Over the past six months, Connection’s shares (currently trading at $58.52) have posted a disappointing 10.3% loss, well below the S&P 500’s 10.1% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Connection, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Connection Will Underperform?

Even with the cheaper entry price, we're cautious about Connection. Here are three reasons there are better opportunities than CNXN and a stock we'd rather own.

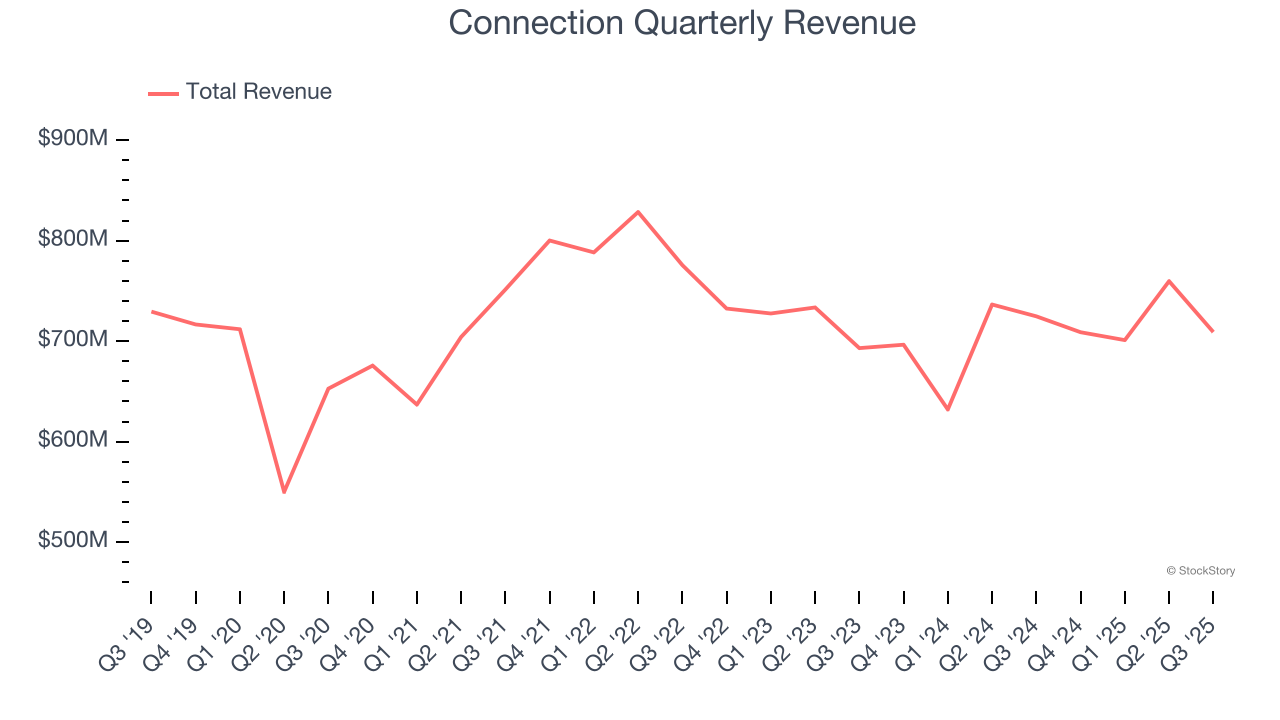

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Connection’s sales grew at a sluggish 1.8% compounded annual growth rate over the last five years. This was below our standards.

2. EPS Barely Growing

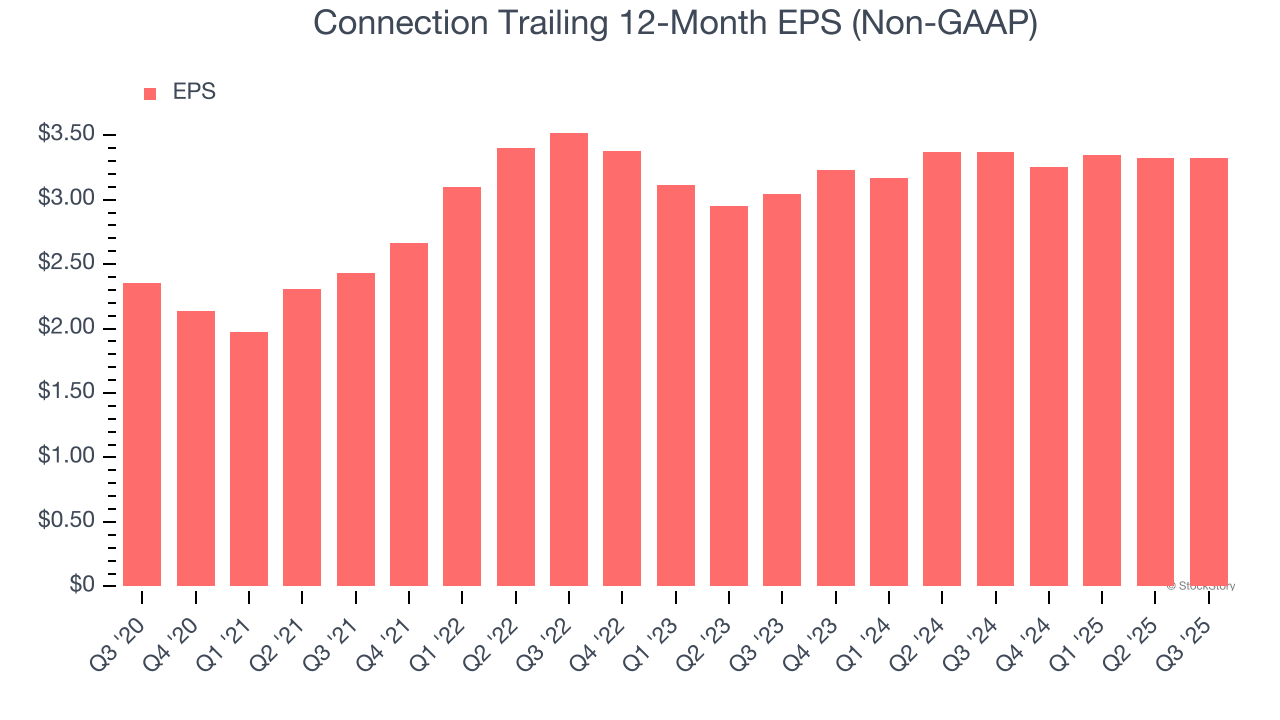

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Connection’s EPS grew at an unimpressive 7.2% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.8% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

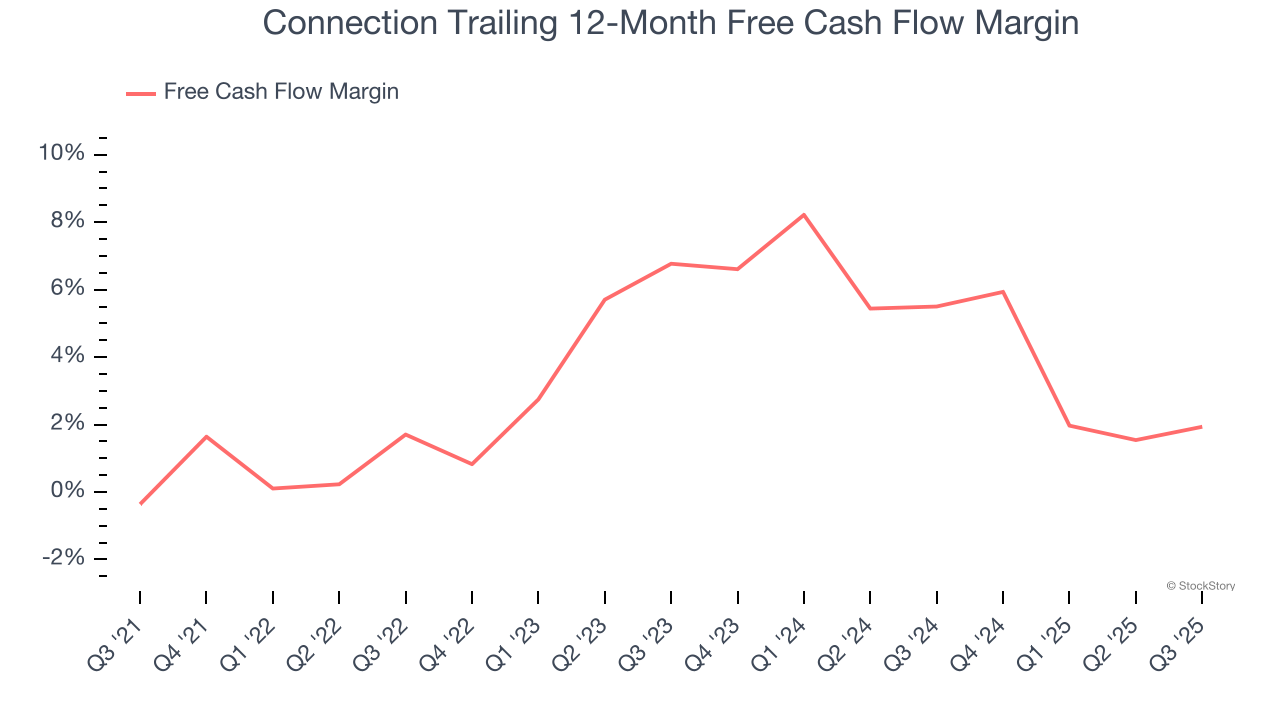

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Connection has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.1%, subpar for a business services business.

Final Judgment

Connection doesn’t pass our quality test. Following the recent decline, the stock trades at 16.3× forward P/E (or $58.52 per share). At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere. We’d recommend looking at one of our top digital advertising picks.

Stocks We Like More Than Connection

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.