Electronic Arts trades at $152.95 and has moved in lockstep with the market. Its shares have returned 6.1% over the last six months while the S&P 500 has gained 5.3%.

Is now the time to buy Electronic Arts, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Electronic Arts Not Exciting?

We're sitting this one out for now. Here are three reasons why you should be careful with EA and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

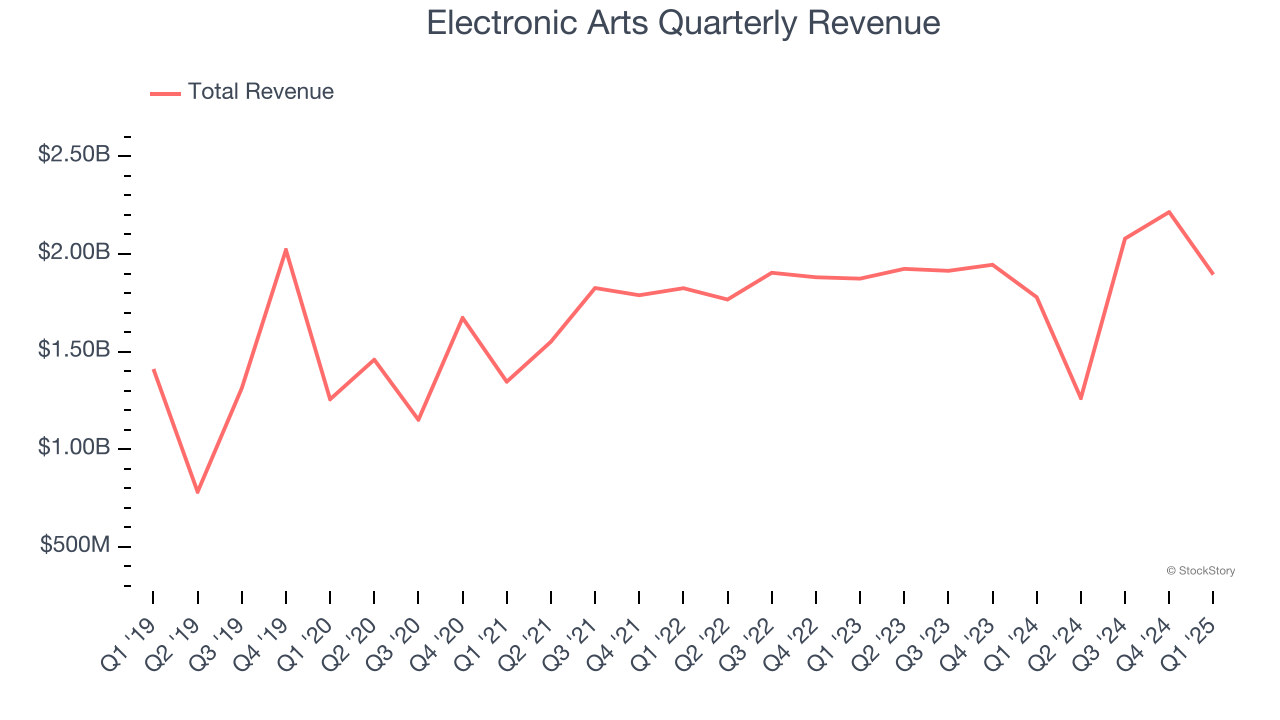

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Electronic Arts grew its sales at a sluggish 2.1% compounded annual growth rate. This fell short of our benchmarks.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Electronic Arts’s revenue to stall, a slight deceleration versus This projection is underwhelming and suggests its products and services will see some demand headwinds.

3. Shrinking EBITDA Margin

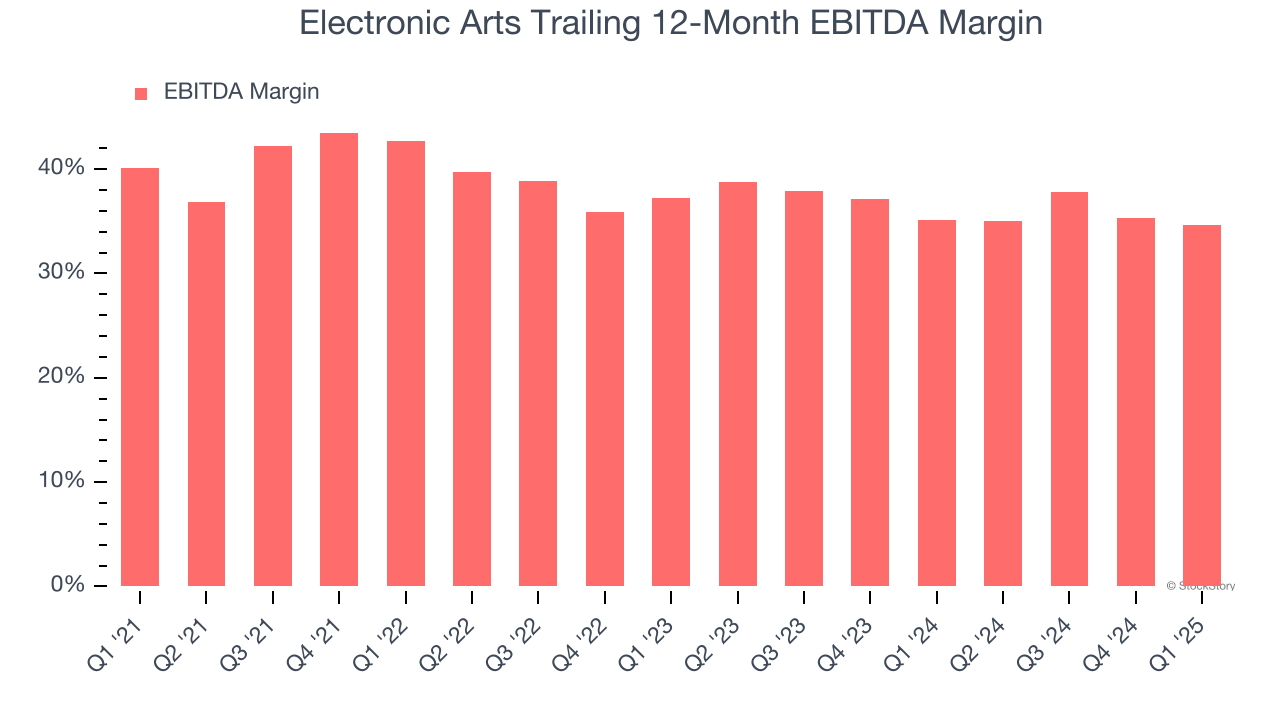

Investors regularly analyze operating income to understand a company’s profitability. Similarly, EBITDA is a common profitability metric for consumer internet companies because it excludes various one-time or non-cash expenses, offering a better perspective of the business’s profit potential.

Looking at the trend in its profitability, Electronic Arts’s EBITDA margin decreased by 8.1 percentage points over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its EBITDA margin for the trailing 12 months was 34.6%.

Final Judgment

Electronic Arts isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 15.3× forward EV/EBITDA (or $152.95 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than Electronic Arts

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.