Over the past six months, International Flavors & Fragrances’s stock price fell to $71.69. Shareholders have lost 6% of their capital, which is disappointing considering the S&P 500 has climbed by 10.1%. This may have investors wondering how to approach the situation.

Is now the time to buy International Flavors & Fragrances, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think International Flavors & Fragrances Will Underperform?

Even with the cheaper entry price, we're swiping left on International Flavors & Fragrances for now. Here are three reasons we avoid IFF and a stock we'd rather own.

1. Revenue Spiraling Downwards

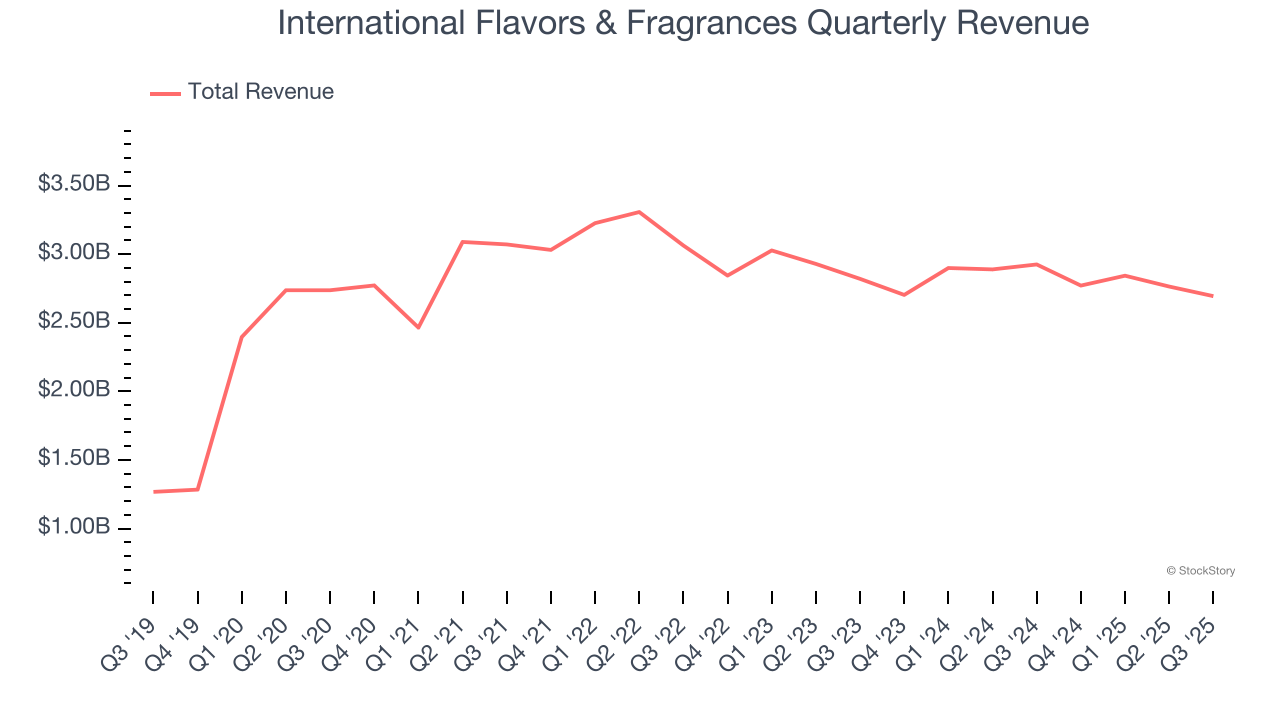

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. International Flavors & Fragrances’s demand was weak over the last three years as its sales fell at a 4.3% annual rate. This was below our standards and is a sign of poor business quality.

2. Operating Losses Sound the Alarms

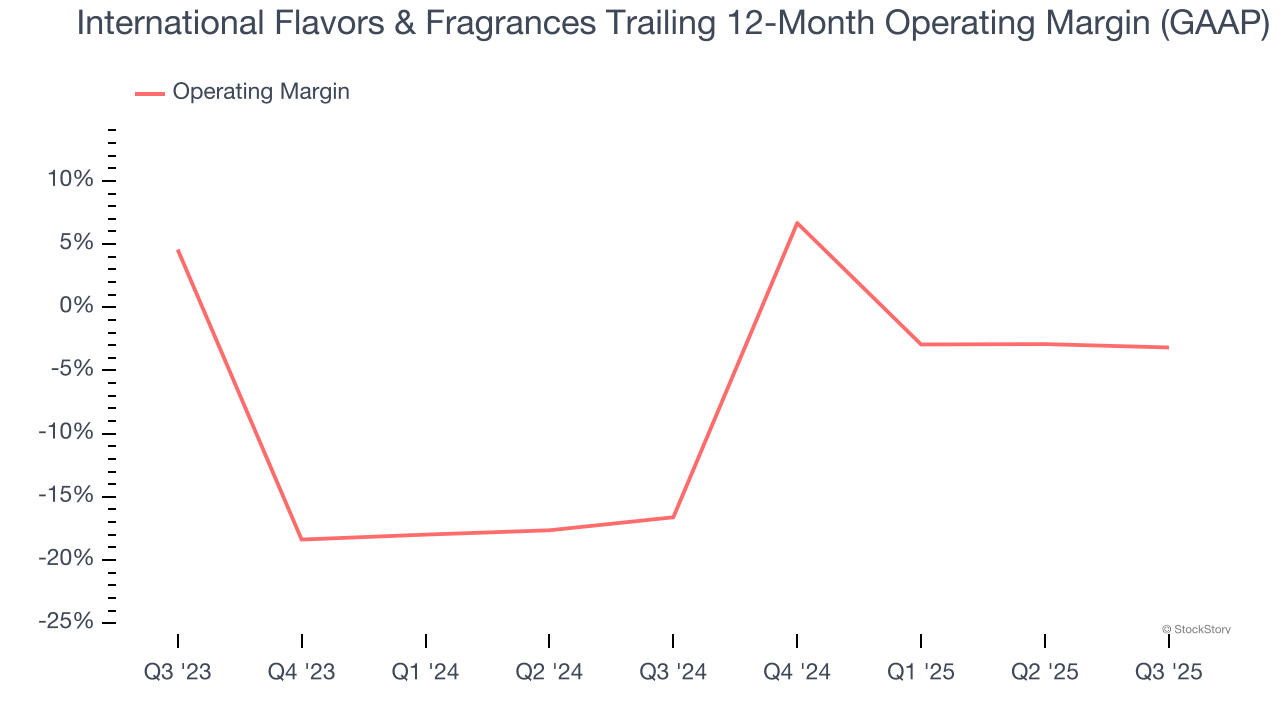

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

Although International Flavors & Fragrances was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 10% over the last two years. Unprofitable public companies are rare in the defensive consumer staples industry, so this performance certainly caught our eye.

3. Previous Growth Initiatives Have Lost Money

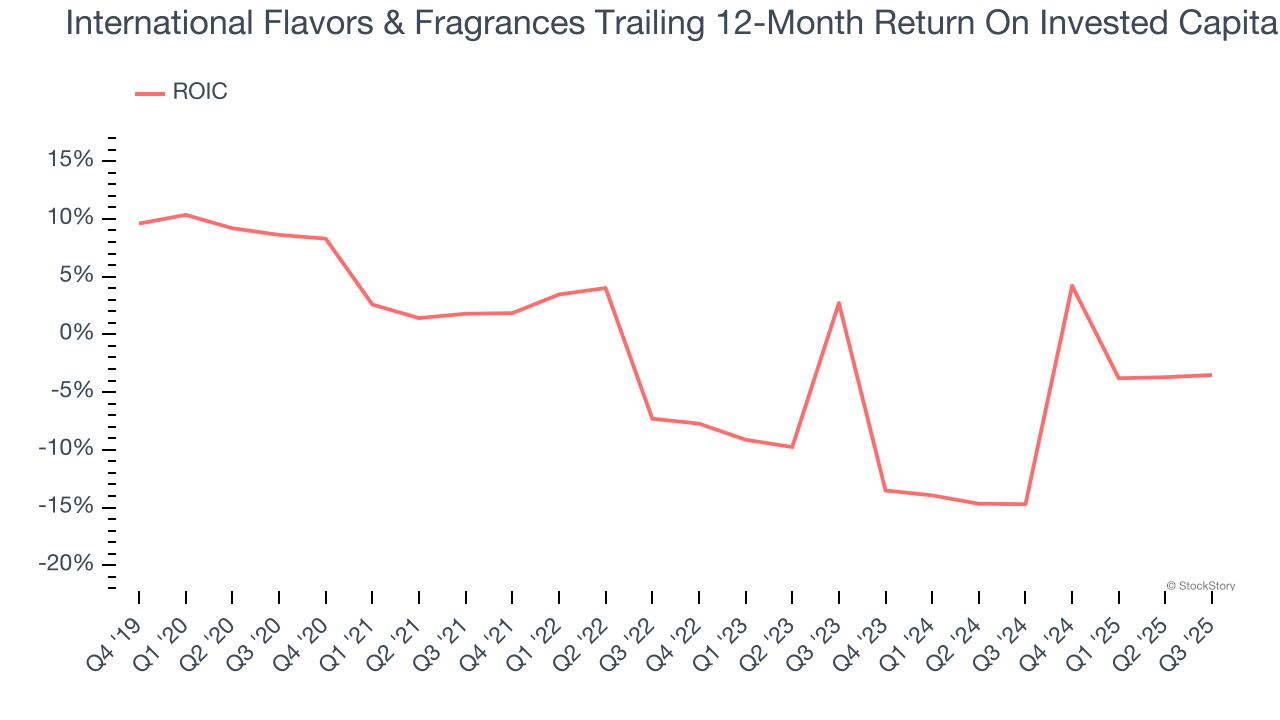

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

International Flavors & Fragrances’s five-year average ROIC was negative 4.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

Final Judgment

International Flavors & Fragrances doesn’t pass our quality test. After the recent drawdown, the stock trades at 16.3× forward P/E (or $71.69 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.