As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the leisure facilities industry, including Live Nation (NYSE: LYV) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 11 leisure facilities stocks we track reported a mixed Q1. As a group, revenues missed analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was in line.

Luckily, leisure facilities stocks have performed well with share prices up 16.7% on average since the latest earnings results.

Best Q1: Live Nation (NYSE: LYV)

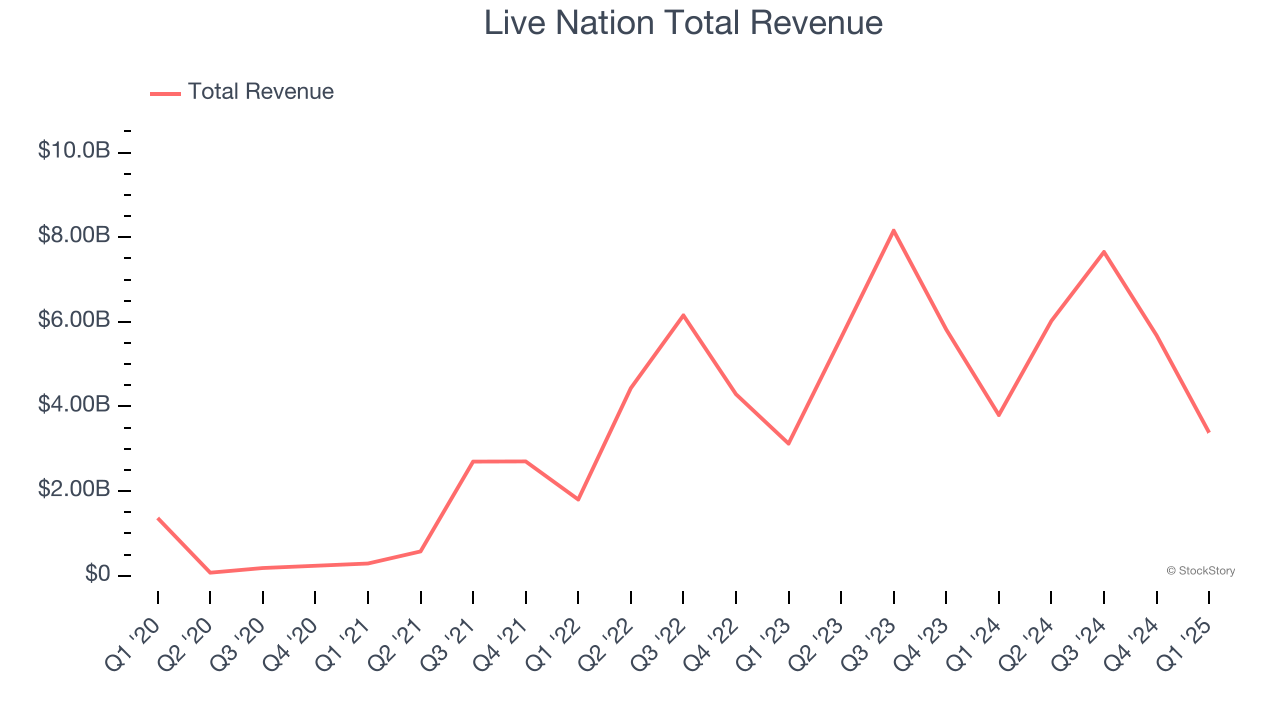

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Live Nation reported revenues of $3.38 billion, down 11% year on year. This print fell short of analysts’ expectations by 2.8%, but it was still a very strong quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Interestingly, the stock is up 10.7% since reporting and currently trades at $145.27.

Is now the time to buy Live Nation? Access our full analysis of the earnings results here, it’s free.

European Wax Center (NASDAQ: EWCZ)

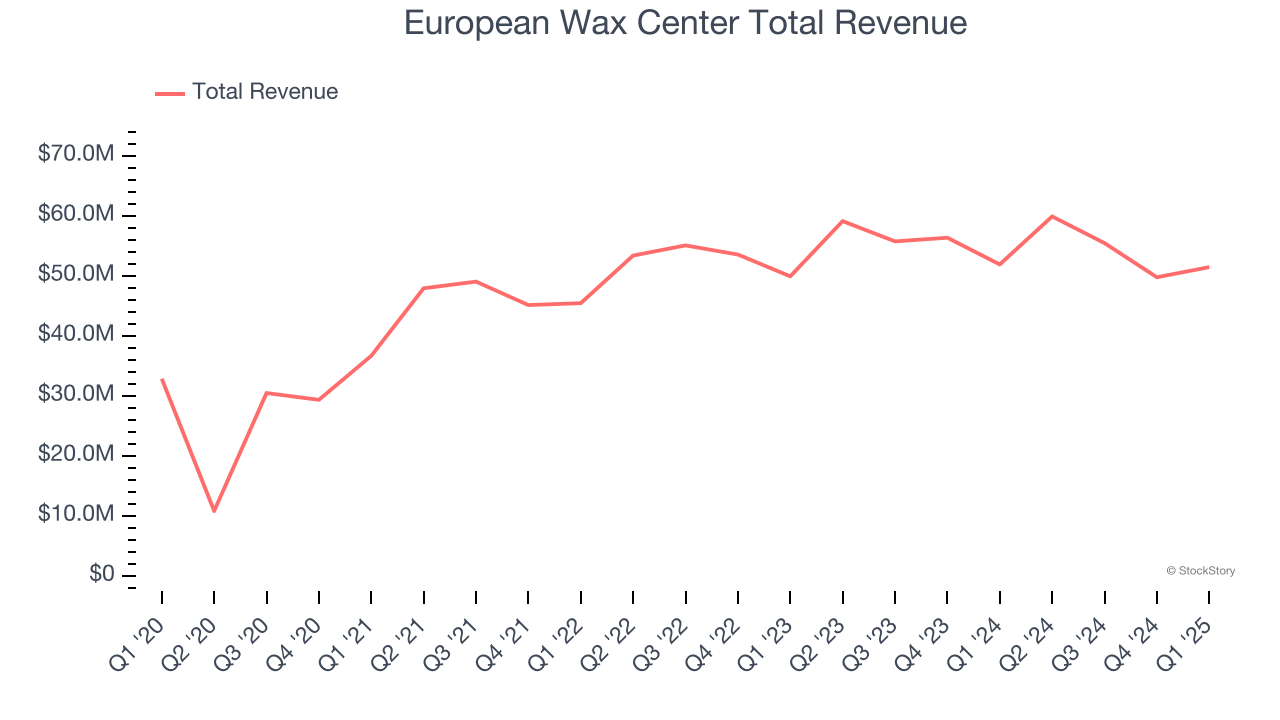

Founded by two siblings, European Wax Center (NASDAQ: EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

European Wax Center reported revenues of $51.43 million, flat year on year, outperforming analysts’ expectations by 3.7%. The business had a very strong quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

European Wax Center scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 46.2% since reporting. It currently trades at $5.76.

Is now the time to buy European Wax Center? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Lucky Strike (NYSE: LUCK)

Born from the transformation of traditional bowling alleys into modern entertainment destinations, Lucky Strike (NYSE: LUCK) operates bowling alleys and other entertainment venues with upscale amenities, arcade games, and food and beverage services across North America.

Lucky Strike reported revenues of $339.9 million, flat year on year, falling short of analysts’ expectations by 5.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS and adjusted operating income estimates.

Interestingly, the stock is up 3.5% since the results and currently trades at $9.85.

Read our full analysis of Lucky Strike’s results here.

Topgolf Callaway (NYSE: MODG)

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE: MODG) sells golf equipment and operates technology-driven golf entertainment venues.

Topgolf Callaway reported revenues of $1.09 billion, down 4.5% year on year. This print beat analysts’ expectations by 2.2%. More broadly, it was a satisfactory quarter as it also logged a solid beat of analysts’ EPS estimates but full-year EBITDA guidance missing analysts’ expectations significantly.

Topgolf Callaway had the weakest full-year guidance update among its peers. The stock is up 12.4% since reporting and currently trades at $8.90.

Read our full, actionable report on Topgolf Callaway here, it’s free.

Planet Fitness (NYSE: PLNT)

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE: PLNT) is a gym franchise that caters to casual fitness users by providing a friendly and inclusive atmosphere.

Planet Fitness reported revenues of $276.7 million, up 11.5% year on year. This result missed analysts’ expectations by 1.2%. Zooming out, it was a mixed quarter as it also produced an impressive beat of analysts’ adjusted operating income estimates but a miss of analysts’ EPS estimates.

Planet Fitness achieved the fastest revenue growth among its peers. The stock is up 4.5% since reporting and currently trades at $106.33.

Read our full, actionable report on Planet Fitness here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.