Laser company nLIGHT (NASDAQ: LASR) announced better-than-expected revenue in Q2 CY2025, with sales up 22.2% year on year to $61.74 million. On top of that, next quarter’s revenue guidance ($64.5 million at the midpoint) was surprisingly good and 13.8% above what analysts were expecting. Its non-GAAP profit of $0.06 per share was significantly above analysts’ consensus estimates.

Is now the time to buy nLIGHT? Find out by accessing our full research report, it’s free.

nLIGHT (LASR) Q2 CY2025 Highlights:

- Revenue: $61.74 million vs analyst estimates of $55.63 million (22.2% year-on-year growth, 11% beat)

- Adjusted EPS: $0.06 vs analyst estimates of -$0.09 (significant beat)

- Adjusted EBITDA: $5.55 million vs analyst estimates of -$1.52 million (9% margin, significant beat)

- Revenue Guidance for Q3 CY2025 is $64.5 million at the midpoint, above analyst estimates of $56.66 million

- EBITDA guidance for the full year is $4 million at the midpoint, above analyst estimates of -$4.55 million

- Operating Margin: -6.9%, up from -25.1% in the same quarter last year

- Free Cash Flow was -$14.7 million compared to -$7.39 million in the same quarter last year

- Market Capitalization: $972.5 million

Company Overview

Founded by a former CEO and Harvard-educated entrepreneur Scott Keeneyn, nLIGHT (NASDAQ: LASR) offers semiconductor and fiber lasers to the industrial, aerospace & defense, and medical sectors.

Revenue Growth

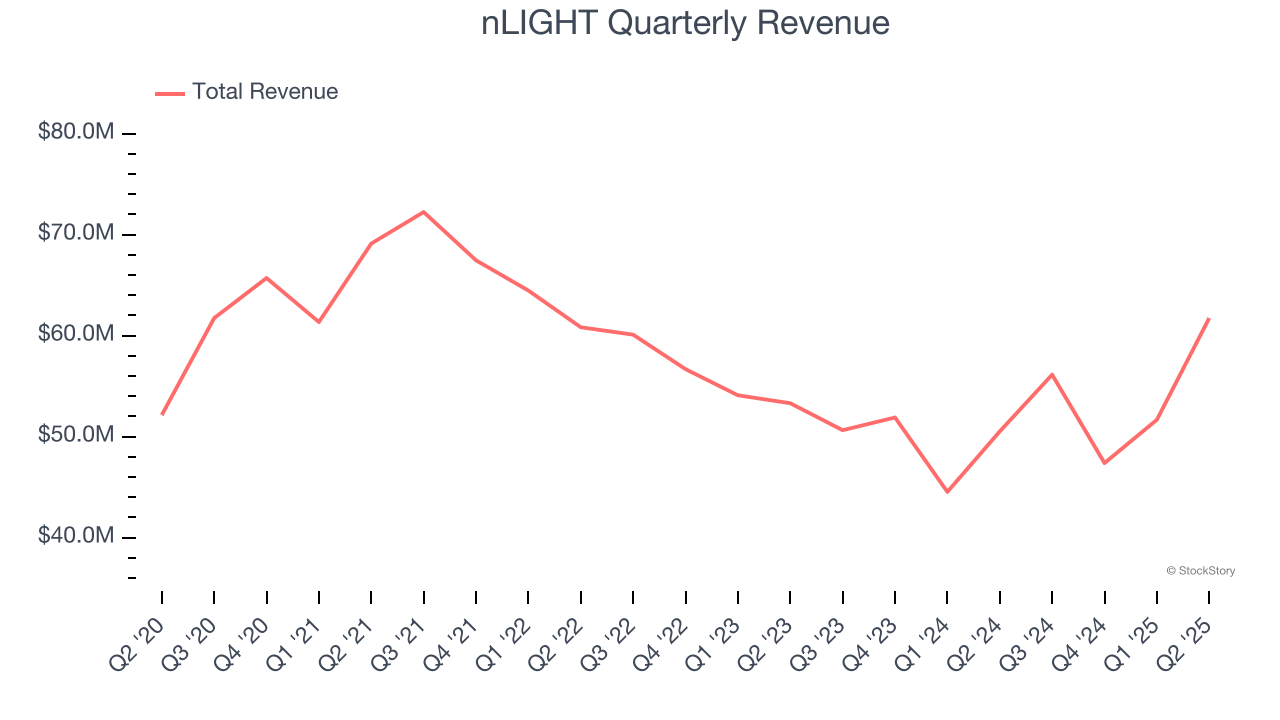

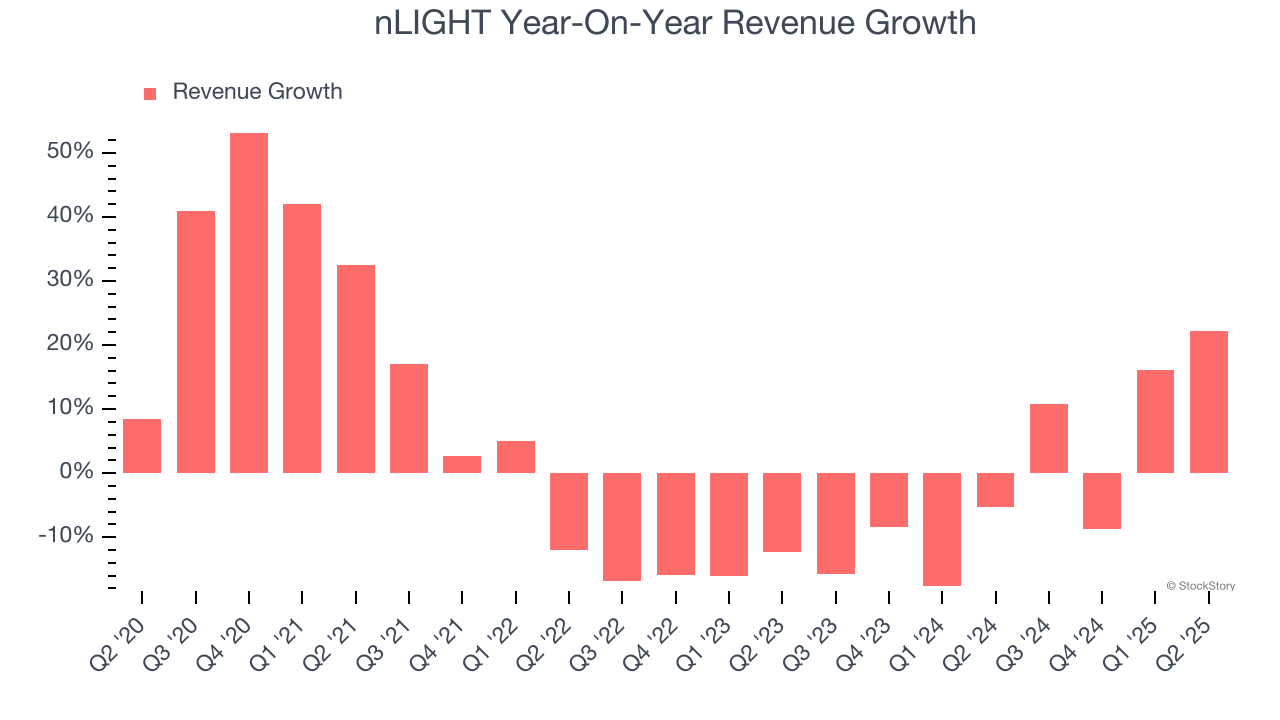

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, nLIGHT grew its sales at a sluggish 3.6% compounded annual growth rate. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. nLIGHT’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.6% annually. nLIGHT isn’t alone in its struggles as the Electronic Components industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

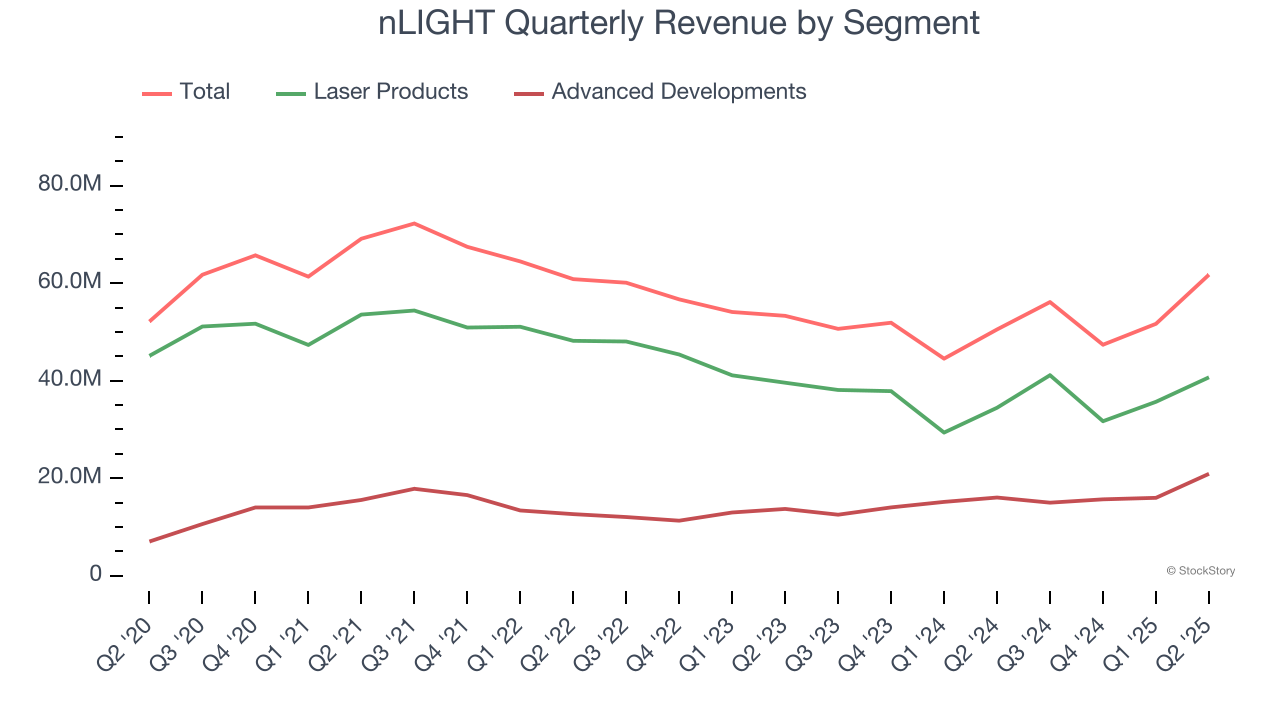

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Laser Products and Advanced Developments, which are 65.9% and 33.9% of revenue. Over the last two years, nLIGHT’s Laser Products revenue (lasers, amplifiers, and directed energy products) averaged 5.9% year-on-year declines. On the other hand, its Advanced Developments revenue (R&D contracts) averaged 16.1% growth.

This quarter, nLIGHT reported robust year-on-year revenue growth of 22.2%, and its $61.74 million of revenue topped Wall Street estimates by 11%. Company management is currently guiding for a 14.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

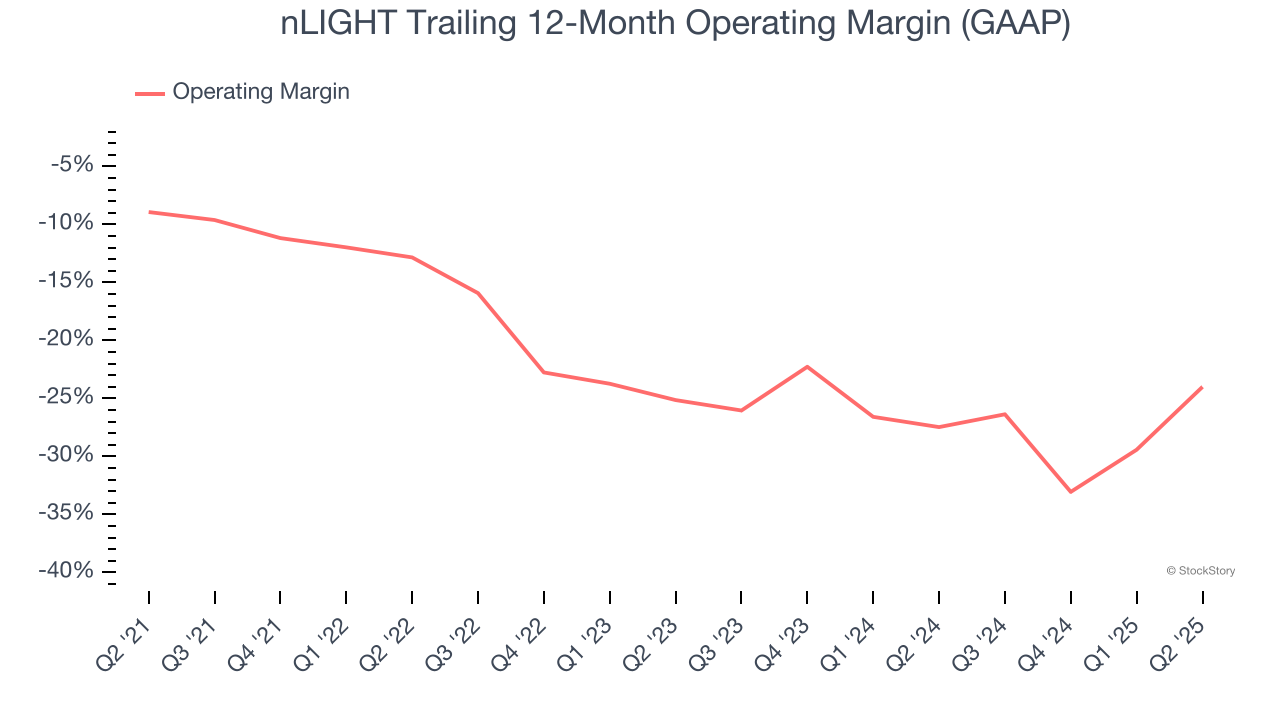

nLIGHT’s high expenses have contributed to an average operating margin of negative 18.9% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, nLIGHT’s operating margin decreased by 15.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. nLIGHT’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, nLIGHT generated a negative 6.9% operating margin. The company's consistent lack of profits raise a flag.

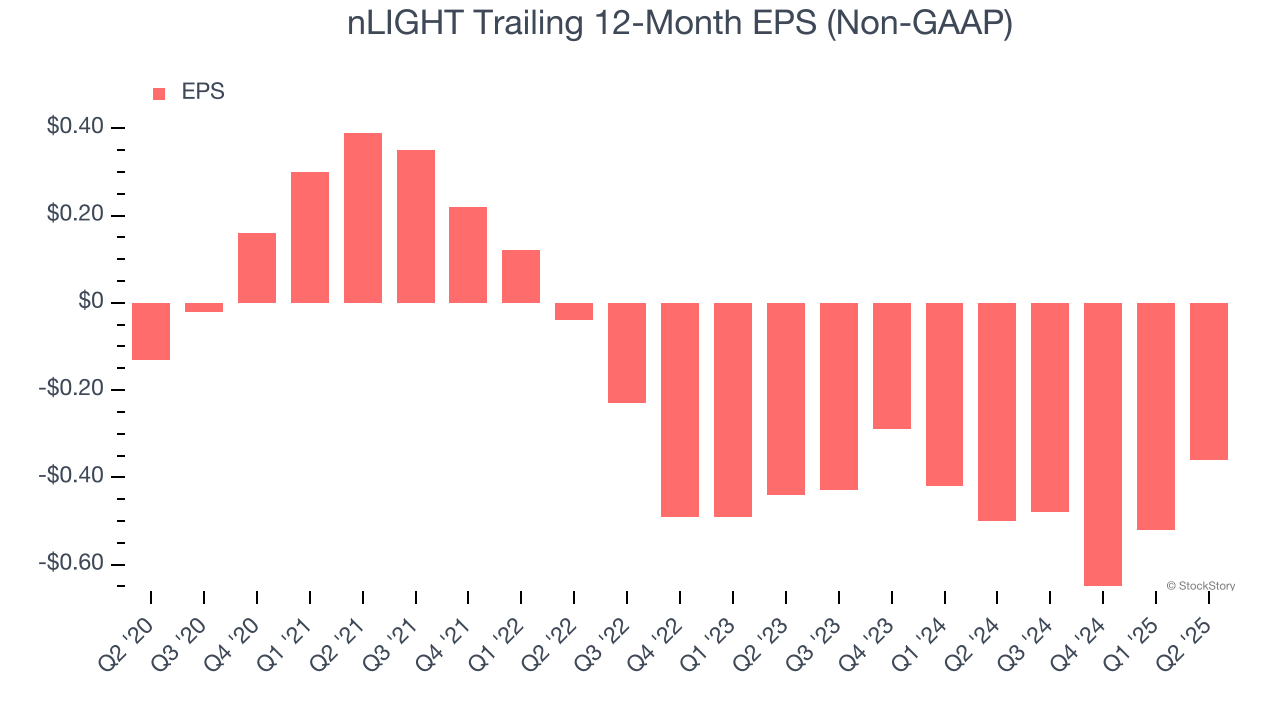

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

nLIGHT’s earnings losses deepened over the last five years as its EPS dropped 22.6% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, nLIGHT’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For nLIGHT, its two-year annual EPS growth of 9.5% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q2, nLIGHT reported adjusted EPS at $0.06, up from negative $0.10 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast nLIGHT’s full-year EPS of negative $0.36 will reach break even.

Key Takeaways from nLIGHT’s Q2 Results

We were impressed by nLIGHT’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EPS outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 17.5% to $24.04 immediately after reporting.

nLIGHT had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.