Customer engagement platform Braze (NASDAQ: BRZE) announced better-than-expected revenue in Q2 CY2025, with sales up 23.8% year on year to $180.1 million. Guidance for next quarter’s revenue was optimistic at $184 million at the midpoint, 2.1% above analysts’ estimates. Its non-GAAP profit of $0.15 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Braze? Find out by accessing our full research report, it’s free.

Braze (BRZE) Q2 CY2025 Highlights:

- Revenue: $180.1 million vs analyst estimates of $171.6 million (23.8% year-on-year growth, 5% beat)

- Adjusted EPS: $0.15 vs analyst estimates of $0.03 (significant beat)

- Adjusted Operating Income: $6.04 million vs analyst estimates of $1.17 million (3.4% margin, significant beat)

- The company lifted its revenue guidance for the full year to $718.5 million at the midpoint from $704 million, a 2.1% increase

- Management raised its full-year Adjusted EPS guidance to $0.42 at the midpoint, a 152% increase

- Operating Margin: -21.5%, down from -19.2% in the same quarter last year

- Free Cash Flow Margin: 2%, down from 14.1% in the previous quarter

- Customers: 2,422, up from 2,342 in the previous quarter

- Net Revenue Retention Rate: 108%, down from 109% in the previous quarter

- Billings: $170.1 million at quarter end, up 32.5% year on year

- Market Capitalization: $3.00 billion

Company Overview

With its technology powering interactions with 6.2 billion monthly active users across the digital landscape, Braze (NASDAQ: BRZE) provides a platform that helps brands build and maintain direct relationships with their customers through personalized, cross-channel messaging and engagement.

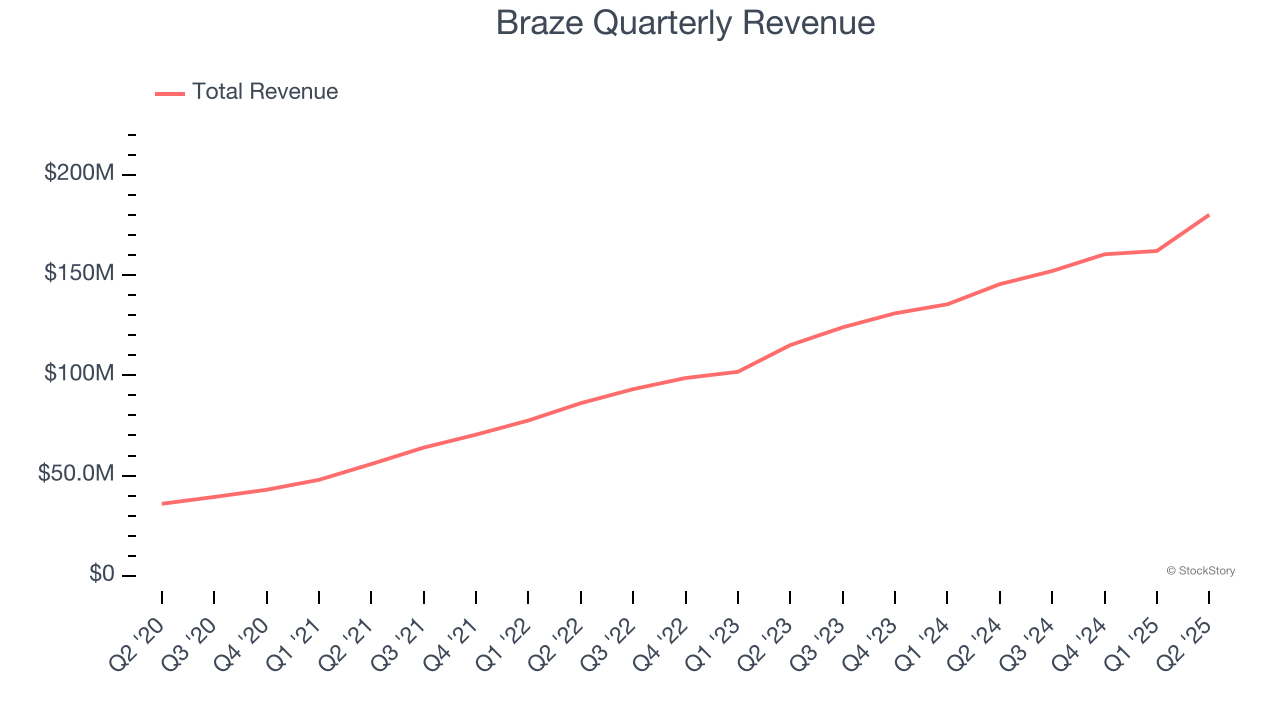

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Braze’s 30% annualized revenue growth over the last three years was impressive. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Braze reported robust year-on-year revenue growth of 23.8%, and its $180.1 million of revenue topped Wall Street estimates by 5%. Company management is currently guiding for a 21% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.7% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is admirable and suggests the market is forecasting success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

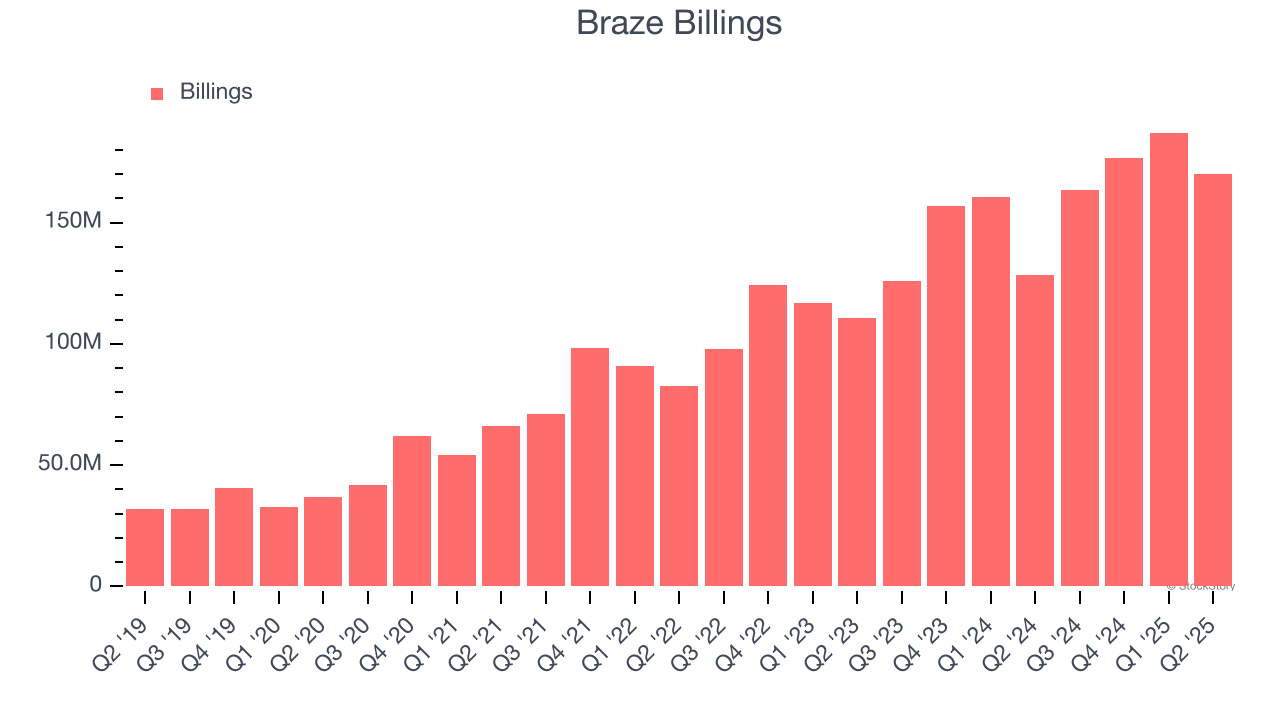

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Braze’s billings punched in at $170.1 million in Q2, and over the last four quarters, its growth was impressive as it averaged 23% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

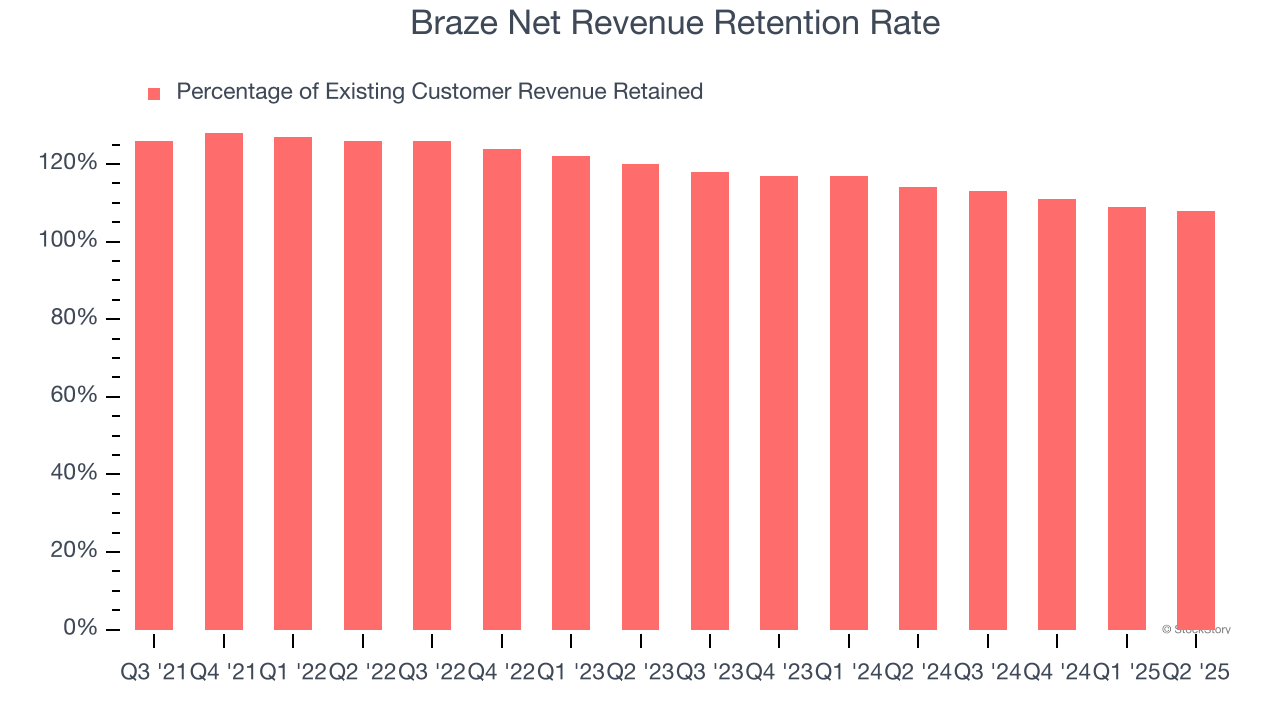

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Braze’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 110% in Q2. This means Braze would’ve grown its revenue by 10.3% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, Braze still has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from Braze’s Q2 Results

We were impressed by how significantly Braze blew past analysts’ billings expectations this quarter. We were also glad its customer growth accelerated. Zooming out, we think this quarter featured some important positives. The stock traded up 13.9% to $31.55 immediately following the results.

Braze put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.