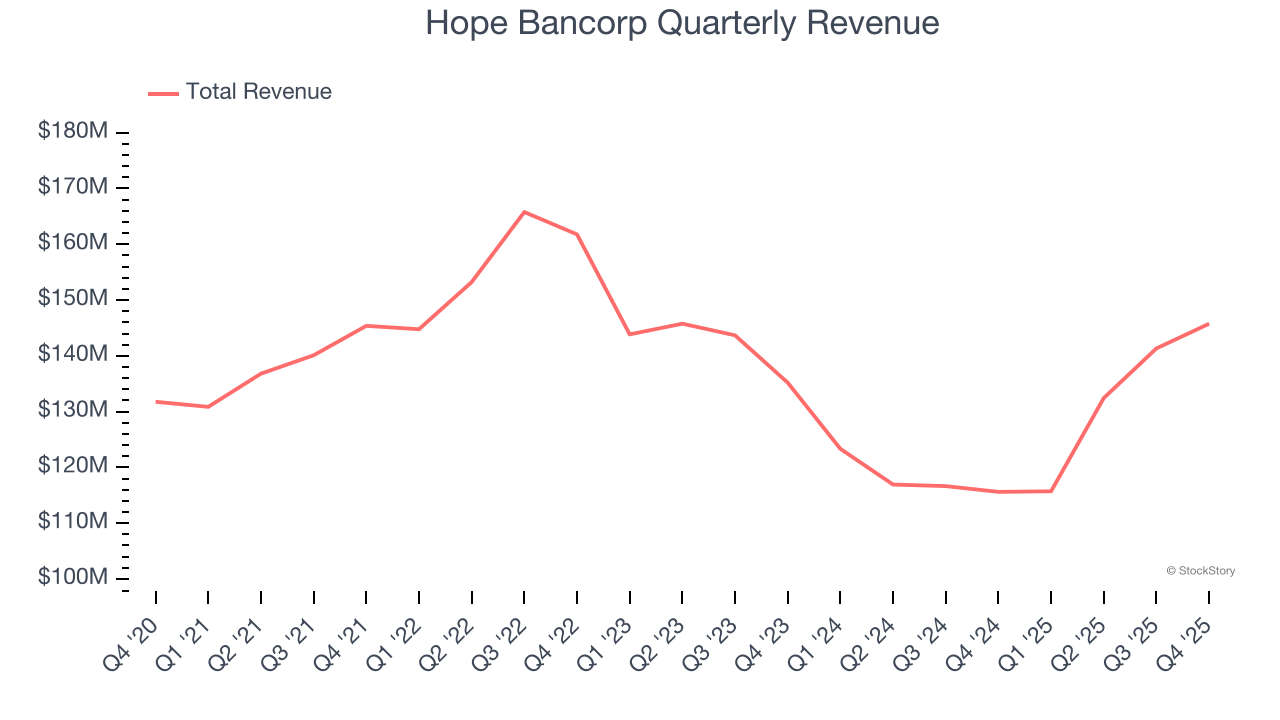

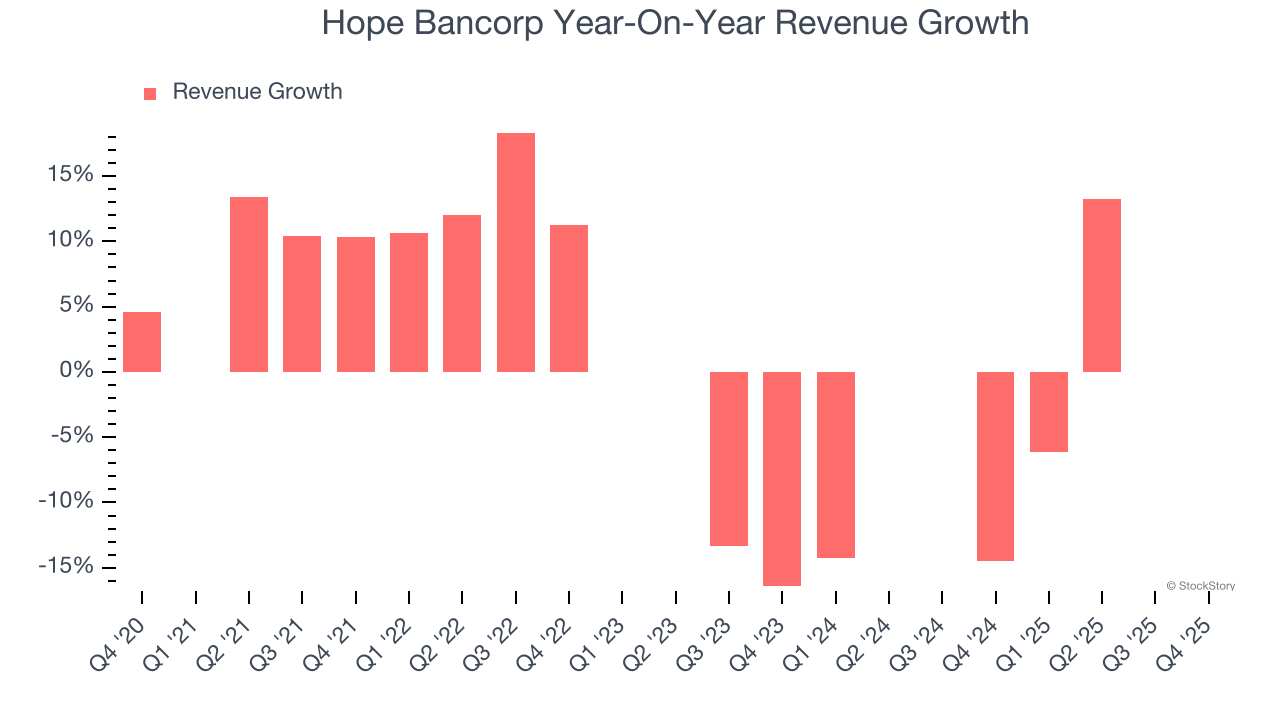

Sales Growth

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Unfortunately, Hope Bancorp struggled to consistently increase demand as its $535.2 million of revenue for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Hope Bancorp’s recent performance shows its demand remained suppressed as its revenue has declined by 3% annually over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Hope Bancorp reported robust year-on-year revenue growth of 26.1%, and its $145.8 million of revenue topped Wall Street estimates by 1.7%.

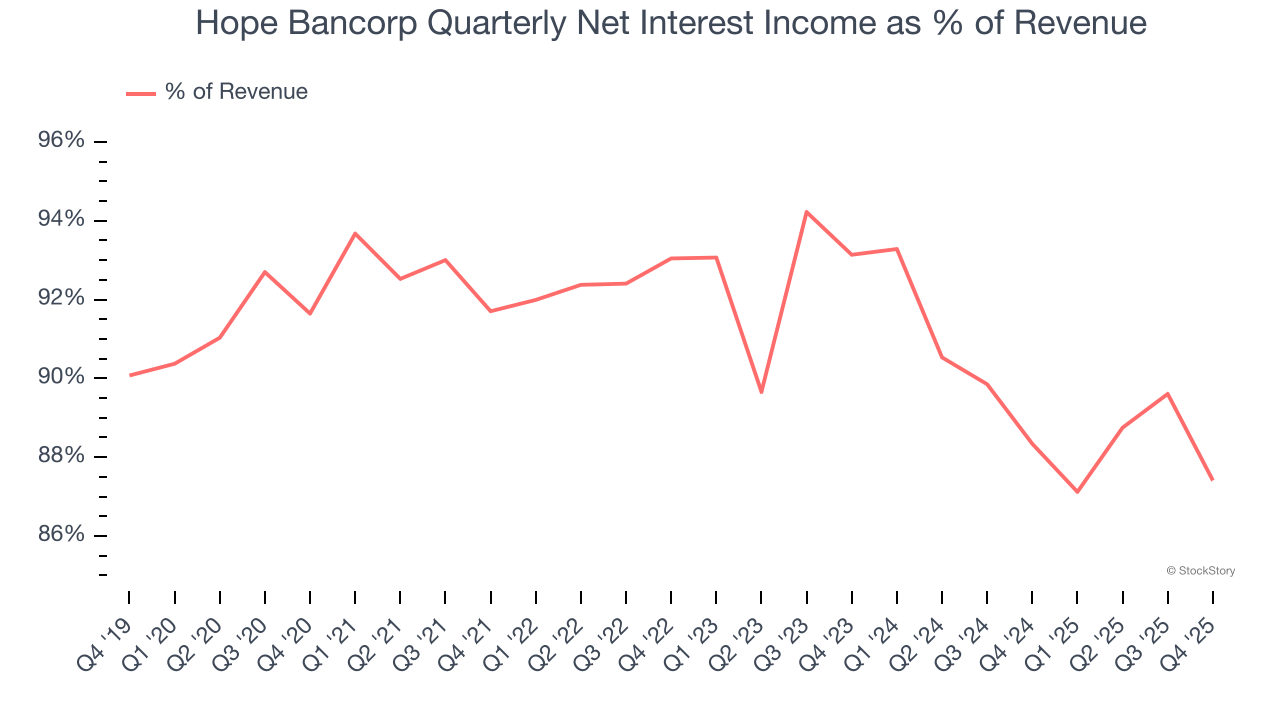

Net interest income made up 91.3% of the company’s total revenue during the last five years, meaning Hope Bancorp lives and dies by its lending activities because non-interest income barely moves the needle.

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

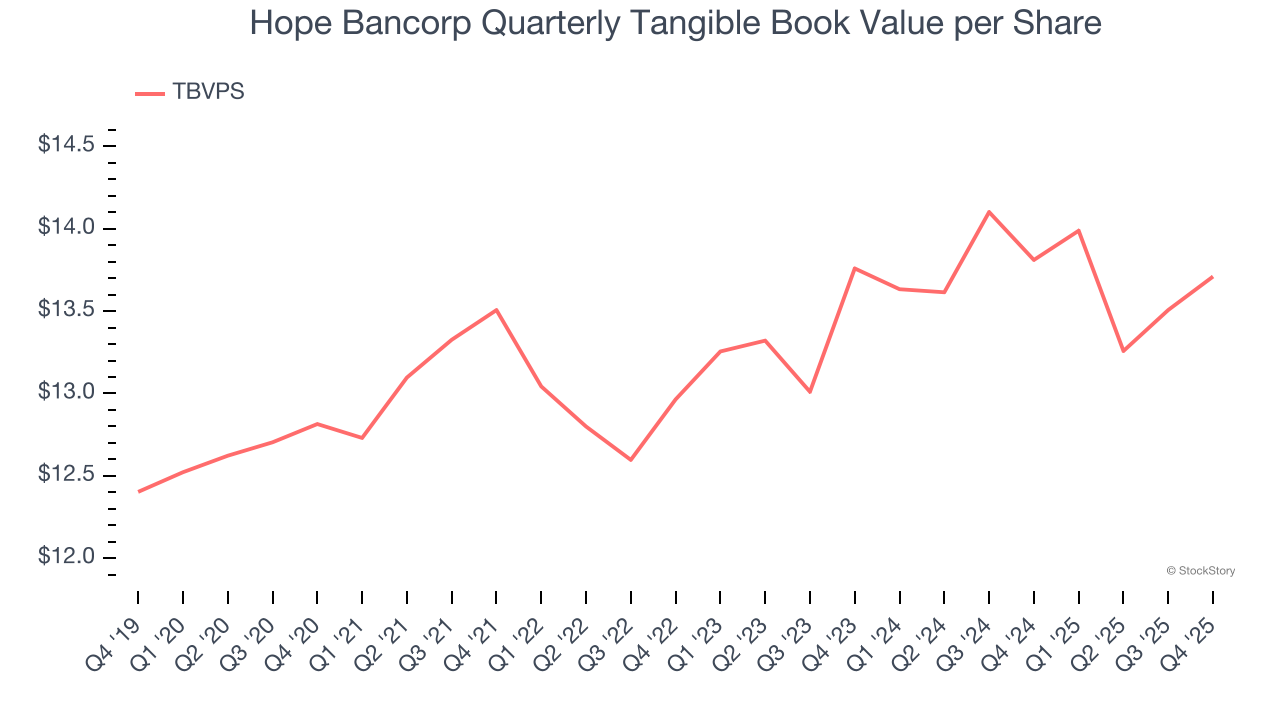

Tangible Book Value Per Share (TBVPS)

Banks operate as balance sheet businesses, with profits generated through borrowing and lending activities. Valuations reflect this reality, emphasizing balance sheet strength and long-term book value compounding ability.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark. By excluding intangible assets with uncertain liquidation values, this metric captures real, liquid net worth per share. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

Hope Bancorp’s TBVPS grew at a sluggish 1.4% annual clip over the last five years. TBVPS growth has also decelerated a bit recently as it was flat over the last two years at roughly $13.71 per share.

Over the next 12 months, Consensus estimates call for Hope Bancorp’s TBVPS to grow by 4.7% to $14.36, lousy growth rate.

Key Takeaways from Hope Bancorp’s Q4 Results

It was encouraging to see Hope Bancorp beat analysts’ revenue and EPS expectations this quarter. On the other hand, its net interest income missed. Overall, we think this was still a decent quarter. The stock remained flat at $11.78 immediately following the results.

Big picture, is Hope Bancorp a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).