Donnelley Financial Solutions currently trades at $56.80 and has been a dream stock for shareholders. It’s returned 416% since August 2020, blowing past the S&P 500’s 84.4% gain. The company has also beaten the index over the past six months as its stock price is up 14.6%.

Is now the time to buy Donnelley Financial Solutions, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Donnelley Financial Solutions Not Exciting?

We’re happy investors have made money, but we're cautious about Donnelley Financial Solutions. Here are two reasons you should be careful with DFIN and a stock we'd rather own.

1. Revenue Spiraling Downwards

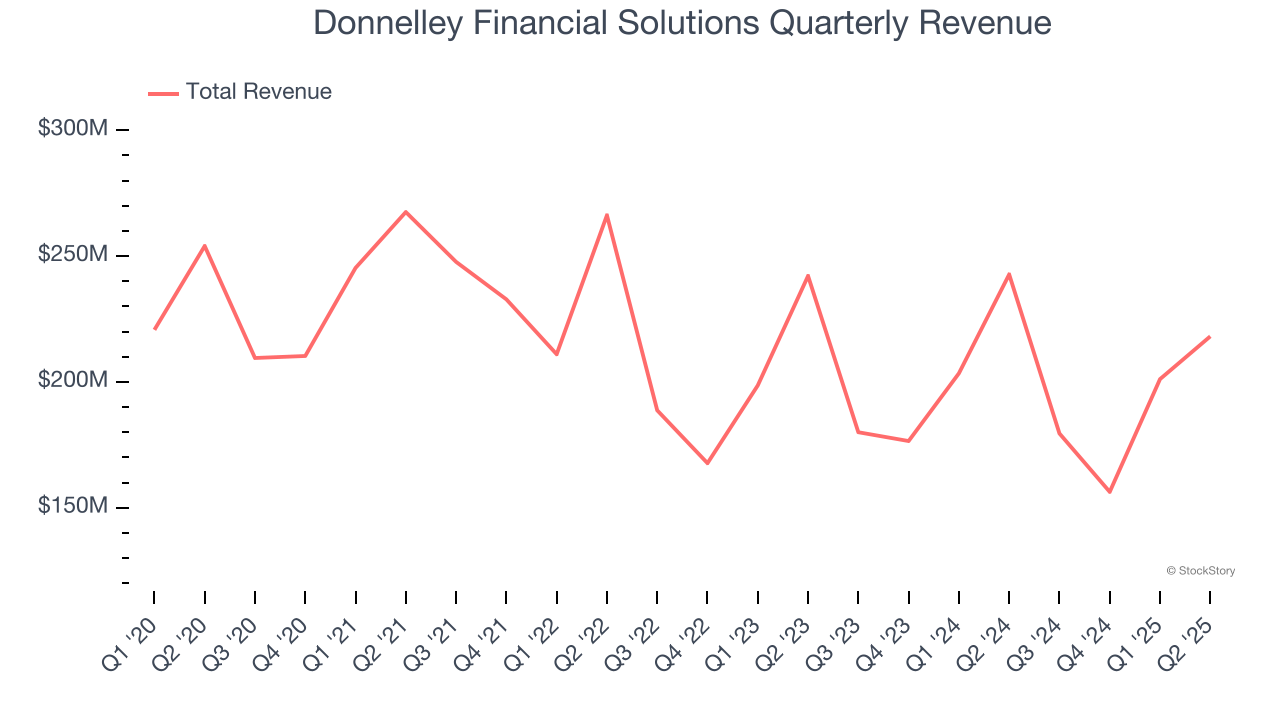

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Over the last five years, Donnelley Financial Solutions’s demand was weak and its revenue declined by 2.5% per year. This wasn’t a great result and is a sign of lacking business quality.

2. Recent EPS Growth Below Our Standards

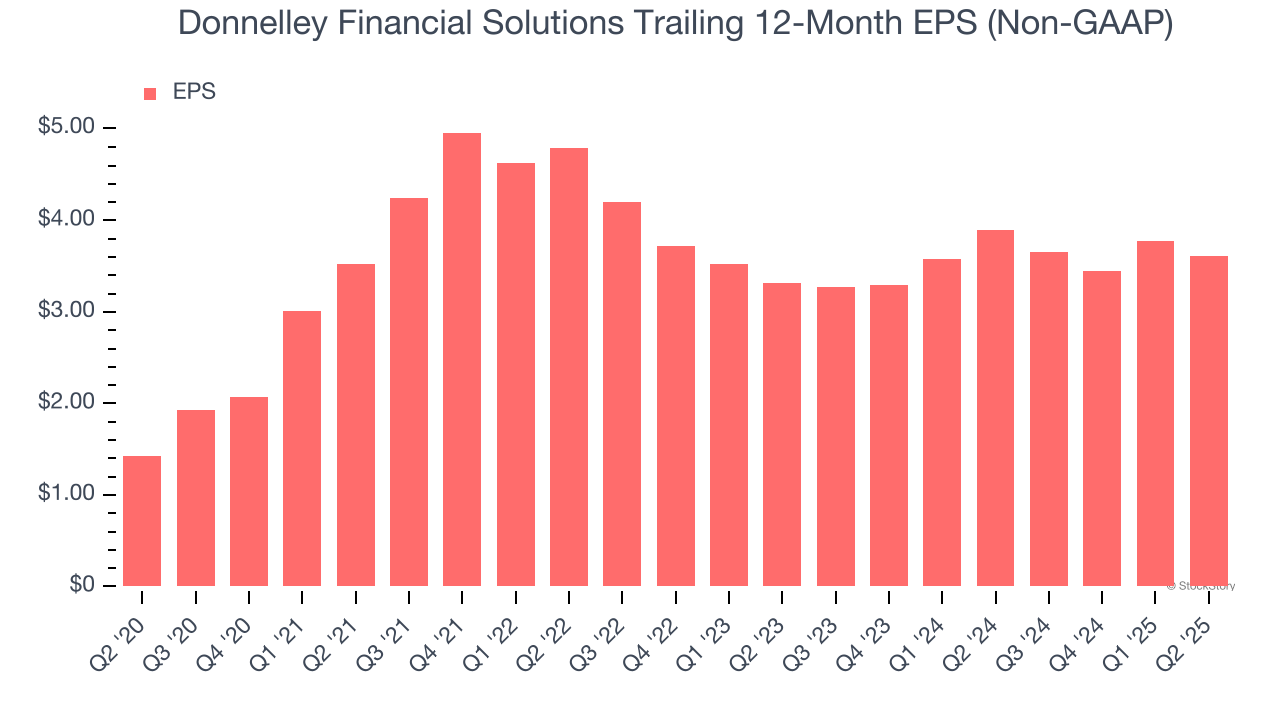

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Donnelley Financial Solutions’s EPS grew at a weak 4.3% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 2.7% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Final Judgment

Donnelley Financial Solutions isn’t a terrible business, but it isn’t one of our picks. With its shares beating the market recently, the stock trades at $56.80 per share (or a forward price-to-sales ratio of 2×). The market typically values companies like Donnelley Financial Solutions based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Donnelley Financial Solutions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.