ServiceNow has been treading water for the past six months, recording a small return of 1% while holding steady at $915. The stock also fell short of the S&P 500’s 11.6% gain during that period.

Is now the time to buy NOW? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Is ServiceNow a Good Business?

Built on a single code base that processes over 4 billion workflow transactions daily, ServiceNow (NYSE: NOW) provides a cloud-based platform that helps organizations automate and digitize workflows across departments, from IT and HR to customer service and security.

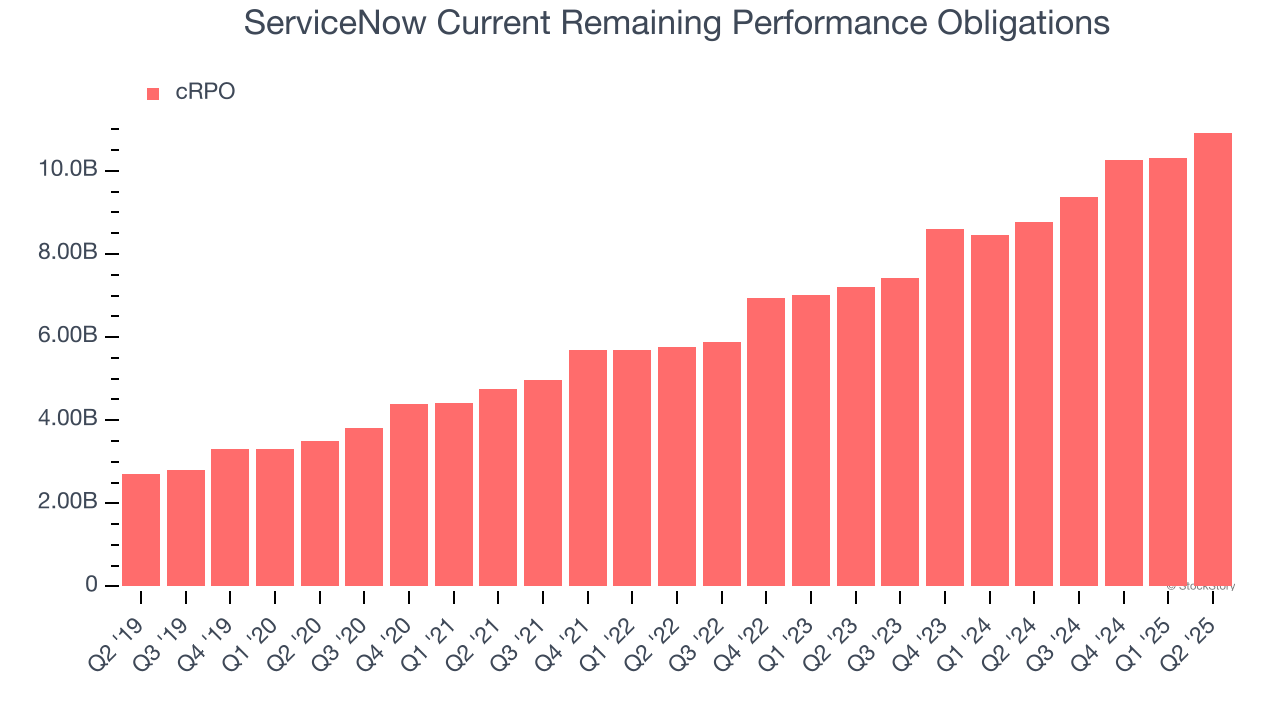

1. Surging cRPO Locks In Future Sales

In addition to reported revenue, it is useful to analyze cRPO, or current remaining performance obligations, for ServiceNow because it shows the value of contracted services to be delivered over the next year. It therefore gives visibility into future revenue.

ServiceNow’s cRPO punched in at $10.92 billion in Q2, and over the last four quarters, its year-on-year growth averaged 22.9%. This performance was impressive and shows the company has a robust pipeline of undelivered services. Its growth also suggests that customers are committing to long-term contracts, enhancing ServiceNow’s predictability and providing a tailwind to its valuation.

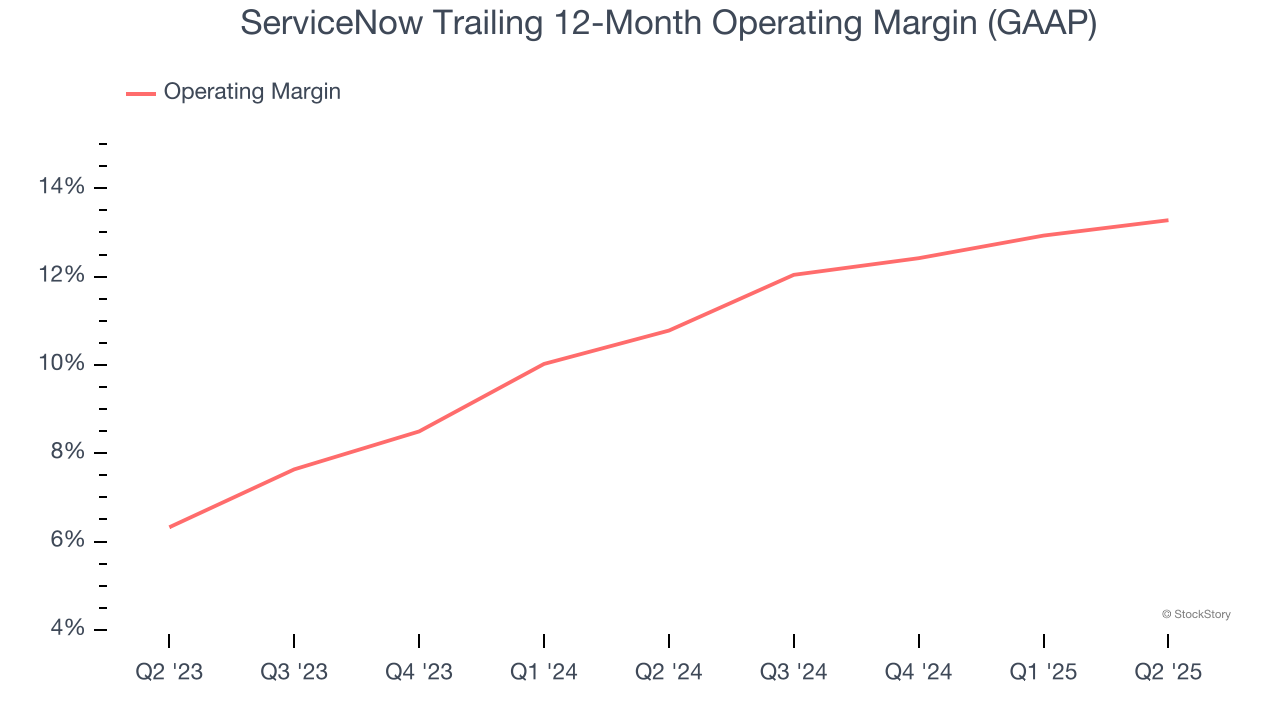

2. Operating Margin Reveals a Well-Run Organization

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

ServiceNow has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 13.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

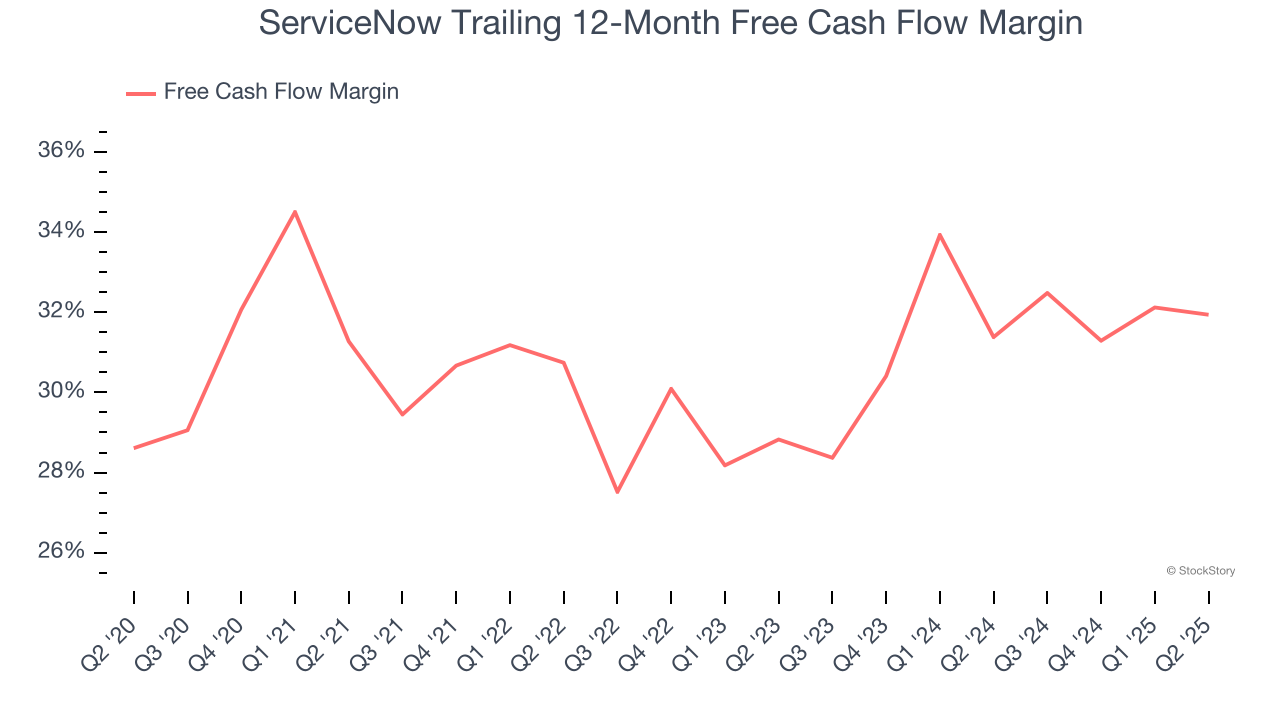

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

ServiceNow has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 31.9% over the last year.

Final Judgment

These are just a few reasons why we're bullish on ServiceNow. With its shares underperforming the market lately, the stock trades at 13.4× forward price-to-sales (or $915 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than ServiceNow

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.