Since February 2025, Cincinnati Financial has been in a holding pattern, posting a small return of 4.2% while floating around $154.01.

Is now the time to buy Cincinnati Financial, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Cincinnati Financial Not Exciting?

We're cautious about Cincinnati Financial. Here are three reasons there are better opportunities than CINF and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services.

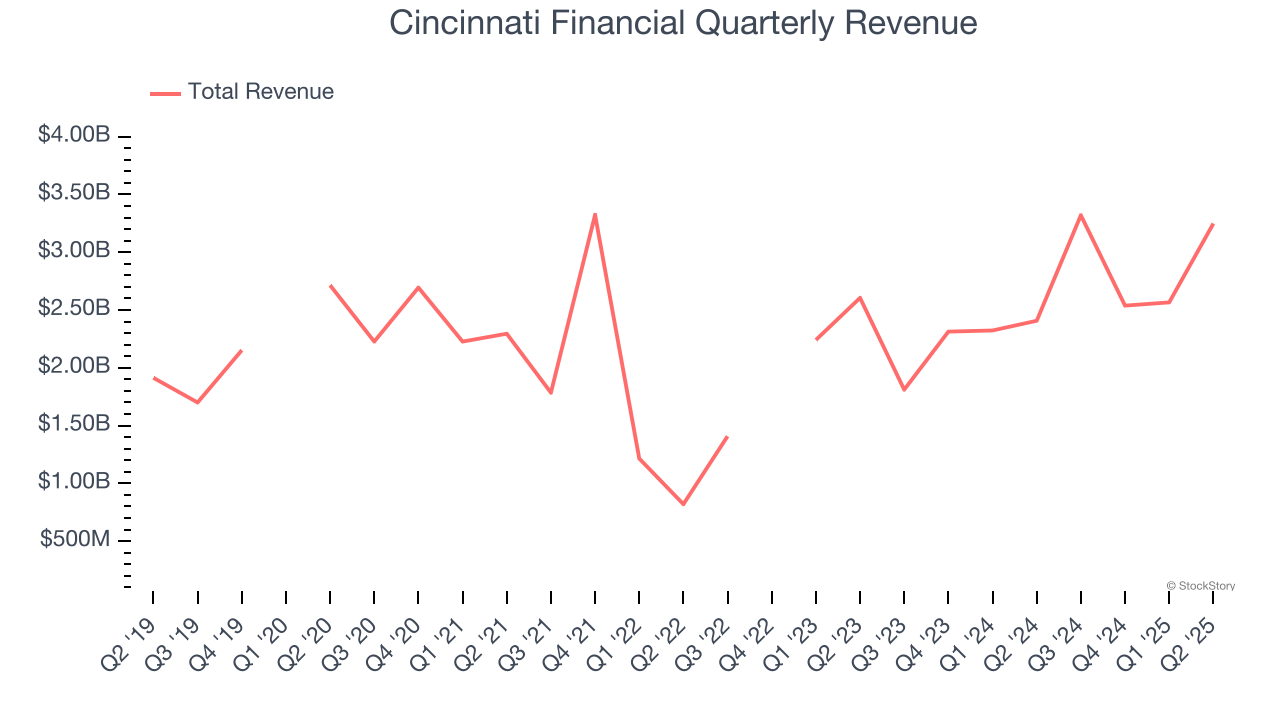

Unfortunately, Cincinnati Financial’s 6.8% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the insurance sector.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

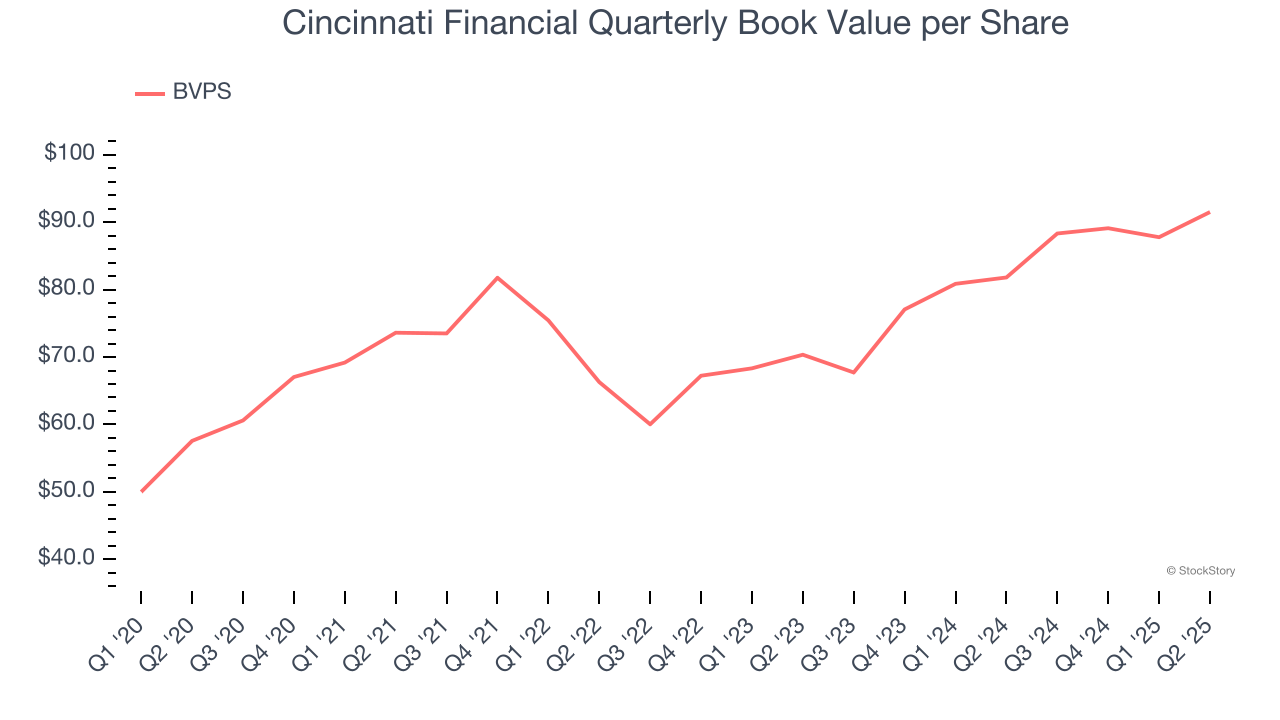

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.3. Projected BVPS Growth Is Slim

The key to book value per share (BVPS) growth is an insurer’s ability to earn underwriting profits while generating strong returns on its float - Warren Buffet’s secret sauce.

Over the next 12 months, Consensus estimates call for Cincinnati Financial’s BVPS to grow by 2.8% to $89.75, lousy growth rate.

Final Judgment

Cincinnati Financial isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 1.7× forward P/B (or $154.01 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you toward one of our top digital advertising picks.

Stocks We Would Buy Instead of Cincinnati Financial

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.