Meat company Tyson Foods (NYSE: TSN) announced better-than-expected revenue in Q2 CY2025, with sales up 3.6% year on year to $13.88 billion. Its non-GAAP profit of $0.91 per share was 16.2% above analysts’ consensus estimates.

Is now the time to buy Tyson Foods? Find out by accessing our full research report, it’s free.

Tyson Foods (TSN) Q2 CY2025 Highlights:

- Revenue: $13.88 billion vs analyst estimates of $13.5 billion (3.6% year-on-year growth, 2.9% beat)

- Adjusted EPS: $0.91 vs analyst estimates of $0.78 (16.2% beat)

- Adjusted EBITDA: $589 million vs analyst estimates of $807 million (4.2% margin, 27% miss)

- Operating Margin: 1.9%, in line with the same quarter last year

- Free Cash Flow Margin: 3.9%, similar to the same quarter last year

- Sales Volumes were flat year on year (1.1% in the same quarter last year)

- Market Capitalization: $18.71 billion

"Our third quarter results demonstrate the strength of our multi-protein, multi-channel portfolio and our relentless focus on operational excellence," said Donnie King, President & CEO of Tyson Foods.

Company Overview

Started as a simple trucking business, Tyson Foods (NYSE: TSN) is one of the world’s largest producers of chicken, beef, and pork.

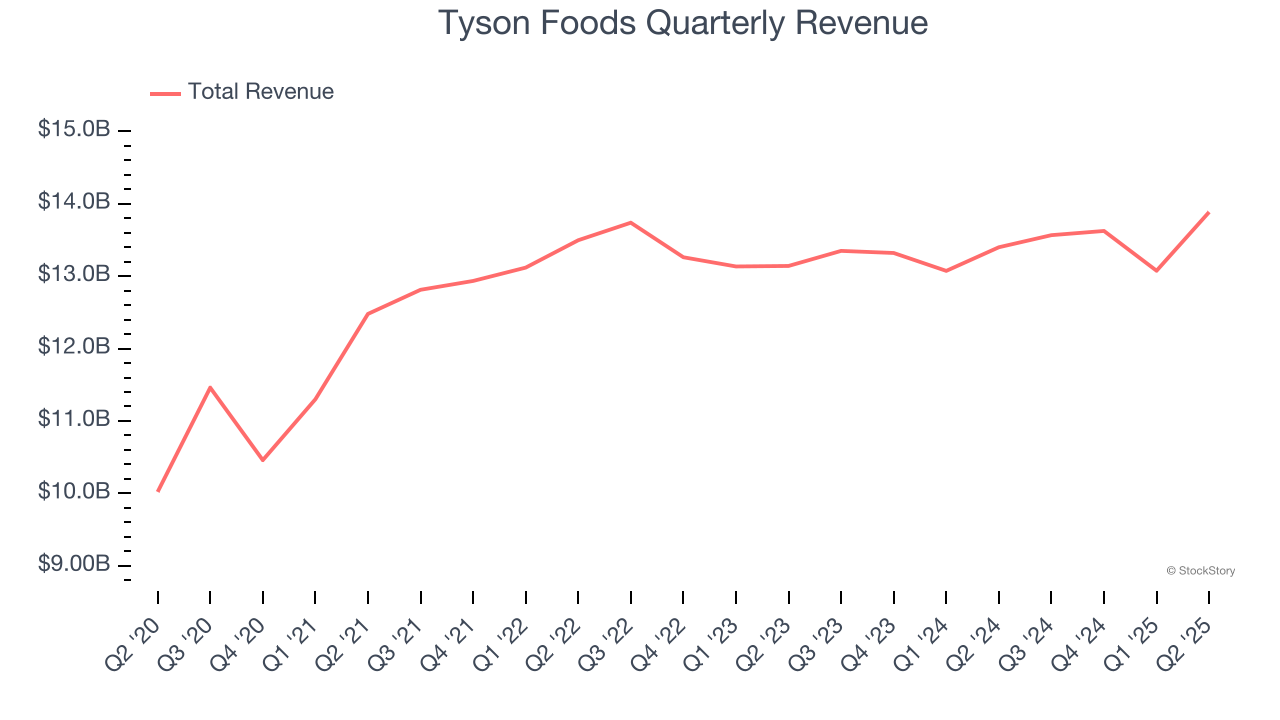

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $54.15 billion in revenue over the past 12 months, Tyson Foods is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. To expand meaningfully, Tyson Foods likely needs to tweak its prices, innovate with new products, or enter new markets.

As you can see below, Tyson Foods’s sales grew at a weak 1.1% compounded annual growth rate over the last three years, but to its credit, consumers bought more of its products.

This quarter, Tyson Foods reported modest year-on-year revenue growth of 3.6% but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and suggests its newer products will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

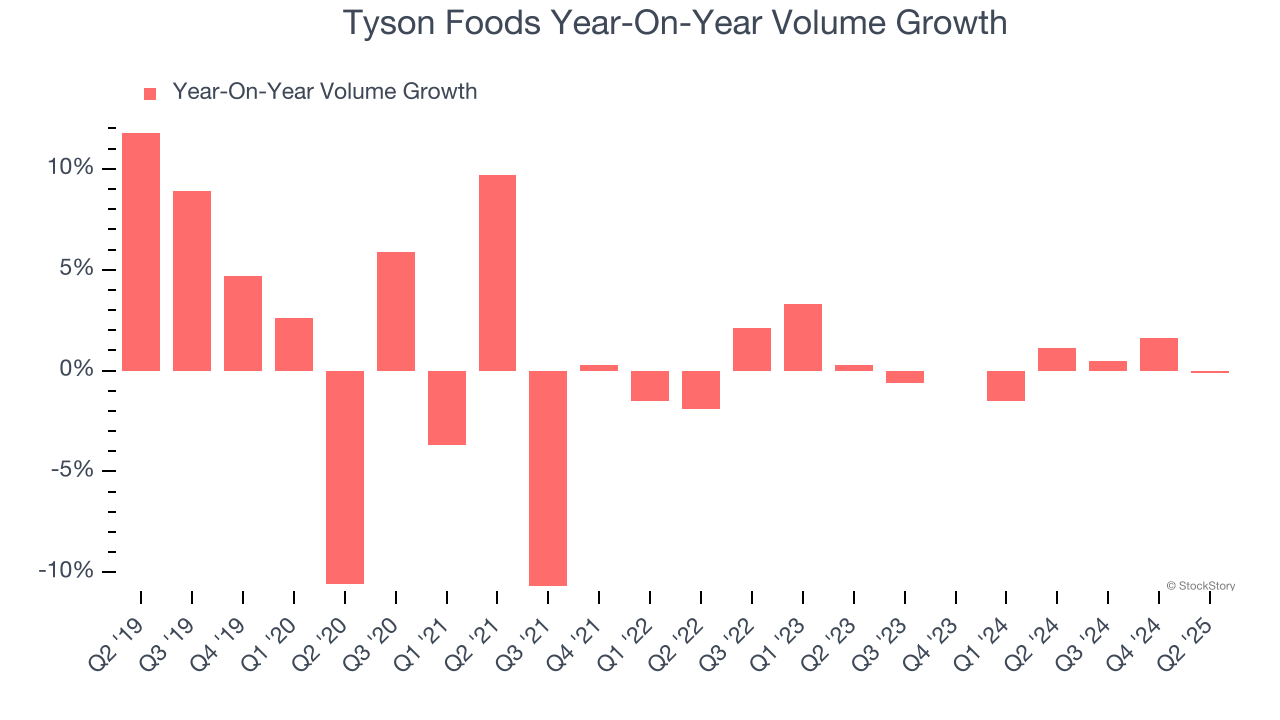

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Tyson Foods’s quarterly sales volumes have, on average, stayed about the same over the last two years. This stability is normal because the quantity demanded for consumer staples products typically doesn’t see much volatility.

In Tyson Foods’s Q2 2025, year on year sales volumes were flat. This result was more or less in line with its historical levels.

Key Takeaways from Tyson Foods’s Q2 Results

We enjoyed seeing Tyson Foods beat analysts’ gross margin expectations this quarter. We were also happy its revenue and EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter. The stock traded up 3% to $54.13 immediately following the results.

Is Tyson Foods an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.